Published on July 16th, 2025 by Bob Ciura

Investing legend Peter Lynch was one of the most famous fund managers of all time. As the manager of the Magellan Fund for Fidelity Investments, Lynch produced annual returns of 29.2% from 1977-1990.

This performance made the Magellan fund the top-performing mutual fund in the world, cementing Lynch as one of the best money managers of all time.

Lynch also popularized the term “Growth-at-a-Reasonable Price” investing. Put simply, GARP investing is to try to find undervalued stocks that also offer long-term growth potential.

This is fairly difficult to put into practice, as many stocks are undervalued, but have weak growth prospects. Meanwhile, the best growth stocks in the market typically sport high valuations, and are rarely undervalued.

Therefore, stocks that combine both are hard to find, and requires investors to search far and wide. Perhaps Lynch himself put it best:

I think it was just looking at different companies and I always thought if you looked at 10 companies, you’d find one that’s interesting, if you’d look at 20, you’d find two, or if you look at 100 you’ll find 10. The person that turns over the most rocks wins the game. I’ve also found this to be true in my personal investing.

A good place to start looking for GARP stocks is the blue chip stocks list, a group of stocks that have raised their dividends for at least 10 years.

You can download the list of over 500 blue chip stocks now, by clicking on the link below:

This article will list the top 10 blue chip stocks that are undervalued according to their P/E ratios, with positive earnings growth of at least 5% annually expected for the future.

Lastly, these 10 stocks are based in the U.S., and have the lowest price-to-earnings ratios. The list is sorted by their P/E ratio, in ascending order.

These 10 dividend stocks qualify as growth-at-a-reasonable price.

Table of Contents

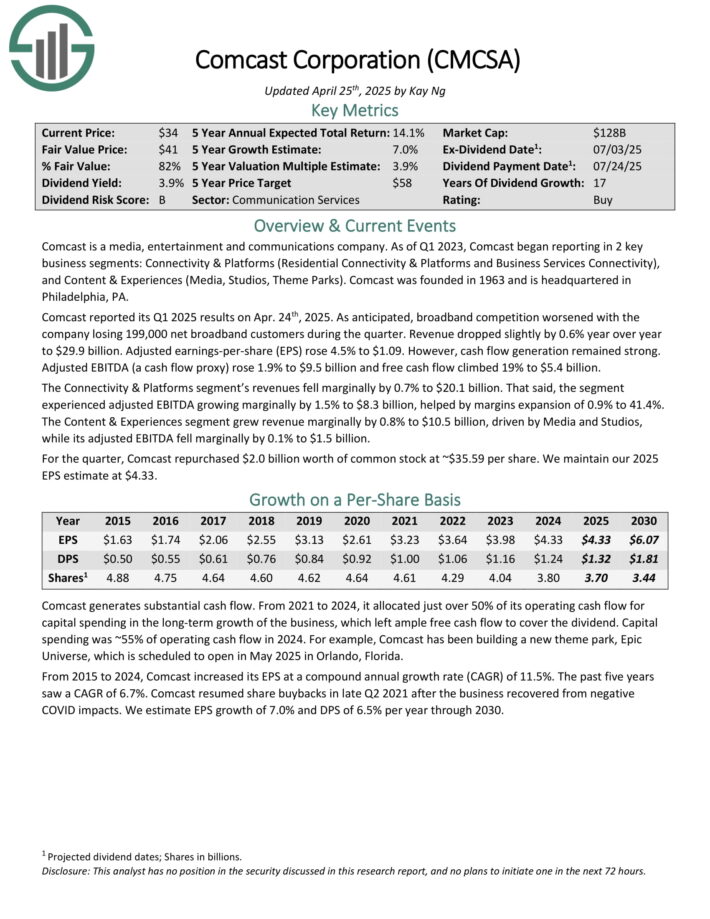

GARP Stock #10: Comcast Corp. (CMCSA)

5-Year Annual Expected EPS Growth: 7.0%

P/E Ratio: 8.1

Comcast is a media, entertainment and communications company. As of Q1 2023, Comcast began reporting in 2 key business segments: Connectivity & Platforms (Residential Connectivity & Platforms and Business Services Connectivity), and Content & Experiences (Media, Studios, Theme Parks).

Comcast reported its Q1 2025 results on Apr. 24th, 2025. As anticipated, broadband competition worsened with the company losing 199,000 net broadband customers during the quarter.

