On June 17, Treasury Secretary Scott Bessent tweeted:

Recent reporting projects that stablecoins could grow into a $3.7 trillion market by the end of the decade. That scenario becomes more likely with passage of the GENIUS Act.

A thriving stablecoin ecosystem will drive demand from the private sector for US Treasuries, which back stablecoins. This newfound demand could lower government borrowing costs and help rein in the national debt. It could also onramp millions of new users—across the globe—to the dollar-based digital asset economy.

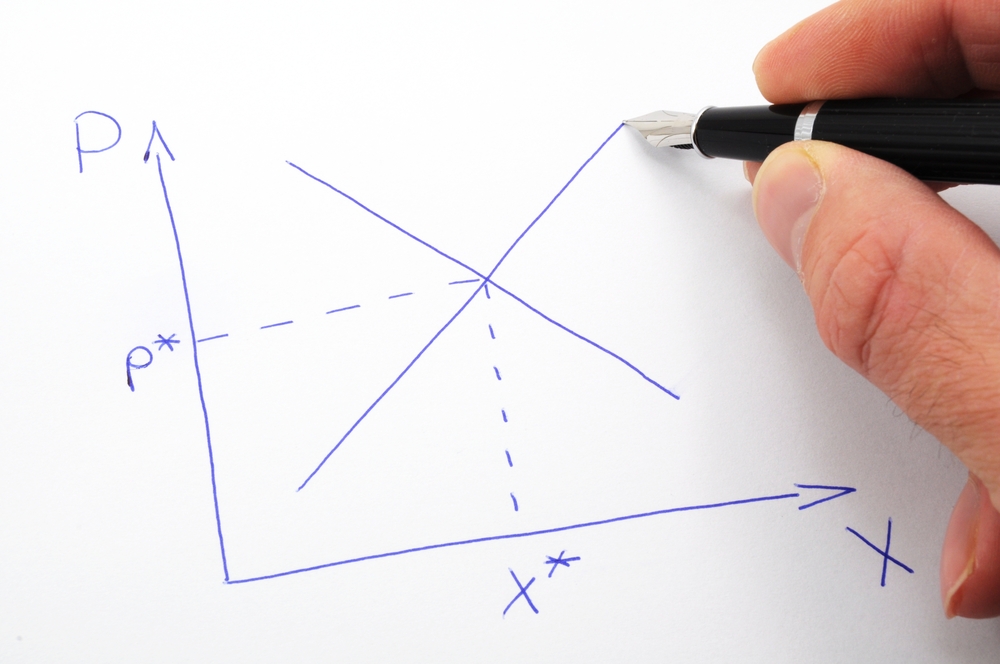

Bessent makes two Econ 101 errors in this tweet. First, as pointed out by my old GMU professor Larry White, increasing demand for Treasury bills would increase the equilibrium quantity of those bills exchanged in the market. In other words, it would increase the quantity supplied of US government debt, not lower it. [Update 7/8: this sentence originally said “increase quantity demanded” when it should have said “quantity supplied.” Thanks to Craig Richardson for pointing out the error on Facebook. I also added the following sentence, at Craig Richardson’s suggestion.] Following an increase in demand, you have higher prices and higher equilibrium quantity.

Secondly, as interest rates fall,* the cost of borrowing for the government falls, too. It’s the law of demand: as the cost of something goes down, the quantity demanded rises. People will want to hold more debt and the government will want to issue more debt. So, if Bessent is correct that stablecoins will be a “thriving” market, then the incentives would be for more government debt, not less.

Now, it is possible that Secretary Bessent read my EconLog post from about a year ago where I argued:

The people making spending and budgetary decisions do not face the full costs of their decisions. Neither do voters (indeed, the costs are spread out across all taxpayers). Consequently, we end up in a situation that James Buchanan and Richard Wagner call “Democracy in Deficit”: politicians prefer easy choices over hard, and will generally support higher spending and lower taxes.

In this case, the supply of Treasury bills is unrelated to the price level of Treasury bills: the supply is perfectly inelastic (a vertical line, for those of you drawing along supply and demand graphs at home). But, in this case, the Treasury Secretary is still incorrect in his assessment. If the amount of borrowing is unrelated to the price, then an increase in demand would lower the interest rate, but it would have no effect on the amount of debt issued. It would still be incorrect to claim that the Federal Debt would be reined in.

While it is theoretically possible that the demand curve for Treasury bills slopes upwards (although I am not sure why Treasury bills would be a Giffen good), it’s empirically unlikely.

—*For those not well-versed in monetary economics: the prices of bonds and their interest rates (also known as the bond yields) move in opposite directions. If the price goes up, the interest rate goes down. If price goes down, interest rates go up. The price of the bond is what you pay for the bond. The interest rate (yield) is what is paid to the holder of the bond over and above the price at maturity.