The One Big Beautiful Bill’s (OBBB) changes to the taxation of international income have surprising implications for state codes, yielding taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities.

increases and a revised tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates.

that, through quirks of state incorporation, bears very little resemblance to the federal base and almost nothing of its purpose.

Whereas the conversion of the global intangible low-taxed income (GILTI) regime to the new net CFC-tested income (NCTI) regime contains both revenue raisers and tax savings that represent a net tax cut at the federal level, these provisions are haphazardly incorporated into the tax codes of states that have heretofore included GILTI. The result is not just an increase in state tax liability, but an inversion of the intent of the federal reforms. The changes to the federal base have their own pitfalls and shortcomings, but they are still largely designed to align with GILTI’s purpose—a guardrail against profit shiftingProfit shifting is when multinational companies reduce their tax burden by moving the location of their profits from high-tax countries to low-tax jurisdictions and tax havens.

to low-tax countries after the US moved to a largely territorial tax systemTerritorial taxation is a system that excludes foreign earnings from a country’s domestic tax base. This is common throughout the world and is the opposite of worldwide taxation, where foreign earnings are included in the domestic tax base.

—while, perversely, states would increasingly do the opposite, increasing taxes on multinational businesses when they owe more tax abroad.

This double taxationDouble taxation is when taxes are paid twice on the same dollar of income, regardless of whether that’s corporate or individual income.

is undesirable in its own right and undermines the competitiveness of states choosing to implement it. But high rates of international tax are also a good indication that the activity of a corporation’s foreign affiliates is genuine foreign activity (e.g., European sales) rather than profit-shifting activity (e.g., locating intellectual property in a low-tax country and having related companies pay royalties to it, shifting their profits to a country where the tax rate is lower).

GILTI and the States

Prior to the Tax Cuts and Jobs Act (TCJA) of 2017, the US taxed the worldwide income of US corporations and their affiliates, including controlled foreign corporations (CFCs) based abroad, while allowing such companies to take credits against their US liability for foreign taxes paid. Under the TCJA’s territorial tax system, foreign income is not taxed by default, but Congress wanted to avoid profit-shifting activity in response. GILTI was intended as a minimum tax on certain foreign earnings, undermining the potential tax benefit of such profit shifting. The new NCTI regime arguably provides a better calibration at the federal level, but a far worse one for states incorporating the provision into their own tax codes.

Under GILTI, federal law sought to distinguish between routine and “supernormal” returns, with lawmakers postulating that a CFC’s returns above 10 percent of the value of its tangible assets very likely constituted income from intangibles (e.g., patents, trademarks, copyrights, and other forms of intellectual property from which royalties are derived). This initial 10 percent was excluded under the qualified business asset investment (QBAI) exclusion, which represented a rough-and-ready deemed return on physical capital. Any returns above 10 percent were subject to GILTI.

The remaining income, subject to GILTI, received both a deduction (initially 50 percent) and an offset worth 80 percent of foreign taxes paid. The deduction meant that the US tax rate on GILTI was lower than the rate on US income, reflecting the fact that it was earned abroad and is not an ordinary part of the tax base. The 50 percent deduction under § 250, therefore, functionally turned the 21 percent corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax.

rate into a 10.5 percent rate on GILTI. (The deduction was scheduled to decline to 37.5 percent in 2026, yielding a 13.125 percent rate.) Actual foreign taxes paid, moreover, yielded foreign tax credits, and 80 percent of their value could be applied against GILTI. The system was far from perfect, but it was designed to tax CFCs’ income to the extent that it was “undertaxed” abroad, potentially (but not always) indicative of US tax avoidance rather than genuine economic activity in other countries.

Unfortunately, when states incorporated GILTI after the enactment of the TCJA, parts of this system immediately fell apart. The federal provisions were not adopted with states in mind, and states’ corporate apportionmentApportionment is the determination of the percentage of a business’ profits subject to a given jurisdiction’s corporate income or other business taxes. U.S. states apportion business profits based on some combination of the percentage of company property, payroll, and sales located within their borders.

rules weren’t designed to handle foreign income.

The foreign taxes generating the federal credits were paid by the foreign corporations that US-based multinationals owned or in which they had a substantial investment stake. As a pure matter of accounting, if the US shareholding entity is to be treated as having paid those taxes itself, an equivalent share must also be included in the company’s GILTI income, to avoid a double benefit. The 80 percent of credited taxes are first included in the US company’s income for GILTI purposes under the § 78 “gross-up,” and then the credit is applied. At the federal level, that all worked. But states rarely allow foreign tax credits, while they do conform to the gross-up, so their GILTI bases included 80 percent of the value of taxes paid by CFCs abroad, without the tax credits that gross-up was intended to facilitate. Rather than reducing tax liability based on foreign taxes having already been paid on the income, states’ GILTI regimes tax this income more because of the foreign taxes paid on it. The foreign taxes paid by the CFCs of corporations doing business in a state are not, of course, even remotely US corporate profits, which is what state corporate income taxes are intended to tax.

