Published on May 21st, 2025 by Bob Ciura

There are good reasons for investors to own international stocks, such as diversification. Many companies that operate outside the U.S. have access to geographic markets that could outperform the U.S. in the event of a domestic economic downturn.

Of course, there are risks to purchasing international stocks, such as currency risk.

Still, income investors looking for quality dividend stocks should not always ignore international stocks. Indeed, there are many quality international stocks that have compiled impressive dividend growth histories.

Income investors are likely familiar with the Dividend Aristocrats, which are some of the highest-quality stocks to buy and hold for the long term.

You can download the full Dividend Aristocrats list, along with important metrics like dividend yields and price-to-earnings ratios, by clicking on the link below:

Disclaimer: Sure Dividend is not affiliated with S&P Global in any way. S&P Global owns and maintains The Dividend Aristocrats Index. The information in this article and downloadable spreadsheet is based on Sure Dividend’s own review, summary, and analysis of the S&P 500 Dividend Aristocrats ETF (NOBL) and other sources, and is meant to help individual investors better understand this ETF and the index upon which it is based. None of the information in this article or spreadsheet is official data from S&P Global. Consult S&P Global for official information.

The list of Dividend Aristocrats is diversified across multiple sectors, including consumer goods, financials, industrials, and healthcare. But it is not diversified geographically to include international stocks.

With this in mind, this article will discuss 10 international dividend growth stocks that have raised their dividends for over 25 consecutive years, in their home currencies.

Table of Contents

The table of contents below allows for easy navigation. The stocks are listed by 5-year annual expected returns, in ascending order.

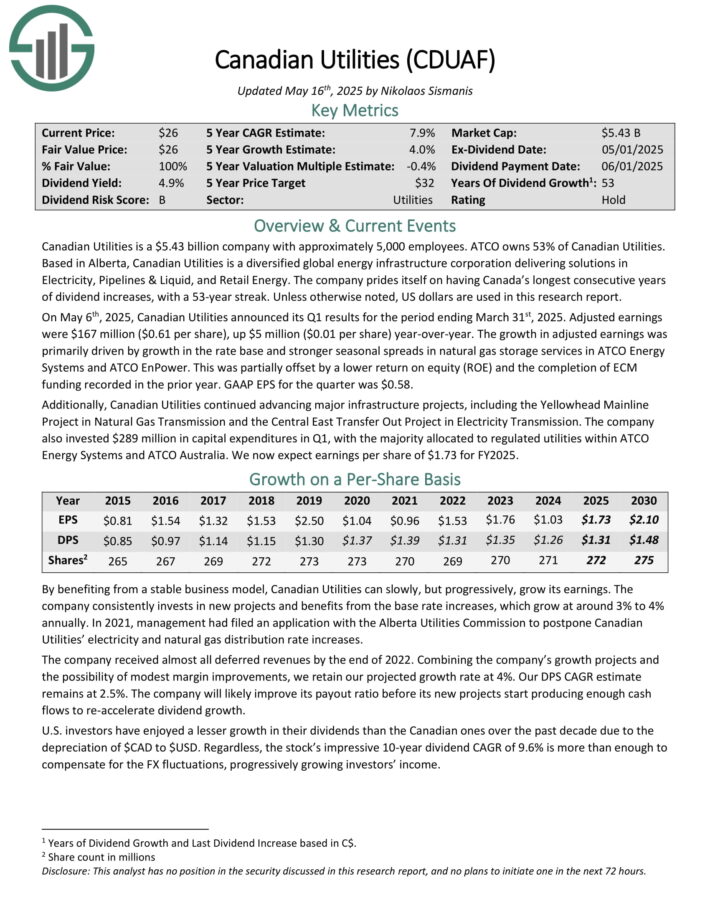

International Dividend Aristocrat #10: Canadian Utilities Ltd. (CDUAF)

Consecutive Years Of Dividend Increases: 53

Annual Expected Returns: 7.5%

Canadian Utilities is a utility company with approximately 5,000 employees. ATCO owns 53% of Canadian Utilities. Based in Alberta, Canadian Utilities is a diversified global energy infrastructure corporation delivering solutions in Electricity, Pipelines & Liquid, and Retail Energy.

