Published on September 30th, 2025 by Bob Ciura

The S&P 500 has been historically overvalued (in hindsight) non-stop since 2010 using the Shiller P/E ratio.

The Shiller P/E ratio uses an average of 10 years of earnings for the “E” (earnings) in the P/E ratio to smooth out results and make the metric relevant when earnings temporary turn negative, during recessions.

The historical average Shiller P/E ratio is 17.3. It’s currently at 40.0. Therefore, the S&P 500 is 131% overvalued according to the Shiller P/E ratio.

When the market is overvalued, investors should look to quality dividend growth stocks, particularly those that are undervalued.

For example, the free high dividend stocks list spreadsheet below has our full list of individual securities (stocks, REITs, MLPs, etc.) with with 5%+ dividend yields.

Fortunately, there are still plenty of strong dividend stocks that are reasonably valued.

The following article will rank 10 dividend stocks based in the U.S., that are currently trading at or below the Shiller P/E of 17.3.

In addition, they have Dividend Risk Scores of ‘C’ or better in the Sure Analysis Research Database, and dividend yields above 2%.

The list is sorted by annual expected returns over the next five years, from lowest to highest.

Table of Contents

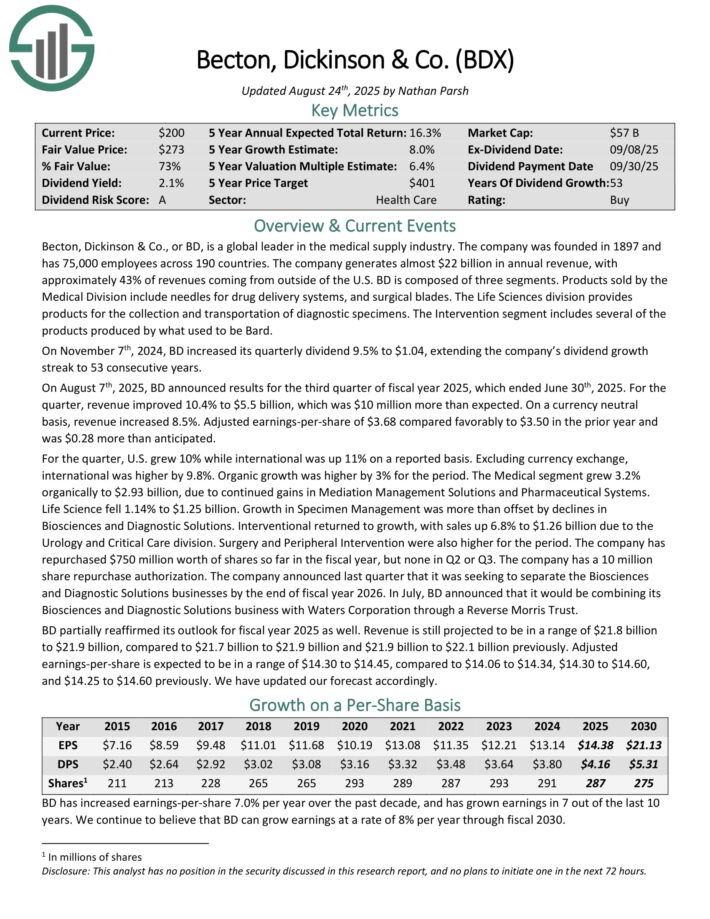

Bargain Dividend Stock #10: Becton, Dickinson & Co. (BDX)

Annual Expected Returns: 18.3%

Becton, Dickinson & Co. is a global leader in the medical supply industry. The company was founded in 1897 and has 75,000 employees across 190 countries.

The company generates about $20 billion in annual revenue, with approximately 43% of revenues coming from outside of the U.S.

Becton, Dickinson & Co., or BD, is a global leader in the medical supply industry. The company generates almost $22 billion in annual revenue, with approximately 43% of revenues coming from outside of the U.S.

BD is composed of three segments. Products sold by the Medical Division include needles for drug delivery systems, and surgical blades. The Life Sciences division provides products for the collection and transportation of diagnostic specimens. The Intervention segment includes several of the products produced by what used to be Bard.