Revenue dropped slightly by 0.6% year-over-year to $29.9 billion. Adjusted earnings-per-share (EPS) rose 4.5% to $1.09. However, cash flow generation remained strong.

Adjusted EBITDA (a cash flow proxy) rose 1.9% to $9.5 billion and free cash flow climbed 19% to $5.4 billion. The Connectivity & Platforms segment’s revenues fell marginally by 0.7% to $20.1 billion. The segment experienced adjusted EBITDA growing marginally by 1.5% to $8.3 billion, helped by margins expansion of 0.9% to 41.4%.

The Content & Experiences segment grew revenue marginally by 0.8% to $10.5 billion, driven by Media and Studios, while its adjusted EBITDA fell marginally by 0.1% to $1.5 billion.

Click here to download our most recent Sure Analysis report on CMCSA (preview of page 1 of 3 shown below):

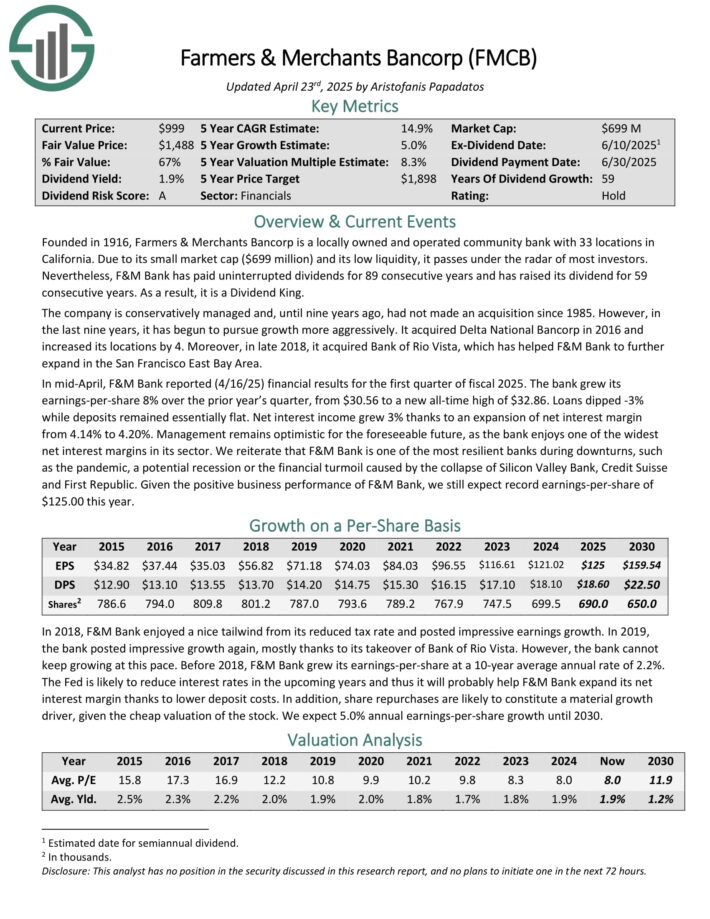

GARP Dividend Stock #9: Farmers & Merchants Bancorp (FMCB)

5-Year Annual Expected EPS Growth: 5.0%

P/E Ratio: 8.0

Farmers & Merchants Bancorp is a locally owned and operated community bank with 32 locations in California. Due to its small market cap and its low liquidity, it passes under the radar of most investors.

F&M Bank has paid uninterrupted dividends for 89 consecutive years and has raised its dividend for 59 consecutive years.

In mid-April, F&M Bank reported (4/16/25) financial results for the first quarter of fiscal 2025. The bank grew its earnings-per-share 8% over the prior year’s quarter, from $30.56 to a new all-time high of $32.86.

Loans dipped -3% while deposits remained essentially flat. Net interest income grew 3% thanks to an expansion of net interest margin from 4.14% to 4.20%.

F&M Bank is a prudently managed bank, which has always targeted a conservative capital ratio. The bank currently has a total capital ratio of 15.2%, which results in the highest regulatory classification of “well capitalized.”

Moreover, its credit quality remains exceptionally strong, as there are extremely few non-performing loans and leases in its portfolio.