The company prides itself on having Canada’s longest consecutive years of dividend increases, with a 53-year streak. Unless otherwise noted, US dollars are used in this research report.

On May 6th, 2025, Canadian Utilities announced its Q1 results. Adjusted earnings were $167 million ($0.61 per share), up $5 million ($0.01 per share) year-over-year.

The growth in adjusted earnings was primarily driven by growth in the rate base and stronger seasonal spreads in natural gas storage services in ATCO Energy Systems and ATCO EnPower. This was partially offset by a lower return on equity (ROE) and the completion of ECM funding recorded in the prior year. GAAP EPS for the quarter was $0.58.

Additionally, Canadian Utilities continued advancing major infrastructure projects, including the Yellowhead Mainline Project in Natural Gas Transmission and the Central East Transfer Out Project in Electricity Transmission.

Click here to download our most recent Sure Analysis report on CDUAF (preview of page 1 of 3 shown below):

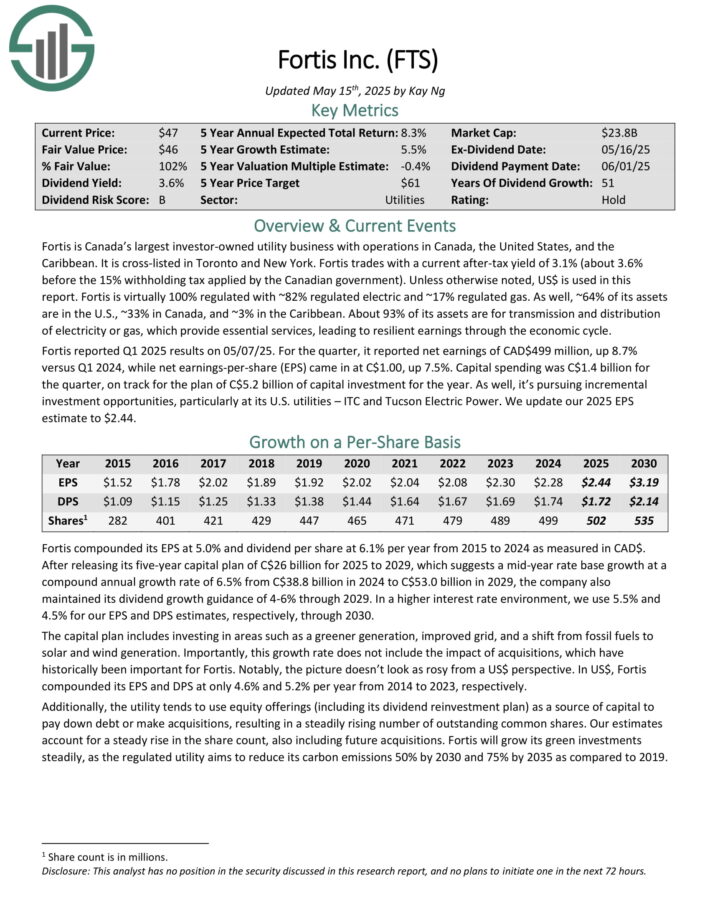

International Dividend Aristocrat #9: Fortis Inc. (FTS)

Consecutive Years Of Dividend Increases: 51

Annual Expected Returns: 7.9%

Fortis is Canada’s largest investor-owned utility business with operations in Canada, the United States, and the Caribbean. It is cross-listed in Toronto and New York.

Fortis is virtually 100% regulated with ~82% regulated electric and ~17% regulated gas. As well, ~64% of its assets are in the U.S., ~33% in Canada, and ~3% in the Caribbean. About 93% of its assets are for transmission and distribution of electricity or gas, which provide essential services, leading to resilient earnings through the economic cycle.

Fortis reported Q1 2025 results on 05/07/25. For the quarter, it reported net earnings of CAD$499 million, up 8.7% versus Q1 2024, while net earnings-per-share (EPS) came in at C$1.00, up 7.5%.

Capital spending was C$1.4 billion for the quarter, on track for the plan of C$5.2 billion of capital investment for the year.

After releasing its five-year capital plan of C$26 billion for 2025 to 2029, which suggests a mid-year rate base growth at a compound annual growth rate of 6.5% from C$38.8 billion in 2024 to C$53.0 billion in 2029, the company also maintained its dividend growth guidance of 4-6% through 2029.

The capital plan includes investing in areas such as a greener generation, improved grid, and a shift from fossil fuels to solar and wind generation.

Click here to download our most recent Sure Analysis report on FTS (preview of page 1 of 3 shown below):

International Dividend Aristocrat #8: Canadian National Railway (CNI)

Consecutive Years Of Dividend Increases: 30

Annual Expected Returns: 7.9%

Canadian National Railway is the largest railway operator in Canada. The company has a network of approximately 20,000 route miles and connects three coasts: the Atlantic, the Pacific and the Gulf of Mexico. It handles over $200 billion worth of goods annually and carries over 300 million tons of cargo.

On January 30th, 2025, Canadian National Railway increased its dividend 5% for the March 31st, 2025 payment date.

On May 1st, 2025, Canadian National Railway reported first quarter results. For the quarter, revenue grew 2.3% to $3.18 billion, which was $25 million more than expected. Adjusted earnings-per share of $1.40 compared favorably to $1.26 in the prior year and was $0.12 above estimates.

For the quarter, Canadian National Railway’s operating ratio improved 20 basis points to 63.4%. Revenue ton miles improved 1% from the prior year while carloads declined 2.2%.

Revenue results were mixed for most of the company’s individual product categories. Using constant currency, Coal (+9%), Grain and Fertilizers (+7%), and Petroleum and Chemicals (+3%) were all higher for the period.

Click here to download our most recent Sure Analysis report on CNI (preview of page 1 of 3 shown below):

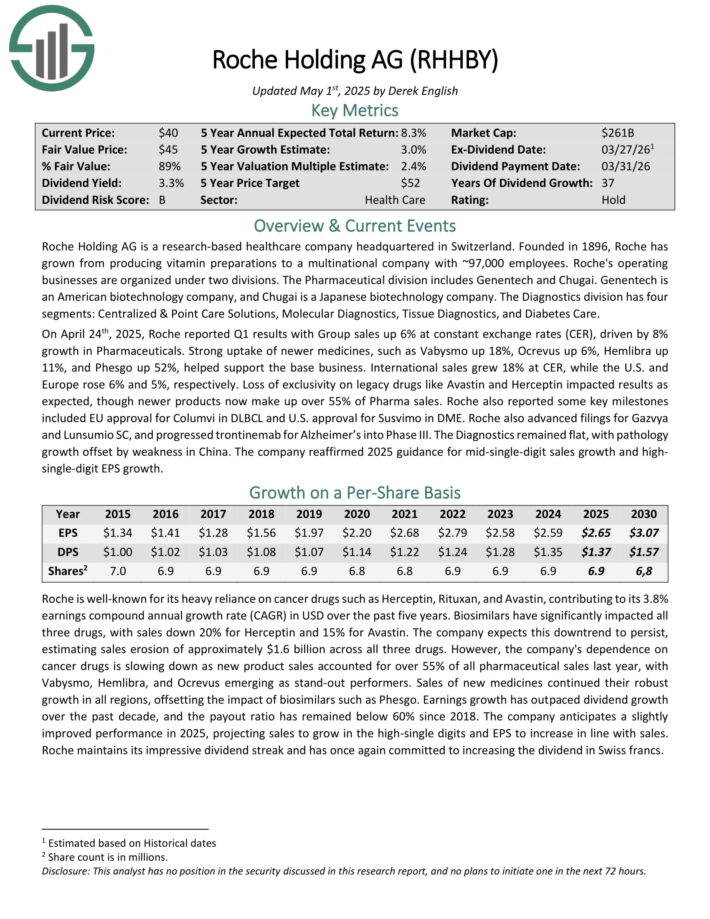

International Dividend Aristocrat #7: Roche Holding AG (RHHBY)

Consecutive Years Of Dividend Increases: 37

Annual Expected Returns: 8.4%

Roche Holding AG is a research-based healthcare company headquartered in Switzerland. Founded in 1896, Roche has grown from producing vitamin preparations to a multinational company with ~97,000 employees. Roche’s operating businesses are organized under two divisions.

