Published on October 16th, 2025 by Bob Ciura

Investing in high-quality dividend growth stocks might not be the most exciting idea. But for dividend growth investors, buying “boring” stocks can be a good thing.

Certain market sectors, such as consumer staples, utilities, and health care, contain many quality dividend stocks. These sectors have proven that sometimes slow-and-steady wins the race for long-term investors.

Not surprisingly, many quality dividend payers in these defensive industries have increased their dividends for decades on end.

With this in mind, we created a list of all the Dividend Kings, a group of just 56 stocks with 50+ consecutive years of dividend increases.

You can see the full downloadable spreadsheet of all 56 Dividend Kings (along with important financial metrics such as dividend yields, payout ratios, and price-to-earnings ratios) by clicking on the link below:

For investors primarily interested in income, it is also useful to rank the Dividend Kings according to their dividend yields.

This article will list 10 “boring” stocks that operate in recession-resistant market sectors, with 50+ years of dividend increases.

Table of Contents

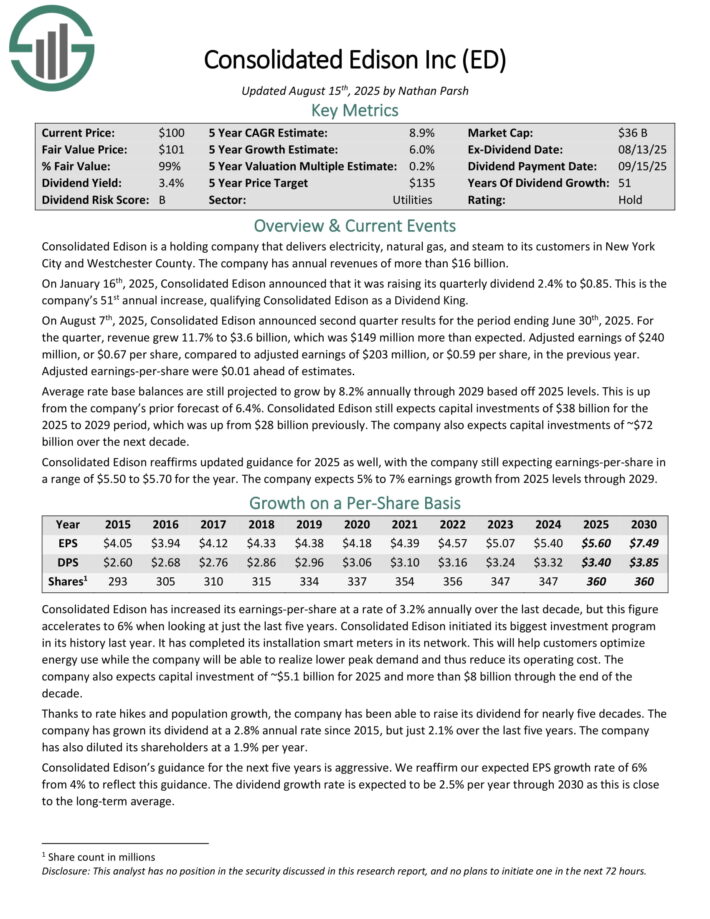

Boring Dividend Stock: Consolidated Edison (ED)

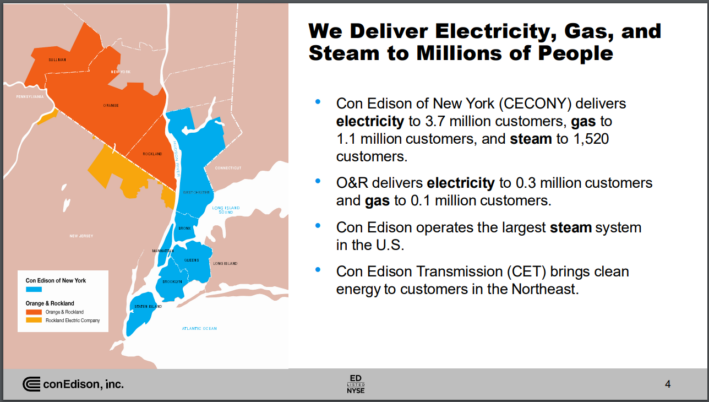

Consolidated Edison is a large-cap utility stock. The company generates approximately $15 billion in annual revenue. The company serves over 3 million electric customers, and another 1 million gas customers, in New York.

