Gold exchange-traded funds (ETFs) have grown in popularity as a way for investors to gain exposure to gold without owning the metal physically. They trade on major stock exchanges like regular stocks and offer the ability to buy and sell quickly during market hours. Gold ETFs are attractive because they eliminate the need for secure storage, insurance, and verification of authenticity.

In addition to convenience, gold ETFs offer liquidity and a relatively low cost of entry compared to buying physical gold. This makes them accessible to both seasoned investors and beginners looking to diversify their portfolios. According to the U.S. Department of the Treasury, gold plays a significant role in maintaining economic stability, making it a valuable hedge for investors.

What to Look for When Choosing the Best Gold ETF

When evaluating gold ETFs, consider the following factors:

Expense ratios: Lower fees can improve your net returns over time.

Backing type: Physically-backed ETFs hold gold in secure vaults, while synthetic ETFs use derivatives to track gold prices.

Liquidity: Higher trading volumes generally mean tighter bid-ask spreads and easier execution.

Tracking accuracy: Look for funds that closely follow the spot price of gold with minimal deviation.

Taking these factors into account will help you find an ETF that matches your risk tolerance, investment goals, and time horizon.

Understanding Different Types of Gold ETFs

Gold ETFs come in several types, each serving a different purpose in a portfolio.

Standard Gold ETFs

These ETFs are backed by physical gold stored in secure vaults. Examples include SPDR Gold Shares (GLD) and iShares Gold Trust (IAU). They aim to mirror the price of gold and are generally used by long-term investors as a hedge against inflation or market volatility.

Leveraged Gold ETFs

Leveraged gold ETFs use financial derivatives to amplify the daily movement of gold prices, often by 2x or 3x. They can generate larger short-term gains but also carry higher risk. Because of the compounding effect, they are best suited for short-term traders who actively monitor their positions.

Current Promotion: get your Free Gold IRA Guide Today!

Inverse Gold ETFs

Inverse gold ETFs are designed to rise in value when the price of gold falls. These funds are often used by traders to hedge against declines in gold or to speculate on downward price movements. Like leveraged ETFs, they are typically for short-term use.

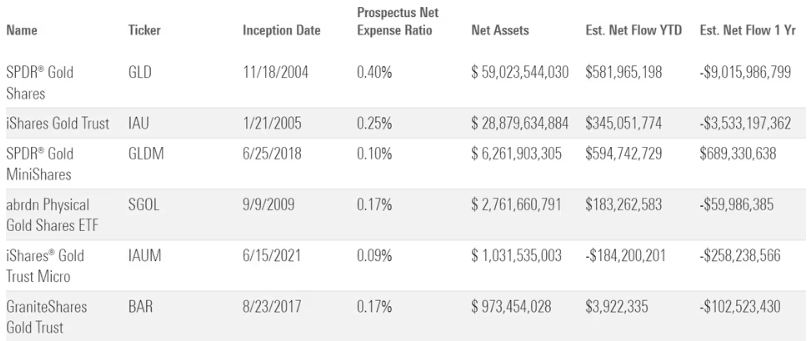

Comparing Popular Gold ETFs

Choosing the right gold ETF can be easier when you compare leading options side-by-side.

SPDR Gold Shares (GLD): One of the largest and most liquid ETFs, backed by physical gold. Expense ratio around 0.40%.

iShares Gold Trust (IAU): Lower expense ratio than GLD at 0.25%, making it appealing for cost-conscious investors.

Aberdeen Standard Physical Gold Shares ETF (SGOL): Stores gold in Swiss vaults, which some investors prefer for geopolitical diversification.

ProShares Ultra Gold (UGL): A leveraged ETF for traders seeking 2x daily gold price exposure.

Comparing factors like fees, vault location, and trading volume can help narrow your choices.

Buying Gold ETFs vs. Buying from the Mint

Buying gold from the U.S. Mint or other sovereign mints gives investors physical ownership in the form of coins or bullion. This can be appealing for those who value having tangible assets. However, physical gold requires secure storage, insurance, and may have higher transaction costs.