Click here to download our most recent Sure Analysis report on FMCB (preview of page 1 of 3 shown below):

GARP Dividend Stock #8: Century Financial (CYFL)

5-Year Annual Expected EPS Growth: 6.0%

P/E Ratio: 8.0

Century Financial Corporation is a bank holding company based in Coldwater, Michigan, that operates primarily through its wholly-owned subsidiary, Century Bank and Trust.

The bank offers a wide range of financial services, like traditional banking products such as deposit accounts, commercial and consumer loans, residential mortgage loans, and wealth management services.

Also, the bank provides specialized financial services, such as trust and investment management, which are important contributors to non-interest income.

Century Bank and Trust serves its local communities through a network of 11 banking offices located across Branch, St. Joseph, and Hillsdale Counties in Michigan, as well as various ATM locations. At the end of March, Century Financial had deposits of $415.1 million.

On May 5th, 2025, Century Financial Corporation released its Q1 results for the period ending March 31st, 2025. For the quarter, net income reached $2.3 million, or $1.38 per share, up from $2.0 million or $1.18 per share last.

Net interest income totaled $5.0 million, an increase from $4.7 million in Q1 2024, driven by growth in loans and a stable interest rate environment.

Non-interest income grew to $1.35 million, up from $1.33 million a year earlier, reflecting continued strength in trust and investment management services.

Click here to download our most recent Sure Analysis report on CYFL (preview of page 1 of 3 shown below):

GARP Dividend Stock #7: Benchmark Bankshares (BMBN)

5-Year Annual Expected EPS Growth: 6.0%

P/E Ratio: 7.6

Benchmark Bankshares is a financial holding company that operates primarily through its wholly-owned subsidiary, Benchmark Community Bank.

Headquartered in Kenbridge, Virginia, the bank provides a variety of traditional banking services, including deposit accounts, consumer and commercial loans, and mortgage banking.

The bank also offers wealth management services and operates a robust portfolio of business solutions that include credit services, merchant services, and debit card processing.

Benchmark Community Bank operates 17 branches, with a geographical focus on Southside Virginia and Northern North Carolina, including key locations in areas such as Kenbridge, South Hill, and Farmville in Virginia, and Wake Forest, North Carolina.

The bank has steadily grown its footprint, most recently expanding its services in North Carolina by opening a full-service branch in Wake Forest and converting its Loan Production Office (LPO) in Zebulon into a full-service branch.

On May 19th, 2025, Benchmark announced its Q1 2025 results for the period ending March 31st, 2025. For the quarter, Benchmark posted net income of $4.6 million, or $1.03 per share, compared to $3.2 million, or $0.72 per share last year.

Net interest income rose 16.8% to $13.3 million, with the net interest margin (NIM) rising to 4.64% from 4.25%.

Click here to download our most recent Sure Analysis report on BMBN (preview of page 1 of 3 shown below):

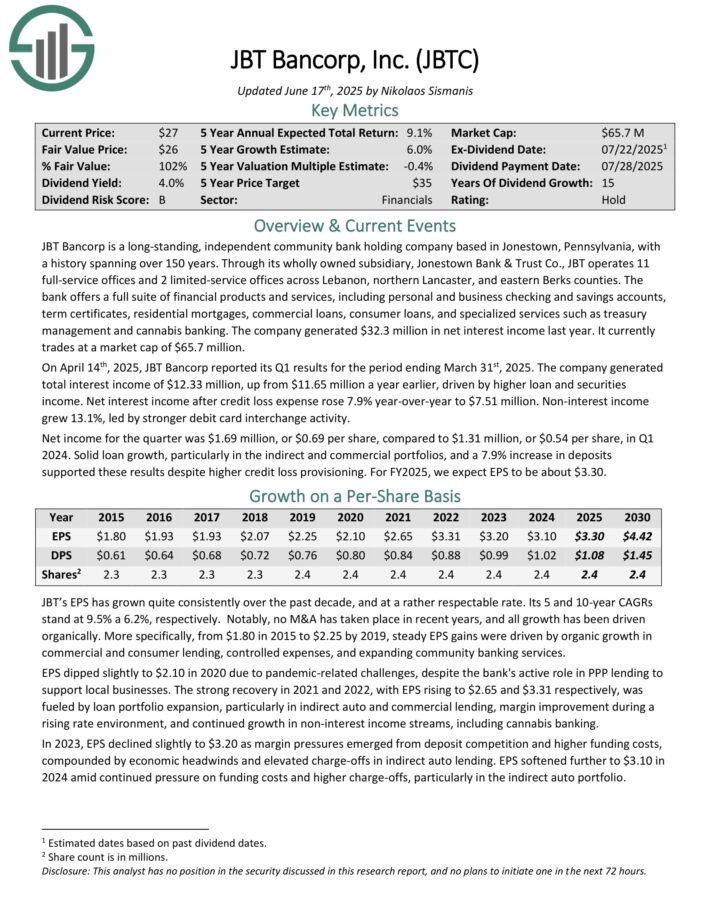

GARP Dividend Stock #6: JBT Bancorp (JBTC)