The Pharmaceutical division includes Genentech and Chugai. Genentech is an American biotechnology company, and Chugai is a Japanese biotechnology company. The Diagnostics division has four segments: Centralized & Point Care Solutions, Molecular Diagnostics, Tissue Diagnostics, and Diabetes Care.

On April 24th, 2025, Roche reported Q1 results with Group sales up 6% at constant exchange rates (CER), driven by 8% growth in Pharmaceuticals. Strong uptake of newer medicines, such as Vabysmo up 18%, Ocrevus up 6%, Hemlibra up 11%, and Phesgo up 52%, helped support the base business.

International sales grew 18% at CER, while the U.S. and Europe rose 6% and 5%, respectively. Loss of exclusivity on legacy drugs like Avastin and Herceptin impacted results as expected, though newer products now make up over 55% of Pharma sales.

Roche also reported some key milestones included EU approval for Columvi in DLBCL and U.S. approval for Susvimo in DME. Roche also advanced filings for Gazvya and Lunsumio SC, and progressed trontinemab for Alzheimer’s into Phase III.

Click here to download our most recent Sure Analysis report on RHHBY (preview of page 1 of 3 shown below):

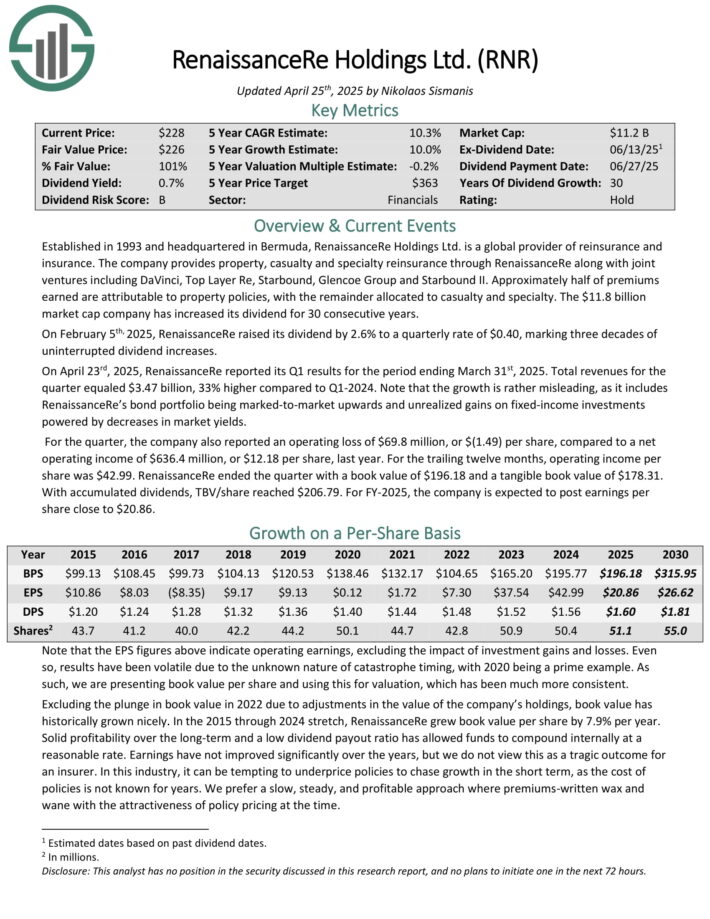

International Dividend Aristocrat #6: RenaissanceRe Holdings Ltd. (RNR)

Consecutive Years Of Dividend Increases: 30

Annual Expected Returns: 8.7%

Established in 1993 and headquartered in Bermuda, RenaissanceRe Holdings Ltd. is a global provider of reinsurance and insurance.

The company provides property, casualty and specialty reinsurance through RenaissanceRe along with joint ventures including DaVinci, Top Layer Re, Starbound, Glencoe Group and Starbound II.

Approximately half of premiums earned are attributable to property policies, with the remainder allocated to casualty and specialty.

On February 5th, 2025, RenaissanceRe raised its dividend by 2.6% to a quarterly rate of $0.40, marking three decades of uninterrupted dividend increases.