Current Promotion: $15,000 in Free Silver on Qualified Purchases

Gold ETFs, by contrast, provide a paper-based way to invest in gold that can be traded easily and without the logistical challenges of owning bullion. Some investors choose to combine both approaches, holding ETFs for liquidity and physical gold for long-term wealth preservation.

How Gold ETFs Perform in Different Market Conditions

Gold ETFs often behave differently depending on the economic environment.

During inflationary periods: Gold ETFs may rise as investors seek a hedge against currency devaluation.

In times of market uncertainty: Demand for gold as a safe haven can increase, lifting ETF prices.

During strong equity markets: Gold ETFs may underperform as investors shift toward riskier assets.

Understanding these patterns can help you decide when and how to adjust your gold ETF holdings.

Spotlight on Hamilton Gold Group

Hamilton Gold Group is known for providing both physical gold investment options and education for those interested in gold ETFs. They offer resources to help investors understand the benefits and risks of each method and assist in creating balanced precious metals strategies. By combining physical gold and ETFs, investors can enjoy both security and flexibility.

Current Promotion: Unconditional Buy Back Guarantee

Common Mistakes When Investing in Gold ETFs

Overlooking expense ratios, which can erode returns over time.

Misunderstanding the risks associated with leveraged or inverse ETFs.

Concentrating all gold exposure in one ETF without diversification.

Failing to plan for tax implications.

Avoiding these mistakes can lead to more consistent performance and better alignment with your financial goals.

Strategies for Using Gold ETFs in Your Portfolio

Gold ETFs can be used in several ways:

Long-term hedge: Standard gold ETFs can serve as protection against inflation and currency devaluation.

Short-term trades: Leveraged and inverse ETFs may be suitable for tactical market moves.

Diversification tool: Combining gold ETFs with stocks, bonds, and other assets can reduce portfolio volatility.

Rebalancing mechanism: Use gold ETFs to adjust your portfolio allocation efficiently.

Tax Considerations for Gold ETF Investors

In the United States, most gold ETFs that hold physical bullion are taxed as collectibles. This means long-term gains may be subject to a maximum federal tax rate of 28%, compared to lower rates for stocks. Short-term gains are taxed as ordinary income. Investors should factor taxes into their overall strategy and consider consulting a tax professional.

Conclusion

The best gold ETF for you will depend on your objectives, risk tolerance, and investment strategy. Standard physically-backed ETFs like GLD and IAU are popular choices for long-term investors. More advanced traders may consider leveraged or inverse ETFs for short-term strategies. Understanding the differences and knowing how each type fits into your overall plan is the key to making the right choice.

Curious about buying precious metals as a part of your portfolio allocation? Check out our new read: How to invest in gold and silver!

FAQ Section

The safest gold ETFs are typically physically-backed funds from well-established issuers. Examples include SPDR Gold Shares (GLD) and iShares Gold Trust (IAU). These ETFs hold allocated gold in secure vaults and are audited regularly to ensure transparency.

Yes, most major brokerage firms allow gold ETFs in traditional and Roth IRAs. This provides an easy way to gain gold exposure within a tax-advantaged account without dealing with the storage rules that come with physical gold in a self-directed IRA.

Leveraged gold ETFs are generally not recommended for beginners. They are designed for short-term trading and can lose value quickly due to daily compounding effects. Beginners are usually better served with standard, physically-backed gold ETFs.

Gold ETFs offer liquidity, lower transaction costs, and no need for physical storage. Owning gold coins provides tangible ownership, which some investors prefer for long-term wealth preservation or as a hedge against extreme market events. Many investors choose to hold both for diversification.

In the United States, most gold ETFs that hold physical bullion are taxed as collectibles, with a maximum federal tax rate of 28% on long-term gains. This is higher than the long-term capital gains rate for stocks, which can make tax planning an important part of gold ETF investing.

The Best Stock Newsletters as of June 29, 2025

Ranking of Top Stock Newsletters Based on Last 3 Years of Stock Picks

We are paid subscribers to dozens of stock newsletters. We actively track every recommendation from all of these services, calculate performance, and share the results of the top performing stock newsletters whose subscriptions fees are under $500. The main metric to look for is “Excess Return” which is their return above that of the S&P500. So, based on last 3 years ending June 29, 2025: