In recent months, Federal Reserve officials have repeatedly referred to monetary policy as restrictive. In September, Jerome Powell said policy was “clearly restrictive,” and in November, New York Fed President John Williams stated “I still view the current monetary policy level as moderately tight…”

Well, it may be that current policy is “restrictive” compared to, say, the policies of Bernanke and Yellen. But recent data on the money supply suggests that the money supply in recent months is finding plenty of room to increase rapidly, in spite of what Fed officials say.

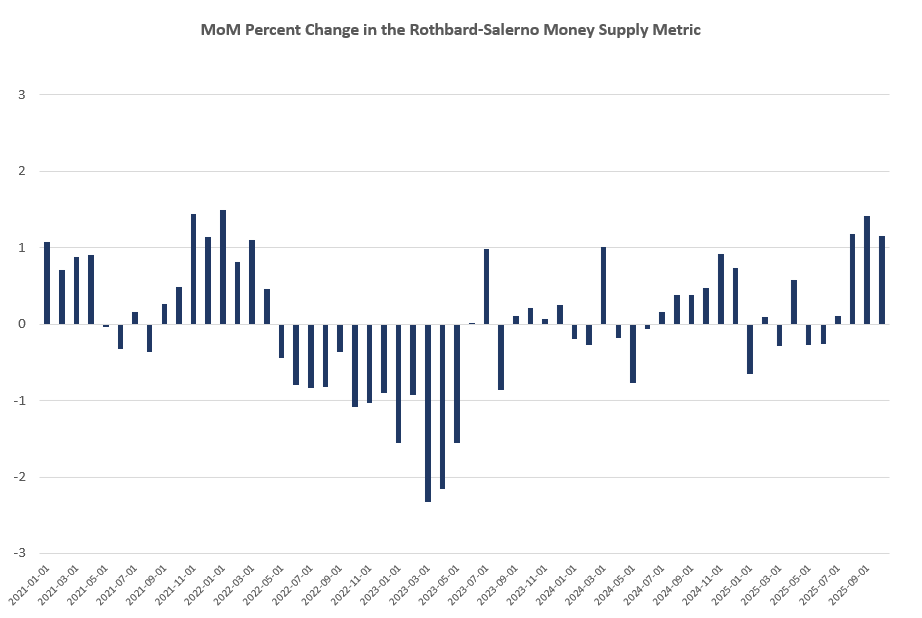

For example, the money supply has increased every month for the past four months, and as some of the highest rates we’ve seen in years. Moreover, when measured year-over-year, the money supply has accelerated over the past three months and is now at the highest rate of growth seen in 40 months—or since July of 2022.

While the money supply largely flatlined through much of the mid-2025, growth has clearly accelerated since August of this year.

During October, year-over-year growth in the money supply was at 4.76 percent. That’s up from September year-over-year increase of 4.06 percent. Money supply growth is also up sizably compared to October of last year when year-over-year growth was 1.27 percent.

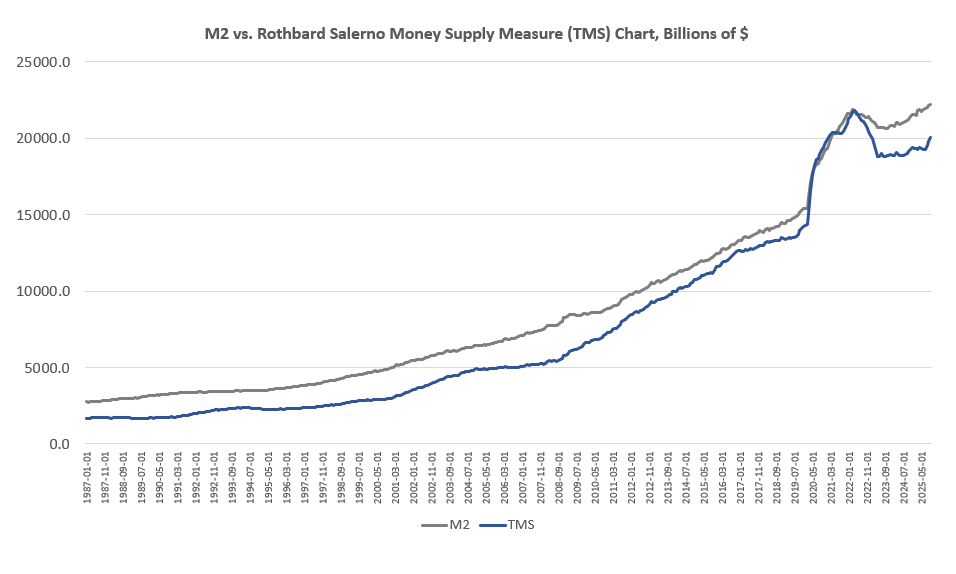

In October, the total money supply again rose above $20 trillion for the first time since January of 2023, and grew by half a trillion dollars from August to October.

In month-to-month growth, August, September, and October all posted some of the largest growth rates we’ve seen since 2022, rising 1.18 percent, 1.4 percent, and 1.14 percent, respectively. topping off four months of growth.

The money supply metric used here—the “true,” or Rothbard-Salerno, money supply measure (TMS)—is the metric developed by Murray Rothbard and Joseph Salerno, and is designed to provide a better measure of money supply fluctuations than M2. (The Mises Institute now offers regular updates on this metric and its growth.)

Historically, M2 growth rates have often followed a similar course to TMS growth rates, but M2 has even outpaced TMS growth in eleven of the last twelve months. In October, the M2 growth rate, year over year, was 4.63 percent. That’s up from September’s growth rate of 4.47 percent. October’s growth rate was also up from October 2024’s rate of 2.97 percent.

Although year-over-year and month-to-month growth rates moderated during the summer—and even fell substantially during 2023 and early 2024, money-supply totals are again rapidly heading upward. M2 is now at the highest level it’s ever been, topping $22.2 trillion. TMS has not yet returned to its 2022 peak, but is now at a 34-month high.

Since 2009, the TMS money supply is now up by more than 200 percent. (M2 has grown by nearly 160 percent in that period.) Out of the current money supply of $20 trillion, nearly 29 percent of that has been created since January 2020. Since 2009, in the wake of the global financial crisis, more than $13 trillion of the current money supply has been created. In other words, more than two-thirds of the total existing money supply have been created since the Great Recession.

Given current economic conditions, it is surprising to see such robust growth in the money supply.

Given current stagnating economic conditions, it is surprising to see such robust growth in the money supply. Private commercial banks play a large role in growing the money supply in response to loose Fed policy. When economic conditions are expansive, and as employment grows, lending also grows, further loosening monetary conditions.

In recent months, however, economic indicators continue to point to both worsening employment conditions and rising delinquencies. For example, US layoffs in October surged to a two-month high. Meanwhile, Bloomberg reports that “ Mom-and-Pop Business Bankruptcies Hit a Record as Debts Rise.” The latest price-sector jobs numbers show more job losses.

This all applies downward pressure on money supply growth. However, in an effort to further pump asset prices and somehow counter our growing economic stagnation, the Fed lowered the target federal funds rate in September and throughout much of this year has slowed its efforts to reduce the Fed’s balance sheet—also known as “quantitative tightening.”

This return to accommodative monetary policy—which belies Fed claims of “restrictive” policy—has surely done its part in returning the money supply to growth levels we haven’t seen in years.