On August 7th, 2025, BD announced results for the third quarter of fiscal year 2025, which ended June 30th, 2025. For the quarter, revenue improved 10.4% to $5.5 billion, which was $10 million more than expected.

On a currency neutral basis, revenue increased 8.5%. Adjusted earnings-per-share of $3.68 compared favorably to $3.50 in the prior year and was $0.28 more than anticipated.

For the quarter, U.S. grew 10% while international was up 11% on a reported basis. Excluding currency exchange, international was higher by 9.8%. Organic growth was higher by 3% for the period.

The Medical segment grew 3.2% organically to $2.93 billion, due to continued gains in Mediation Management Solutions and Pharmaceutical Systems.

Life Science fell 1.14% to $1.25 billion. Growth in Specimen Management was more than offset by declines in Biosciences and Diagnostic Solutions. Interventional returned to growth, with sales up 6.8% to $1.26 billion due to the Urology and Critical Care division. Surgery and Peripheral Intervention were also higher for the period.

BD partially reaffirmed its outlook for fiscal year 2025 as well. Revenue is still projected to be in a range of $21.8 billion to $21.9 billion, compared to $21.7 billion to $21.9 billion and $21.9 billion to $22.1 billion previously. Adjusted earnings-per-share is expected to be in a range of $14.30 to $14.45.

Click here to download our most recent Sure Analysis report on BDX (preview of page 1 of 3 shown below):

Bargain Dividend Stock #9: KBR, Inc. (KBR)

Annual Expected Returns: 18.4%

KBR is a global technology and engineering solutions provider specializing in mission-critical defense, aerospace, and sustainable energy projects.

The company operates in two segments: Mission Technology Solutions, which provides defense, intelligence, space, and classified mission support for government agencies, and Sustainable Technology Solutions, which focuses on clean energy, digital solutions, and advanced engineering services.

KBR operates in over 29 countries and employs approximately 35,000 people. The firm generated $7.7 billion in revenue in 2024.

On July 31st, 2025, KBR, Inc. announced its second-quarter 2025 financial results for the period ending July 4th, 2025. The company reported net income of $73 million for Q2 2025, down from $106 million in Q2 2024, primarily impacted by the HomeSafe Alliance JV contract termination, partially offset by growth in defense and sustainable technology segments.

Diluted earnings per share (EPS) declined to $0.56, compared to $0.79 in the prior-year quarter. Quarterly net sales reached $1.95 billion, a 6% increase year-over-year. The Mission Technology Solutions (MTS) segment grew 7% to $1.412 billion, supported by new and existing U.S. Department of Defense contracts and contributions from the LinQuest acquisition.

The Sustainable Technology Solutions (STS) segment saw a 2% increase to $540 million, driven by increasing demand for sustainable technologies and strong LNG project execution. Adjusted EBITDA totaled $242 million, up 12% from $216 million a year ago, with an adjusted EBITDA margin of 12.4%.

Management now expects full-year 2025 revenue between $7.9 billion and $8.1 billion, revised down from the prior $8.7 billion to $9.1 billion range, compared to $7.7 billion in 2024. If revenue reaches the upper end of guidance, 2025 would still mark a new all-time high.

Click here to download our most recent Sure Analysis report on KBR (preview of page 1 of 3 shown below):

Bargain Dividend Stock #8: Sonoco Products (SON)

Annual Expected Returns: 19.5%

Sonoco Products provides packaging, industrial products and supply chain services to its customers. The markets that use the company’s products include those in the appliances, electronics, beverage, construction and food industries.

The company generates over $5 billion in annual sales. Sonoco Products is now composed of 2 major segments, Consumer Packaging, and Industrial Packaging, with all other businesses listed as “All Other”.

On April 16th, 2025, Sonoco Products raised its quarterly dividend 1.9% to $0.53, extending the company’s dividend growth streak to 49 consecutive years.

