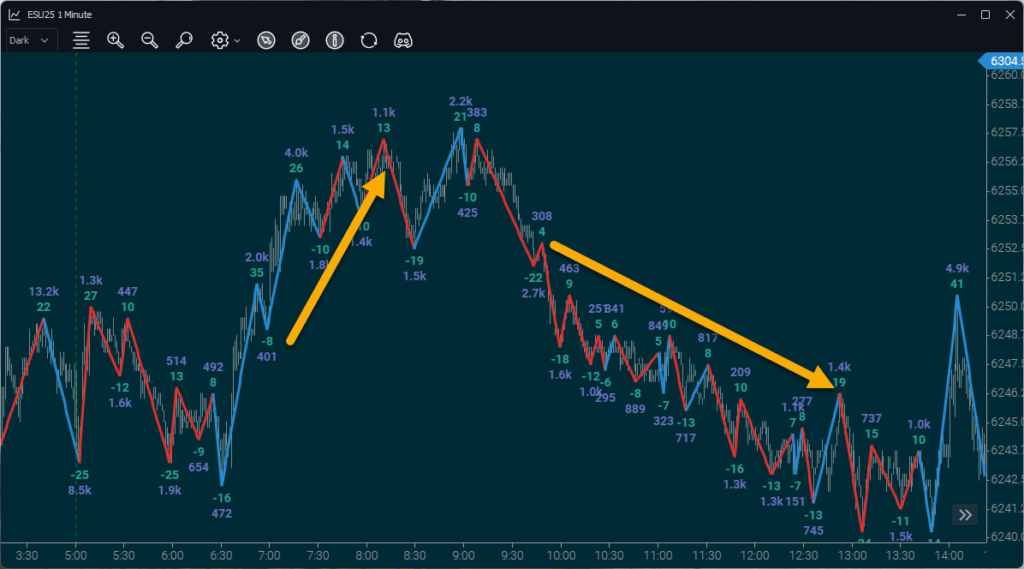

If a pullback ends in absorption then “with trend” traders jump in earlier.

In some pullbacks, “with trend” traders suddenly jump in

In some pullbacks “with trend” traders don’t jump in till we are near the peak of move before the pullback

But – you should see a pick-up – it just depends how quickly people recognize the pullback ended. From that point it is much faster action and it will be more volatile relative to the pullback. Which basically means it’s gonna shake you out in what appear to be aggressive pushes against you. Level 5 – Sitting in a trade through multiple with/counter trend moves. If you can handle a pullback and a with trend move, then you should be able to sit through many consecutive pullbacks and with trend moves, right? The thing is – if you trade pullbacks, you’ll know one thing for sure – they don’t all look like pullbacks. I can only speak for myself – but this sort of “jumping on a pullback” trade is quite selective. You don’t take every pullback, you take the ones that are more obvious. Maybe you have a specific thing you want to see (like absorption) at the end of a pullback, so you focus on those.  There’s good arguments for not ever trying to manage trades like this with Order Flow. There’s arguments that just letting it go are better. Also – if you just let it go – you are making fewer decisions during the trade. If you watch like a hawk and make 20 decisions during the life of the trade to stay in – then you need all of those decisions to be right. I’m not saying you should not do it. Some people are naturals at reading order flow. What I would say is that you should assess whether it’s right for you or not by comparing your results with what would have happened if you’d just let it run. Level 6 – Trading a News Event With a news event, you definitely want to sit through pullback as volatility goes through the roof. Trading is all about making the most of the opportunity the markets give us on any day. News is the thing that brings in the most volatility – but traders are advised against it because it is “too risky” – but don’t WE set the risk on our trades? News moves are the most volatile. That means wider stops and targets. It means smaller size for many. The good thing about news moves, is you expected the news, you see the market react to it as you expected – you really do know with a high degree of confidence that this move was generated by that news. The moves generated are way more volatile – which makes them tough to read – but you aren’t trying to read every tick – you are looking for the crowd to wane overall. Pullbacks are brutal and timing an entry simply isn’t possible much of the time – so you are often going to get in on the right side of the market but still sit through a brutal comeback. Like anything – if you focus on it and have the aptitude, you’ll learn it. What you can’t do is go from level 1 – not getting run over to level 6 overnight. Conclusion The lesson here, I think, is that you don’t want to ruin order flow for yourself by trying to do something too advanced initially. I don’t so much care that you skip a level – I just care you don’t quit because you did so without realizing you were taking on too much. Good luck.

There’s good arguments for not ever trying to manage trades like this with Order Flow. There’s arguments that just letting it go are better. Also – if you just let it go – you are making fewer decisions during the trade. If you watch like a hawk and make 20 decisions during the life of the trade to stay in – then you need all of those decisions to be right. I’m not saying you should not do it. Some people are naturals at reading order flow. What I would say is that you should assess whether it’s right for you or not by comparing your results with what would have happened if you’d just let it run. Level 6 – Trading a News Event With a news event, you definitely want to sit through pullback as volatility goes through the roof. Trading is all about making the most of the opportunity the markets give us on any day. News is the thing that brings in the most volatility – but traders are advised against it because it is “too risky” – but don’t WE set the risk on our trades? News moves are the most volatile. That means wider stops and targets. It means smaller size for many. The good thing about news moves, is you expected the news, you see the market react to it as you expected – you really do know with a high degree of confidence that this move was generated by that news. The moves generated are way more volatile – which makes them tough to read – but you aren’t trying to read every tick – you are looking for the crowd to wane overall. Pullbacks are brutal and timing an entry simply isn’t possible much of the time – so you are often going to get in on the right side of the market but still sit through a brutal comeback. Like anything – if you focus on it and have the aptitude, you’ll learn it. What you can’t do is go from level 1 – not getting run over to level 6 overnight. Conclusion The lesson here, I think, is that you don’t want to ruin order flow for yourself by trying to do something too advanced initially. I don’t so much care that you skip a level – I just care you don’t quit because you did so without realizing you were taking on too much. Good luck.