struggles at 1.36 after GDP contracts. eases after yesterday’s jump, geopolitical tensions & the US-China deal are in focus.

GBP/USD Struggles at 1.36 After GDP Contracts

GBP/USD is holding steady, giving up earlier gains after data showed that the UK economy shrank more than expected in April.

According to data from the Office for National Statistics, the contracted by 0.3% month on month in April, more than the 0.1% decline that was forecast. This marked the largest monthly slide in 18 months and sets the stage for a tepid second quarter. Diving deeper into the figures, the services sector contracted 0.4% whilst manufacturing experienced nought .9% drop in production.

The was stronger than expected as firms rushed to get ahead of tariffs.

However, with concerns over the outlook for the UK economy growing, Q2 growth is expected to be subdued. The UK economy is facing a challenging time as the labour market lost around 1/4 of a million jobs since Reeves ramped up payroll taxes and the minimum wage in her budget.

There was a payback effect from the temporary factors that boosted Q1, including threats of US tariffs forcing manufacturers to Russia exports. Good exports to the US fell by £2 billion in April, and consumers also pulled back after splashing out in the first quarter.

An Awful April also saw consumers hit by higher bills for energy and other utility services, while firms had the hit from payroll taxes.

Meanwhile, the is struggling around a seven-week low. While details surrounding the US-China trade deal are few and far between, worries over the upcoming deadline for reciprocal tariffs are also a concern.

While has yet to show any meaningful impact of trade tariffs on the economy, the jobs market is showing signs of a slowdown. US data is due later today and is expected to show that initial payrolls rose by 240k. Weak jobless claims could fuel further weakness in the USD.

GBP/USD Forecast – Technical Analysis

GBP/USD has struggled to push meaningfully above 1.36. While the longer-term trend is upwards, the bulls are showing signs of losing steam amid a bearish RSI divergence.

Support is seen at 1.3450 with a break below here creating a lower low.

Buyers will need to rise above 1.36 to break out of range and create a higher high towards 1.37 and 1.3750, a level last seen in 2022.

Oil Eases After Strong Gains, Geopolitical Tensions and the US-China Deal in Focus

After rising over 5% yesterday, oil prices are easing slightly today as traders continue monitoring tensions in the Middle East and the latest US trade policy developments.

Well surged yesterday after the US ordered nonessential staff out of parts of the at least owing to heightened security concerns. This move came ahead of the Iran nuclear talks, which are due to take place this weekend in Oman.

Meanwhile, traders are also monitoring U.S. trade developments after talks with China resulted in a trade deal agreed to yesterday. However, details are relatively scarce. The two sides agreed to return to the tariffs agreed in Geneva, with a total of 55% on Chinese imports to the US. This is 30% from this administration and 25% from the previous. US imports into China will be levied at 10%.

Trump has also said that he plans to send letters to trading partners in the next one or two weeks regarding unilateral tariff rates, creating a level of caution in the markets. High tariffs are expected to slow economic growth, which could hit the demand outlook.

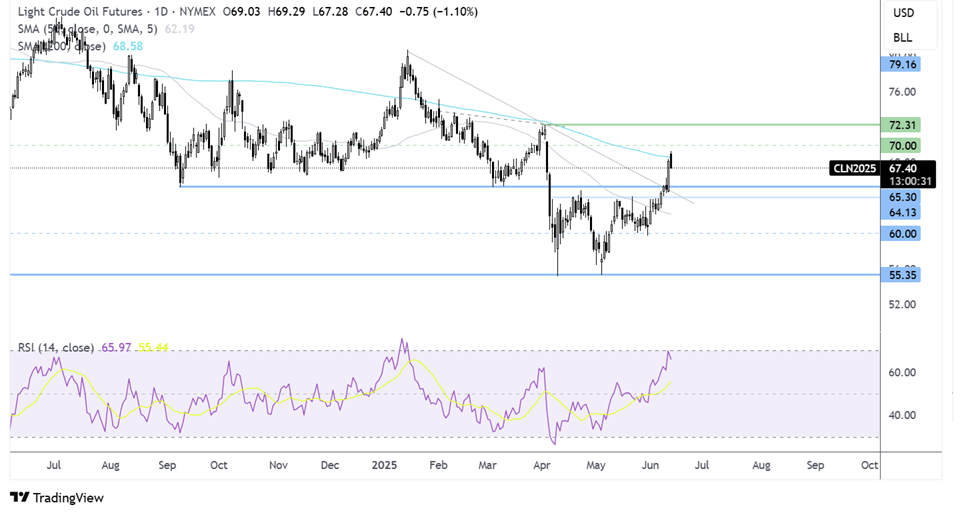

Oil Forecast- Technical Analysis

Oil has extended its recovery from 55.30, breaking out above 65.00, and is attempting to rise above the 200 SMA. The RSI supports further upside while it remains out of overbought conditions.

A close above the 200 SMA could open the door to 70.00, the round number, and 72.00, the April high.

On the downside, support is at 65.00, the March and September low, and the falling trendline dating back to the start of the year. A break below here and 64.00 brings 60.00 into focus.

Original Post