In This Article

I talk to short-term rental hosts all the time who are struggling to figure out why their place is not booking. They have followed the design tips, adjusted their pricing, responded to messages quickly, and done everything they were instructed to do.

The truth is, the problem often started before they ever welcomed a guest. It began when they bought.

Buying in an unfriendly short-term rental market can be the last nail in the coffin. You can find a property just outside the city limits, or try your luck and hope you don’t get shut down, but that’s not a long-term strategy. To build something sustainable, you need to know which markets are true vacation destinations, or pivot your model toward business and mid-term travelers.

Some of these places do have zones that can work for short-term rentals, so it is not always a matter of never investing there. But these are markets where you should proceed with caution.

What Makes a Good Short-Term Rental Market?

A good short-term rental market has several key elements in place from the outset. Established regulations are actually a positive sign. They provide clear guidelines and demonstrate that the city has already considered how to handle STRs. What makes me nervous are places with no rules at all, because that usually means officials have not yet decided, and one vote could shut everything down.

I also stay away from HOAs. They wield too much power and can change their stance at a moment’s notice. The only exception I would ever make is in a community with no restrictions and plenty of STRs already operating, where strength in numbers offers some protection.

Beyond the legal side, it is essential to know your vision and your guest avatar. You might think a bachelorette-themed house in Los Angeles is a sure hit, until you realize that it is not the type of traveler visiting LA.

I prefer markets that have always relied on tourism and STR demand. Urban markets can still hold significant value, but if you want the confidence that your investment will stand the test of time, look for destinations where the local economy heavily relies on tourism. If short-term rentals disappeared, those towns would crumble, and that kind of reliance works in your favor as an investor.

A Tale of Two Investors

Imagine two friends, Maya and Alex, both excited about making their first Airbnb investment. Maya goes for the glitz: She buys a sleek condo in San Jose, California. Alex chooses a rustic cottage outside Flagstaff, Arizona.

Initially, both share the same dream: Airbnb revenues pouring in to fund their adventures. It doesn’t work out equally.

Maya’s San Jose property costs more than four times the price of a typical U.S. home. Listings suitable for short-term rentals account for a mere 0.41% of the market. Demand is weak, regulations are strict, and local ordinances limit guests. Within a year, she’s losing money.

Meanwhile, Alex’s Arizona cottage draws hikers year-round. His costs are lower. His market’s occupancy rate stays healthy. While his revenue isn’t dizzying, he isn’t contending with crippling overhead or impenetrable red tape.

Alex is living the dream Maya thought she’d have.