On July 23rd, 2025, Sonoco Products announced second quarter results for the period ending June 29th, 2025. For the quarter, revenue grew 17.9% to $1.91 billion, which was in-line with estimates. Adjusted earnings-per-share of $1.37 compared to $1.28 in the prior year, but was $0.08 less than expected.

Revenues and earnings benefited from the addition of Eviosys. For the quarter, Consumer Packaging revenues surged 110% to $1.23 billion, mostly due to contributions from Eviosys.

Volume growth was strong and favorable currency exchange rates also aided results. Industrial Paper Packing sales fell 2% to $588 million due to the impact of foreign currency exchange rates and lower volume following two plant divestitures in China last year.

Click here to download our most recent Sure Analysis report on Sonoco (SON) (preview of page 1 of 3 shown below):

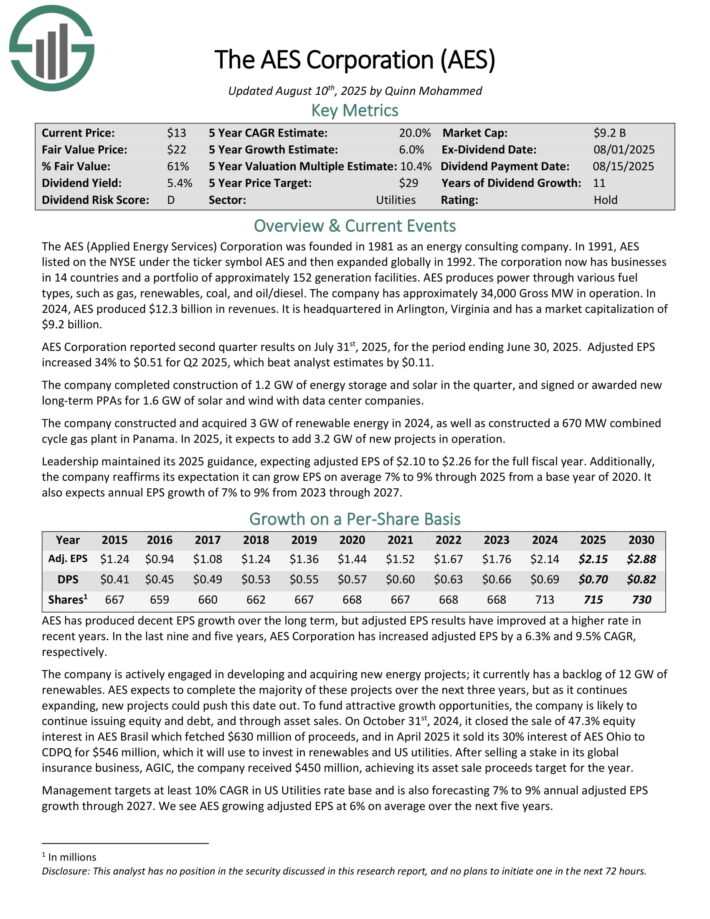

Bargain Dividend Stock #7: AES Corp. (AES)

Annual Expected Returns: 20.5%

The AES (Applied Energy Services) Corporation has businesses in 14 countries and a portfolio of approximately 160 generation facilities. AES produces power through various fuel types, such as gas, renewables, coal, and oil/diesel.

The company has more than 36,000 Gross MW in operation. In 2024, AES produced $12.3 billion in revenues.

AES Corporation reported second quarter results on July 31st, 2025, for the period ending June 30, 2025. Adjusted EPS increased 34% to $0.51 for Q2 2025, which beat analyst estimates by $0.11.

The company completed construction of 1.2 GW of energy storage and solar in the quarter, and signed or awarded new long-term PPAs for 1.6 GW of solar and wind with data center companies.

The company constructed and acquired 3 GW of renewable energy in 2024, as well as constructed a 670 MW combined cycle gas plant in Panama. In 2025, it expects to add 3.2 GW of new projects in operation. Leadership maintained its 2025 guidance, expecting adjusted EPS of $2.10 to $2.26 for the full fiscal year.

Additionally, the company reaffirms its expectation it can grow EPS on average 7% to 9% through 2025 from a base year of 2020. It also expects annual EPS growth of 7% to 9% from 2023 through 2027.