Converting to NCTI

For states, converting to NCTI makes the problem worse. To begin with, it eliminates the QBAI exclusion, bringing all the income of CFCs into the GILTI/NCTI base rather than just the “supernormal” returns. At the federal level, this base expansion is substantially offset through other changes, but for states, some of them turn into tax multipliers instead. Additionally, under NCTI, the § 250 deduction (which had been at 50 percent but was scheduled to fall to 37.5 percent in 2026), is made permanent at 40 percent, which has the effect of increasing states’ effective rates on this broader base.

But NCTI changes far more than this. Previously, under the GILTI regime, many expenses by US-based multinationals were sourced to their CFCs to the extent that they were deemed to benefit them. Since these business expenses would have ordinarily been deductions from the US company’s taxable incomeTaxable income is the amount of income subject to tax, after deductions and exemptions. For both individuals and corporations, taxable income differs from—and is less than—gross income.

, these expense allocation rules (1) increased US tax liability for US-based multinationals, since they were denied deductions for some of their business expenses; but, at the same time, (2) provided deductions for the CFCs, reducing their taxable income potentially subject to GILTI.

On net, businesses would have preferred to have the deduction for their US-based corporations, as the ordinary rate is higher than the GILTI rate and because foreign taxes paid on ordinary business activity of CFCs abroad often yield credits in excess of GILTI tax liability, leaving some credits unused. (GILTI is, after all, a minimum tax. Foreign tax liability can often exceed its minimum.) Under NCTI, changes in expense allocation rules mean that more of these deductions are taken by the US parent corporation. Consequently, there are fewer deductions for their CFCs, yielding a larger NCTI base than the old GILTI base. That’s a welcome shift for many corporations with significant tax liability in other countries, because they get the benefit of the US deductions and can use more of their foreign tax credits against the new NCTI base. Simultaneously, the new law reduces the limitation on foreign tax credits (called the “FTC haircut”), raising the inclusion amount from 80 to 90 percent with a commensurate increase in the § 78 gross-up.

It’s not hard to imagine where this goes wrong at the state level. The NCTI base expands yet again, and the greater allowance for foreign tax credits, rather than offsetting liability, is picked up as additional income to be taxed. All four major changes—scrapping the QBAI exclusion, adjusting the § 250 deduction, trimming the FTC haircut with a commensurate increase in the § 78 gross-up, and revising expense allocation rules—make state taxation of NCTI more aggressive than state taxation of GILTI, whereas these changes yield a net tax cut at the federal level.

State Incorporation of GILTI and NCTI

Twenty-one states currently include at least some GILTI in their base, though many reduce GILTI taxability in some way, typically by subjecting it to the state’s dividends received deduction. Eleven states and the District of Columbia bring in 50 percent of GILTI (the full amount possible under the § 250 deduction) and would be on track to bring in 60 percent of NCTI since the § 250 deduction would decline to 40 percent. Nine other states bring in lesser shares of GILTI, ranging from 5 to 30 percent.

