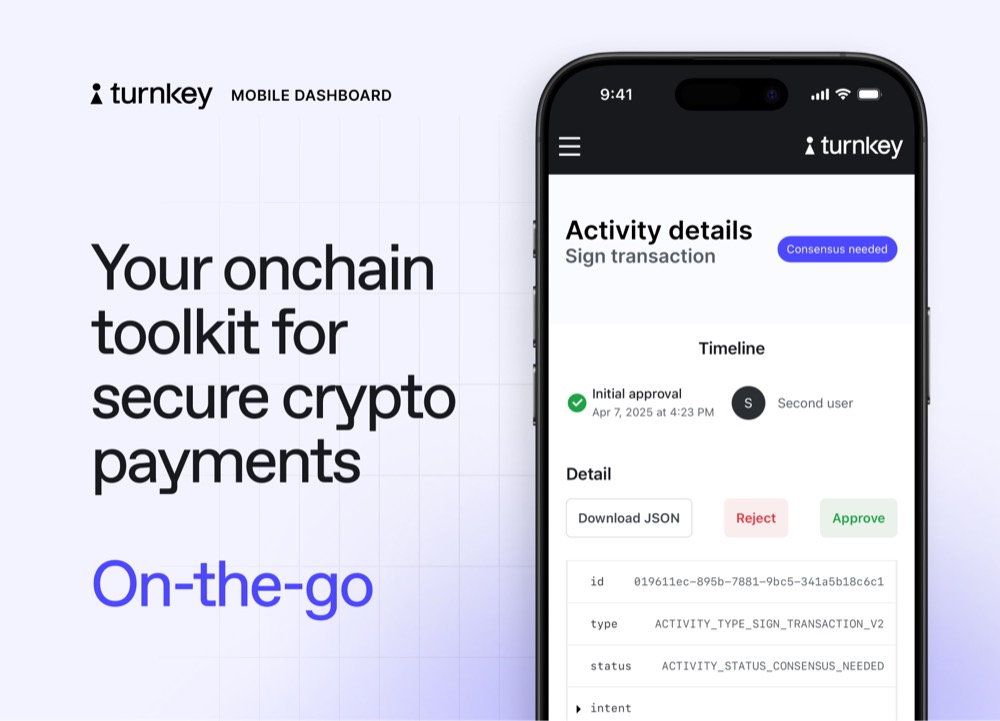

The cryptocurrency industry experiences a fundamental shift as traditional finance and crypto infrastructure converge, with major players like Stripe, Robinhood, and PayPal integrating stablecoin and wallet technologies into their core offerings. Despite the blockchain technology market reaching over $30B in estimated size, legacy crypto wallet infrastructure continues to create bottlenecks for developers with outdated APIs, poor scalability, and security compromises that prevent mainstream adoption. Turnkey addresses this challenge by providing secure, scalable, and programmable crypto infrastructure for embedded wallets and onchain transaction automation, offering developers the ability to create millions of secure, non-custodial wallets directly inside their applications without seed phrases or confusing UX. The company has pioneered the use of secure enclaves and Trusted Execution Environments (TEEs) to deliver the first verifiable key management system of its kind, enabling seamless onboarding experiences while maintaining enterprise-grade security. With their infrastructure now powering over 50 million embedded wallets and processing millions of transactions weekly across use cases from DeFi and payments to AI agents and consumer applications, Turnkey has established itself as the foundation enabling crypto’s evolution toward mainstream adoption.

AlleyWatch sat down with Turnkey CEO and Cofounder Bryce Ferguson to learn more about the business, its future plans, and recent funding round, and much, much more…

Who were your investors and how much did you raise?

Turnkey raised $30M in Series B funding, bringing the company’s total funding to more than $50M. Bain Capital Crypto led the round, with participation from Sequoia Capital, Lightspeed Faction, Galaxy Ventures, Wintermute Ventures, and Variant.

Tell us about the product or service that Turnkey offers.

Turnkey provides secure, scalable, and programmable crypto infrastructure for embedded wallets and onchain transaction automation. Let me explain both:

Embedded wallets: Many of the world’s fastest-growing crypto companies, from Moonshot to Infinex to Magic Eden, have used Turnkey to create millions of secure, non-custodial wallets on behalf of their customers, directly inside their app. No seed phrases. No confusing UX. Just seamless onboarding.

Transaction automation: Turnkey lets teams automate onchain workflows at scale with fine-grained control policies. You can securely move assets, approve actions, or trigger transactions — all programmatically.