5-Year Annual Expected EPS Growth: 6.0%

P/E Ratio: 7.6

JBT Bancorp is a long-standing, independent community bank holding company based in Jonestown, Pennsylvania, with a history spanning over 150 years.

Through its wholly owned subsidiary, Jonestown Bank & Trust Co., JBT operates 11 full-service offices and 2 limited-service offices across Lebanon, northern Lancaster, and eastern Berks counties.

The bank offers a full suite of financial products and services, including personal and business checking and savings accounts, term certificates, residential mortgages, commercial loans, consumer loans, and specialized services such as treasury management and cannabis banking.

The company generated $32.3 million in net interest income last year.

On April 14th, 2025, JBT Bancorp reported its Q1 results for the period ending March 31st, 2025. The company generated total interest income of $12.33 million, up from $11.65 million a year earlier, driven by higher loan and securities income.

Net interest income after credit loss expense rose 7.9% year-over-year to $7.51 million. Non-interest income grew 13.1%, led by stronger debit card interchange activity.

Net income for the quarter was $1.69 million, or $0.69 per share, compared to $1.31 million, or $0.54 per share, in Q1 2024.

Click here to download our most recent Sure Analysis report on JBTC (preview of page 1 of 3 shown below):

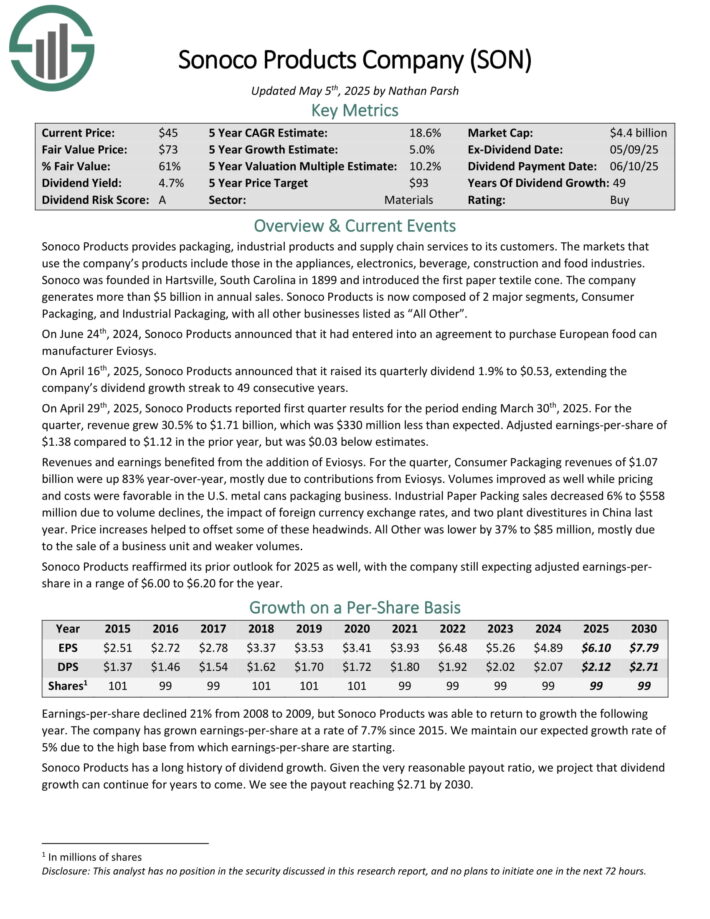

GARP Dividend Stock #5: Sonoco Products (SON)

5-Year Annual Expected EPS Growth: 5.0%

P/E Ratio: 7.4

Sonoco Products provides packaging, industrial products and supply chain services to its customers. The markets that use the company’s products include those in the appliances, electronics, beverage, construction and food industries.