It operates electric, gas, and steam transmission businesses.

Source: Investor Presentation

On May 2nd, 2025, Consolidated Edison reported first quarter results for the period ending March 31st, 2025. For the quarter, revenue grew 12.1% to $4.8 billion, which beat estimates by $346 million.

Adjusted earnings of $792 million, or $2.26 per share, compared to adjusted earnings of $742 million, or $2.15 per share, in the previous year.

Adjusted earnings-per-share were $0.07 better than expected. Average rate base balances are still projected to grow by 8.2% annually through 2029 based off 2025 levels. This is up from the company’s prior forecast of 6.4%.

Click here to download our most recent Sure Analysis report on ED (preview of page 1 of 3 shown below):

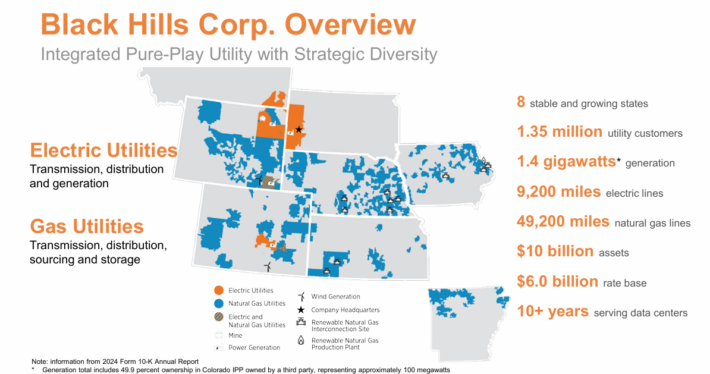

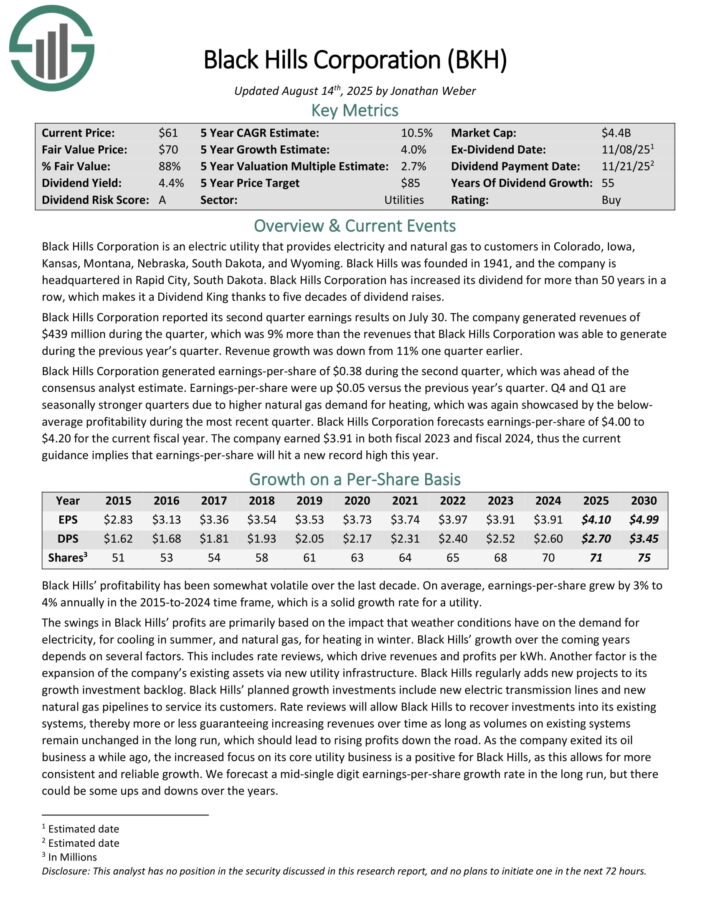

Boring Dividend Stock: Black Hills Corporation (BKH)

Black Hills Corporation is an electric utility that provides electricity and natural gas to customers in Colorado, Iowa, Kansas, Montana, Nebraska, South Dakota, and Wyoming.

