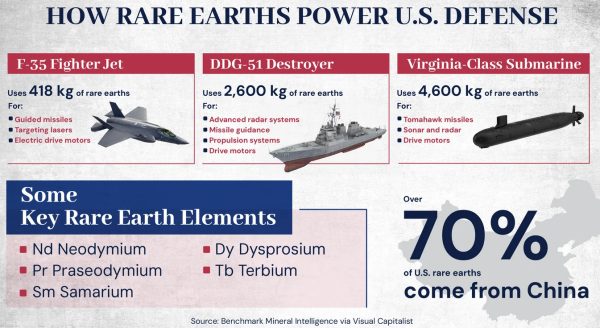

Rare earth elements (REE) are at the core of modern military power. Embedded in jet engines, precision-guided munitions, radar systems, and advanced communications, these materials enable capabilities that give the United States military its technological edge. In a sustained crisis or great-power conflict, disruptions in the REE supply chain could ripple through U.S. defense production, slowing or halting critical programs. Securing access to these materials is therefore not just an industrial policy question but a matter of national security.

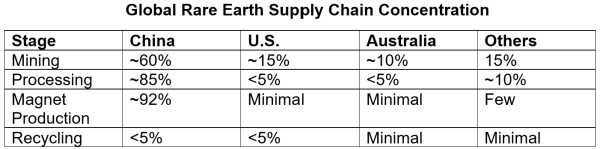

REE are a small group of metals with extraordinary magnetic, thermal, and electronic properties that make them indispensable to modern military technology. The global supply chain for these materials is highly concentrated, with the People’s Republic of China dominating mining, processing and magnet production. Recently, China has retaliated against U.S. import tariffs by restricting exports of REE. This article describes the role of REE in weapons production and the foreign policy implications of controlling their supply

Rare Earth Elements: Why the Military Needs Them

There are seventeen rare earth elements. Their unique combination of magnetic strength, temperature resistance, and optical characteristics makes them essential to modern weapons systems. REEs underpin many of the most sophisticated defense systems, from jet engines to precision-guided munitions. While many are abundant, they are difficult to extract and process. Few nations have invested in the costly and environmentally challenging refining processes required for their use at scale.

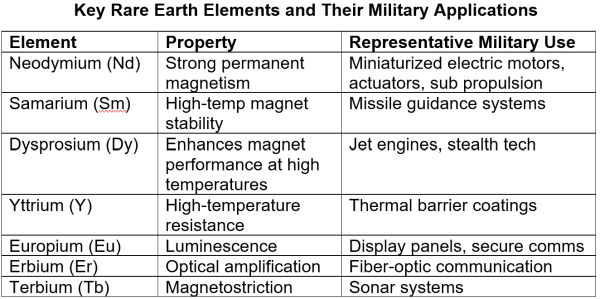

Rare earth elements permeate every domain of modern warfare. They are essential to the performance, efficiency, and stealth of advanced systems. Their strategic value lies not only in their technical properties but in their irreplaceability in critical applications. The table below links key REE materials to their military applications.

Strategic Competition and National Security Implications

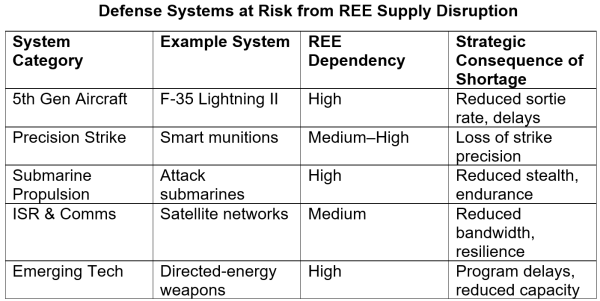

Rare earth elements have become a geopolitical lever. In the context of intensifying U.S.–China competition, control of processing and magnet production represents a critical vulnerability for Western defense industries. Management of REE supply has become an integral component of national security strategy.

Supply Chain Vulnerabilities and Strategic Risks

Although REEs are mined in several countries, China accounts for most of the world’s refining capacity and magnet production. This concentration creates a single point of vulnerability for defense industrial bases worldwide. China’s recent REE export restrictions have demonstrated the strategic leverage this confers.

Rare earth mining – It’s a big job

Rare Earths in China/U.S. Trade War

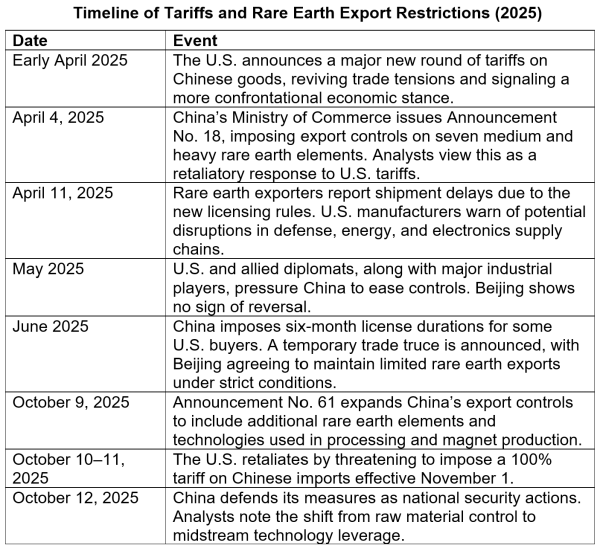

When the Trump administration increased tariffs on imports from China this year, China retaliated by restricting exports of REE. The following table describes the development of this trade conflict.