The company generates over $5 billion in annual sales. Sonoco Products is now composed of 2 major segments, Consumer Packaging, and Industrial Packaging, with all other businesses listed as “All Other”.

On April 16th, 2025, Sonoco Products raised its quarterly dividend 1.9% to $0.53, extending the company’s dividend growth streak to 49 consecutive years.

On April 29th, 2025, Sonoco Products reported first quarter results for the period ending March 30th, 2025.

Source: Investor Presentation

For the quarter, revenue grew 30.5% to $1.71 billion, which was $330 million less than expected. Adjusted earnings-per-share of $1.38 compared to $1.12 in the prior year, but was $0.03 below estimates.

Revenues and earnings benefited from the addition of Eviosys. For the quarter, Consumer Packaging revenues of $1.07 billion were up 83% year-over-year, mostly due to contributions from Eviosys.

Volumes improved as well while pricing and costs were favorable in the U.S. metal cans packaging business.

Click here to download our most recent Sure Analysis report on Sonoco (SON) (preview of page 1 of 3 shown below):

GARP Dividend Stock #4: Canandaigua National Corporation (CNND)

5-Year Annual Expected EPS Growth: 5.0%

P/E Ratio: 7.4

Canandaigua National Corporation (CNC) is the parent company of The Canandaigua National Bank & Trust Company (CNB) and Canandaigua National Trust Company of Florida (CNTF), offering a wide range of financial services, including banking, lending, mortgage services, trust, investment management, and insurance.

With 23 branches across its service areas, CNC is focus on serving local communities by providing personalized financial solutions to individuals, businesses, and municipalities.

CNC emphasizes community banking, focusing on reinvesting in the local economy through a diverse lending portfolio. As of December 31st, 2024, CNC reported total deposits of $4.0 billion.

In early March, Canandaigua National released its full-year results for the period ending December 31st, 2024. For the year, total interest income grew 13% to $248 million.

Total interest expenses grew 29% to $111 million. Net interest income grew by 3% to $137 million. Total other income (service charges on deposit accounts and trust and investment services) increased 6% to $54 million.

Total other expenses (Inc. salaries, occupancy, and marketing) grew 6% to $125 million. Net income was $45 million, relatively flat year-over-year. EPS was $24.15.

Click here to download our most recent Sure Analysis report on CNND (preview of page 1 of 3 shown below):

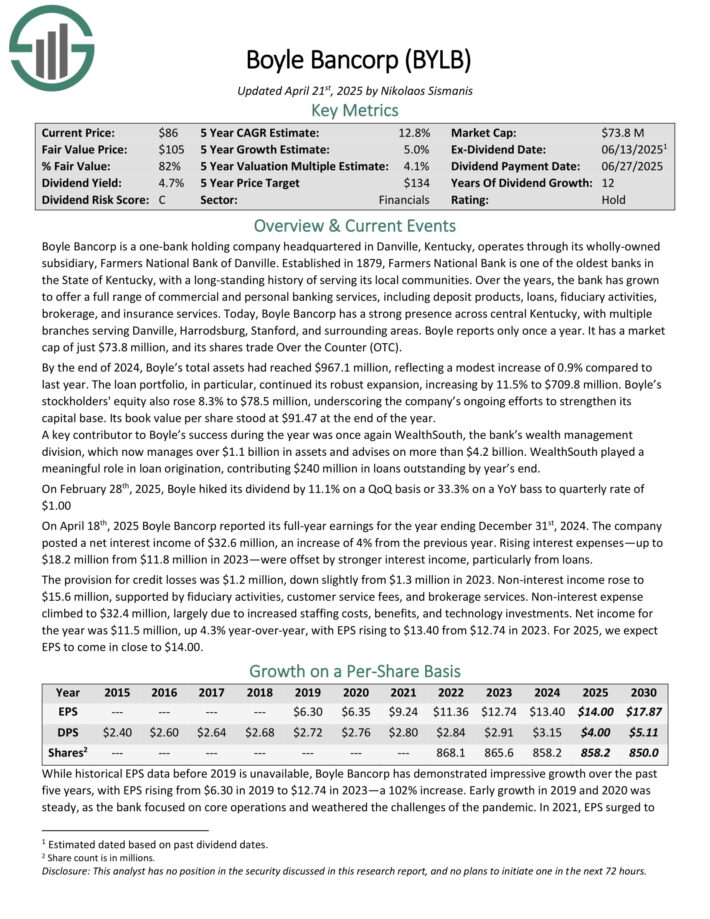

GARP Dividend Stock #3: Boyle Bancorp (BYLB)

5-Year Annual Expected EPS Growth: 5.0%

P/E Ratio: 6.4

Boyle Bancorp is a one-bank holding company headquartered in Danville, Kentucky, operates through its wholly-owned subsidiary, Farmers National Bank of Danville.

