Seagate Technology, Credo Technology, and Astera Labs are positioned to capitalize on powerful industry tailwinds that could drive significant earnings beats.

For investors seeking exposure to high-growth tech sectors, these stocks represent compelling opportunities.

Looking for more actionable trade ideas? Subscribe now to unlock access to InvestingPro’s AI-selected stock winners for up to 50% off amid the summer sale.

As the Q2 earnings season unfolds, investors are closely watching the tech sector, where innovation and market demand continue to drive growth. Three companies— Seagate Technology (NASDAQ:), Credo Technology (NASDAQ:), and Astera Labs (NASDAQ:)—are positioned to deliver strong earnings beats and are worth owning ahead of their upcoming reports.

Below, we explore what makes these stocks attractive buys in the current market environment.

1. Seagate Technology: Leading the Data Storage Boom

Year-To-Date Performance: +72.7%

Market Cap: $31.6 Billion

Seagate Technology, a dominant player in the hard disk drive (HDD) and storage solutions market, is benefiting from the resurgence of data storage demand driven by AI, cloud computing, and enterprise digitization.

The company’s innovative Heat-Assisted Magnetic Recording (HAMR) technology is the talk of Wall Street: Goldman Sachs, Morgan Stanley, and BofA have all hiked price targets on the back of accelerating adoption by hyperscalers.

Seagate is scheduled to report earnings in mid-July. Analysts expect revenue growth of 27.5% year-over-year to $2.41 billion, with EPS of $2.43, more than doubling from a profit of $1.05 in the year-ago period.

The proliferation of AI applications is driving record demand for high-capacity data storage, Seagate’s specialty. As enterprises and hyperscale customers expand data lakes and train larger AI models, hard drive and storage solutions become mission-critical.

Source: InvestingPro

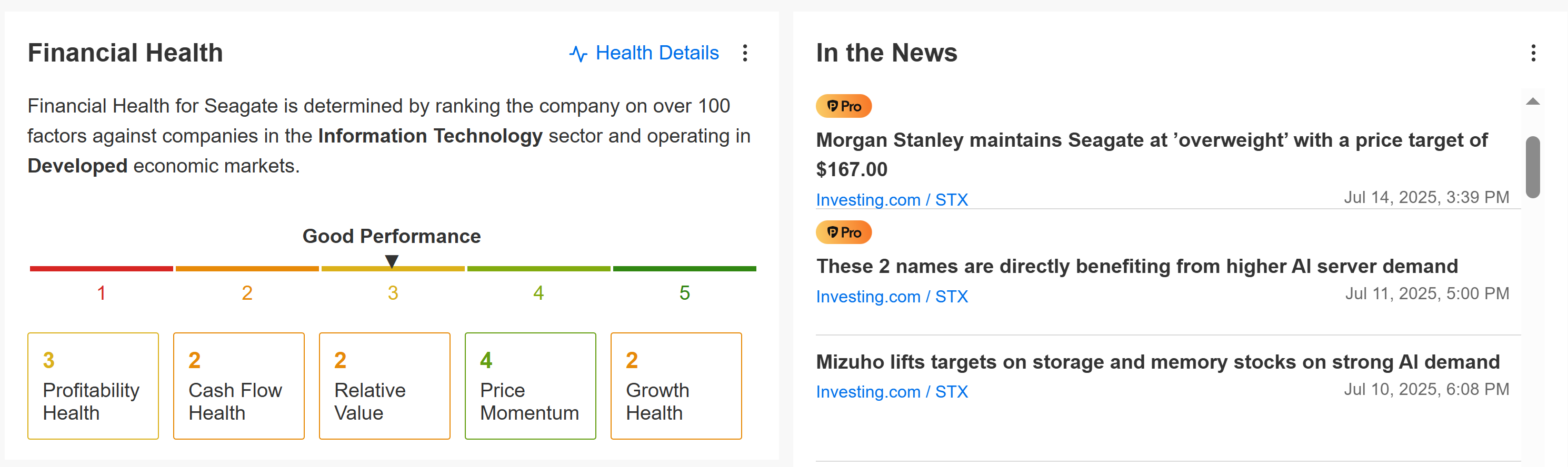

Seagate Technology lands with a solid overall health score of 2.92, enjoying ‘EXCELLENT’ price momentum (4.27) and ‘GREAT’ profit health (3.38). It should also be noted that the company has paid out an annual dividend for 15 consecutive years and currently sports a 2.11% yield.

