The Four Core Fundamentals of Great Positioning.

How do you build online positioning? If you want to be seen as an authority and trusted expert in the 401(k) market, there are four core fundamentals you need to put in place so when plan sponsors look you up online, you’ve built the kind of online positioning that make the competition irrelevant.

The four core fundamentals of great positioning are the building blocks of positioning yourself as a specialist in the 401k industry (or any industry for that matter).

In a competitive market, it’s the well-positioned brand that stands out.

So let’s look at what it means to be a well-positioned brand.

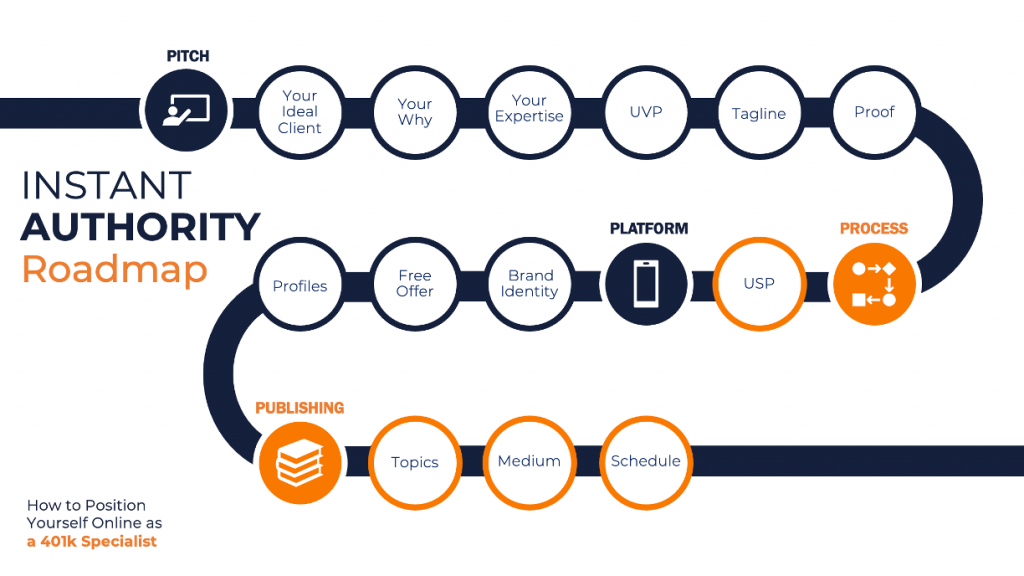

4 CORE FUNDAMENTALS OF GREAT POSITIONING

To have great positioning, you must have a clear pitch. This is how you say who you are, what you do and how you’re different. But it’s a lot more than that as you’ll see.

The second fundamental is getting you out of the commodity trap by having a clear and unique process for how you service your clients.

Third is having a professionally branded online platform. This includes your website and social media assets, and anything else you publish online.

Finally, is the content that you publish that sets you apart and helps build trust, credibility, and authority.

Each of these core areas has a bit more to it….

YOUR PITCH

You should start with your pitch because is the core language and message you use in the other three areas.

It’s about getting really clear on your unique value proposition, who you help, what you help them with and how that benefits them; your motto, or slogan, something short and catchy you can put on your business card or social profiles; your why – sharing some backstory that really helps plan sponsors get to know you on a more personal level; your expertise, (the 401k industry is highly regulated) so any expertise, training, experience you have here will be important to helping you do your job and to help show plan sponsors you’re qualified to help them; and finally proof, this comes in the form of case studies, statistics, and more.

YOUR PROCESS

It’s important to build a unique service process that sets clear expectations in a way for plan sponsors to visualize how you help them, in a way that’s structured and easy to understand.

YOUR PLATFORMS

After you have those things clearly defined, it’s time to set up (or review and update) your online platforms. This starts with having a clear brand identity that can be used across all platforms. And having something you can give away to plan sponsors in exchange for their email address, so you can collect qualified leads online. Then plugging it all into the various platforms you have online.

YOUR CONTENT

Finally, it’s essential to help plan sponsors really get to know you and like you and trust you – and you do that through publishing content. You’ll want to pick the topics you want to be known for, pick the best channel or medium for you to publish on, and set up a posting schedule that makes the most sense for you.

All of these elements combined make up the Instant Authority Roadmap: How to position yourself online as a 401k specialist.

This is an excerpt from the new Instant Authority Masterclass – a 12-week, hands on workshop that helps you build trust, authority, and credibility online.