On April 23rd, 2025, RenaissanceRe reported its Q1 results for the period ending March 31st, 2025. Total revenues for the quarter equaled $3.47 billion, 33% higher compared to Q1-2024.

Note that the growth is rather misleading, as it includes RenaissanceRe’s bond portfolio being marked-to-market upwards and unrealized gains on fixed-income investments powered by decreases in market yields.

For the quarter, the company also reported an operating loss of $69.8 million, or $(1.49) per share, compared to a net operating income of $636.4 million, or $12.18 per share, last year.

Click here to download our most recent Sure Analysis report on RNR (preview of page 1 of 3 shown below):

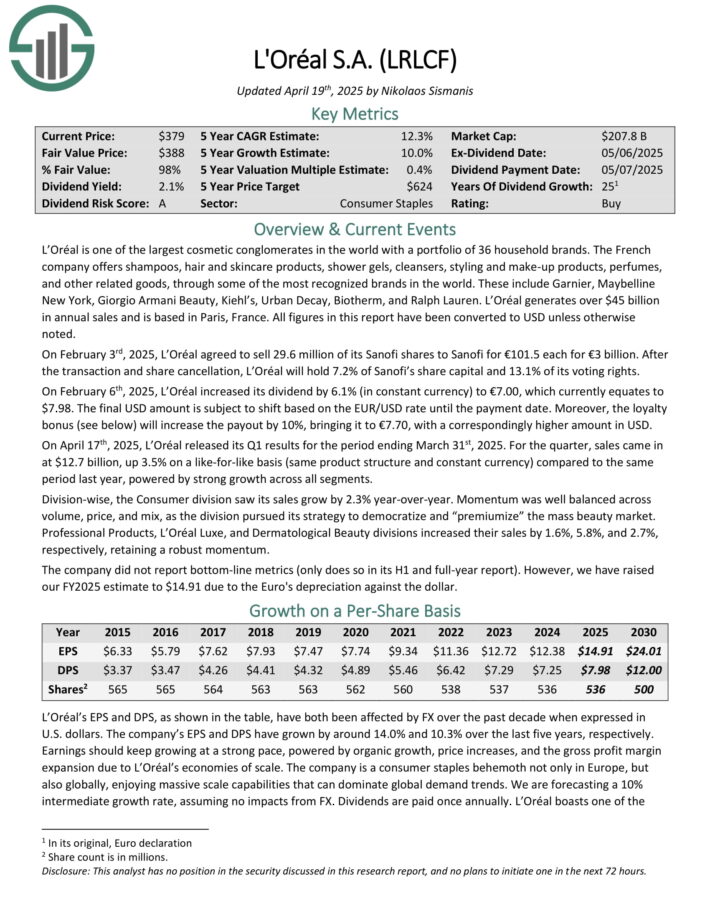

International Dividend Aristocrat #5: L’Oreal (LRLCF)

Consecutive Years Of Dividend Increases: 25

Annual Expected Returns: 10.1%

L’Oréal is one of the largest cosmetic conglomerates in the world with a portfolio of 36 household brands. The French company offers shampoos, hair and skincare products, shower gels, cleansers, styling and make-up products, perfumes, and other related goods, through some of the most recognized brands in the world.

These include Garnier, Maybelline New York, Giorgio Armani Beauty, Kiehl’s, Urban Decay, Biotherm, and Ralph Lauren. L’Oréal generates over $45 billion in annual sales and is based in Paris, France. All figures in this report have been converted to USD unless otherwise noted.

On February 3rd, 2025, L’Oréal agreed to sell 29.6 million of its Sanofi shares to Sanofi for €101.5 each for €3 billion. After the transaction and share cancellation, L’Oréal will hold 7.2% of Sanofi’s share capital and 13.1% of its voting rights. On February 6th, 2025, L’Oréal increased its dividend by 6.1% (in constant currency) to €7.00.

On April 17th, 2025, L’Oréal released its Q1 results for the period ending March 31st, 2025. For the quarter, sales came in at $12.7 billion, up 3.5% on a like-for-like basis (same product structure and constant currency) compared to the same period last year, powered by strong growth across all segments.