Despite concerns about global trade tensions and tariffs, Seagate’s focus on enterprise and cloud storage markets provides a buffer. The company’s valuation remains reasonable compared to peers, and its strong operating leverage makes it an attractive buy for investors seeking exposure to the data storage boom.

2. Credo Technology: Riding the AI and Connectivity Wave

Year-To-Date Performance: +52.6%

Market Cap: $17.6 Billion

Credo Technology’s specialized focus on high-speed connectivity solutions positions it perfectly for the AI boom. With major cloud providers ramping up AI infrastructure investments, Credo is expected to see sustained demand growth.

The company’s products are essential for connecting AI chips in data centers, making it a critical enabler of the AI revolution.

Source: InvestingPro

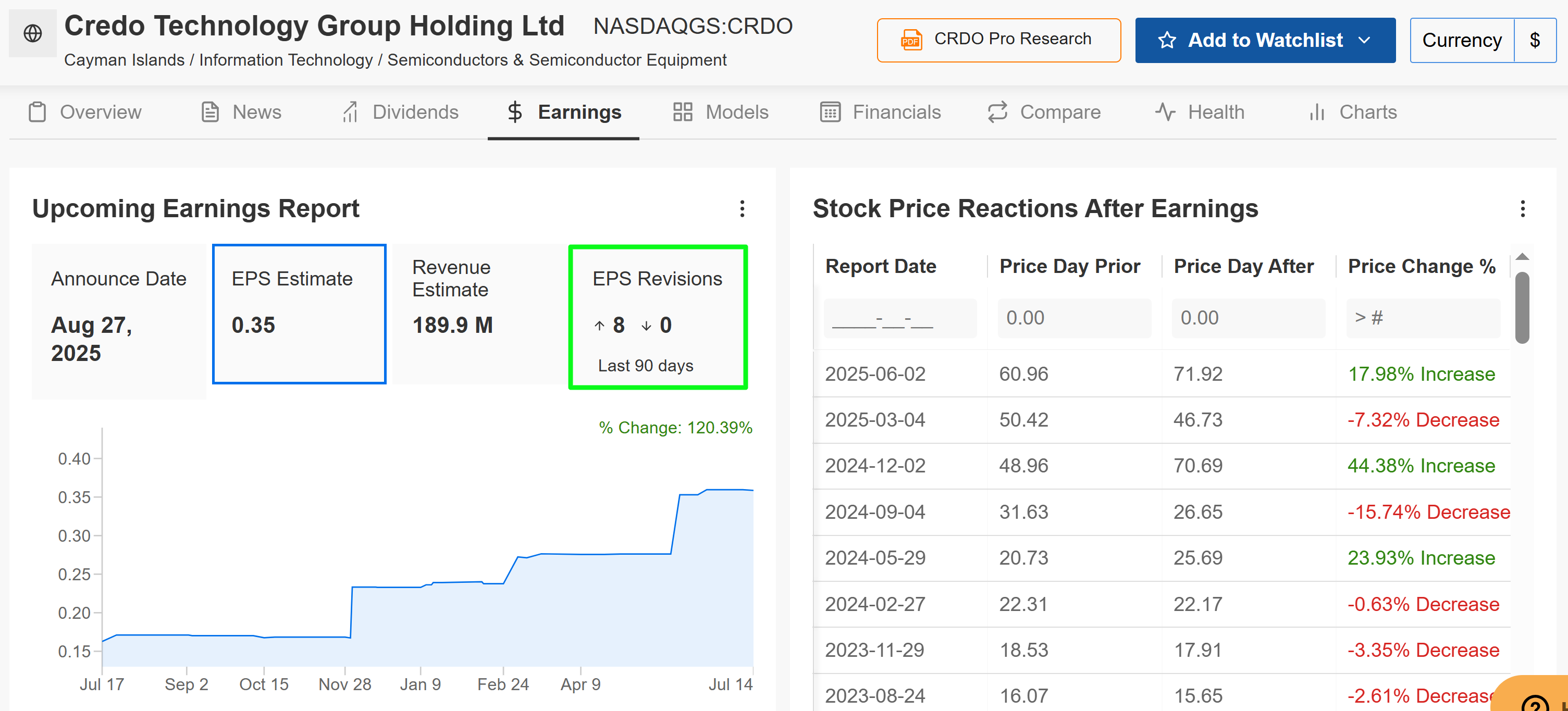

