Various tools and machinery that individuals have produced were produced in order to better produce consumer goods. The quantity and the quality of various tools and machinery—capital goods—places a limit on the quantity and the quality of the production of consumer goods. Through the introduction of better capital goods, greater output can be secured more productively and efficiently. The increase of capital accumulation and the enhancement of the structure of production requires prior saving to support various individuals that are engaged in developing more roundabout processes of production as well as the maintenance of the existing infrastructure.

It is previous savings—a subsistence fund—that support individuals employed in the various stages of production. Through increased savings a better infrastructure can be built and this, in turn, drives economic growth. Economic growth also leads to greater production of consumer goods at lower prices. This allows for further saving and capital investment for further economic growth. With expanding saving, production, and capital investment more advanced infrastructure can be generated.

Wealth-generators save and employ their savings in the buildup of the infrastructure through capital investment. The savings of wealth-generators are employed to sustain various individuals who are specialized in the making and maintaining the structure of production. Savings also sustain individuals that are engaged in the production of consumer goods.

Since government doesn’t produce any wealth obviously it cannot save. Hence, for the government to engage in various activities it must necessarily divert savings and production from wealth-generators. The public sector must take from the private sector in order to do anything. As a rule, such activities amount to providing support to various non-productive activities, wasting resources and crowding out private production and investment.

Since government activities, in essence, only consume and neither produce nor generate savings, obviously, government cannot grow an economy. An increase in government spending means a weakening of wealth-generators, thus weakening economic growth. This is despite much popular opinion and even what seems to be some empirical evidence. How then are we to reconcile the so-called empirical “facts” that are supposedly presented by various econometric studies that purport to show that government can grow the economy?

Contrary to the popular way of thinking, data cannot “speak for itself.” Data must be assessed by means of a presupposed theory (even if one does not consciously acknowledge it) that can withstand some basic scrutiny, such as whether the government—while not being a wealth-generator—can grow the economy. First, just by logically understanding the fact that government necessarily must extract resources coercively from the private economy, we should be highly skeptical of various econometric studies that tell us the exact opposite.

It must be realized that the data out of which various so-called “facts” are produced appear to be supportive of various empirical research conclusions as long as the private sector of the economy generates enough savings to support productive and non-productive activities. In other words, governments can only spend a lot because of genuine private economic growth. Further, government spending and artificial growth can happen alongside genuine growth as long as there is enough genuine saving, maintenance of the capital structure, and production.