Click here to download our most recent Sure Analysis report on LRLCF (preview of page 1 of 3 shown below):

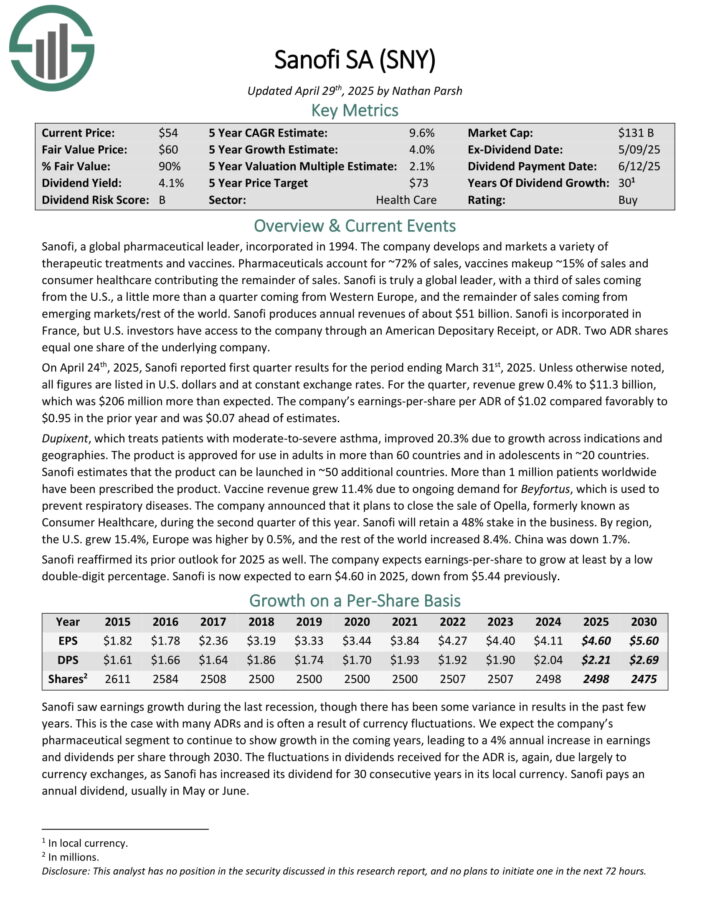

International Dividend Aristocrat #4: Sanofi (SNY)

Consecutive Years Of Dividend Increases: 30

Annual Expected Returns: 10.1%

Sanofi is a global pharmaceutical company that develops and markets a variety of therapeutic treatments and vaccines. Pharmaceuticals account for ~72% of sales, vaccines makeup ~15% of sales and consumer healthcare contributing the remainder of sales.

Sanofi produces annual revenues of about $51 billion. It is incorporated in France, but U.S. investors have access to the company through an American Depositary Receipt, or ADR. Two ADR shares equal one share of the underlying company.

On April 24th, 2025, Sanofi reported first quarter results for the period ending March 31st, 2025. Unless otherwise noted, all figures are listed in U.S. dollars and at constant exchange rates.

For the quarter, revenue grew 0.4% to $11.3 billion, which was $206 million more than expected. The company’s earnings-per-share per ADR of $1.02 compared favorably to $0.95 in the prior year and was $0.07 ahead of estimates.

Dupixent, which treats patients with moderate-to-severe asthma, improved 20.3% due to growth across indications and geographies. The product is approved for use in adults in more than 60 countries and in adolescents in ~20 countries. Sanofi estimates that the product can be launched in ~50 additional countries.

Vaccine revenue grew 11.4% due to ongoing demand for Beyfortus, which is used to prevent respiratory diseases.

