Gold prices have indeed soared to all-time highs in 2025, prompting headlines about a historic rally. But according to Bank of America (BofA) Global Research, the story is more nuanced: The gold sector, while booming, hasn’t returned to all of the metrics that defined previous cyclical peaks, especially regarding its value relative to the broader equity market and its own historical valuations.

This year, gold surged past major thresholds, as the traditional hedge against inflation and macroeconomic uncertainty has been propelled by a preponderance of both. On September 2, gold shot past $3,500/oz, climbing further to $3,600/oz on the Monday following the disappointing U.S. jobs data for August, which raised bets on easier monetary policy. The BofA Commodities team is “bullish,” they say, now forecasting the quarterly average price reaching $4,000/oz in the second quarter of 2026, with the spot price already up 4.1% week-over-week to $3,589/oz.

Rob Haworth, senior investment strategist at U.S. Bank Wealth Management, told Fortune in March that gold may be a good investment for some but it’s not exactly liquid. “You’re not sending gold to buy your Domino’s pizza,” he said, adding that gold’s rally in recent years has been driven by central banks buying the precious metal as the U.S. dollar weakens and countries like China seek alternatives.

Here’s why Bank of America says perspective is important in evaluating gold’s record high, and it depends on how you look at it.

Sector market cap doubling past peaks, but …

The global gold sector’s total market capitalization has ballooned to just over $550 billion, nearly twice the peaks seen in 2011 and 2020 ($331-$334 billion), more than 8x the 2016 cycle low ($70 billion), and more than 3x the recent cycle low of $170 billion in 2022. This rally, according to BofA, reflects not just price gains. but also investor interest heightened by inflation and sector cost pressures.

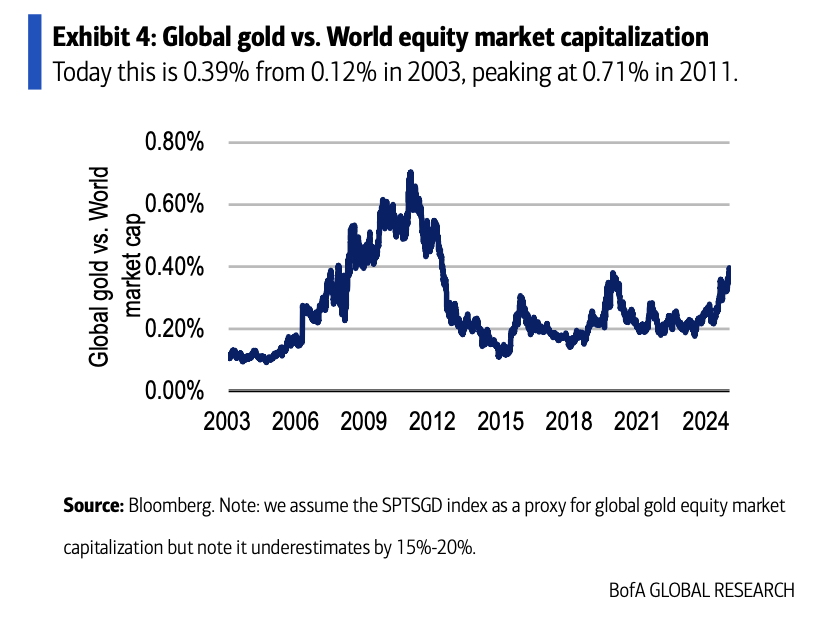

Yet, when viewed as a share of the total global equity market, gold’s ascent looks less dramatic and it’s “far below” its previous highs, the Commodities team says. The sector now stands at 0.39% of world market capitalization, matching the 2020 peak but still far below 2011’s high of 0.71%. If the sector returned to that 2011 percentage, it would imply a market cap of nearly $990 billion—a potential upside only if the cycle continues long enough.

Room to run

Despite high metal prices, gold equities are not trading at historical top valuations. The sector’s next-12-month (NTM) EV/EBITDA multiple sits at 11x, well below the 2020 peak of 15.4x. Price-to-net-asset-value (P/NAV) for the sector rests at 1.88x, compared to 2.27x in 2020 and 2.19x in 2011. Adjusted for current spot gold prices, sector multiples suggest even further upside, with NTM EV/EBITDA at 11.7x and P/NAV at 1.39x.

Gold equities have responded to the price rally, but not uniformly. Major indices such as the S&P/TSX Global Gold Index (+5.5% WoW), Philadelphia Gold and Silver Index (+4.8%), and NYSE Arca Gold Bugs Index (+4.1%) all surged alongside bullion’s breakout. Year-to-date, Fresnillo is the best performer, climbing over 268%, spotlighting disparate returns in the sector.

BofA’s research points to room for growth—if current trends in monetary policy, inflation, and investor sentiment persist. However, the gold sector remains a small slice of the global equity pie, with equity valuations still well below historical highs. For market observers, the surging price of gold is only part of the story; the fundamentals suggest this boom is not yet a rerun of previous peaks, and “record highs” should be viewed in context.

For this story, Fortune used generative AI to help with an initial draft. An editor verified the accuracy of the information before publishing.