After working for a major international brokerage firm, along with my own private asset management company, for nearly 20 years, I’ve seen it all when it comes to money management. From family feuds over inheritances to middle-class families being able to afford college for their kids, the profession offered me a front-row seat to the highs and lows of personal finance.

But through all the ups and downs, a few immutable truths revealed themselves time and time again. Here are the most important lessons I’ve garnered from my nearly two decades in the industry.

Check Out: I’m a Financial Advisor: My Wealthiest Clients All Do These 3 Things

Read Next: I’m a Retired Boomer: 6 Bills I Canceled This Year That Were a Waste of Money

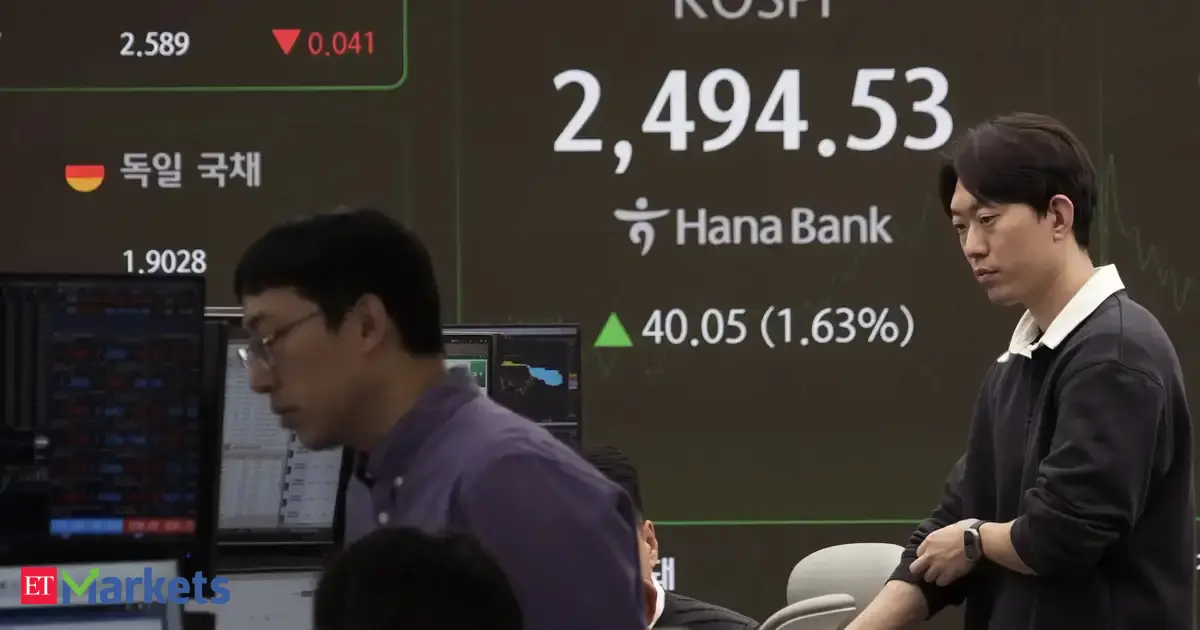

As Michael Douglas’s character Gordon Gekko famously says in the movie “Wall Street,” “Don’t get emotional about stock, it clouds your judgement.” While coming from a fictional character, the sentiment is spot-on. Fear and greed are the two most dominant emotions when it comes to investing in the stock market, and unfortunately, each one seems to pop up at the exact right time to encourage bad decisions.

When markets scream higher, investors get euphoric. Conversely, when markets sell off sharply, investors get fearful, sometimes to the point of panic. These dual scenarios lead to situations in which investors buy high and sell low, when they should be doing the exact opposite. In the words of billionaire CEO Warren Buffett, investors should “be greedy when others are fearful, and fearful when others are greedy.” Don’t let your emotions twist this around and lead you to doing the opposite.

See More: I Asked ChatGPT To Explain What a Blockchain Is Like I’m 12 — Here’s What It Said

When asked which financial obligation is the most important, many clients will list mortgage/rent, food and household bills like utilities as essential. And while it’s true that all of these bills must be paid, if you prioritize them ahead of your savings, you’ll likely find that you end every month without any money at all to invest.

This is where the famous mantra “pay yourself first” comes into play. By setting aside money for your savings and investments before you pay any bills — via automated transfers, of course — you force yourself to live beneath your means. If you find yourself coming up short in terms of paying your monthly expenses, it means it’s time to trim your costs, not reduce your savings.

One of the saddest parts of being a financial advisor is watching how families tear themselves apart fighting for “their share” of an inheritance. Many of these family disputes can be nipped in the bud by drafting a clearly worded estate plan and sharing it with family members ahead of time. When your explicit wishes are mapped in advance and disclosed to all of your beneficiaries, you greatly reduce the chance of in-fighting among family members after your passing.

Story Continues