Established in 1879, Farmers National Bank is one of the oldest banks in the State of Kentucky, with a long-standing history of serving its local communities.

By the end of 2024, Boyle’s total assets had reached $967.1 million, reflecting a modest increase of 0.9% compared to last year. The loan portfolio, in particular, continued its robust expansion, increasing by 11.5% to $709.8 million. Its book value per share stood at $91.47 at the end of the year.

A key contributor to Boyle’s success during the year was once again WealthSouth, the bank’s wealth management division, which now manages over $1.1 billion in assets and advises on more than $4.2 billion. WealthSouth played a meaningful role in loan origination, contributing $240 million in loans outstanding by year’s end.

On February 28th, 2025, Boyle hiked its dividend by 11.1% on a QoQ basis or 33.3% on a YoY bass to quarterly rate of $1.00.

On April 18th, 2025 Boyle Bancorp reported its full-year earnings for the year ending December 31st, 2024. The company posted a net interest income of $32.6 million, an increase of 4% from the previous year.

Rising interest expenses—up to $18.2 million from $11.8 million in 2023—were offset by stronger interest income, particularly from loans.

Click here to download our most recent Sure Analysis report on BYLB (preview of page 1 of 3 shown below):

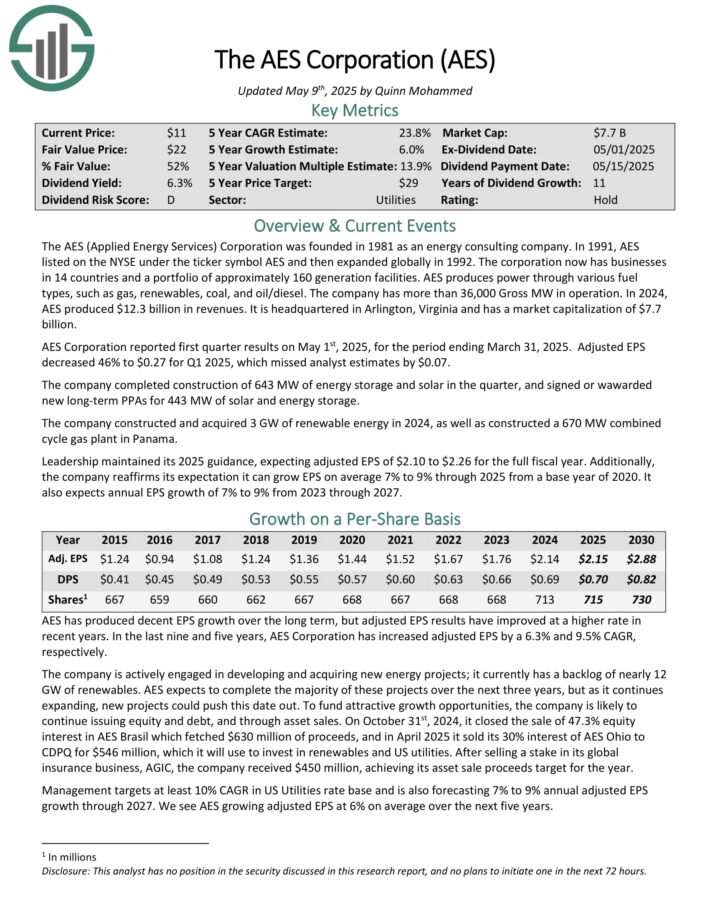

GARP Dividend Stock #2: AES Corp. (AES)

5-Year Annual Expected EPS Growth: 6.0%

P/E Ratio: 6.1

The AES (Applied Energy Services) Corporation has businesses in 14 countries and a portfolio of approximately 160 generation facilities. AES produces power through various fuel types, such as gas, renewables, coal, and oil/diesel.

The company has more than 36,000 Gross MW in operation. In 2024, AES produced $12.3 billion in revenues.