The company has 1.35 million utility customers in eight states. Its natural gas assets include 49,200 miles of natural gas lines. Separately, it has ~9,200 miles of electric lines and 1.4 gigawatts of electric generation capacity.

Source: Investor Presentation

Black Hills Corporation reported its second quarter earnings results on July 30. The company generated revenues of $439 million during the quarter, up 9% year-over-year.

Black Hills Corporation generated earnings-per-share of $0.38 during the second quarter, which was ahead of the consensus analyst estimate.

Earnings-per-share were up $0.05 versus the previous year’s quarter. Q4 and Q1 are seasonally stronger quarters due to higher natural gas demand for heating.

Black Hills Corporation forecasts earnings-per-share of $4.00 to $4.20 for the current fiscal year.

Click here to download our most recent Sure Analysis report on BKH (preview of page 1 of 3 shown below):

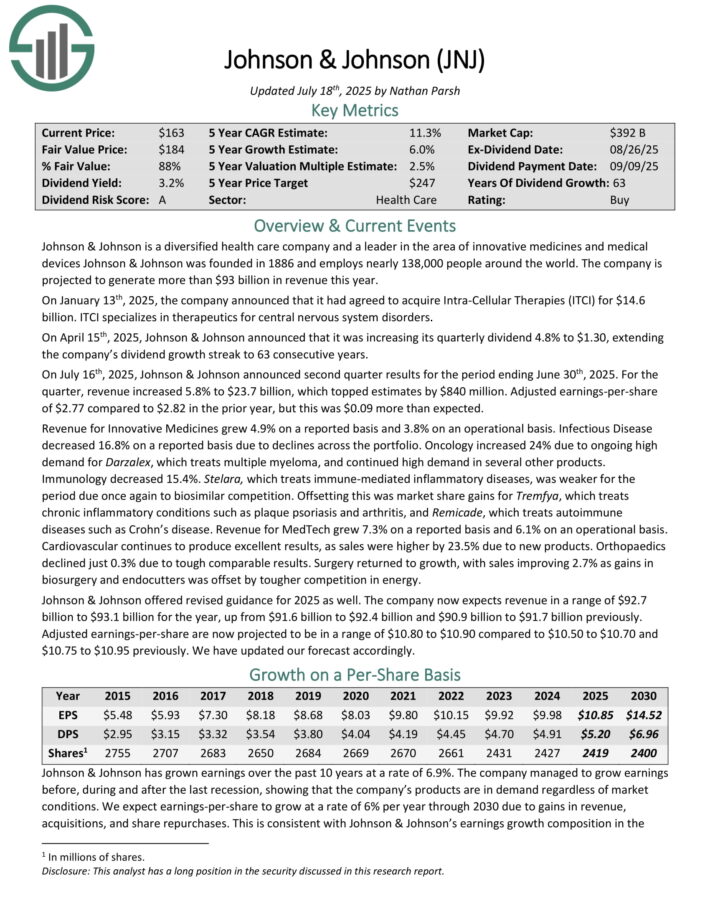

Boring Dividend Stock: Johnson & Johnson (JNJ)

Johnson & Johnson is a diversified health care company and a leader in the area of innovative medicines and medical devices Johnson & Johnson was founded in 1886.

On July 16th, 2025, Johnson & Johnson announced second quarter results for the period ending June 30th, 2025. For the quarter, revenue increased 5.8% to $23.7 billion, which topped estimates by $840 million.

Adjusted earnings-per-share of $2.77 compared to $2.82 in the prior year, but this was $0.09 more than expected.

Revenue for Innovative Medicines grew 4.9% on a reported basis and 3.8% on an operational basis. Infectious Disease decreased 16.8% on a reported basis due to declines across the portfolio.

Oncology increased 24% due to ongoing high demand for Darzalex, which treats multiple myeloma, and continued high demand in several other products.

Johnson & Johnson offered revised guidance for 2025 as well. The company now expects revenue in a range of $92.7 billion to $93.1 billion for the year, up from $91.6 billion to $92.4 billion and $90.9 billion to $91.7 billion previously.

