Bitwise Chief Investment Officer Matt Hougan is pushing back against one of the loudest bearish narratives around bitcoin treasury company Strategy (MSTR, formerly MicroStrategy): that it could be forced into a liquidation of its roughly $60 billion bitcoin stack. In his latest CIO memo, Hougan writes bluntly that “Michael Saylor and Strategy selling bitcoin is not one of” the real risks in crypto.

Will Strategy Sell Its Bitcoin?

The immediate trigger for market anxiety is MSCI’s consultation on whether to remove so-called digital asset treasury companies (DATs) like Strategy from its investable indexes. Nearly $17 trillion in assets tracks those benchmarks, and JPMorgan estimates index funds might have to sell up to $2.8 billion of MSTR if it is excluded.

MSCI’s rationale is structural: it views many DATs as closer to holding companies or funds than operating companies, and its investable universes already exclude holding structures such as REITs.

Hougan, a self-described “deep index geek” who previously spent a decade editing the Journal of Indexes, says he can “see this going either way.” Michael Saylor and others are arguing that Strategy remains very much an operating software company with “complex financial engineering around bitcoin,” and Hougan agrees that this is a reasonable characterization. But he notes that DATs are divisive, MSCI is currently leaning toward excluding them, and he “would guess there is at least a 75% chance Strategy gets booted” when MSCI announces its decision on January 15.

He argues, however, that even a removal is unlikely to be catastrophic for the stock. Large, mechanical index flows are often anticipated and “priced in well ahead of time.” Hougan points out that when MSTR was added to the Nasdaq-100 last December, funds tracking the index had to buy about $2.1 billion of stock, yet “its price barely moved.”

He believes some of the downside in MSTR since October 10 already reflects investors discounting a probable MSCI removal, and that “at this point, I don’t think you’ll see substantial swings either way.” Over the long term, he insists, “the value of MSTR is based on how well it executes its strategy, not on whether index funds are forced to own it.”

The more dramatic claim is the so-called MSTR “doom loop”: MSCI exclusion leads to heavy selling, the stock trades far below NAV, and Strategy is somehow forced to sell its bitcoin. Here Hougan is unequivocal: “The argument feels logical. Unfortunately for the bears, it’s just flat wrong. There is nothing about MSTR’s price dropping below NAV that will force it to sell.”

He breaks the problem down to actual balance sheet constraints. Strategy, he says, has two key obligations: about $800 million per year in interest payments and the need to refinance or redeem specific debt instruments as they mature.

Smaller DATs Are The Bigger Problem

On interest, the company currently has approximately $1.4 billion in cash, enough to “make its dividend payments easily for a year and a half” without touching its bitcoin or needing heroic capital markets access. On principal, the first major maturity does not arrive until February 2027, and that tranche is “only about $1 billion—chump change” compared with the roughly $60 billion in bitcoin the company holds.

Governance further reduces the likelihood of forced selling. Michael Saylor controls around 42% of Strategy’s voting shares and is, in Hougan’s words, a person with extraordinary “conviction on bitcoin’s long-term value.” He notes that Saylor “didn’t sell the last time MSTR stock traded at a discount, in 2022.”

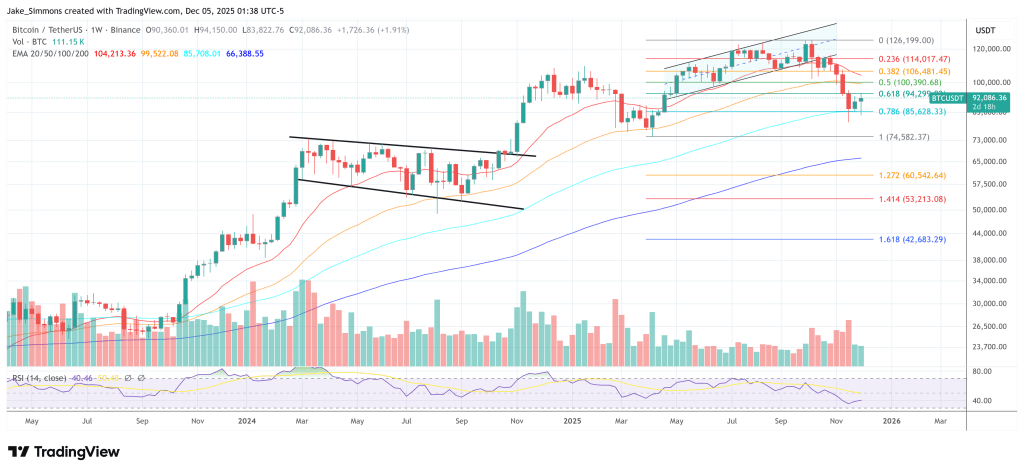

Hougan concedes that a forced liquidation would be structurally significant for bitcoin, roughly equivalent to two years of spot ETF inflows dumped back into the market. He simply does not see a credible path from MSCI index mechanics and equity volatility to that outcome “with no debt due until 2027 and enough cash to cover interest payments for the foreseeable future.” At the time of writing, he notes, bitcoin trades around $92,000, about 27% below its highs but still 24% above Strategy’s average acquisition price of $74,436 per coin. “So much for the doom.”

Hougan ends by stressing that there are real issues to worry about in crypto—slow-moving market structure legislation, fragile and “poorly run” smaller DATs, and a likely slowdown in DAT bitcoin purchases in 2026. But on Strategy specifically, his conclusion is direct: he “wouldn’t worry about the impact of MSCI’s decision on the stock price” and sees “no plausible near-term mechanism that would force it to sell its bitcoin. It’s not going to happen.”

At press time, BTC traded at $92,086.

Featured image created with DALL.E, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.