U.S. spot Bitcoin ETFs took in over a billion dollars of net inflows over the past week as Bitcoin price showed strength above $110,000, setting up a clean test of supply and demand if the Federal Reserve cuts rates next week.

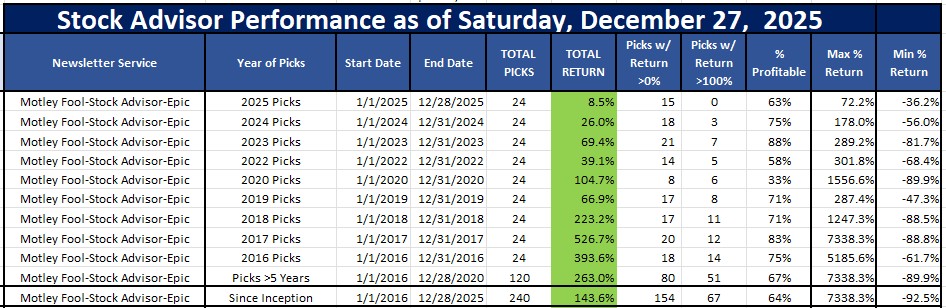

Farside Investors shows $741.5 million on the day, with Fidelity’s FBTC at $299.0 million and BlackRock’s IBIT at $211.2 million, while intraday vendor tallies vary slightly due to timing and processing of creations and redemptions.

Bitcoin traded around $114,132 on Sept. 11, following August’s record above $124,000 reported by Reuters.

At current prices, the arithmetic is straightforward. A $757 million net inflow buys about 6,640 BTC, which equates to nearly 15 days of new issuance at the post-halving pace of roughly 450 BTC per day.

The halving last April cut the block subsidy to 3.125 BTC, and with about 144 blocks mined per day, baseline issuance sits near that 450 BTC mark, subject to small fluctuations in block times.

Net ETF flow (USD)Implied BTC bought (at $114,000)Days of issuance absorbed (~450 BTC/day)$500,000,000≈4,386 BTC≈9.7 days$757,000,000≈6,640 BTC≈14.8 days$1,000,000,000≈8,772 BTC≈19.5 days$5,000,000,000 (per month)≈43,860 BTC≈97.5 days

The set-up for another demand shock hinges on policy. A Reuters poll of economists conducted Sept. 8–11 points to a 25 basis point cut on Sept. 17, and the survey notes markets already fully anticipate that move.

CME’s FedWatch tool shows how fed funds futures embed those odds in real time, with messaging that its probabilities should be attributed to FedWatch. If the Fed cuts and 10-year real yields drift lower from the 1.79 percent print last week, the macro backdrop that supported record gold ETF inflows in recent months would rhyme with bitcoin’s ETF era, since lower real yields reduce the carry hurdle for long-duration assets.

Flows are already building again. Farside’s daily table shows the strongest one-day intake since July, led by FBTC and IBIT. SoSoValue’s issuer-level dashboard corroborates the leadership split, with its latest 1-day readings listing IBIT 1D net inflow near $211 million and FBTC near $299 million, consistent with the totals above. Data vendors differ at the margin because of cut-off times and share-count updates, but the order of magnitude is clear.

The supply side has become mechanical after the halving.

Mined issuance now reflects the 3.125 BTC block subsidy and an average cadence near 144 blocks daily, which places a ceiling on organic supply into ETF demand windows.

The halving block at height 840,000 on April 20, 2024, is a verifiable on-chain reference for the subsidy change (block 840,000). Frictions inside ETF plumbing have also eased. In late July, the SEC approved in-kind creations and redemptions for crypto ETPs, aligning bitcoin and ether products with the mechanics used by commodity ETPs.

That change reduces cash drag and can tighten the arbitrage band, which can influence how quickly primary market demand transmits into spot buying.

3 Seconds Now. Gains That Compound for Years.

Act fast to join the 5-day Crypto Investor Blueprint and avoid the mistakes most investors make.

Brought to you by CryptoSlate

A cut would test how much of that demand is rate-sensitive versus structural. One way to frame it is in “days of issuance absorbed per day.” If daily net inflows run at $250 million, $500 million, then $1 billion, the absorption rate spans about 4.9, 9.7, then 19.5 days of issuance per day at a $114,000 price.

A price shift changes the math; the same $757 million would absorb about 16.0 days at $105,000 and about 14.0 days at $120,000, reflecting the fewer coins purchased when prices are higher. That sensitivity is immediate in the primary market, and it will interact with dealer inventories, cross-venue liquidity, and futures basis costs.

Derivatives carry costs remain moderate by 2025’s standards. Aggregated three-month rates across major venues generally cluster in the mid-single digits, a zone that neither adds a large headwind to hedged ETF-related inventory nor invites extreme carry compression.

If a cut pulls funding and basis lower, the relative appeal of unhedged, spot-only exposure inside ETFs can rise in asset allocation models that manage tracking error and gross leverage.

The stock of available coins matters alongside flow.

Glassnode’s illiquid supply metric, which tracks coins held by entities with little or no spending history, rose to a record above 14.3 million BTC in late August. This inventory is historically slow to mobilize, so primary ETF demand often leans on exchange balances and dealer warehousing rather than immediate LTH distribution.

Mining economics sit in the background as a release valve. Luxor’s hashprice work shows post-halving revenue per unit of hash remains compressed, and while network difficulty hit new highs through August, the direct contribution to circulating supply is capped by the protocol. Pressure on miner treasuries can free up some inventory, but that channel is finite relative to ETF intake at the speeds cited above.

Scenario frame for next week is therefore narrow and testable. If the Fed cuts 25 bps and ETF net inflows migrate into a $500 million to $1 billion daily range for several sessions, the primary market would absorb roughly 10 to 20 days of issuance each day at current prices, which tightens available float unless exchange balances replenish.

If the Fed holds and real yields firm, flows could fade toward flat to $250 million, which implies zero to about five days of issuance absorbed per day, a setting where miner and trader supply can meet demand without visible dislocations.

The in-kind regime, the present basis term structure, and the illiquid supply share all point to how quickly any imbalance would show up in spreads and price impact rather than in a drawn-out squeeze.

For now, the tape offers a simple benchmark. One day, the U.S. spot ETF flow matched nearly two weeks of the new Bitcoin, and the policy decision on Sept. 17 will determine whether that ratio becomes a routine feature or an outlier of a strong week.

Mentioned in this article