Credo is forecast to report Q2 EPS of $0.35, surging over 700% from EPS of $0.04 in the year-ago period, with revenue growth of 220% year-over-year, driven by increasing demand for its power-efficient connectivity solutions.

The surge in AI applications, particularly generative AI models, requires robust data center infrastructure. Credo’s products, such as its 400G and 800G connectivity solutions, are in high demand as hyperscalers like Microsoft (NASDAQ:), Alphabet (NASDAQ:), Amazon (NASDAQ:), and Meta (NASDAQ:) expand their AI capabilities.

Source: InvestingPro

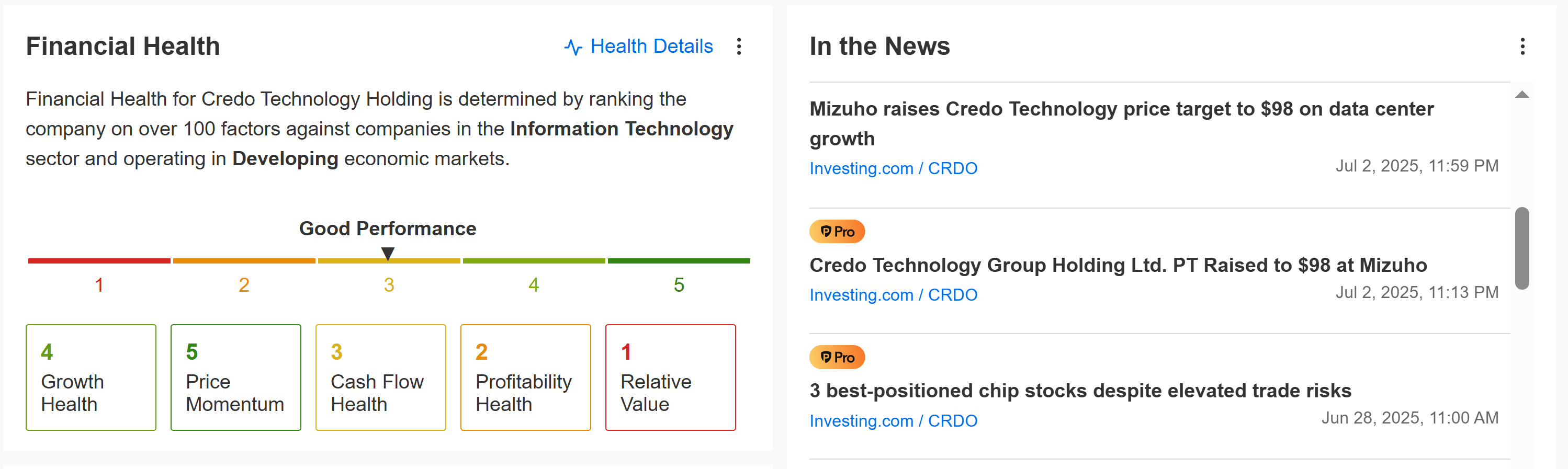

Credo posts an above-average 2.90 overall InvestingPro financial health score, with standout ratings in growth (3.75) and cash flow (3.08). The company’s growth label is ‘GREAT’, and its price momentum is downright ‘EXCELLENT’ (4.68).

Despite potential macroeconomic headwinds like tariffs, Credo’s niche in high-growth sectors insulates it from broader market volatility, making it a strong candidate for an earnings beat.