Click here to download our most recent Sure Analysis report on AES (preview of page 1 of 3 shown below):

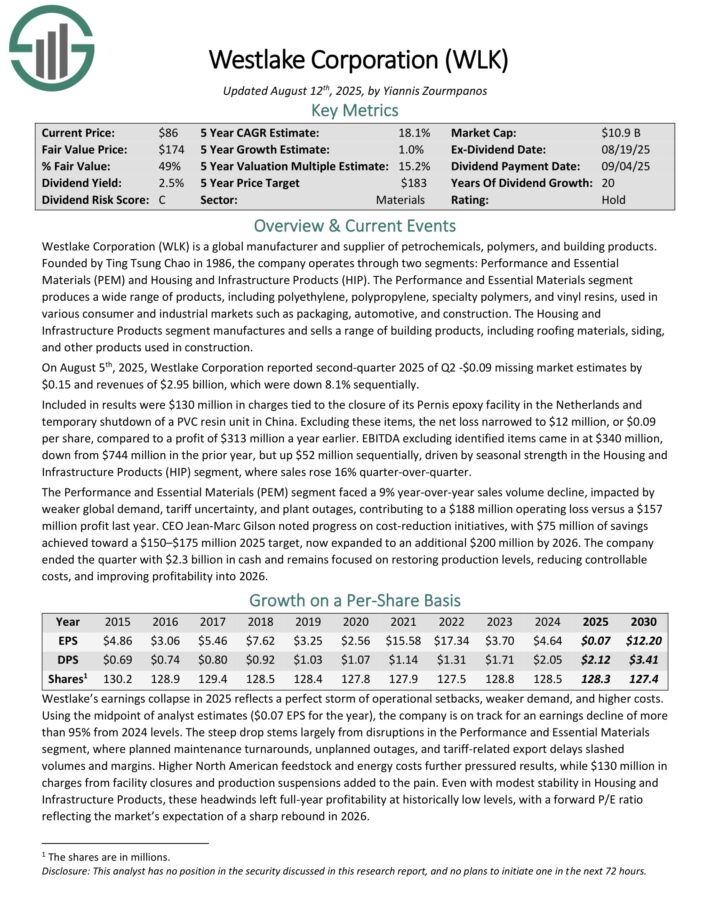

Bargain Dividend Stock #6: Westlake Corporation (WLK)

Annual Expected Returns: 20.7%

Westlake Corporation is a global manufacturer and supplier of petrochemicals, polymers, and building products. Founded by Ting Tsung Chao in 1986, the company operates through two segments: Performance and Essential Materials (PEM) and Housing and Infrastructure Products (HIP).

The Performance and Essential Materials segment produces a wide range of products, including polyethylene, polypropylene, specialty polymers, and vinyl resins, used in various consumer and industrial markets such as packaging, automotive, and construction.

The Housing and Infrastructure Products segment manufactures and sells a range of building products, including roofing materials, siding, and other products used in construction.

On August 5th, 2025, Westlake Corporation reported second-quarter 2025 of Q2 -$0.09 missing market estimates by $0.15 and revenues of $2.95 billion, which were down 8.1% sequentially.

Included in results were $130 million in charges tied to the closure of its Pernis epoxy facility in the Netherlands and temporary shutdown of a PVC resin unit in China. Excluding these items, the net loss narrowed to $12 million, or $0.09 per share, compared to a profit of $313 million a year earlier.

EBITDA excluding identified items came in at $340 million, down from $744 million in the prior year, but up $52 million sequentially, driven by seasonal strength in the Housing and Infrastructure Products (HIP) segment, where sales rose 16% quarter-over-quarter.

The Performance and Essential Materials (PEM) segment faced a 9% year-over-year sales volume decline, impacted by weaker global demand, tariff uncertainty, and plant outages, contributing to a $188 million operating loss versus a $157 million profit last year.

