Micron Technology Inc. (NASDAQ: MU) is gearing up to report first-quarter results after delivering a strong performance in the final months of FY25. As the leading memory manufacturer in the US, the company is well-positioned to capitalize on the accelerating AI opportunity. The momentum is fueled by surging demand for High Bandwidth Memory, a critical component in next-generation AI infrastructure.

What to Expect

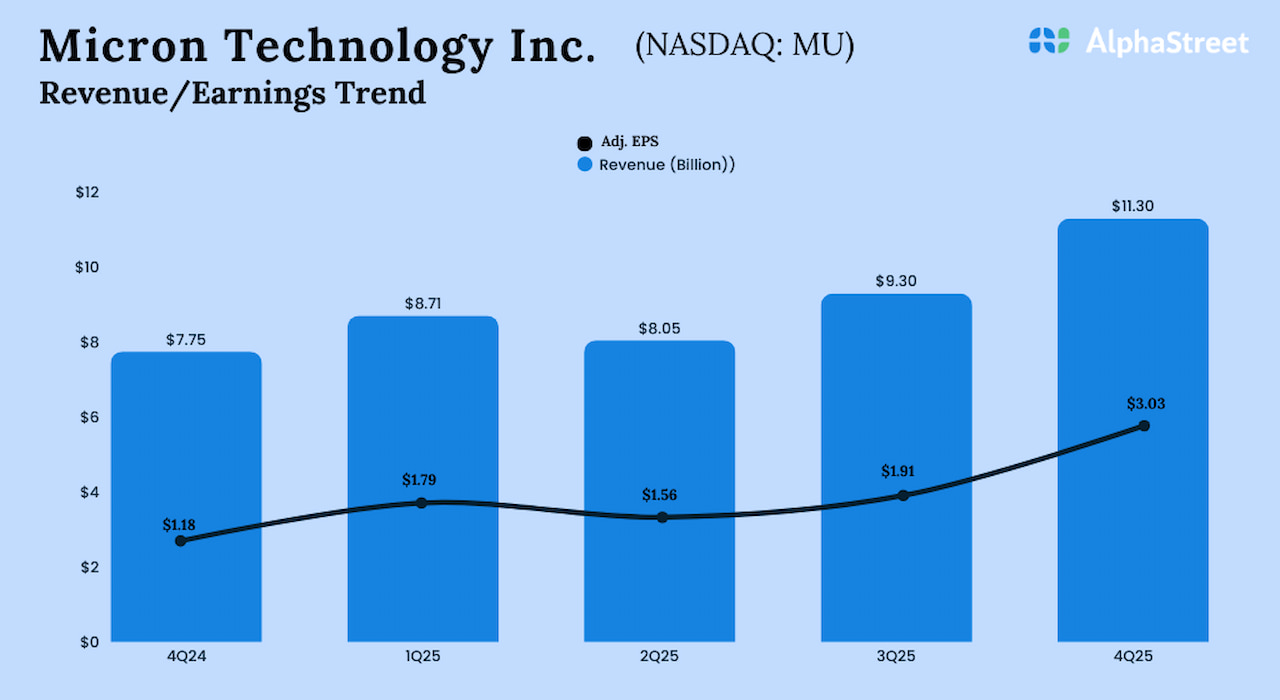

In the recent statement, the Idaho-headquartered tech firm said it expects first-quarter 2026 revenues to be around $12.50 billion, and adjusted earnings to be approximately $3.75 per share. The projection is below analysts’ estimates for revenues of $12.71 billion and earnings of $3.83 per share for the quarter. Notably, in the comparable quarter of FY25, the company posted a much lower revenue of $8.71 billion and earnings of $1.79 per share. The Q1 report is scheduled for release on December 17, after regular trading hours.

Over the past three months, Micron’s stock has been in an upward spiral, more than doubling and outperforming the S&P 500 index by a wide margin during that period. A few weeks ago, the shares climbed to an all-time high before ending the rally and stabilizing ahead of next week’s earnings. The upbeat investor sentiment mainly reflects the strength of Micron’s data center business, with revenues reaching all-time highs across the board in fiscal 2025. Despite the elevated valuation, compared to historical averages, Micron remains a compelling long-term investment.

Earnings Surge

In the fourth quarter, adjusted earnings more than doubled year-over-year to $3.03 per share, beating estimates. On a reported basis, net income was $3.20 billion or $2.83 per share in Q4, compared to $887 million or $0.79 per share in the prior-year quarter. Driving the bottom-line growth, revenues rose sharply to a record high of $11.3 billion from $7.75 billion last year, exceeding expectations. Quarterly revenue and profit have consistently beaten estimates since Q3 2023. Buoyed by the strong Q4 outcome, the Micron leadership raised its growth forecast on industry-DRAM-bit demand and industry-NAND-bit demand for calendar 2025.

From Micron’s Q4 2025 Earnings Call:

“As we enter fiscal 2026, Micron is positioned better than ever. Our leadership in advanced technologies, including HBM, 1-gamma DRAM, and G9 NAND, enables a differentiated product portfolio that drives strong ROI. AI-driven demand is accelerating, and industry DRAM supply is tight. Our HBM performance has been strong, and robust demand, tight DRAM supply, and disciplined execution have significantly strengthened the profitability of the rest of our DRAM portfolio. In NAND, our higher mix to data center and improving industry conditions are contributing to profitability. Our fiscal Q1 guidance reflects new records for revenue and EPS.”

AI Boom

There has been a severe shortage of memory globally, as the AI-driven growth in the data center has led to a surge in demand for memory and storage. Earlier this month, Micron revealed plans to exit its consumer memory business to improve supply and support for larger customers in faster-growing segments. The management targets fiscal 2026 CapEx above its FY25 spending of $13.8 billion as the company continues to invest heavily in advanced DRAM technology and High Bandwidth Memory.

Micron’s stock price has more than tripled since the beginning of 2025, and has grown well beyond the 12-month average of $127.03. MU was trading up 2.3% on Tuesday afternoon.