Click here to download our most recent Sure Analysis report on SNY (preview of page 1 of 3 shown below):

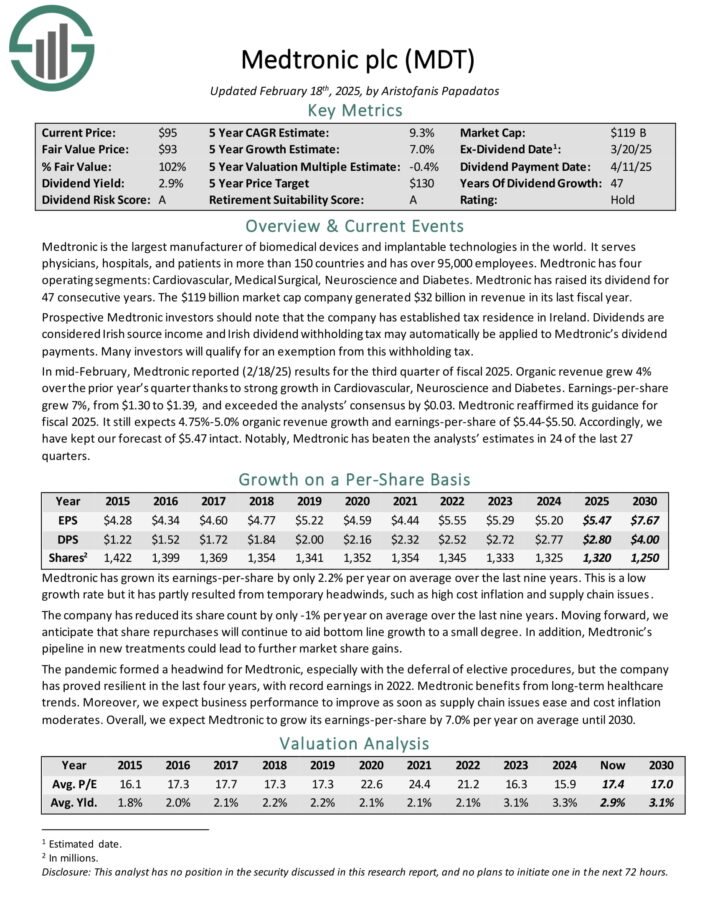

International Dividend Aristocrat #3: Medtronic plc (MDT)

Consecutive Years Of Dividend Increases: 47

Annual Expected Returns: 11.2%

Medtronic is the largest manufacturer of biomedical devices and implantable technologies in the world. It serves physicians, hospitals, and patients in more than 150 countries and has over 95,000 employees.

Medtronic has four operating segments: Cardiovascular, Medical Surgical, Neuroscience and Diabetes. Medtronic has raised its dividend for 47 consecutive years. The company generated $32 billion in revenue in its last fiscal year.

Prospective Medtronic investors should note that the company has established tax residence in Ireland. Dividends are considered Irish source income and Irish dividend withholding tax may automatically be applied to Medtronic’s dividend payments. Many investors will qualify for an exemption from this withholding tax.

In mid-February, Medtronic reported (2/18/25) results for the third quarter of fiscal 2025. Organic revenue grew 4% over the prior year’s quarter thanks to strong growth in Cardiovascular, Neuroscience and Diabetes.

Earnings-per-share grew 7%, from $1.30 to $1.39, and exceeded the analysts’ consensus by $0.03. Medtronic reaffirmed its guidance for fiscal 2025. It still expects 4.75%-5.0% organic revenue growth and earnings-per-share of $5.44-$5.50.

Click here to download our most recent Sure Analysis report on MDT (preview of page 1 of 3 shown below):