Click here to download our most recent Sure Analysis report on WLK (preview of page 1 of 3 shown below):

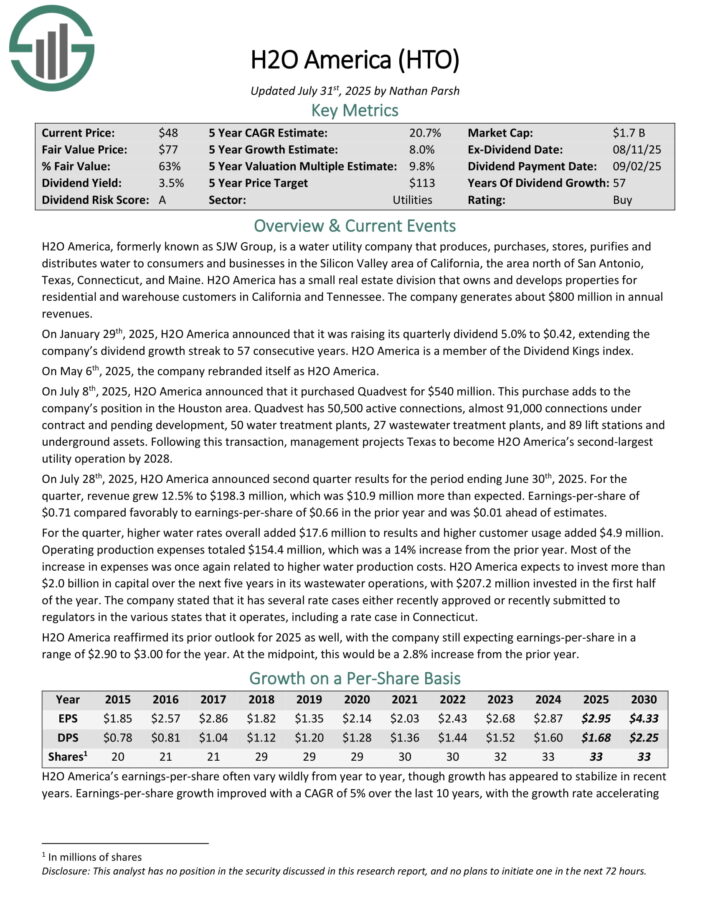

Bargain Dividend Stock #5: H2O America (HTO)

Annual Expected Returns: 20.8%

H2O America, formerly known as SJW Group, is a water utility company that produces, purchases, stores, purifies and distributes water to consumers and businesses in the Silicon Valley area of California, the area north of San Antonio, Texas, Connecticut, and Maine.

It also has a small real estate division that owns and develops properties for residential and warehouse customers in California and Tennessee. The company generates about $670 million in annual revenues.

On July 8th, 2025, H2O America announced that it purchased Quadvest for $540 million. This purchase adds to the company’s position in the Houston area.

Quadvest has 50,500 active connections, almost 91,000 connections under contract and pending development, 50 water treatment plants, 27 wastewater treatment plants, and 89 lift stations and underground assets.

On July 28th, 2025, H2O America announced second quarter results for the period ending June 30th, 2025. For the quarter, revenue grew 12.5% to $198.3 million, which was $10.9 million more than expected.

Earnings-per-share of $0.71 compared favorably to earnings-per-share of $0.66 in the prior year and was $0.01 ahead of estimates.

For the quarter, higher water rates overall added $17.6 million to results and higher customer usage added $4.9 million. Operating production expenses totaled $154.4 million, which was a 14% increase from the prior year.

Click here to download our most recent Sure Analysis report on HTO (preview of page 1 of 3 shown below):