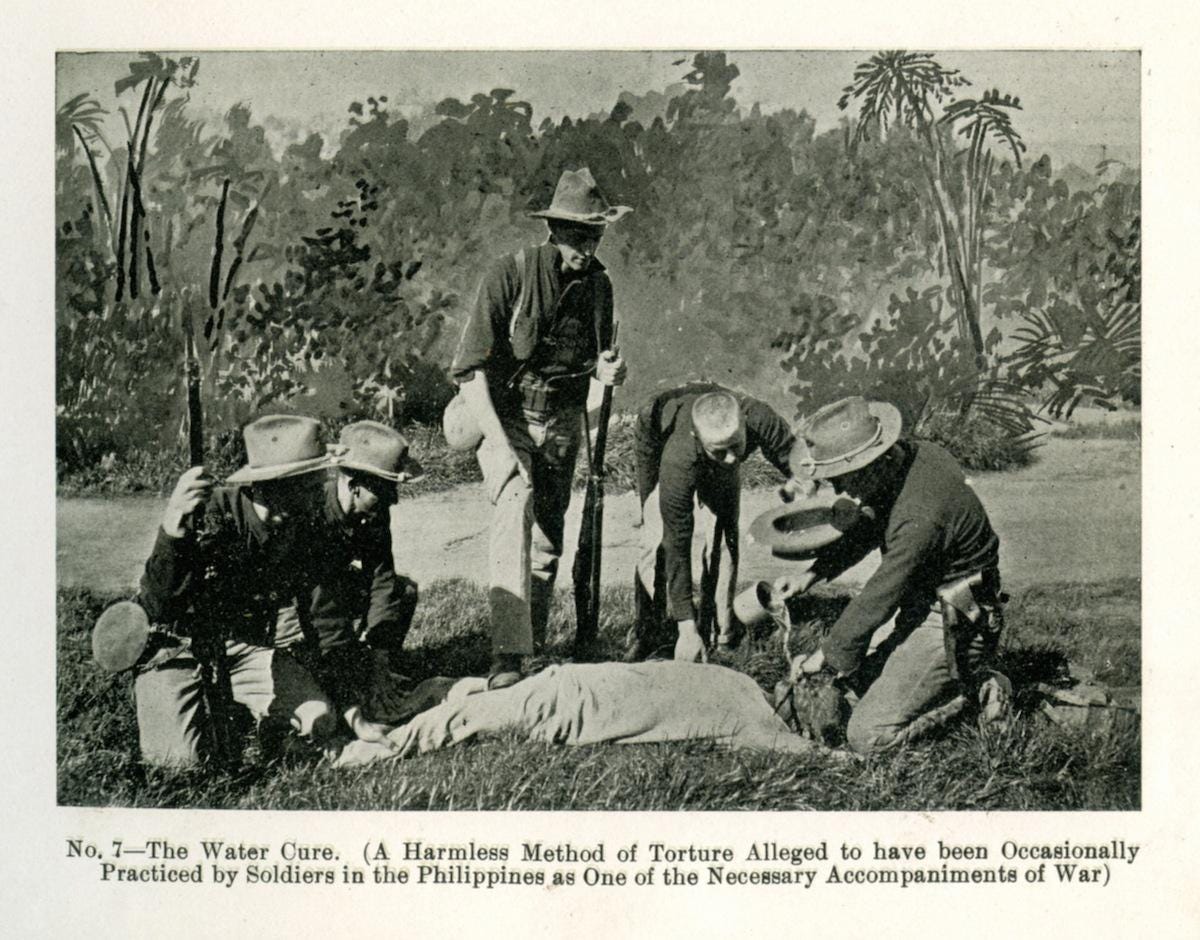

As long as this is the case, various econometric data-torturing techniques can produce a “support” for any “pie in the sky” theory such as that the government can grow an economy. The so-called empirical findings provide support for the Keynesian theory—that when government spends more on goods and services, this boosts the overall income in the economy by a multiple of the increase in government spending. Hence, it would superficially appear that the more the government spends, the larger the national income.

Government cannot increase its spending without reducing the means of wealth-generators. Once the ability of wealth-producers to generate savings curtailed, economic growth follows suit and no amount of money that the government pushes into the economy can make it grow. According to Mises,

…there is need to emphasize the truism that a government can spend or invest only what it takes away from its citizens and that its additional spending and investment curtails the citizens’ spending and investment to the full extent of its quantity.

Furthermore, according to Mises,

An essential point in the social philosophy of interventionism is the existence of an inexhaustible fund, which can be squeezed forever. The whole system of interventionism collapses when this fountain is drained off: The Santa Claus principle liquidates itself.

The More Government Spends, the More It Diverts

Since government outlays have to be funded, it means that—in addition to taxes—the government has to secure some other means of funding such as borrowing or printing money (or new forms of taxation). An increase in government outlays increases the diversion of wealth from wealth-generating activities to non-wealth-generating activities. It leads to economic impoverishment.

In this sense, an increase in government spending to strengthen the overall economy’s demand should be regarded as bad news for the wealth-generating process and for the economy. Various impressive projects that the government undertakes also fall into the category of wealth destruction because all the money, labor, resources must be taken from the private, productive economy. The very fact that the private sector did not undertake these projects demonstrates that these projects are on the low priority list of consumers.

Given the state of the pool of private savings in the economy, the implementation of these government projects and/or projects fueled by easy money and artificial credit expansion undermine the well-being of individuals since these projects are at the expense of production that is more highly valued by consumers. For example, let us assume that the government decides to embark on the building of a pyramid. Individuals employed in this project and the money and resources to produce it must be taken away from the private economy. To produce this pyramid the government would have to tax, borrow, and/or print at the expense of the private economy. Additionally, we also do not see the opportunity cost of what other economic activities might have taken place in absence of the pyramid project. The government would have to impose taxes on wealth-generators—limiting their consumption, saving, and/or investment—in order to support the building of the pyramid.

Government Taxes Stifle the Market Process

Whenever wealth-producers exchange their products with each other, the exchange is voluntary. Producers exchange goods in their possession for goods that they expect to benefit them more. The crux is that the exchange or the trade must be free and thus reflective of the individual’s subjective values. Government taxes are, however, of a coercive nature: they force producers to part with their money in an exchange for low-priority goods. This implies that producers are forced to exchange more for less and obviously this impairs their well-being.

The more non-market-related projects the government undertakes, the more must be taken away from wealth-producers. Note that the level of tax taken from wealth-producers is determined by the size and extent of government activities. The essence of what has been said is not altered by the introduction of money. In the money economy, the government taxes and pays out the received money to various individuals that are employed directly or indirectly by the government. Government-employed individuals are now able to exchange the taxed money for various goods and services, changing the structure of production.

Government Can Force Non-Market Projects, Not Genuine Production

The government can force various non-market projects. The government, however, cannot make these projects economically viable. As time goes by, the burden that these projects impose on the economy through higher taxes and a distorted structure of production undermines real economic growth. Thus, these projects are an economic burden.

What about the lowering of taxes on businesses? Surely this will give a boost to capital investment and strengthen the process of wealth formation? Any decrease in taxes would be great, but if this tax lowering is not matched by the lowering of government spending and the distortionary effects of inflationary credit expansion, savings will still be channeled to investments that would not be otherwise undertaken. In other words, economic growth is still distorted and inhibited.

What undermines economic growth has to do with the amount and extent of government spending. The larger the government outlays, the worse it is for real economic growth.