AES Corporation reported first quarter results on May 1st, 2025, for the period ending March 31, 2025. Adjusted EPS decreased 46% to $0.27 for Q1 2025, which missed analyst estimates by $0.07.

The company completed construction of 643 MW of energy storage and solar in the quarter, and signed or wawarded new long-term PPAs for 443 MW of solar and energy storage.

The company constructed and acquired 3 GW of renewable energy in 2024, as well as constructed a 670 MW combined cycle gas plant in Panama. Leadership maintained its 2025 guidance, expecting adjusted EPS of $2.10 to $2.26 for the full fiscal year.

Click here to download our most recent Sure Analysis report on AES (preview of page 1 of 3 shown below):

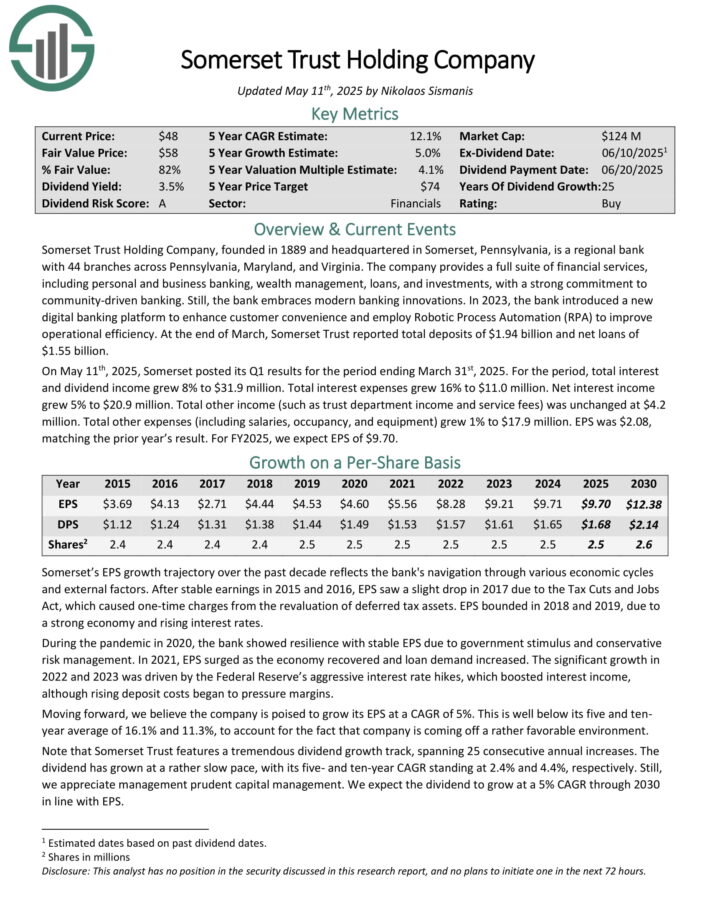

GARP Dividend Stock #1: Somerset Trust Holding Company (SOME)

5-Year Annual Expected EPS Growth: 5.0%

P/E Ratio: 5.4

Somerset Trust Holding Company, founded in 1889 and headquartered in Somerset, Pennsylvania, is a regional bank with 44 branches across Pennsylvania, Maryland, and Virginia.

The company provides a full suite of financial services, including personal and business banking, wealth management, loans, and investments, with a strong commitment to community-driven banking. Still, the bank embraces modern banking innovations.

At the end of March, Somerset Trust reported total deposits of $1.94 billion and net loans of $1.55 billion.

On May 11th, 2025, Somerset posted its Q1 results for the period ending March 31st, 2025. For the period, total interest and dividend income grew 8% to $31.9 million. Total interest expenses grew 16% to $11.0 million. Net interest income grew 5% to $20.9 million.

Total other income (such as trust department income and service fees) was unchanged at $4.2 million. Total other expenses (including salaries, occupancy, and equipment) grew 1% to $17.9 million. EPS was $2.08, matching the prior year’s result.

Click here to download our most recent Sure Analysis report on SOME (preview of page 1 of 3 shown below):

Final Thoughts

Blue chip stocks tend to have many or all of the following characteristics:

Market leaders

Popular / well-known

Large-cap market capitalization

Long history of paying rising dividends

Consistent profitability even during recessions

That’s why they can make excellent investments for the long-run. And their strength and reliability make them compelling investments for investors of all experience levels, from beginners to experts.

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

Other Sure Dividend Resources

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].