The National Association of Realtors today released its November report on home sales. According to the report, home sales inched up for the month, rising from historic lows during a year of falling home prices and frustrated sellers quitting the market. Although home sales rose month to month, they remained down year over year.

According to the NAR press release:

The housing market got a small boost from lower mortgage rates last month, with sales of previously owned homes rising for the third-straight month after a weak spring and summer.

Closings on existing homes rose 0.5% in November from the prior month to a seasonally adjusted annual rate of 4.13 million, the highest level in nine months, the National Association of Realtors® reported Friday.

Still, the November figure was down 1% from last year, when a surge of home sales in the fourth quarter was not enough to prevent 2024 from registering the lowest number of home sales in nearly 30 years.

By the standards of the NAR, this is a pretty downbeat report. After all, the Realtors Association is famously bullish in its assessments, unless obviously grim realities force it to admit otherwise. For old timers who watch real estate markets, this is a well-known rule. After all, for those of us who were around during the final days of the last housing bubble, we know that things have to be undeniably bad before the NAR will put out anything that might endanger the perennial Realtor message of “there’s never been a better time to buy.”

So, while the month-to-month print for prices was not especially bad this month, the general context of the market isn’t looking up.

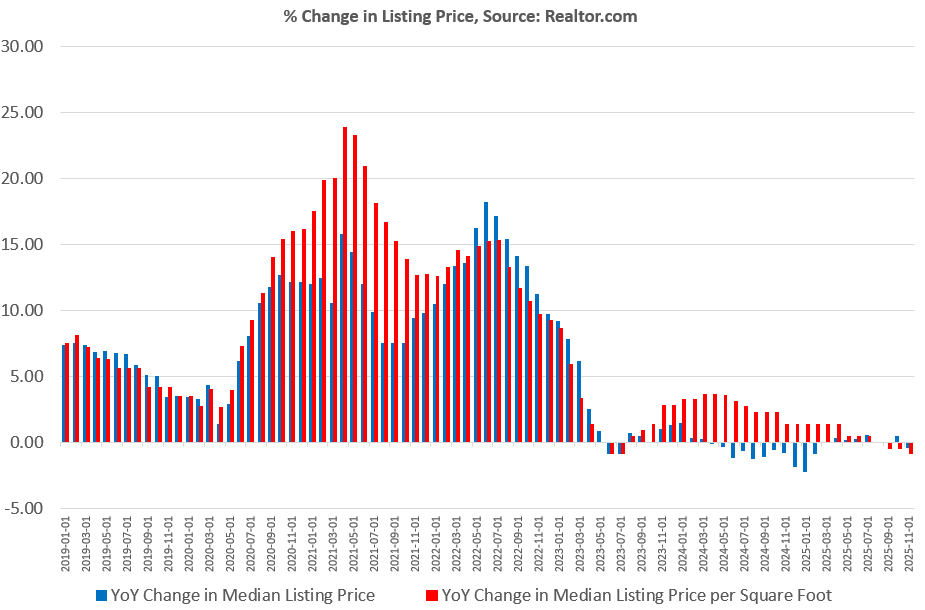

For example, according to NAR, the November median listing price for the United States turned negative again, dropping to -0.4 percent, year over year. The median listing price spent most of 2023 in negative territory also.

Meanwhile, the median listing price per square foot has been negative or zero for the past four months, dropping to -0.9 percent, year over year.

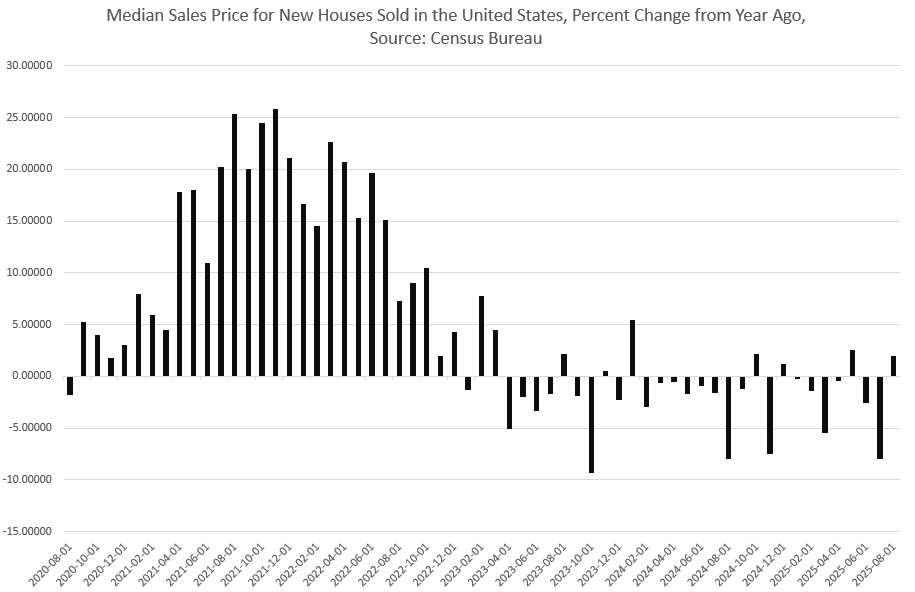

This lackluster demand is further reflected by the most recent numbers for new houses sold, as reported by the Census Bureau. Eight of last twelve months showed falling year-over-year prices for new homes sold. This measure reflects sales prices for new construction and shows that builders are facing headwinds when it comes to pricing. It’s wo wonder that home builder confidence has been trending down since 2021. Thanks to relentless price inflation, real prices are even worse than the nominal prices, from the builder perspective, especially since the reported prices for new homes generally don’t take into account seller incentives. That is, when builders throw in appliances, cover closing costs, buy down mortgage rates, or include upgrades, that doesn’t show up in the stated closing price.