3. Astera Labs: Powering the AI Infrastructure Revolution

Year-To-Date Performance: -30.3%

Market Cap: $15.2 Billion

Astera Labs, a relatively new player in the semiconductor space, specializes in connectivity solutions for AI and machine learning workloads. Backed by Nvidia (NASDAQ:), Astera is gaining traction as a critical supplier in the AI ecosystem.

Its products, including PCIe retimers and connectivity chips, are essential for enabling high-speed data transfer in AI-driven data centers.

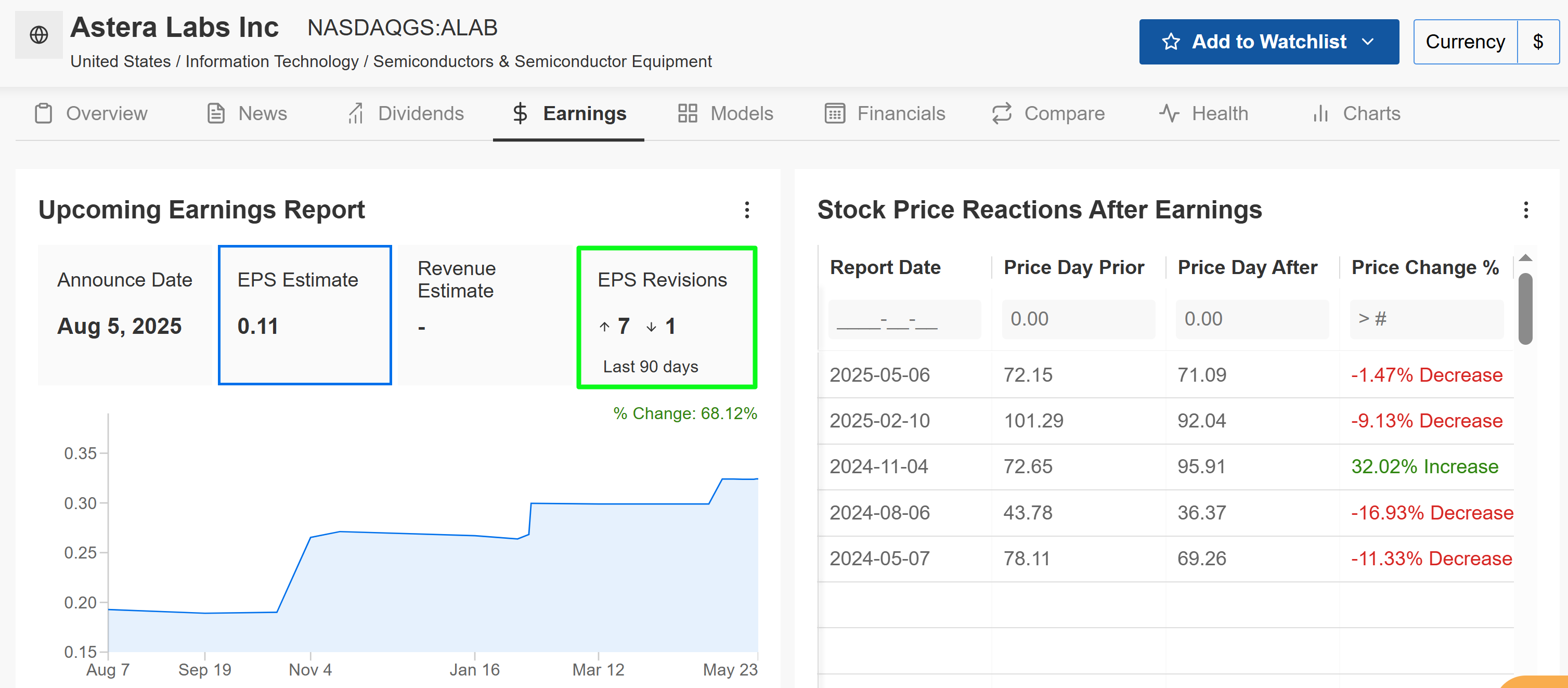

Source: InvestingPro

Astera Labs is expected to report its Q2 earnings in early August. Analysts expect revenue growth of 45% year-over-year, fuelled by new product ramps and expanding customer contracts, with adjusted EPS of $0.11, up from a loss of -$0.05 in the year-ago period.

