When it comes to securing your child’s financial future, choosing the best UGMA/UTMA accounts is crucial. In this article, we’ll review and compare the top custodial accounts to help you decide which one best meets your needs, considering factors like fees, investment options, and unique features.

Understanding UGMA and UTMA Accounts

UGMA (Uniform Gifts to Minors Act) and UTMA (Uniform Transfers to Minors Act) accounts are two types of custodial accounts designed to hold and manage money or other assets for a minor until they reach the age of majority. These custodial accounts fall under the umbrella of investment accounts but differ from tax-advantaged college savings plans like 529s. UGMA/UTMA accounts allow family members, including an adult custodian, to gift stock, mutual funds, index funds, or even cash to a child without needing to establish a trust.

The custodian—often a parent or close relative—manages the investments in the account until the child reaches the designated age, usually 18 or 21 depending on the state. At that point, the child gains full control of the custodial account and can use the funds for any purpose, such as college, starting a small business, or buying their first car. These accounts are often used as a way to teach children about saving and investing while preparing them for long-term financial independence.

UGMA/UTMA accounts are considered custodial investment accounts and are commonly used by parents who want to invest money in their child’s future. They are particularly effective for young investors because the funds grow with the market over time. Unlike college savings plans, the assets in these accounts are not limited to educational use.

Key Benefits and Considerations

One of the most appealing benefits of UGMA and UTMA accounts is their flexibility. They accept contributions from anyone and can hold a wide range of investment options, including individual stocks, mutual funds, exchange traded funds (ETFs), and other investments. Contributions are irrevocable gifts and may incur federal gift tax if they exceed the annual exclusion amount.

Important considerations include:

Assets in the account are considered the child’s and can affect financial aid.

Unearned income may be taxed at the parent’s tax rate due to kiddie tax rules.

You cannot withdraw money without using it for the benefit of the child.

Because of their flexibility and low fees, UGMA and UTMA accounts remain among the best custodial accounts for long-term wealth transfer.

Get a $25 BONUS when you sign up for Wealthsimple and deposit $1 within 30 days!

Top UGMA/UTMA Account Providers

Charles Schwab Custodial Account

Charles Schwab offers one of the best custodial brokerage account options on the market. With no account minimums, no maintenance fees, and access to fractional shares, it’s ideal for families looking for affordable, easy-to-manage accounts. Schwab offers account registration online and provides access to a wide array of stocks, bonds, mutual funds, and ETFs.

Features:

No monthly fees

No account minimums

Commission-free ETF trades and stock trades

Access to Vanguard funds

Strong educational resources and physical locations for in-person support

Greenlight App Custodial Investing

Greenlight is designed to help families manage money and introduce kids to saving and investing. It allows for real-time monitoring and helps children make informed investment decisions. It’s perfect for young investors who are just getting started.

Features:

Parental controls and insights

Custom savings goals and allowance tools

Invest money in ETFs and stocks

Educational games and lessons

Acorns Early

Acorns Early simplifies custodial investing with automatic round-ups and professionally managed portfolios. It’s one of the few services where even small transactions help start saving and investing.

Features:

Start with as little as $5

Diversified portfolios using ETFs and mutual funds

Round-Ups® to grow investment assets from spare change

Smart tax strategies and long-term savings tools

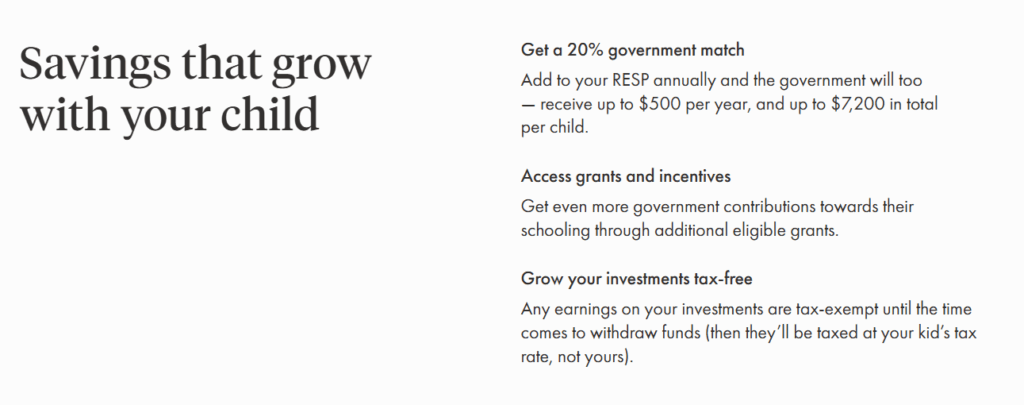

Wealthsimple

For Canadian users, Wealthsimple offers a sleek, low-fee platform that combines checking, saving, and investing. Its custodial investment accounts are easy to manage and come with advisor support.

Features:

Cash-back spending

Up to 2.75% interest

No monthly fees

Personalized investment management

Get a 1% match when you transfer an eligible account to Wealthsimple!

Tax Benefits and Implications

UGMA and UTMA accounts provide important tax benefits, especially when compared to a retirement account or Roth IRA, which have contribution limits. While contributions are not tax deductible, they can lower a family’s taxable estate. Here’s what you need to know:

Contributions over $19,000 per child ($38,000 for a married couple filing jointly) may incur federal gift tax.

Investment income is subject to the kiddie tax.

The child’s benefit is taxed progressively: the first $1,250 is tax-free, the next $1,250 is taxed at the child’s rate, and amounts beyond that are taxed at the parent’s tax rate.