What inspired the start of Turnkey?

Jack Kearney (cofounder) and I met at Coinbase. We had often talked about starting a company, but we imagined we’d need to hide out for months to figure out what to build. That wasn’t the case at all.

Starting Turnkey happened very naturally — it was an extension of the work we had been doing previously. We had built key management infrastructure at Coinbase, and we had seen how the crypto industry was evolving. After Coinbase, when I was at Trade Republic and Jack was at Polychain, we hit our heads against the wall integrating with existing key management solutions. We experienced firsthand where this infrastructure was falling short and saw clear gaps in the market.

So in 2022, we got together and started asking, “should we explore this a little bit more?” Soon after, we raised our seed round, brought together old colleagues from Coinbase, and started to build towards our vision of infrastructure that would let developers programmatically control wallets and transactions without compromising on security.

How is Turnkey different?

The crypto industry moves very, very quickly. On the use case side, you have crypto companies focused on emerging areas like AI agents for crypto trading. On the adoption side, crypto companies can experience sharp spikes in users and transactions overnight — like Moonshot after $TRUMP launched.

Because the crypto industry moves so fast, infrastructure providers are too often a bottleneck. Turnkey is the opposite — the security, flexibility, and scalability built into our platform allows developers to build incredible products. Our platform is built in such a way that we are a future-proof option for developers that will allow them to evolve with the crypto industry.

From the beginning, Turnkey also took a very different approach to security. We leveraged secure enclaves, which were a little-used tool for crypto wallet security back in 2022. In our early days of selling Turnkey, there was a huge education component for prospective customers on what secure enclaves were, and how customers would benefit from this security approach. In large part because of the work Turnkey did, secure enclaves are now becoming the default when people think about key management security.

What market does Turnkey target and how big is it?

Most immediately, Turnkey falls into the blockchain technology market, with an estimated size of over $30B .

In the coming years, though, I see the addressable market being significantly larger. Already, we have billions of dollars in crypto transactions being powered by Turnkey’s infrastructure. As crypto becomes even more widely adopted, and Turnkey scales to work with more customers beyond the crypto-native, I anticipate processing trillions in crypto transactions.

What’s your business model?

Turnkey’s pricing is a combination of a monthly minimum, and per signature pricing that scales with volume.

How are you preparing for a potential economic slowdown?

I don’t see near-term signs of a crypto slowdown. If anything, I think political and economic conditions will result in the crypto industry scaling rapidly over the next few years. That being said, our leadership team is taking the long view on growing Turnkey. We recognize there could be downturns, and are investing in our team and infrastructure in a way that will allow us to weather any economic headwinds.

What was the funding process like?

We actually weren’t actively fundraising when investors came knocking. Because of the growth we have been seeing, investors recognized the opportunity in what we are building, and our fundraising process was streamlined. Bain Capital Crypto in particular brought deep technical expertise, and quickly understood how important Turnkey’s infrastructure will be in bringing crypto to the masses.

What are the biggest challenges that you faced while raising capital?

Because Turnkey has taken a fundamentally different approach to key management infrastructure, much of our early investor conversations focused on resetting mental models and clarifying the scale of the opportunity.

What factors about your business led your investors to write the check?

For Turnkey’s Seed and Series A rounds, investors were more focused on the strength of the team, and the potential for the technology. For the Series B we just raised, our investors are both excited about our customer traction, as well as our long-term vision of programmable, open, and verifiable primitives that support real-world use cases.

What are the milestones you plan to achieve in the next six months?

Over the next six months, we’ll double down on our core wallet infrastructure to make it easier and easier to build in crypto. We’ll scale our team across engineering, product, go-to-market, and operations. We’ll also invest in open sourcing applications, deeper integrations, and more modular infrastructure for payments, AI agents, DeFi, and more.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

With the advent of AI, it’s easier than ever to build with very little resources. If you believe in your mission, keep building until it’s impossible for VCs to ignore your product.

Where do you see the company going now over the near term?

Turnkey is scaling across the board — engineering, product, GTM. Our team is also continuing to invest in open source and verifiability, expanding our integrations, and building more modular infrastructure to support new use cases in payments, DeFi, AI agents, and more. Our goal is for Turnkey to become the default infrastructure powering crypto transactions.

What’s your favorite spring destination in and around the city?

The second the sun comes out, you can find me running on the West Side Highway!