Data Behind the Warning Signs

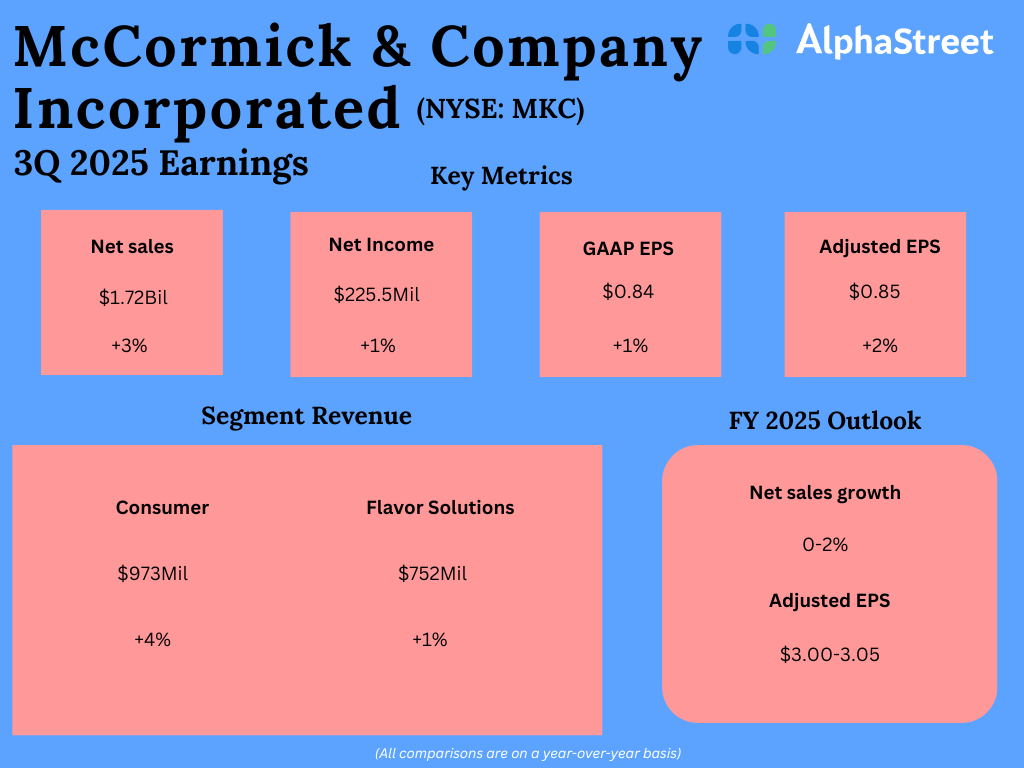

A report released last year prompted me to consider what exactly constitutes a “bad” short-term rental market. I don’t necessarily agree with every city on the list, and there are several data points that suggest these rankings are incorrect.

Clever Real Estate’s 2024 ranking of short-term rental markets paints a clear picture of what they consider to be underperformers. San Jose sits at the bottom, accompanied by:

Birmingham, AL

San Antonio, TX

Houston, TX

Sacramento, CA

Raleigh, NC

Riverside, CA

San Francisco, CA

Oklahoma City, OK

Pittsburgh, PA

In many of these markets, oversupply and tepid tourism keep revenues down.

You might also like

I’ve found that some of the biggest cities are actually the worst places to invest in short-term rentals. Indeed, the counterpoint is valid: These markets often have stronger appreciation and a more straightforward transition to long-term or mid-term rentals if regulations tighten.

But personally, I wouldn’t risk it. These major cities usually combine weak returns with strict regulations, making them challenging to justify as STR investments.

For example:

New York City limits rentals under 30 days to instances when the host is present and ensures that hosts reside in the property for at least 183 days per year. That’s a nonstarter for most investors.

Los Angeles only allows short-term rentals in a host’s primary residence, caps them at 120 nights per year, and requires hosts to register with the city and display their registration number. To exceed 120 nights, owners must apply for an Extended Home-Sharing permit, which involves extra fees, neighbor notification, and stricter oversight.

San Diego imposes multitier licensing and caps whole-home rental licenses at 1% of the housing stock.

Denver requires STRs to be primary residences; hosts must pay a Lodger’s Tax of 10.75%.

Even if you dodge the worst financial metrics, you may be tripped up by the rules.

Places Where the Law Says “Just Don’t”

Some cities go beyond simply regulating; they nearly ban investor-owned short-term rentals:

New Orleans, LA bans whole-home rentals outside a few commercial zones. The city allows only one short-term rental permit per block; corporate operators are forbidden.

Santa Monica, CA allows home-sharing only if the host lives there; unhosted stays are illegal.

Honolulu (Oahu), HI attempted to require stays of at least 90 days outside resort zones. Though a court injunction currently holds the minimum stay at 30 days, unhosted vacation rentals remain confined mainly to resort areas.

Nashville, TN separates permits for owner-occupied and non?owner?occupied STRs. New non?owner?occupied permits are only allowed in non-residentially zoned areas.

Brookhaven, GA (a suburb of Atlanta) restricts STRs to owner-occupied homes; hosts must show proof of a homestead exemption and pay local taxes.

Atlanta, GA allows a short-term rental license only for your primary residence and one additional unit.

Lessons for Aspiring Hosts

By now, Maya has put her San Jose condo up for sale and is searching for markets that won’t strangle her with high costs and restrictive laws. Alex, on the other hand, continues to host hikers and hikers’ dogs, albeit constantly checking for evolving rules.

Here’s what investors and aspiring hosts can learn from their contrasting experiences.

Do your homework on regulations

Some markets require registration, tax collection, and adherence to strict rules; others limit whole-home rentals altogether. Always consult official sources before purchasing.

Consider overall demand and supply

High-cost cities like San Jose, San Francisco, and Sacramento have fewer suitable STR properties and high purchase prices.

Watch for hidden fees and taxes

Occupancy taxes, business fees, and license costs quickly reduce net income.

Think about your travel goals

If you want to operate in vibrant markets, pick those with a strong tourism draw, moderate housing costs, and balanced regulations. Avoid purely speculative buys where numbers don’t add up.

Final Thoughts

Real estate investing is more than crunching numbers; it’s about understanding the rules of the game. Do your homework, dig into the data, and take lessons from Maya’s and Alex’s experience, so your story becomes a success, not a warning.