Adjusted earnings-per-share are now projected to be in a range of $10.80 to $10.90.

Click here to download our most recent Sure Analysis report on JNJ (preview of page 1 of 3 shown below):

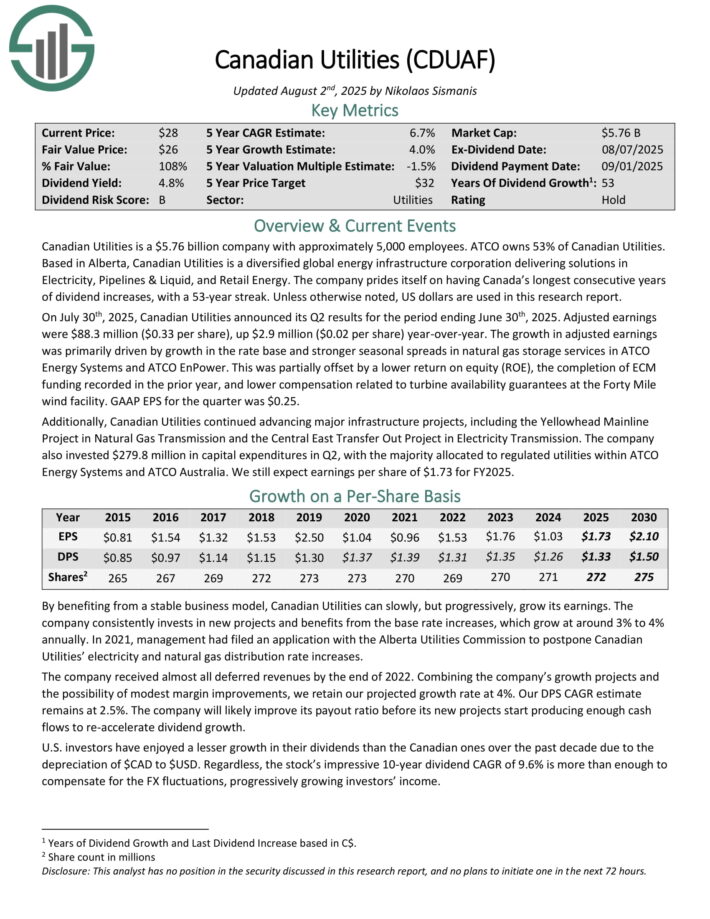

Boring Dividend Stock: Canadian Utilities (CDUAF)

Canadian Utilities is a utility company with approximately 5,000 employees. ATCO owns 53% of Canadian Utilities. Based in Alberta, Canadian Utilities is a diversified global energy infrastructure corporation delivering solutions in Electricity, Pipelines & Liquid, and Retail Energy.

On July 30th, 2025, Canadian Utilities announced its Q2 results for the period ending June 30th, 2025. Adjusted earnings were $88.3 million ($0.33 per share), up $2.9 million ($0.02 per share) year-over-year.

The growth in adjusted earnings was primarily driven by growth in the rate base and stronger seasonal spreads in natural gas storage services in ATCO Energy Systems and ATCO EnPower.

This was partially offset by a lower return on equity (ROE), the completion of ECM funding recorded in the prior year, and lower compensation related to turbine availability guarantees at the Forty Mile wind facility. GAAP EPS for the quarter was $0.25.

Click here to download our most recent Sure Analysis report on CDUAF (preview of page 1 of 3 shown below):

