Shares of Macy’s, Inc. (NYSE: M) rose 2% on Monday. The stock has gained 72% in the past three months. The retailer is set to publish its earnings results for the third quarter of 2025 on Wednesday, December 3, before markets open. Here’s a look at what to expect from the earnings report:

Revenue

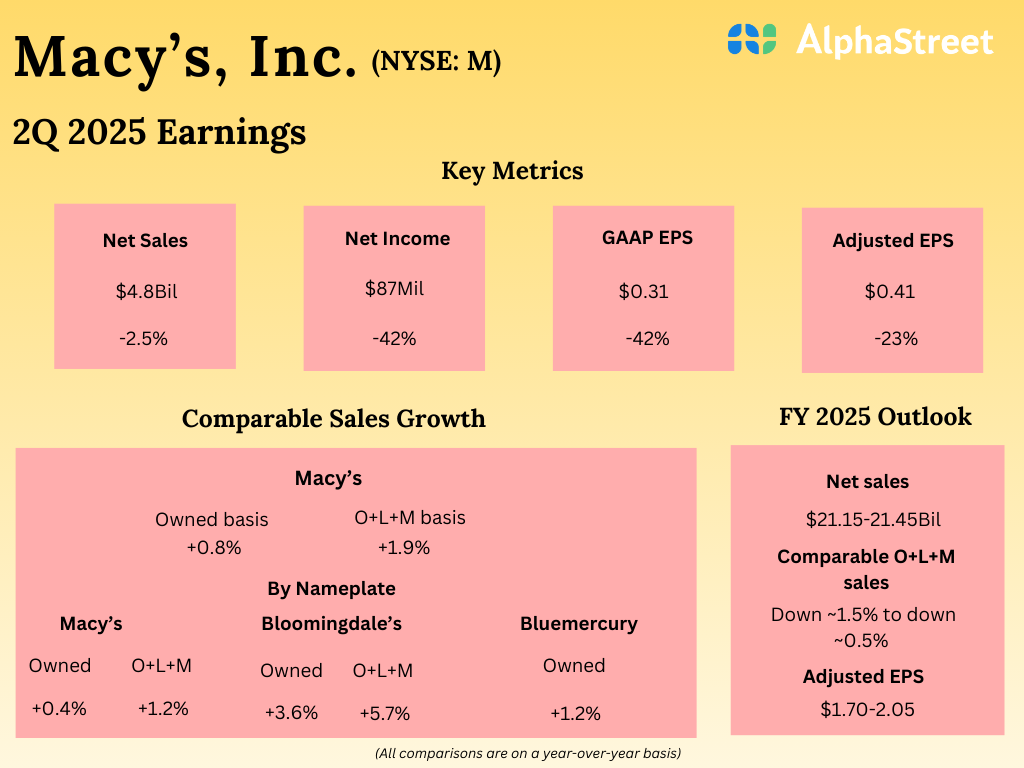

Macy’s has guided for net sales of approx. $4.5-4.6 billion for the third quarter of 2025. Analysts are projecting $4.53 billion for Q3, which indicates a decline of over 4% from the same period a year ago. In the second quarter of 2025, net sales decreased 2.5% year-over-year to $4.81 billion.

Earnings

Macy’s has guided for adjusted loss per share of $0.20-0.15 for Q3 2025. Analysts are predicting a loss of $0.15 per share, which compares to adjusted earnings per share of $0.04 reported in the year-ago quarter. In Q2 2025, adjusted EPS declined 23% YoY to $0.41.

Points to note

Macy’s has forecast comparable sales to be down approx. 1.5% to up 0.5% in the third quarter of 2025. In Q2 2025, comparable sales were up 0.8% on an owned basis and up 1.9% on an owned-plus-licensed-plus-marketplace (O+L+M) basis.

Macy’s continues to face a dynamic macro environment and it remains cautious on consumer demand and competition. However, the company believes its multi-brand, multi-category, and multi-nameplate model gives it the flexibility to respond to consumer demand in all environments. Macy’s is likely to have seen a healthy back-to-school season and it appears to be well-positioned for the holiday season. These factors may have benefited the third quarter.

Macy’s luxury nameplates are performing well, with Bloomingdale’s and Bluemercury delivering sales and comps growth in the second quarter. For the Macy’s nameplate, although sales declined 3.8% last quarter, comps rose 1.2%. Comps for its go-forward business and its Reimagine 125 locations also saw growth. These trends are likely to have continued in the to-be-reported quarter.

The retailer continues to make progress on its Bold New Chapter strategy. It has been reshaping its store base by closing underperforming locations and investing in areas with more potential. It has also been investing in brands and partnerships and in improving its omni-channel capabilities. These efforts are anticipated to continue yielding benefits.