The timeline illustrates how a conventional trade dispute can quickly acquire strategic weight. The U.S. tariff escalation in early April prompted a targeted Chinese response in the form of rare earth export controls—an area where Beijing has significant leverage. What followed was a series of reciprocal moves that broadened the dispute from tariffs to critical materials and industrial capacity.

By October, China had extended its controls beyond raw materials to processing technologies, signaling its willingness to use supply chain dominance as a strategic tool. The U.S. countered with tariff threats, framing the issue as a matter of national security. This sequence underscores how critical mineral supply chains can serve as instruments of geopolitical influence, turning what might appear as an economic disagreement into a contest over technological and strategic advantage.

Policy Responses and Supply Chain Diversification

The U.S. and its allies have begun to address REE vulnerabilities through a combination of domestic production, allied sourcing, recycling, substitution research, and strategic stockpiling. These initiatives are long-term undertakings but are crucial to maintaining technological superiority.

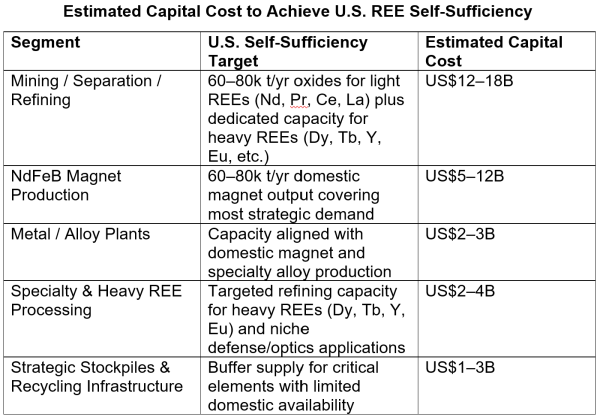

Achieving full U.S. self-sufficiency in REE, covering both light and heavy elements as well as specialty uses, would require an estimated $22–40 billion in capital investment over approximately 7–12 years. This includes building sufficient mining and separation capacity to meet domestic demand for light REEs such as neodymium, praseodymium, cerium, and lanthanum, while adding targeted capacity for heavy and specialty REEs like dysprosium, terbium, yttrium, and europium, which are essential for defense, aerospace, and advanced optics. Additional investment would fund NdFeB magnet production, metal and alloy plants, and stockpiling and recycling infrastructure to buffer against supply shocks.

Defense Materials Autarky?

While the cost of establishing U.S. self-sufficiency in rare earth elements is substantial, on the order of tens of billions of dollars over a decade, rare earths are just one critical input among many required to sustain a modern defense-industrial base. Achieving true defense materials autarky would require massive investments across many other foundational sectors: semiconductors, energetics, specialty metals, shipbuilding, advanced composites, precision manufacturing, and power technologies.

The U.S. defense industry relies on an estimated $125–210 billion per year in foreign-sourced materials, components, and systems concentrated in a handful of strategically critical categories such as semiconductors, advanced electronics, rare earths, energetics, specialty metals, high-end machine tools, and shipbuilding inputs. These imports are often low in volume but high in supply-chain leverage, meaning disruptions can have disproportionate operational effects.

Replacing these imports with fully domestic production would require building entire upstream and midstream supply chains. On a national scale, this implies capital investments in the low to mid trillions of dollars over one to two decades, along with major workforce expansion and long-term industrial coordination. In short, U.S. defense import dependence is relatively modest in dollar terms but strategically concentrated and costly to unwind, making autarky a long-term, resource-intensive undertaking rather than a rapid substitution.

Achieving defense materials autarky in the United States would require a level of central economic planning and coordination fundamentally at odds with the structure of the U.S. political economy. The scale of investment, sequencing, and workforce mobilization involved cannot be achieved through market forces alone; it demands long-term commitments, prioritized capital allocation, synchronized infrastructure build-outs, and centralized control over critical supply chains. Yet the U.S. system is built around decentralized private investment, fragmented regulatory authority, and short political time horizons, making sustained strategic coordination difficult.

Conclusion

Rare earth elements are an industrial prerequisite of modern military power. They enable the performance and reliability of systems that define strategic advantage. Because REE production is concentrated in the hands of a few foreign producers, they are also a source of vulnerability. Managing this risk requires deliberate investment, coordination, and innovation. The volatile and erratic international economic policies of the Trump administration are at odds with the coherent strategic planning required to build a stable defense infrastructure. Facts are stubborn things, and the economic facts of securing REE and other strategic materials will ultimately determine the course of U.S. trade policy.