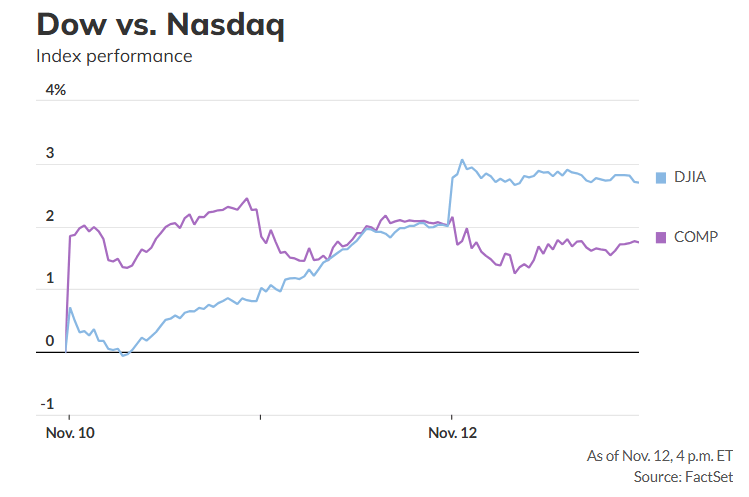

Now, on the dollar — as we’ve discussed before, a modest weakening from 108 to 104 or even 102 was acceptable. But what we’re seeing now is more of an oversell. Much of this pressure has come from positioning by Chinese and Japanese investors. I believe some of that will reverse, and the dollar index could move back to the 100–102 range. That said, there is a contrarian view — some believe the dollar could weaken further. But in my view, money will ultimately flow back to the dollar, and the current European enthusiasm may be short-lived. So yes, that’s my take on the US economy and the dollar outlook.

How is sentiment shaping up for emerging markets, particularly India? Taking cues from the US, benchmark indices here have been inching higher and even hit record closes. Could this trend benefit India and broader EMs?Anurag Singh: The challenge with India is that it’s no longer a cheap market. It does try to correct, but it’s mostly a story of flows. Systematic Investment Plans (SIPs) and retail inflows — nearly ₹50,000 crore a month — are preventing any meaningful correction. Of the entire market, only about 15% is held by FIIs, and the rest is largely retail-driven. Promoters may be selling at the margins, but broadly, domestic buying continues to support the market.

That said, I don’t see the market racing ahead either. Growth and earnings are only in the high single digits, so we’re likely in for a period of consolidation. Over the past five years, the Nifty delivered ~20% returns and mid- and small-caps grew around 30%. It’s reasonable to now expect a pause. Everyone knows it’s a great market, but everything is already priced in. FIIs are not rushing in right now — they may enter selectively, but broad-based participation seems unlikely. Valuations are fair, and there are no bargains — that’s my assessment.Shifting focus back to the US — especially in light of recent banking earnings. Many major US banks have reported results that are in line or better than expectations. In contrast, India’s Q1 banking results are expected to be muted due to slower credit growth. What’s your take on the resurgence of banking performance in the US?Anurag Singh: Bank regulation in the US is undergoing significant change. If you go back to 2008, when President Obama took office, the Dodd-Frank Act introduced a heavy regulatory burden — driven by figures like Elizabeth Warren. Over the years, this throttled the big banks — JPMorgan, Wells Fargo, Citi, Bank of America, Goldman Sachs, and Morgan Stanley.Now, many of those restrictions are being rolled back. For example, some constraints on Wells Fargo have been removed, and Goldman Sachs leadership is sounding optimistic. Over the next 3–4 years, even small banks are being freed from regulatory pressure. This removal of “regulatory cholesterol” will significantly benefit the US banking sector in the medium term, and that’s already being reflected in stock performance over the past year.

In India, the situation is different. Credit growth has already been phenomenal. Retail credit to GDP doubled from ~20% to over 40% in just five to six years. But now incomes are not keeping pace, and households are highly leveraged — limiting further borrowing capacity. As a result, credit growth is slowing, stabilizing around 10–12%, which is in line with nominal GDP. While banks remain a good investment and aren’t overly expensive, one must remember that banking is cyclical. After a few strong years, some consolidation is expected — and we’re entering that phase now.

Given your current view on India’s valuations and the early stages of earnings season, what’s your portfolio strategy? Should one hold off, or are there sectors or stocks you’re tracking closely based on how earnings evolve?Anurag Singh: A year ago, people quietly advised moderation in return expectations. Now, even leading mutual fund voices are openly saying: don’t expect more than 7–10% annually for the next few years. The Indian market is fairly valued. There are no clear bargains.

If you’re already invested, stay invested. If you’ve had a 20% return year, you can’t expect that every year — that’s just how it is. But don’t jump in with everything at once. Don’t sell your family silver to enter the market right now.

Keep the money flowing in slowly, but be cautious. I’ll still point out a couple of sectors. Healthcare — particularly beyond pharma — like hospitals and diagnostics, looks promising. These businesses are growing faster than the economy and have pricing power, so they’re well-positioned.

Other than that, be cautious. Multiples may contract as growth slows. You’ll need to track the US market closely for further cues. Banks are fine — especially the top two-three private sector names — I’ve always liked them. I’m less optimistic about PSU banks.

I remain cautious on life insurance — that sector seems to have peaked. Despite all the hype, insurance stocks haven’t done much. Broking and capital markets are overheated — we now have 18 crore Demat accounts. That growth can’t go on forever, so that space also looks stretched.

Overall, stay cautious. Keep some funds on the sidelines. Allocate 20–25% to bonds. I’ve always advocated for balanced investing — blindly pushing money into SIPs only inflates valuations further. Investors need to reflect and reassess.

This is a time to hold your horses, stick to safe large-caps, and avoid hyped-up sectors like defence where valuations seem unjustified — despite the story. Also, stay away from IPOs for now. That, in essence, is my current portfolio stance.