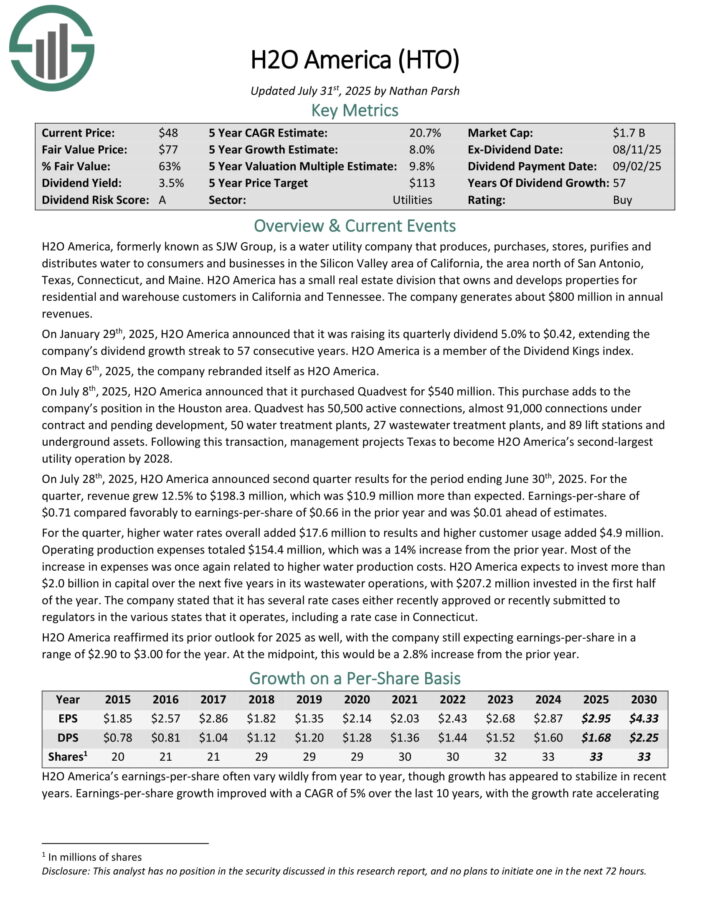

Boring Dividend Stock: H2O America (HTO)

H2O America, formerly known as SJW Group, is a water utility company that produces, purchases, stores, purifies and distributes water to consumers and businesses in the Silicon Valley area of California, the area north of San Antonio, Texas, Connecticut, and Maine.

It also has a small real estate division that owns and develops properties for residential and warehouse customers in California and Tennessee. The company generates about $670 million in annual revenues.

On July 8th, 2025, H2O America announced that it purchased Quadvest for $540 million. This purchase adds to the company’s position in the Houston area.

Quadvest has 50,500 active connections, almost 91,000 connections under contract and pending development, 50 water treatment plants, 27 wastewater treatment plants, and 89 lift stations and underground assets.

On July 28th, 2025, H2O America announced second quarter results for the period ending June 30th, 2025. For the quarter, revenue grew 12.5% to $198.3 million, which was $10.9 million more than expected.

Earnings-per-share of $0.71 compared favorably to earnings-per-share of $0.66 in the prior year and was $0.01 ahead of estimates.

For the quarter, higher water rates overall added $17.6 million to results and higher customer usage added $4.9 million. Operating production expenses totaled $154.4 million, which was a 14% increase from the prior year.

Click here to download our most recent Sure Analysis report on HTO (preview of page 1 of 3 shown below):