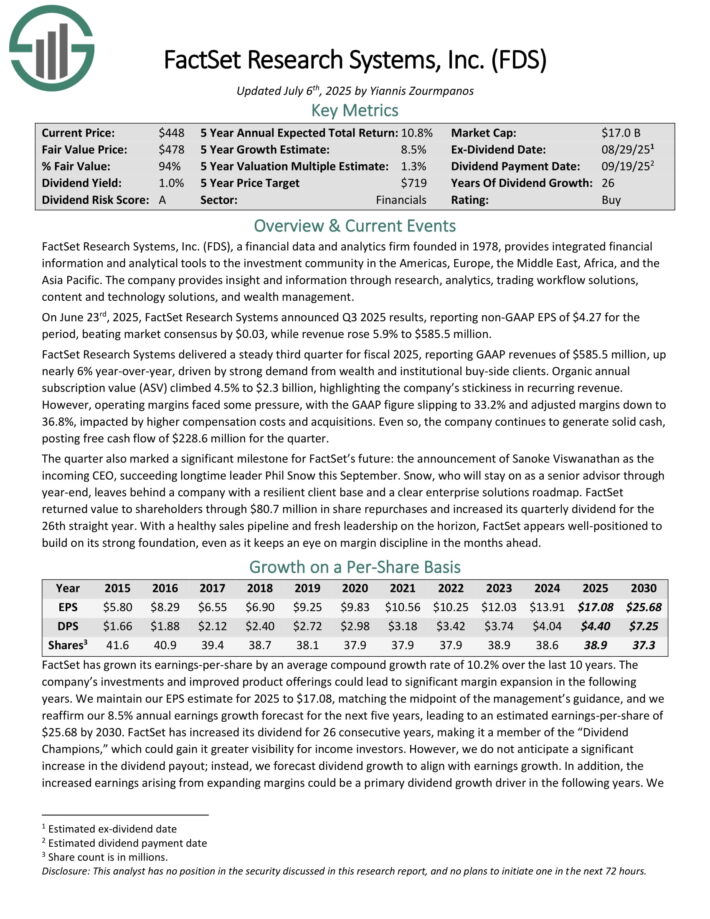

Bargain Dividend Stock #4: FactSet Research Systems (FDS)

Annual Expected Returns: 20.8%

FactSet Research Systems, a financial data and analytics firm founded in 1978, provides integrated financial information and analytical tools to the investment community in the Americas, Europe, the Middle East, Africa, and Asia-Pacific.

The company provides insight and information through research, analytics, trading workflow solutions, content and technology solutions, and wealth management.

On June 23rd, 2025, FactSet Research Systems announced Q3 2025 results, reporting non-GAAP EPS of $4.27 for the period, beating market consensus by $0.03, while revenue rose 5.9% to $585.5 million.

It delivered a steady third quarter for fiscal 2025, reporting GAAP revenues of $585.5 million, up nearly 6% year-over-year, driven by strong demand from wealth and institutional buy-side clients.

Organic annual subscription value (ASV) climbed 4.5% to $2.3 billion, highlighting the company’s stickiness in recurring revenue.

However, operating margins faced some pressure, with the GAAP figure slipping to 33.2% and adjusted margins down to 36.8%, impacted by higher compensation costs and acquisitions.

Even so, the company continues to generate solid cash, posting free cash flow of $228.6 million for the quarter.

FactSet returned value to shareholders through $80.7 million in share repurchases and increased its quarterly dividend for the 26th straight year.

Click here to download our most recent Sure Analysis report on FDS (preview of page 1 of 3 shown below):