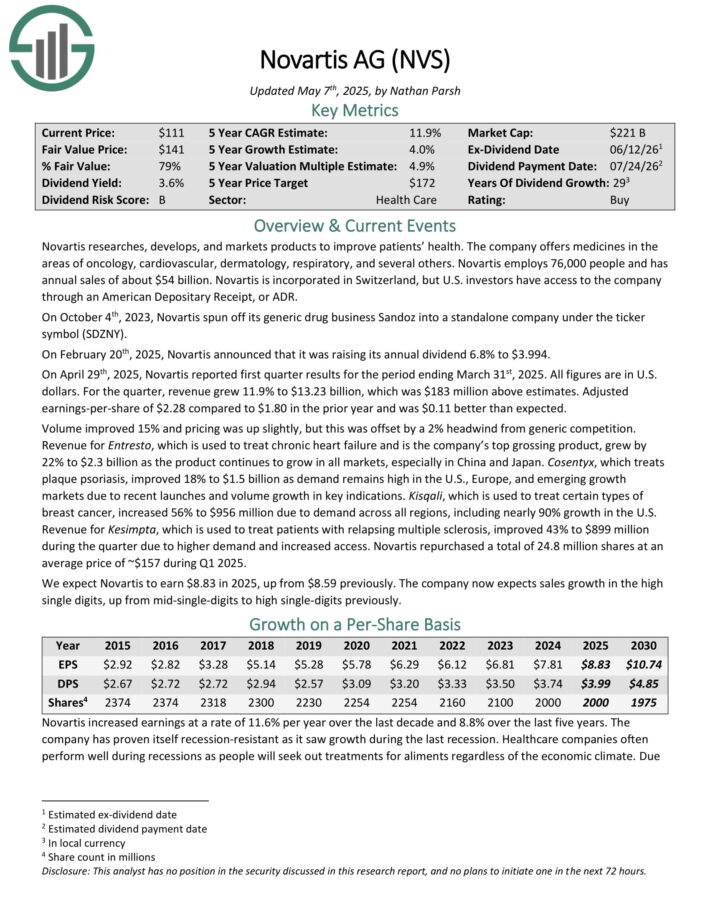

International Dividend Aristocrat #2: Novartis AG (NVS)

Consecutive Years Of Dividend Increases: 29

Annual Expected Returns: 11.5%

Novartis researches, develops, and markets products to improve patients’ health. The company offers medicines in the areas of oncology, cardiovascular, dermatology, respiratory, and several others. Novartis employs 76,000 people and has annual sales of about $54 billion.

Novartis is incorporated in Switzerland, but U.S. investors have access to the company through an American Depositary Receipt, or ADR.

On February 20th, 2025, Novartis announced that it was raising its annual dividend 6.8% to $3.994.

On April 29th, 2025, Novartis reported first quarter results. All figures are in U.S. dollars. For the quarter, revenue grew 11.9% to $13.23 billion, which was $183 million above estimates. Adjusted earnings-per-share of $2.28 compared to $1.80 in the prior year and was $0.11 better than expected.

Volume improved 15% and pricing was up slightly, but this was offset by a 2% headwind from generic competition. Revenue for Entresto, which is used to treat chronic heart failure and is the company’s top grossing product, grew by 22% to $2.3 billion as the product continues to grow in all markets, especially in China and Japan.

Cosentyx, which treats plaque psoriasis, improved 18% to $1.5 billion as demand remains high in the U.S., Europe, and emerging growth markets due to recent launches and volume growth in key indications..

Click here to download our most recent Sure Analysis report on NVS (preview of page 1 of 3 shown below):

International Dividend Aristocrat #1: Novo Nordisk (NVO)

Consecutive Years Of Dividend Increases: 29

Annual Expected Returns: 18.8%

Novo Nordisk A/S ADR is a large global pharmaceutical company headquartered in Denmark. The company focuses on two core business segments: Diabetes & Obesity Care and Rare Diseases.

The Diabetes & Obesity Care segment manufactures insulin, related delivery systems, oral anti-diabetic products, and products to treat obesity. The Rare Diseases segment manufactures products for hemophilia and other chronic diseases. Novo Nordisk derives ~92% of revenue from diabetes and obesity.

Novo Nordisk reported excellent Q1 2025 results on May 7th, 2025. Company-wide sales were up 19% in Danish kroner to and diluted earnings per share (“EPS”) rose 15% on a year-over-year basis.

Diabetes & Obesity sales increased 21% driven by increases in Ozempic and Rybelsus (GLP-1), Wegovy (obesity), long-acting insulin, and fast-acting insulin, offset by lower sales for premix insulin, Saxenda (obesity), Victoza (GLP-1), and flat human insulin.

The Rare Disease segment sales rose 5% caused by rising rare blood and endocrine disorders drugs. The firm is expanding its blockbuster GLP-1 and obesity drugs to other indications and dosing sizes.

The company lowered its outlook to 13 – 21% sales growth and 16%- 24% operating profit growth in 2025.

Click here to download our most recent Sure Analysis report on NVO (preview of page 1 of 3 shown below):

Additional Reading

The following Sure Dividend databases contain the most reliable dividend growers in our investment universe:

If you’re looking for stocks with unique dividend characteristics, consider the following Sure Dividend databases:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].