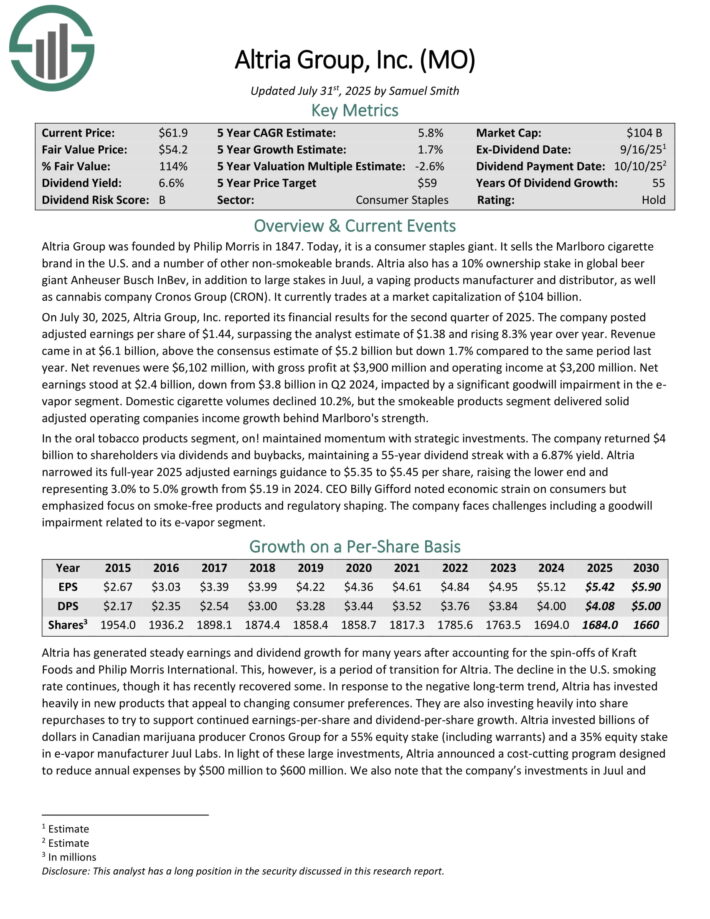

Boring Dividend Stock: Altria Group (MO)

Altria is a tobacco stock that sells cigarettes, chewing tobacco, cigars, e-cigarettes, and more under a variety of brands, including Marlboro, Skoal, and Copenhagen, among others.

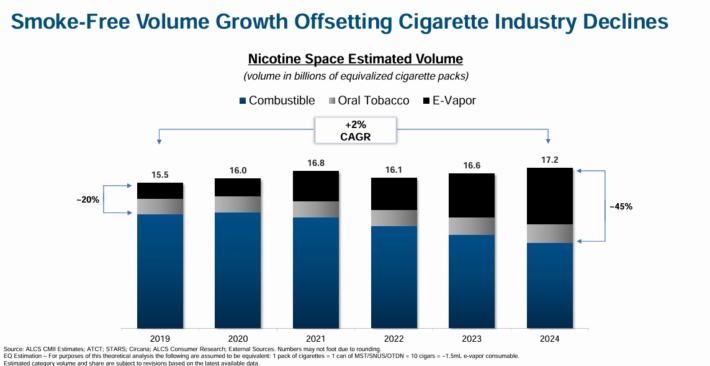

This is a period of transition for Altria. The decline in the U.S. smoking rate continues. In response, Altria has invested heavily in new products that appeal to changing consumer preferences, as the smoke-free category continues to grow.

Source: Investor Presentation

The company also has a 35% investment stake in e-cigarette maker JUUL, and a 45% stake in the Canadian cannabis producer Cronos Group (CRON).

On July 30, 2025, Altria Group, Inc. reported its financial results for the second quarter of 2025. The company posted adjusted earnings per share of $1.44, surpassing the analyst estimate of $1.38 and rising 8.3% year over year.

Revenue came in at $6.1 billion, above the consensus estimate of $5.2 billion but down 1.7% compared to the same period last year. Net revenues were $6,102 million, with gross profit at $3,900 million and operating income at $3,200 million.

Net earnings stood at $2.4 billion, down from $3.8 billion in Q2 2024, impacted by a significant goodwill impairment in the e-vapor segment.

Domestic cigarette volumes declined 10.2%, but the smokeable products segment delivered solid adjusted operating companies income growth behind Marlboro’s strength.

Click here to download our most recent Sure Analysis report on Altria (preview of page 1 of 3 shown below):