Gains from selling stocks or other assets are taxed as capital gains.

If you’re unsure how to navigate these rules, a financial advisor or certified financial planner can help minimize tax liability and clarify the benefits of custodial accounts.

How to Open a UGMA or UTMA Account

Opening a custodial brokerage account is a straightforward process. Most major brokerages and fintech platforms offer online applications that require:

The child’s Social Security number

A valid ID from the custodian

Basic personal information

Once the account is set up, the custodian can start adding money through bank account transfers or rolling over funds from other accounts. There are no account minimums for many providers, though specific investment products may have their own minimum balance requirements.

Investors can choose between self-directed brokerage account platforms or managed portfolios. If you’re new to investing, you may prefer a provider that offers automated investment management or guidance from a financial advisor.

Tips for Managing a Custodial Account

Managing a UGMA or UTMA account takes more than just buying a few stocks. Here are some tips to ensure smart, long-term growth:

1. Diversify Your Investment OptionsDon’t rely solely on individual stocks. Consider mutual funds, index funds, and ETFs for broader exposure.

2. Monitor FeesLook for accounts with low fees and no account maintenance charges. High fees can erode returns over time.

3. Plan for the Age of MajorityOnce the child reaches the age of majority, they gain full control of the custodial account. Be sure to discuss financial responsibility ahead of time.

4. Stay Informed on Tax RulesCapital gains and other investment income must be reported. Consider speaking with a certified financial planner for personalized guidance.

5. Use it as a Teaching ToolCustodial accounts are great for introducing personal finance topics to your child. Include them in discussions about the stock market, saving, and making investment decisions.

Get a $25 BONUS when you sign up for Wealthsimple and deposit $1 within 30 days!

Final Thoughts on UGMA/UTMA Accounts

UGMA and UTMA accounts are versatile, cost-effective tools to transfer wealth, reduce taxable estates, and support a child’s future financial growth. Whether your goal is paying taxes efficiently, teaching kids to manage money, or avoiding federal gift tax, the right custodial investment account can make a difference.

With platforms like Charles Schwab, Acorns Early, and Greenlight, families can access low-cost, feature-rich options for investing in their child’s future. Make sure to evaluate account fees, investment decisions, and long-term goals when selecting your custodial account.

FAQs

UGMA accounts can hold financial assets like stocks, bonds, and mutual funds. UTMA accounts expand on this by allowing additional property types, such as real estate and art. Both are custodial accounts managed by an adult on behalf of a minor until the child reaches the age of majority.

There are no legal contribution limits, but contributions above $19,000 (or $38,000 for a married couple filing jointly) per year may be subject to the federal gift tax.

Yes. A portion of the account’s investment income may be taxed at the child’s tax rate, which is often lower than the parent’s. However, income above certain thresholds may be subject to the “kiddie tax” at the parent’s rate.

Yes. Anyone—including grandparents, godparents, or family friends—can add money to a UGMA or UTMA account. All contributions are irrevocable gifts to the child.

It depends on your goals. A 529 plan offers tax-free growth for education expenses, while UGMA/UTMA accounts are more flexible in how the funds can be used but come with different tax rules and financial aid impacts.

The Best Canadian Brokerages as of June 30, 2025

Ranking of Top Canadian Stock Brokerages Based on Fees, Features, and Sign-Up Bonuses

We are experienced users of dozens of Canadian stock trading platforms. We stay up to date on these platforms’ service offerings, subscription fees, trade commissions, and welcome bonuses. The brokerages listed below are for Canada-based investors, and are ranked in order of overall value received after taking advantage of their sign-up and/or referral offers.

Fees:

$0 commission on equities; $9.95 for mutual funds.Full Review

Features:

✅ Commission-free stock and ETF purchases✅ Dual-currency accounts without conversion fees✅ Advanced trading with multi-leg options support

Sign-up Bonus:

$50 Refer a Friend Bonus

Learn more

Fees:

$0.01/share for CAD stocks; $0.005/share for US stocks.Full Review

Features:

✅ Access to 150+ global markets from a Canadian account✅ Tiered interest on idle cash balances over $10,000 CAD✅ Supports portfolio margin and direct market routing

Sign-up Bonus:

Refer a Friend, Get $200

Learn more

Fees:

$0.99/trade for US equities & ETFs; $0.65/contract for US options.Full Review

Features:

✅ Access to U.S. Markets✅ Access to Canadian Markets✅ RRSP and TFSA Accounts

Sign-up Bonus:

Deposit $100, get $20 in NVDA stock; Deposit $2,000, get $50 in NVDA stock; Deposit $10,000, get $300 in NVDA stock; Deposit $50,000, get $1,000 in NVDA stock

Learn more

Fees:

$8.75 per trade for stocks, ETFs, and mutual funds.Full Review

Features:

✅ Auto-deposit investing in pre-built portfolios✅ In-kind transfers & dividend reinvestment plans for CA stocks✅ RESP and FHSA accounts with self-directed tools

Sign-up Bonus:

$1 off per trade for investors 18-30

Learn more

Features:

✅ Commission-free stock, ETF, and crypto trading in one app✅ 24/5 U.S. market access with fractional share support✅ No FX fees on U.S. trades if subscribed to USD feature

Sign-up Bonus:

$25 bonus after depositing $1 or more (first 30 days)

Learn more

Fees, features, sign-up bonuses, and referral bonuses are accurate as of June 30, 2025. All information listed above is subject to change.