The chemical manufacturing industry stands as a significant contributor to global carbon emissions, generating more than 2B metric tons of carbon dioxide annually. This environmental impact stems from both the raw materials required and the emissions produced during manufacturing processes. The industry has long grappled with these emissions, as many have proven resistant to traditional capture, avoidance, or reduction methods. Turnover Labs has developed an electrolysis technology that not only addresses emissions captured but also transforms these byproducts into valuable chemical building blocks, which can be repurposed for industrial applications including plastic production and fuel manufacturing. The company’s proprietary electrolyzers, which are strategically deployed at manufacturing facilities and seamlessly integrated with existing infrastructure. This on-site implementation enables direct collection of manufacturing emissions while simultaneously producing syngas, a critical precursor for petrochemical production. Through this dual-function approach, Turnover Labs effectively decarbonizes chemical manufacturing operations across both upstream and downstream processes. Aside from the environmental benefits, Turnover Labs’ circular system delivers significant economic advantages. The solution streamlines operations by reducing multiple cost centers, including maintenance requirements, transportation needs, purification processes, infrastructure investments, storage facilities, and monitoring systems.

AlleyWatch caught up with Turnover Labs Founder and CEO Marissa Beatty, PhD to learn more about the inspiration for the business, the company’s strategic plans, recent round of funding, and much, much more…

Who were your investors and how much did you raise?

Turnover Labs just had our pre-seed round, which was co-led by Pace Ventures and GC Ventures for $1.4M.

Tell us about the product or service that Turnover Labs offers.

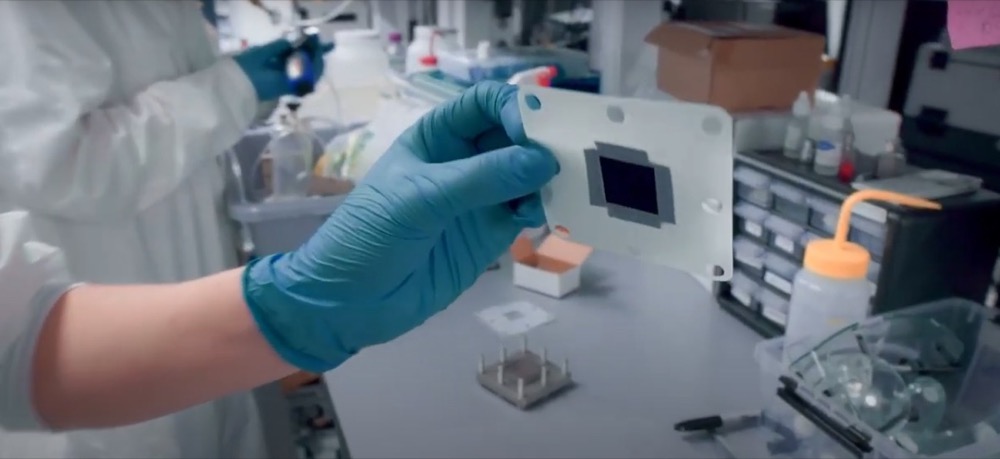

Turnover is developing next-gen ultra-durable electrolyzers for the chemicals industry. Our systems can transform dirty CO2 emissions into valuable chemicals, such as those used in making plastics, solvents, fuels, and more. We’re directly integrating into existing facilities, enabling them to turn their waste streams into revenue.

What inspired the start of Turnover Labs?

I fell in love with this technology during my PhD and wanted to continue working with it. It has a massive potential, and the best way to get it into industry hands is to do it yourself. The academic research was a great foundation for the technology, but to see real-world use, our current development is focused on practical aspects which matter to industry, such as durability, scalability, and economic feasibility.

How is Turnover Labs different?

When it comes to sustainable chemistry, our fundamental approach is to leverage existing infrastructure rather than building something from scratch. This means we work directly with industry incumbents, which definitely has its own challenges, but has the advantage of immediate access to enormous scale. Instead of having to build an entire facility or pipeline from the ground up – we can build directly for existing needs. This industrial focus has revealed the importance of system durability, which is the primary metric we aim to optimize.

What market does Turnover Labs target and how big is it?

We target the petrochemicals industry, which is a massive $425B market. In that industry, we’re looking to make the basic feeds for many basic products such as plastics, solvents, fuels, and more.

What’s your business model?

We’re doing on-site deployment of our technology, because our systems are durable and adaptive to multiple needs of different facilities. On-site deployment greatly reduces the cost of transmission or storage of emissions, which makes our product easy to integrate for companies looking to reduce their carbon footprint without breaking the bank.

How are you preparing for a potential economic slowdown?

By raising money now!

In all honesty, our economic models are intentionally agnostic to government subsidies. They’re a boon if and when we can utilize them, but we aim to provide value to companies regardless of the political or economic context. For instance, by producing chemicals on-site, we decouple from transportation costs, which can be incredibly volatile. With more stable pricing, customers can more confidently forecast future costs, and operate with higher margin.

What was the funding process like?

Intense for a first-timer. Coming from an academic background, it’s daunting to raise money, but we found allies in investors that shared our views, and believed in our mission. Getting recognition from organizations such as Forbes 30 Under 30, the Activate Fellowship, and CleanTech Open has been incredible, and has helped provide a lot of connections.

What are the biggest challenges that you faced while raising capital?

Our work is on the technological cutting edge, so accurately conveying the application of the technology can be difficult.

What factors about your business led your investors to write the check?

Sustainable chemicals is becoming a popular space – I think we stand out because we are building a very capital efficient model that works for our customers. Being able to deliver value at both large and small scales helps us not fall into a scaling trap. Above all, our investors are well acquainted with the problem we’re solving, and are able to see the incredible potential it has.

What are the milestones you plan to achieve in the next six months?

Our value proposition comes from our system durability – so for the next 6 months we’re running our technology through the gauntlet of different real life emissions samples to get durability as high as possible.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

New York has many resources that aren’t visible in plain sight – connect with other founders or companies at your stage, and don’t be afraid to ask questions!

Where do you see the company going in the near term?

We’re looking for early pilot opportunities and places to vet our tech in real world contexts.

What’s your favorite fall destination in and around the city?

Last fall I went up to the Finger Lakes and it was a great trip – amazing foliage and hikes. But my favorite destination within the city might be the bar Mace!