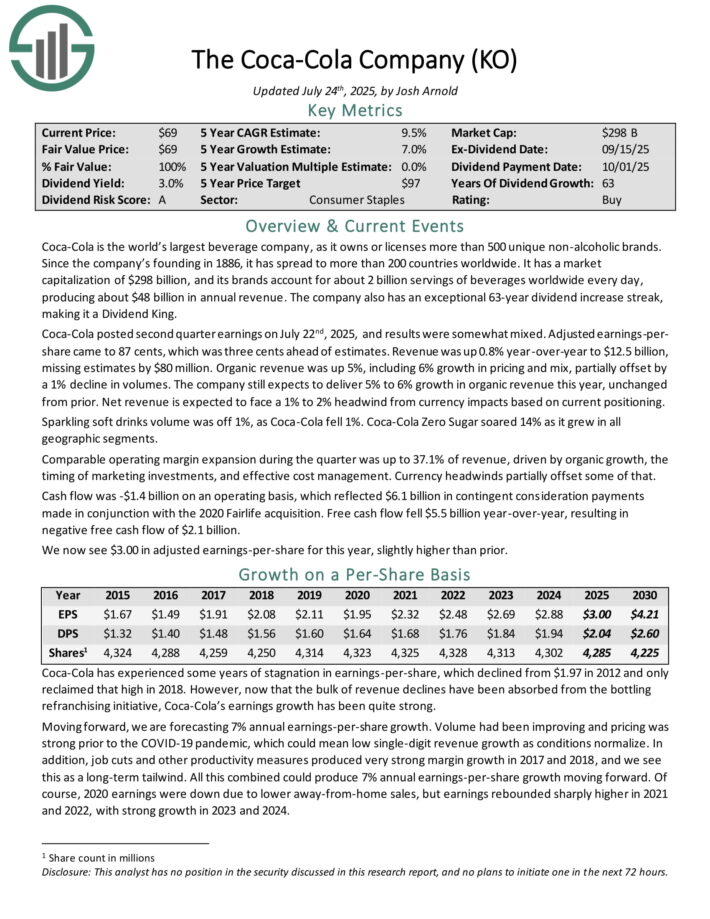

Boring Dividend Stock: Coca-Cola Co. (KO)

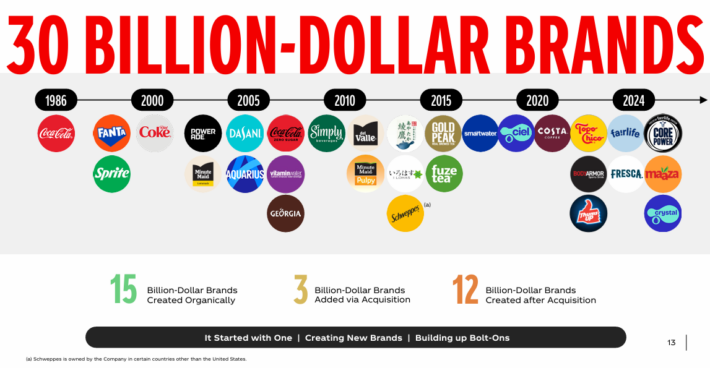

Coca-Cola is the world’s largest beverage company, as it owns or licenses more than 500 unique non–alcoholic brands. Since the company’s founding in 1886, it has spread to more than 200 countries worldwide.

Coca-Cola now has 30 billion-dollar brands in its portfolio, which each generate at least $1 billion in annual sales.

Source: Investor Presentation

Coca-Cola posted second quarter earnings on July 22nd, 2025, and results were somewhat mixed. Adjusted earnings-per-share came to 87 cents, which was three cents ahead of estimates. Revenue was up 0.8% year-over-year to $12.5 billion, missing estimates by $80 million.

Organic revenue was up 5%, including 6% growth in pricing and mix, partially offset by a 1% decline in volumes. The company still expects to deliver 5% to 6% growth in organic revenue this year, unchanged from prior. Net revenue is expected to face a 1% to 2% headwind from currency impacts based on current positioning.

Sparkling soft drinks volume was off 1%, as Coca-Cola fell 1%. Coca-Cola Zero Sugar soared 14% as it grew in all geographic segments. Comparable operating margin expansion during the quarter was up to 37.1% of revenue, driven by organic growth, the timing of marketing investments, and effective cost management.

Click here to download our most recent Sure Analysis report on KO (preview of page 1 of 3 shown below):

