Medicare beneficiaries will face higher premiums across the board in 2026. And for many retirees, those added costs will chip away at Social Security’s 2026 cost-of-living adjustment, or COLA.

The standard Part B premium will rise 9.7% to $202.90 per month — the first time it has crossed the $200 threshold — and because most beneficiaries have this amount deducted directly from their Social Security checks, the increase will reduce the COLA before it even reaches clients’ bank accounts.

For the average retired worker receiving $2,008 per month, the $17.90 increase effectively trims the 2.8% COLA down to 1.9%. A retiree receiving $1,000 per month will feel the effect even more acutely, seeing their COLA reduced to roughly 1%.

Donald LaGrange, a financial advisor at Murphy & Sylvest Wealth Management in Rockwall, Texas, said multiple years of Medicare Part B premium hikes are taking a toll on Social Security-dependent retirees.

“That 2.8% is supposed to keep up with inflation … because insurance goes up and gas goes up. … And so COLA is supposed to help their spending power keep up with all of that,” LaGrange said. “But when you have an outsized inflation on the medical side of things, then that eats away at their purchasing power elsewhere.”

“Really, what it represents is a declining standard of living for the people who rely primarily on Social Security,” he added.

Medicare costs are rising across the board

Almost every component of Medicare will cost more next year. The Part A deductible for hospital admissions will increase to $1,736, and coinsurance for extended hospital stays and skilled nursing facilities will tick higher as well.

Part B’s annual deductible will rise 10% to $283 from $257. Even though the average Part D premium will decline slightly — falling to $34.50 for standalone plans — the maximum deductible will climb to $615, and the out-of-pocket cap will increase to $2,100.

These changes compound a broader trend: health care inflation continues to run ahead of general inflation, and national health expenditures are projected to outpace GDP growth for years to come.

Part B premiums, in particular, reflect the fast-rising costs of outpatient care. More services and medications are being delivered outside hospital settings, shifting expenses into Part B. The continued expansion of Medicare Advantage is also playing a role; the program spends an estimated $80 billion more annually on Medicare Advantage enrollees than it would on traditional Medicare participants, adding upward pressure on premiums for all beneficiaries, regardless of which type of coverage they choose.

Wealthy Medicare enrollees brace for a bigger bill

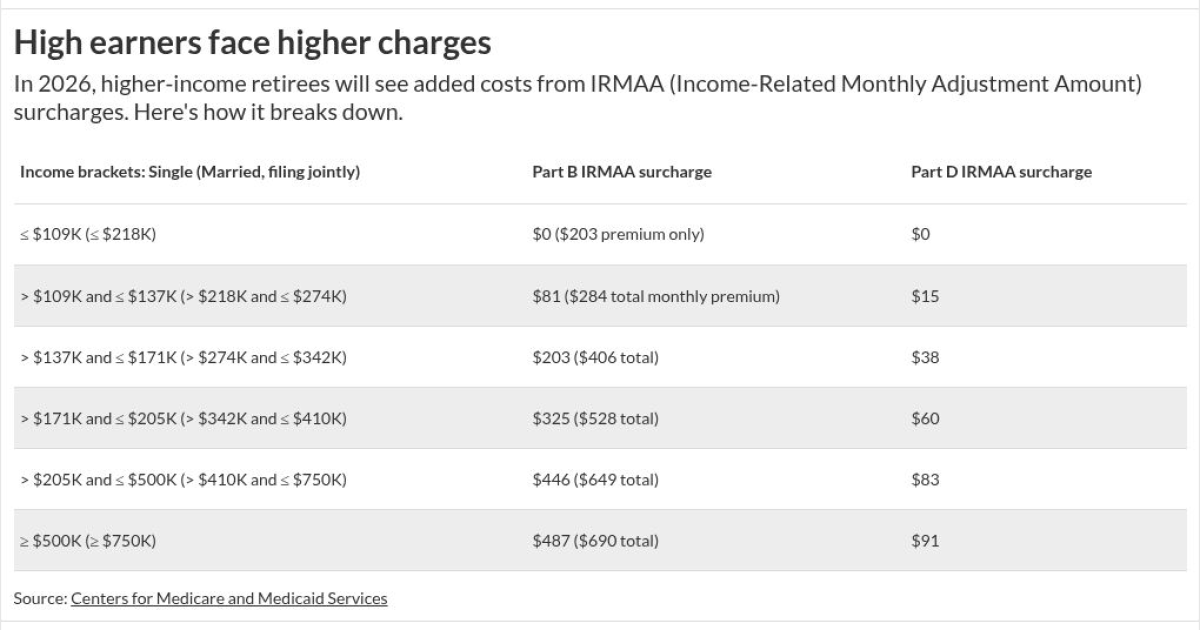

Higher-income retirees will face additional expenses through Income-Related Monthly Adjustment Amount, or IRMAA, surcharges.

In 2026, these surcharges begin for individuals with a 2024 adjusted gross income above $109,000 and couples filing jointly with income above $218,000. Depending on income level, enrollees will owe an extra $81 to $487 per month for Part B, plus an additional $15 to $91 for Part D coverage.

Advisors should pay particularly close attention to clients whose income has dropped after a “life-changing event,” such as retirement, because they may qualify to have their IRMAA reassessed using Form SSA-44.

The cash-strapped majority will feel the biggest impact

The rising cost burden will be felt most intensely by lower- and middle-income retirees. More than 1-in-10 Medicare beneficiaries already spend at least 10% of their income on Part B premiums alone, not including other uncovered expenses like dental care, vision care or long-term care, according to KFF.

With premiums climbing again, many retirees will have even less room in their budgets to handle surprise medical costs or general price pressures. More than half of retirees — 53% — expect Social Security to serve as their main source of income for the duration of retirement, according to the TIAA Institute.

For clients still in the workforce, advisors stress the importance of bolstering savings so Social Security doesn’t become the main pillar of retirement income. But for those already retired, advisors may need to reassess near-term cash-flow plans and weigh whether clients should adjust withdrawals, revisit their Medicare Advantage or Medigap coverage, or explore Medicare Savings Programs that help with premiums and cost sharing.

Open enrollment, which runs from Oct. 15 to Dec. 7, offers a key opportunity for advisors to reevaluate whether clients’ current coverage still fits their needs.