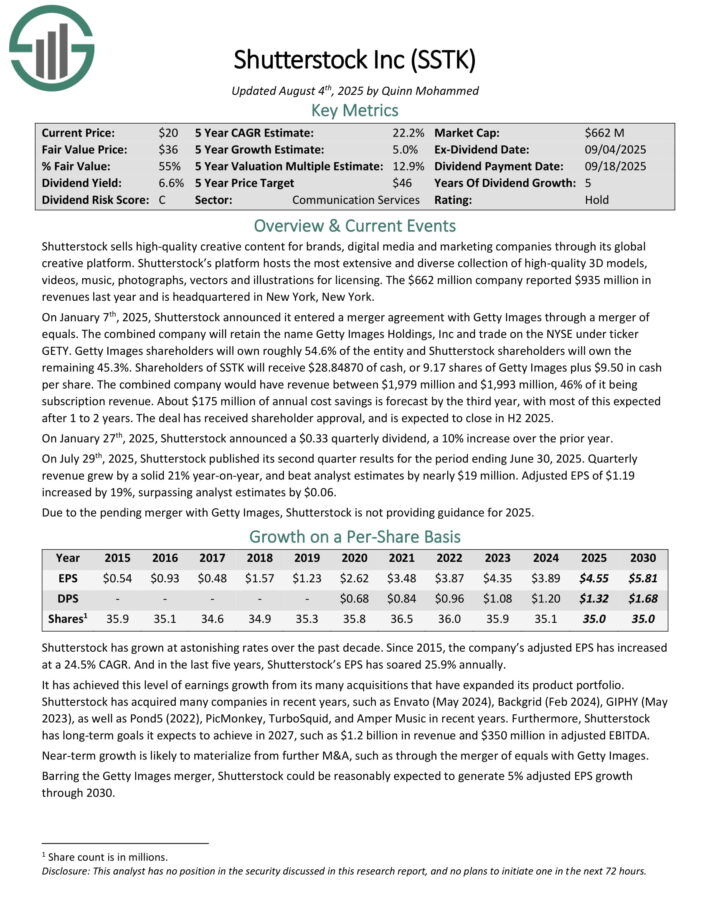

Bargain Dividend Stock #3: Shutterstock, Inc. (SSTK)

Annual Expected Returns: 21.0%

Shutterstock sells high-quality creative content for brands, digital media and marketing companies through its global creative platform.

Its platform hosts the most extensive and diverse collection of high-quality 3D models, videos, music, photographs, vectors and illustrations for licensing. The company reported $935 million in revenues last year.

On January 7th, 2025, Shutterstock announced it entered a merger agreement with Getty Images through a merger of equals. The combined company will retain the name Getty Images Holdings, Inc and trade on the NYSE under ticker GETY.

Getty Images shareholders will own roughly 54.6% of the entity and Shutterstock shareholders will own the remaining 45.3%. Shareholders of SSTK will receive $28.84870 of cash, or 9.17 shares of Getty Images plus $9.50 in cash per share.

The combined company would have revenue between $1,979 million and $1,993 million, 46% of it being subscription revenue. About $175 million of annual cost savings is forecast by the third year, with most of this expected after 1 to 2 years.

On July 29th, 2025, Shutterstock published its second quarter results for the period ending June 30, 2025. Quarterly revenue grew by a solid 21% year-on-year, and beat analyst estimates by nearly $19 million. Adjusted EPS of $1.19 increased by 19%, surpassing analyst estimates by $0.06.

Click here to download our most recent Sure Analysis report on SSTK (preview of page 1 of 3 shown below):

Bargain Dividend Stock #2: Constellation Brands (STZ)

Annual Expected Returns: 21.5%

Constellation Brands was founded in 1945. The company produces and distributes alcoholic beverages including beer, wine, and spirits. It is the third largest beer company in the U.S., and imports and sells beer brands such as Corona, Modelo Especial (the #1 Beer in U.S.), Modelo Negra, and Pacifico.

In addition, Constellation has many wine brands including Robert Mondavi and Kim Crawford, as well as spirits brands including Casa Noble Tequila, and High West Whiskey. The company also has a stake in cannabis company Canopy Growth.

In June 2025, Constellation completed its divestiture of some of its wine and spirits brands to The Wine Group. The brands divested include Woodbridge, Meiomi, Robert Mondavi Private Selection, Cook’s, SIMI, and J. Roget sparkling wine, as well as its inventory, facilities, and vineyards. Constellation retained its high-end wine and spirits brands.

On July 1st, 2025, Constellation Brands reported first quarter fiscal 2026 results for the period ending May 31, 2025. For the quarter, the company recorded $2.52 billion in net sales, down 6% compared to the same prior year period. Beer sales fell 2% year-over-year, while wine and spirits sales plunged 28%.

Comparable earnings-per-share equaled $3.22 for the quarter, which was 10% lower compared to Q1 2025, and $0.07 behind analyst estimates.

In the first quarter, Constellation Brands repurchased $306 million of its shares and paid $182 million in dividends.