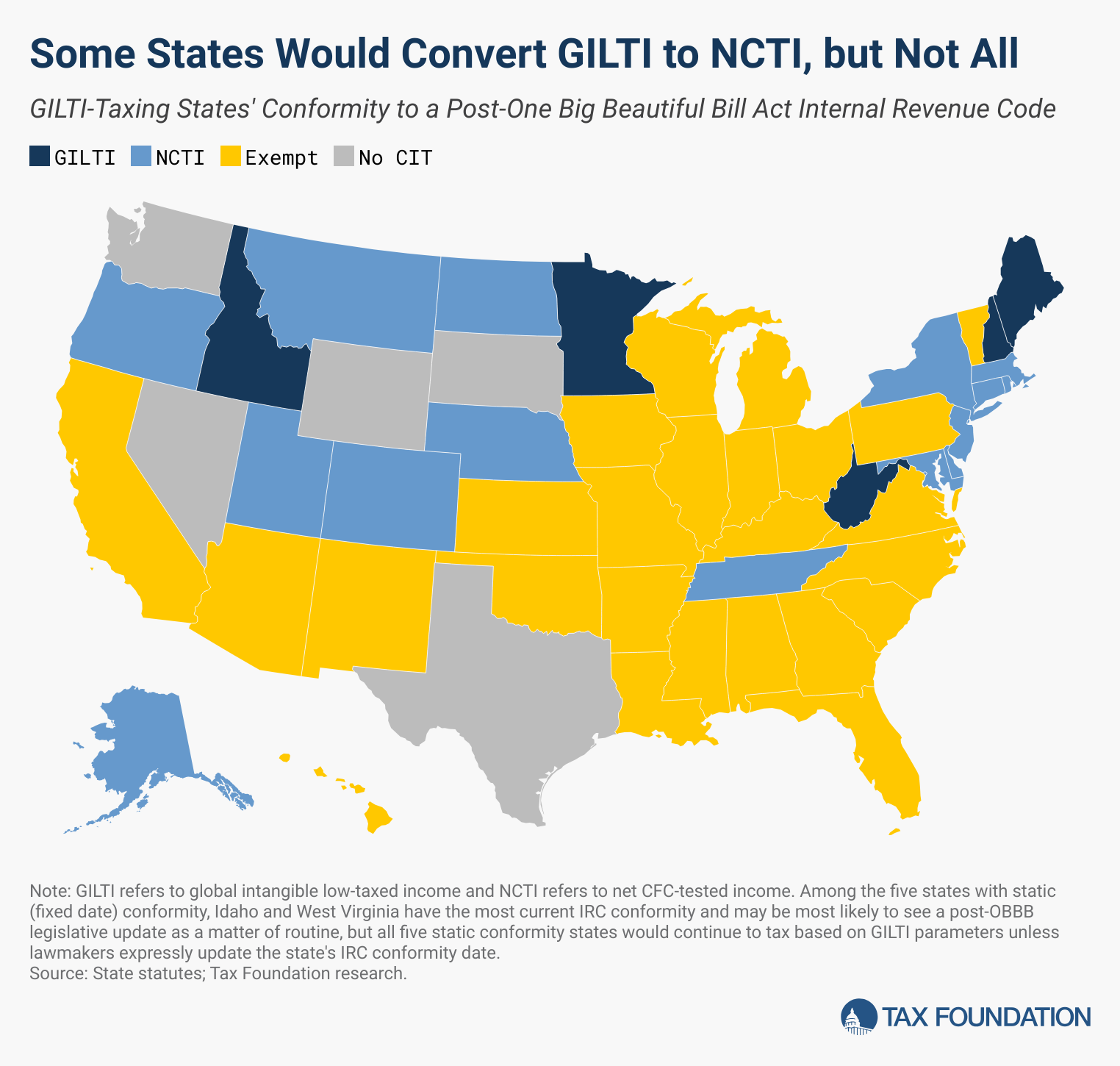

Fifteen states and the District of Columbia will automatically follow the federal government in switching from GILTI to NCTI. These GILTI-including states, which have rolling conformity to changes in the Internal Revenue Code (IRC), are Alaska, Colorado, Connecticut, Delaware, Maryland, Massachusetts, Montana, Nebraska, New Jersey, New York, North Dakota, Oregon, Rhode Island, Tennessee, Utah, and the District of Columbia. Another five states that currently tax GILTI have static (fixed date) conformity to the IRC, and thus would continue to apply GILTI rules unless and until state lawmakers update their state tax code’s conformity to a post-OBBB version. Of these, Idaho and West Virginia, while static conformity states, were “current” prior to the enactment of the OBBB and have generally seen annual conformity updates. Maine, Minnesota, and New Hampshire are all lagging on IRC conformity.

Should a state incorporate GILTI (or, more precisely, IRC § 951A) but conform to a version of the IRC prior to the enactment of the OBBB, it would continue to tax based on GILTI parameters rather than transitioning to NCTI. Such states would need to publish guidance and worksheets for making this conversion, though some states’ inability to issue guidance on other GILTI issues eight years into their taxation of it does not augur well for timely guidance in all relevant states.

State taxation of GILTI never made much sense. The federal government’s purposes in enacting a guardrail against profit shifting had little to do with states, which have not historically taxed international income (with very limited exceptions). Apportionment of the income of these CFCs to states in which the US-based related corporations operate never bore much relation to any activity in the states in question. Taxing the § 78 gross-up always meant that part of the state tax base was foreign tax liability, while states failed to bring in the foreign tax credits that were an integral part of the system. And apportionment has never worked properly for GILTI, as most states deny all factor representation (and only one state, New Mexico, fully provides it), with GILTI put in the numerator of the apportionment factor but not added to the denominator, resulting in an overweighting.

But taxing NCTI makes even less sense. Without the QBAI exclusion, the base includes all income of these CFCs, not just their supernormal returns. And whereas the federal system now relies even more heavily on foreign tax credits (and revised expense allocation rules) to make NCTI a tax on foreign income that faced low taxes abroad, the lack of similar tax credits at the state level obliterates that distinction and renders void the mechanism the new federal system employs to prevent NCTI from being a tax on all of the income of US companies’ foreign affiliates.

This matters not just because state-level NCTI taxation has little logic or justification, but also because it makes the taxing states less competitive. Companies may take steps to reduce in-state sales into states that tax GILTI by using third-party distributors or routing billing through out-of-state entities, thus also reducing their exposure to that state’s ordinary taxes. And under some states’ GILTI regimes, the location of a corporate headquarters in the state can dramatically increase exposure to GILTI, since intangible receipts are sourced to commercial domiciles and some states put net GILTI in the sales factor. GILTI is only responsible for a fraction of a percent of state revenues, but it can be a significant factor for some of the businesses states most want to attract.

States that tax GILTI should regard the federal change as the impetus to get out of the business of taxing this class of international income entirely, under GILTI or NCTI rules. Virtually nothing of its federal purpose or even its intended federal base is retained when incorporated into state tax codes. States can and should say no to NCTI.

Stay informed.

Get the latest tax data, news and analysis.

Subscribe

Share this article