Netflix, Inc. (NASDAQ: NFLX) has reported strong revenue and earnings growth for the third quarter, benefiting from membership growth, pricing adjustments, and record growth in ad revenues. The top-line matched analysts’ estimates, while earnings fell short of expectations, driving the stock sharply lower in after-hours trading on Tuesday.

Stock Falls

The video streaming giant’s stock was trading slightly lower on Thursday morning, after suffering one of the biggest single-day losses soon after the earnings announcement this week. Over the past six months, the shares have been trading above their 52-week average value of $1,063.12. The stock has dropped about 17% since hitting a record high mid-year. Having gained an impressive 48% since last year, NFLX remains a top-performing Wall Street stock.

From Netflix’s Q3 2025 Earnings Call:

“We think the business is very healthy. We feel good about our progress on our key initiatives. We’ve got, also, a lot of opportunity ahead of us, but we’ve got a lot of work we need to accomplish and fully realize those opportunities. So, what’s working; we had a good Q3. We had revenue in line with expectations. Our operating income would have exceeded our forecast absent the Brazilian tax matter. We’re also seeing good progress against our key priorities. So, engagement remains healthy. We achieved a record share of TV time in Q3 in both the U.S. and the U.K.“

Key Metrics

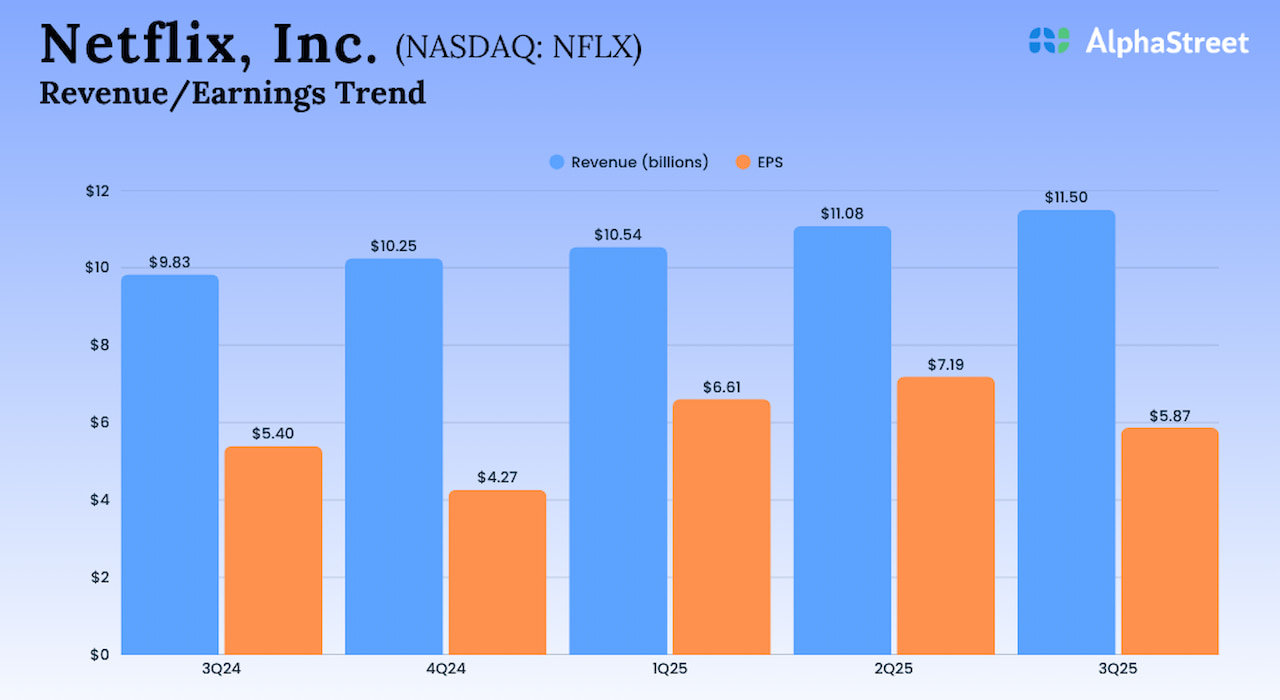

Third-quarter revenue increased 17.2% year-over-year to $11.51 billion from $9.82 billion in the prior-year quarter, in line with analysts’ estimates and management’s guidance. Consequently, net income rose to $2.55 billion or $5.87 per share in Q3 from $2.36 billion or $5.40 per share last year. The bottom line came in below Wall Street’s expectations, marking the first miss since Q1 2024. Operating margin was hit by an expense related to an ongoing dispute with Brazilian tax authorities, regarding certain non-income tax assessments.

Encouraged by the Q3 outcome, the Netflix leadership issued positive guidance. It expects revenues to grow 16.7% year-over-year to $11.96 billion in the fourth quarter. The guidance for Q4 net income is $2.36 billion or $5.45 per share. Operating margin is expected to be 23.9% in the December quarter. The optimistic outlook reflects a strong content slate in the latter part of the year, including the final season of Stranger Things, new seasons of The Diplomat and Nobody Wants This, and Guillermo del Toro’s Frankenstein.

Innovation

Innovation is a key element of Netflix’s growth strategy, given the intense competition the company has been facing from multiple quarters, including linear TV, social media, video gaming, and theatrical movies. During the third quarter, the firm repurchased 1.5 million shares for $1.9 billion, leaving $10.1 billion remaining under its existing share repurchase authorization.

Extending the post-earnings selloff, Netflix’s shares traded slightly lower in early trading on Thursday. The stock is up 25% from the levels seen at the beginning of the year.