Gold has been used as a store of value for thousands of years, serving as a universal medium of exchange and a hedge against economic uncertainty. Unlike paper currency or stocks, gold has intrinsic worth that does not depend on the performance of a company or government. According to the U.S. Department of the Treasury, gold plays a significant role in maintaining economic stability, making it a valuable hedge for investors. For beginners, gold offers a way to preserve wealth during inflationary periods, economic downturns, and market turbulence.

Gold also acts as a diversification tool in an investment portfolio. When other asset classes decline in value, gold often maintains or even increases its worth. This inverse correlation can help stabilize overall portfolio performance, reducing the impact of market volatility. While gold prices can experience short-term fluctuations, history shows that gold consistently holds its value over decades.

The Different Ways You Can Invest in Gold

There is more than one way to add gold to your portfolio. Each option comes with unique advantages and potential drawbacks, so understanding them will help you select the approach that aligns with your financial goals.

Physical Gold – Coins, Bullion, and Bars

Owning physical gold means you hold tangible assets in the form of coins, bullion, or bars. This method provides a sense of security because you have direct control over your investment. However, it also comes with responsibilities, such as arranging secure storage. Investors often choose bank safety deposit boxes, insured vaults, or high-quality home safes. Physical gold also requires careful attention to authenticity, which is why buying from reputable dealers is critical.

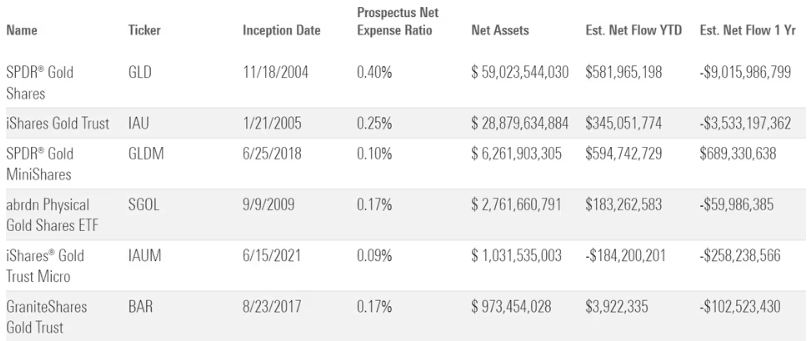

Gold ETFs and Mutual Funds

Gold ETFs and mutual funds allow investors to gain exposure to gold without physically storing it. ETFs are traded on stock exchanges, making them easy to buy and sell. Mutual funds can be actively managed, which might appeal to investors seeking professional oversight. These vehicles generally have lower transaction costs and are more liquid than physical gold, making them appealing to beginners.

Gold Mining Stocks

Gold mining stocks offer indirect exposure to gold prices by investing in companies that mine and process gold. These stocks can deliver higher returns if gold prices rise significantly, but they also carry risks tied to the mining industry, including operational costs, regulatory challenges, and geopolitical instability. Mining stocks can be more volatile than physical gold or ETFs.

Digital Gold and Gold-Backed Tokens

Digital gold and gold-backed tokens are emerging investment vehicles that combine technology with tangible value. These products represent ownership of specific quantities of gold stored in secure vaults. Investors can buy and sell them online, often in smaller increments than traditional gold purchases. While convenient, these options require due diligence to ensure the provider is legitimate and transparent.

Current Promotion: get your Free Gold IRA Guide Today!

How to Get Started With Gold Investing

Getting started with gold investing involves more than simply making a purchase. It requires a clear understanding of your objectives, budget, and preferred investment method.

Determine Your Investment Goals

Your goals will dictate the type of gold investment that best suits your needs. Some investors use gold as a hedge against inflation, others as a store of value for wealth preservation, and still others as part of a diversified growth strategy.

Decide on Allocation Percentage

Many financial planners recommend allocating 5% to 10% of a portfolio to gold. The right allocation depends on your risk tolerance, time horizon, and other assets in your portfolio. Conservative investors may prefer a smaller percentage, while those seeking greater protection from volatility might opt for more.

Buy From a Trusted Source

Working with a reputable dealer or financial institution is essential. Look for sellers who provide authentication certificates, transparent pricing, and a strong reputation in the industry. Regulatory bodies and industry associations can also help verify legitimacy.

Current Promotion: $15,000 in Free Silver on Qualified Purchases

Understand Pricing and Premiums

The spot price is the base market price for gold, but buyers usually pay more due to dealer premiums, which cover minting, distribution, and dealer profit. Comparing prices from multiple sources will help ensure you get the best deal possible.

Mistakes to Avoid When Investing in Gold

Investors often make avoidable mistakes that can impact returns. One common pitfall is overpaying for gold due to excessive premiums or purchasing from unreliable sources. Another is neglecting storage security, which can put assets at risk. Liquidity should also be a consideration, as certain gold forms are harder to sell quickly. Finally, investing solely in gold without balancing it with other asset classes can reduce long-term growth potential.

Spotlight on Hamilton Gold Group

Hamilton Gold Group is a well-known name in the precious metals industry, specializing in helping investors purchase and store gold securely. They offer services such as physical gold purchases, gold IRA rollovers, and insured storage options. For beginners, their client-focused approach, transparent pricing, and educational resources can make the process of buying gold straightforward and stress-free. Working with a trusted provider like Hamilton Gold Group can give new investors confidence as they begin their journey into gold investing.

Current Promotion: Unconditional Buy Back Guarantee

Tips for Long-Term Success in Gold Investing

Success with gold investing comes from patience, discipline, and a diversified approach. Monitor market trends and adjust your allocation as needed. Keep storage secure and insured. Combine gold with a mix of stocks, bonds, and other assets to reduce risk while maintaining growth potential. Reviewing your portfolio regularly ensures your gold investments remain aligned with your financial goals.

Conclusion

Gold remains one of the most enduring and trusted forms of investment in the world. For beginners, it offers stability, portfolio diversification, and protection against inflation and market instability. By understanding the different ways to invest, taking steps to avoid common mistakes, and working with reputable sources, you can build a gold investment strategy that aligns with your long-term financial goals. Whether you choose physical gold, ETFs, mining stocks, or digital options, a disciplined and informed approach will help you make the most of your investment.

FAQ Section

Most financial experts suggest between 5% and 10% of your portfolio, depending on your goals and risk tolerance.

Gold often maintains or gains value during recessions, making it a common safe-haven asset.

Physical gold offers tangible ownership, while ETFs provide convenience and liquidity. Your choice depends on personal preferences and storage capabilities.

Consider secure home safes, bank safety deposit boxes, or insured third-party vaults.

Yes, certain self-directed IRAs allow physical gold investments if they meet IRS regulations.

The Best Stock Newsletters as of June 29, 2025

Ranking of Top Stock Newsletters Based on Last 3 Years of Stock Picks

We are paid subscribers to dozens of stock newsletters. We actively track every recommendation from all of these services, calculate performance, and share the results of the top performing stock newsletters whose subscriptions fees are under $500. The main metric to look for is “Excess Return” which is their return above that of the S&P500. So, based on last 3 years ending June 29, 2025: