The Campbell’s Company (NASDAQ: CPB) is preparing to publish its first-quarter financial data amid a challenging consumer landscape shaped by reduced discretionary spending and changing consumer behaviour. This year, the management is focused on boosting sales through incremental marketing investments and consumer-led innovation, while expanding productivity and accelerating cost savings initiatives.

Q1 Report on Tap

The New Jersey-headquartered food company’s first-quarter FY26 earnings report is slated for release on Tuesday, December 9, at 7:15 am ET. On average, analysts following the business predict an adjusted profit of $0.73 per share and revenues of $2.66 billion for the October quarter. In the corresponding quarter of fiscal 2025, the company had earned $0.89 per share on revenues of $2.77 billion.

The recent performance of Campbell’s stock has been disappointing — lost about 28% since the beginning of the year, underperforming the broader market during that period. Having slipped to a multi-year low this week, CPB is one of the worst-performing Wall Street stocks. Recently, the board declared a quarterly dividend of $0.39 per share, payable on February 2, 2026, to shareholders of record as of January 8, 2026.

Weak Q4

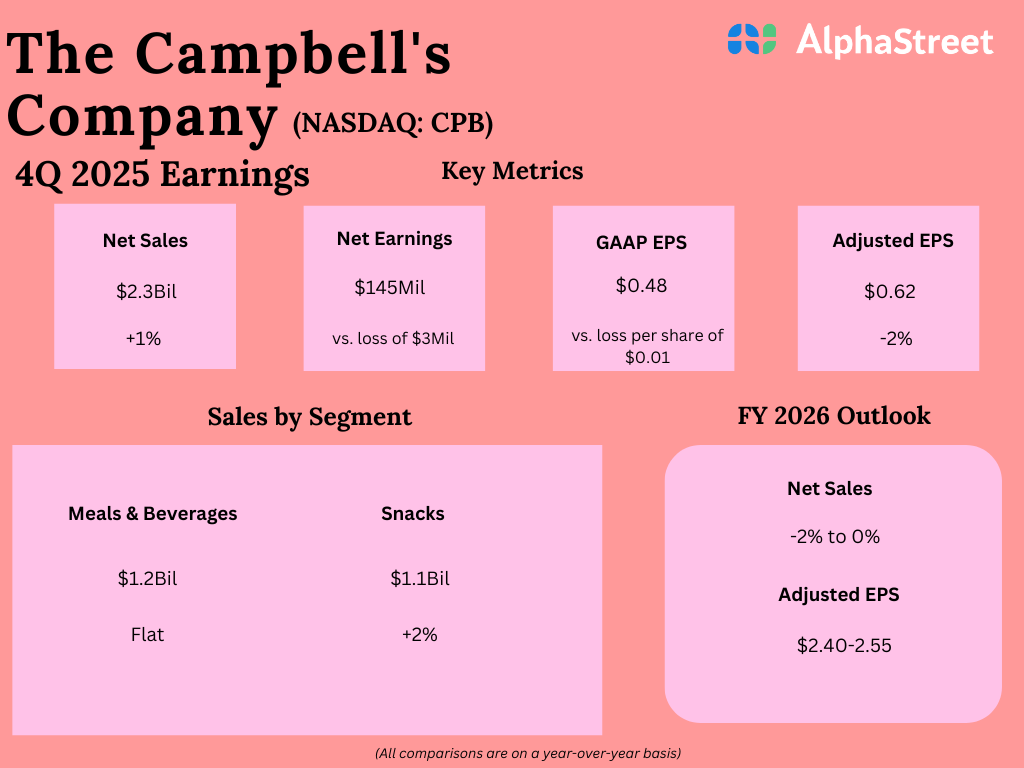

In the final three months of fiscal 2025, Campbell’s sales increased 1% year-over-year to $2.3 billion. Organic sales decreased 3%. A 2% increase in Snacks sales was partially offset by flat sales performance of the Meals & Beverages segment. Net income, on an adjusted basis, declined 2% year-over-year to $0.62 per share in the fourth quarter. Unadjusted net income was $145 million or $0.48 per share during the three months, compared to a loss of $3 million or $0.01 per share last year.

Campbell’s CEO Mick Beekhuizen said in the Q4 FY25 earnings call, “In fiscal 2025, innovation contributed approximately 3% to net sales, and we expect this momentum to increase as we continue investing in our brands and creating food and beverages that meet consumers where they are. Another step we’re taking is removing FD&C colors from our portfolio. As you may have heard me say before, our use of these colors is limited. In the second half of fiscal 2026, in line with consumer preferences, Campbell’s will no longer produce any of our food or beverages with FD&C colors.”

Guidance

A few weeks ago, the management said it expects net sales to be down 2% to flat in fiscal 2026, compared to FY25. Full-year organic sales are expected to be down 1% to up 1%. The guidance for adjusted earnings per share is in the range of 2.40 to 2.55 for the fiscal year. Overall, the outlook for the business is not very encouraging as it continues to face multiple challenges, including financial decline and a lack of innovation.

Campbell’s stock has lost around 10% in the past six months. Extending their long-term downturn, the shares mostly traded lower on Friday. The average price of stock over the past twelve months is $35.32.

The post Campbell’s Company (CPB) looks set for a modest start to FY26 first appeared on AlphaStreet.