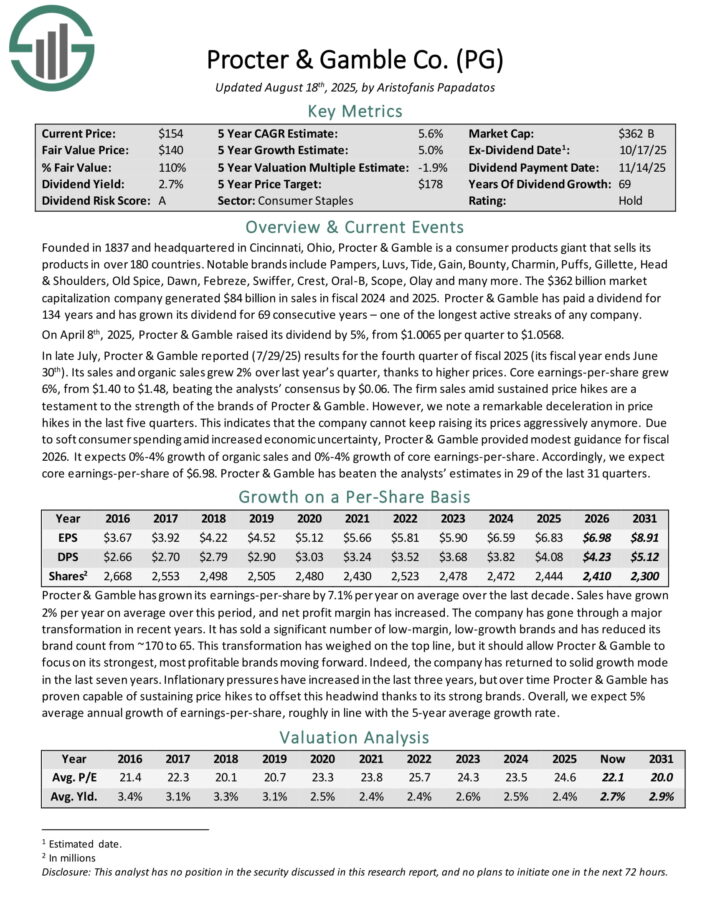

Boring Dividend Stock: Procter & Gamble (PG)

Procter & Gamble is a consumer products giant that sells its products in over 180 countries. Notable brands include Pampers, Luvs, Tide, Gain, Bounty, Charmin, Puffs, Gillette, Head & Shoulders, Old Spice, Dawn, Febreze, Swiffer, Crest, Oral-B, Scope, Olay and many more.

The company generated $84 billion in sales in fiscal 2024 and 2025. Procter & Gamble has paid a dividend for 134 years and has grown its dividend for 69 consecutive years – one of the longest active streaks of any company.

In late July, Procter & Gamble reported (7/29/25) results for the fourth quarter of fiscal 2025 (its fiscal year ends June 30th). Its sales and organic sales grew 2% over last year’s quarter, thanks to higher prices. Core earnings-per-share grew 6%, from $1.40 to $1.48, beating the analysts’ consensus by $0.06.

The firm sales amid sustained price hikes are a testament to the strength of the brands of Procter & Gamble. However, we note a remarkable deceleration in price hikes in the last five quarters. This indicates that the company cannot keep raising its prices aggressively anymore.

Due to soft consumer spending amid increased economic uncertainty, Procter & Gamble provided modest guidance for fiscal 2026. It expects 0%-4% growth of organic sales and 0%-4% growth of core earnings-per-share.

Click here to download our most recent Sure Analysis report on PG (preview of page 1 of 3 shown below):

Boring Dividend Stock: Colgate-Palmolive (CL)

Colgate-Palmolive has been in existence for more than 200 years, having been founded in 1806. It operates in many consumer staples markets, including Oral Care, Personal Care, Home Care, and more recently, Pet Nutrition.

These segments afford the company just over $20 billion in annual revenue. Colgate-Palmolive has increased its dividend for 64 consecutive years.

Colgate posted second quarter earnings on August 1st, 2025, and results were better than expected on both the top and bottom lines. Adjusted earnings-per-share came to 92 cents, which was three cents ahead of estimates.

Revenue was up 1% year-over-year to $5.11 billion, beating estimates but $80 million. Net sales were up 1%, with organic revenue up 1.8%, including a 0.6% negative impact from lower private label pet sales.

Gross profit was down 50 basis points to 60.1% of earnings, while adjusted gross profit was down 70 basis points to 60.1% of revenue. Gross margin was impacted by raw material inflation and tariffs, although management noted those impacts were slightly lessened in the second quarter.

Net cash provided by operations was $1.48 billion for the first six months of the year. The critical Hill’s business, which has fueled much of Colgate’s growth in recent years, was up 5% on an organic basis, including 2% volume gains and 3% price increases.

Click here to download our most recent Sure Analysis report on CL (preview of page 1 of 3 shown below):

Further Reading

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

Other Sure Dividend Resources

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].