Astera’s products are not an optional upgrade; they are a requirement for next-generation AI servers. As major cloud and server companies race to deploy the latest AI accelerators from Nvidia, AMD (NASDAQ:), and others, the demand for Astera’s solutions is expected to soar in tandem.

Source: InvestingPro

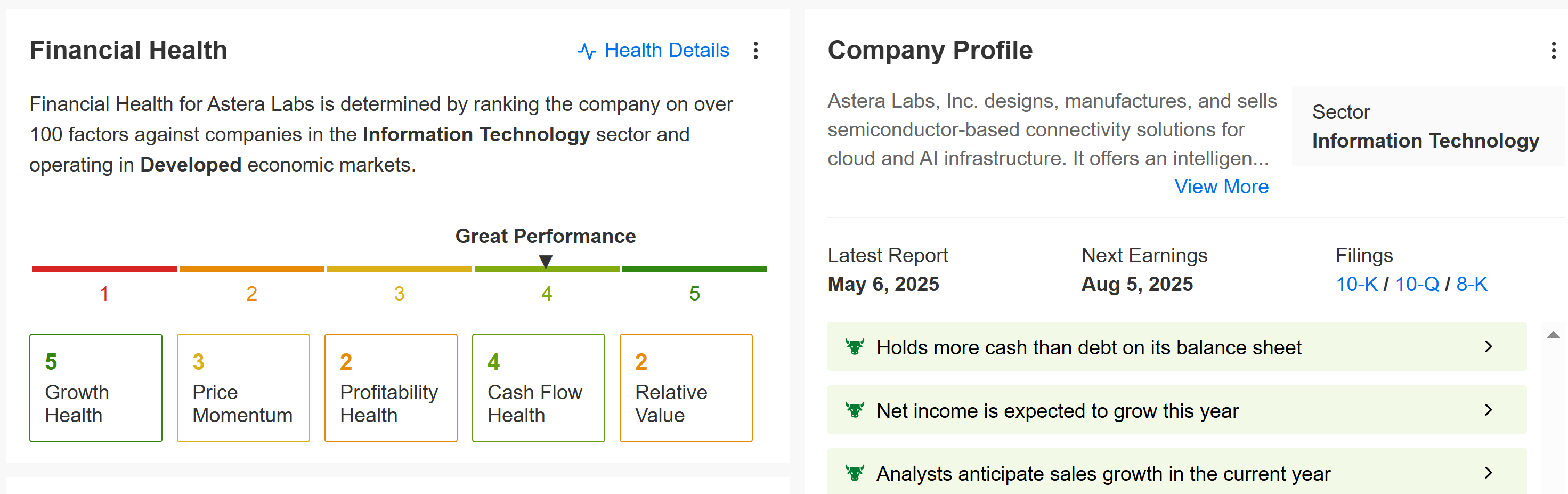

Astera Labs tops the trio with a 3.07 InvestingPro overall health score. Growth is its calling card (4.77, labeled ‘EXCELLENT’), while cash flow is also ‘GREAT’ (3.74).

Even with a premium valuation, Astera Labs’ position in the rapidly expanding AI connectivity market and exceptional growth outlook give it the potential to post ongoing earnings surprises as the AI infrastructure cycle accelerates.

Conclusion

The current market environment, marked by AI-driven growth, increasing data center investments, and resilient enterprise spending, favors companies like Seagate Technology, Credo Technology, and Astera Labs.

Despite potential headwinds like tariffs or macroeconomic uncertainty, these companies operate in high-growth niches with strong secular trends. Their reasonable valuations, combined with analyst optimism and robust demand drivers, position them for potential earnings beats and long-term outperformance.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now for up to 50% off amid the summer sale and instantly unlock access to several market-beating features, including:

ProPicks AI: AI-selected stock winners with proven track record.

InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR® S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Invesco Top QQQ ETF (QBIG), and Invesco S&P 500 Equal Weight ETF (RSP).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.