But outright price reductions are also very much on the table in many areas. As FoxBusiness reported last month, “Price reductions are at an all-time high for newly built homes, with 15.1% of listings lowering their prices in the third quarter of 2025…”

The National Association of Realtors has tried to pin the sluggish market on mortgage rates that are allegedly too high, and on a lack of inventory from new construction. For example, NAP chief economist Laurence Yun today portrayed declining sales as a result of there being so few foreclosures, and due to older homeowners not being ready to sell.

I don’t blame Yun for trying to put a happy face on the situation, but the truth is that sellers are always available if buyers have the money to meet the asking price. As it is, many buyers simply aren’t willing to pay what sellers want, and this is reflected in recent reports that sellers are essentially rage quitting the market—taking their homes off the market when it becomes apparent there are no buyers at the prices sellers thought they could get. As Redfin reported recently:

Home sellers across the U.S. are hitting the brakes and pulling home listings offline at the fastest pace in years. According to Redfin, nearly 85,000 homeowners delisted their properties in September, a 28% jump from last year and the highest level for that month since 2017.

Moreover, if lack of inventory were really an issue, builders would have no problem selling new construction. Instead, builders are having to cut prices and offer incentives. It seems inventory, if anything, is presently too high.

Many within the industry are hoping that prices will somehow head upward next year. Most of the optimists—including Yun—are saying that the market will revive once mortgage rates fall substantially again in the near future. Yet, it’s difficult to see why this should be regarded as the likely outcome for next year.

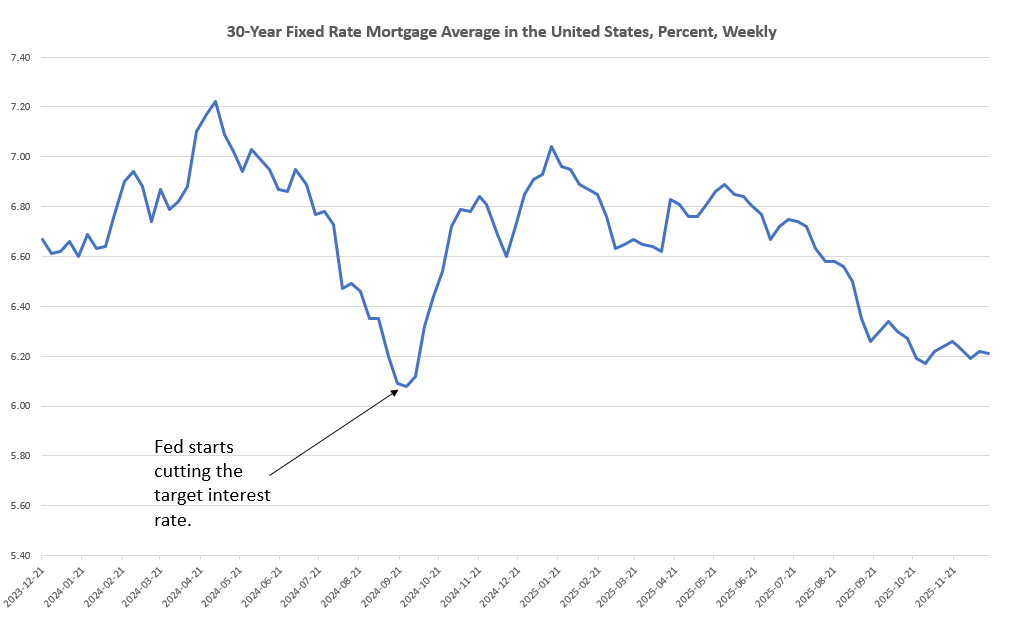

Although Realtor groups—and others who make money from home sales—have been relentlessly calling on the Federal reserve to “lower interest rates,” the Fed doesn’t set long-term rates at all.

After all, the average 30-year fixed mortgage rate is higher now—at 6.21 percent—than it was last September before the Fed started the present cycle of lowering the target policy interest rate. Specifically, in mid September of 2024, the average 30-year fixed rate was 6.09 percent. Since then, the Fed has cut the target rate five times, lowering it by 175 basis points. Yet, the 30-year mortgage rate has actually increased. Contrary to what many home builders and real estate agents seem to think, the Fed can’t wave a magic wand and reduce mortgage rates. In fact, if the Fed is seen as too oriented toward easy money, bond markets could revolt and actually drive long term yields up higher.

So, if sellers are quitting the market today assuming they’ll get more buyers and higher prices later, they may end up very disappointed. As we saw earlier this week, employment trends do not point toward strong income growth, and home sales depend largely on robust income—especially when we can’t count on falling interest rates. With employment fundamentals so weak, the real way to increase home sales is to cut prices further. That, of course, is not what sellers want to hear.