Click here to download our most recent Sure Analysis report on STZ (preview of page 1 of 3 shown below):

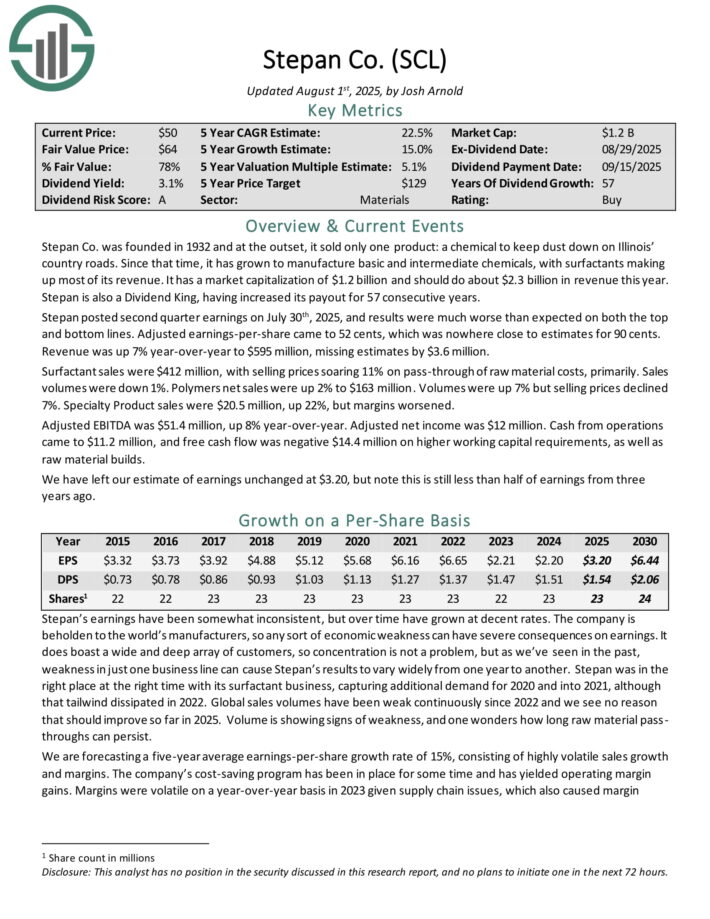

Bargain Dividend Stock #1: Stepan Co. (SCL)

Annual Expected Returns: 23.9%

Stepan manufactures basic and intermediate chemicals, including surfactants, specialty products, germicidal and fabric softening quaternaries, phthalic anhydride, polyurethane polyols and special ingredients for the food, supplement, and pharmaceutical markets.

It is organized into three distinct business lines: surfactants, polymers, and specialty products. These businesses serve a wide variety of end markets.

The surfactants business is Stepan’s largest by revenue. A surfactant is an organic compound that contains both water-soluble and water-insoluble components.

Stepan posted second quarter earnings on July 30th, 2025, and results were much worse than expected on both the top and bottom lines. Adjusted earnings-per-share came to 52 cents, which was nowhere close to estimates for 90 cents. Revenue was up 7% year-over-year to $595 million, missing estimates by $3.6 million.

Surfactant sales were $412 million, with selling prices soaring 11% on pass-through of raw material costs, primarily. Sales volumes were down 1%. Polymers net sales were up 2% to $163 million. Volumes were up 7% but selling prices declined 7%. Specialty Product sales were $20.5 million, up 22%, but margins worsened.

Adjusted EBITDA was $51.4 million, up 8% year-over-year. Adjusted net income was $12 million. Cash from operations came to $11.2 million, and free cash flow was negative $14.4 million on higher working capital requirements, as well as raw material builds.

Click here to download our most recent Sure Analysis report on SCL (preview of page 1 of 3 shown below):

Final Thoughts

The U.S. stock market, as measured by the S&P 500 Index, has been on a nearly uninterrupted bull market since the Great Recession ended in 2009, with the exception of brief downturns on occasion.

As a result, the market’s valuation multiple has reached a historical record.

Cautious investors can still find quality dividend stocks with attractive yields that are undervalued, such as the 10 bargain dividend growth stocks in this article.

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

Other Sure Dividend Resources

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].