In an era where enterprises spend tens of billions annually building custom internal software, a dangerous trend emerges that threatens corporate security at an unprecedented scale. AI-powered “vibe coding” tools enable non-technical employees to build applications more easily than ever, but recent benchmarks reveal that 62% of AI-generated solutions contain security vulnerabilities or have fundamental errors. Superblocks addresses this challenge by offering the first AI agent specifically designed to generate secure enterprise applications from natural language prompts, combining the speed of consumer AI tools with enterprise-grade governance and security. Their platform features Clark, an AI agent that enforces organizational security policies, data permissions, and design standards while generating clean, traceable React code that provides IT teams with full visibility and control. Currently used by thousands of enterprise teams at companies including Instacart, Cvent, and Carrier, Superblocks helps organizations build internal applications 10x faster while maintaining enterprise security standards. Superblocks positions itself as the solution to help enterprises harness AI app generation without compromising security or compliance.

AlleyWatch sat down with Superblocks CEO and Co-Founder Brad Menezes to learn more about the business, its future plans, and recent funding round, which brings the company’s total funding raised to $60M.

Who were your investors and how much did you raise?

We raised a $23M Series A extension, bringing our total funding to $60M. Our investors include Kleiner Perkins, Spark Capital, Greenoaks, and Meritech Capital, along with tech leaders like Aaron Levie (CEO of Box) and Aneel Bhusri (Founder of Workday). We’ve been really intentional about partnering with folks who understand both enterprise software and the shift happening with AI right now.

Tell us about the product or service that Superblocks offers.

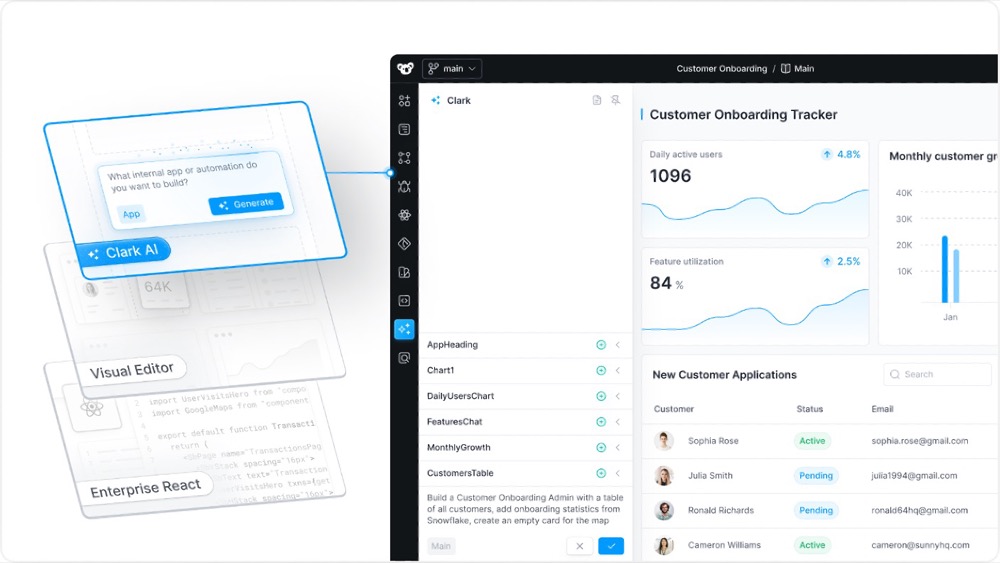

Superblocks is the leading internal app platform for the enterprise. We recently launched Clark, the first AI agent purpose-built to generate secure internal applications from natural language prompts. Think: Lovable, Bolt, or v0, but built for enterprise back-office apps with native support for SSO, RBAC, audit logging, integrations, and more.

What makes Superblocks powerful is the full-stack experience. You can generate apps with AI using Clark, refine them visually with drag-and-drop components in the Superblocks Editor, and extend them infinitely in React using your preferred IDE (Cursor, Windsurf, or VSCode). These three development modalities give teams flexibility: non-engineers can now build safely, while engineering and IT stay in the loop to ensure everything meets enterprise standards.

What inspired the start of Superblocks?

When I was at Datadog, what really stood out was how many Fortune 100s were using it to monitor their internal tools, things like onboarding systems, finance dashboards, support ops. These weren’t just side projects, they were mission-critical, and yet no one really talked about them.

That was the spark for Superblocks. My cofounder Ran Ma and I saw a huge, overlooked opportunity in internal software. And now with AI, we’re at a tipping point: IT, data and business teams can become builders themselves. Our vision is to give every domain expert the ability to safely build the same mission-critical software once bottlenecked on engineering.

How is Superblocks different?A lot of AI tools out there are optimized for speed or quick prototypes, but they fall apart when you try to scale them to production. What makes Superblocks different is that we’re built for the production-grade enterprise apps from day one.

Apps are generated with AI in Superblocks and follow existing enterprise standards like your design system, SSO, RBAC, audit logging, VPC deployments, etc. And under the hood, it’s open React code so your engineering team can easily modify and extend apps in their preferred IDE.

What market does Superblocks target and how big is it?

We target enterprises with significant operational complexity; think financial services, healthcare, logistics, and insurance companies with hundreds of internal tools and processes to manage. Companies spend tens of billions building custom internal software every year and with AI that spend will continue to increase as they build agentic experiences that can replace workflows currently requiring human intervention today.

As AI drives the cost of development down, we expect that enterprises will build 10-100x more internal software to automate every manual business process.

What’s your business model?

We are a SaaS platform and charge based on the number of Builders and End Users primarily.

Our team of AEs and BDRs targets enterprise accounts with heavy operational processes; companies where secure, scalable modern internal tooling has a clear business ROI. We land with a department and expand across the organization quickly.

How are you preparing for a potential economic slowdown?

We’re doubling headcount and investing heavily in engineering and go-to-market to meet demand. It might seem counterintuitive in this climate, but we see this as the moment to lean in. Enterprises are under pressure to drive efficiency and reduce manual work, and that’s exactly where Superblocks delivers value.

What was the funding process like?This recent funding round was led by insider investors excited about the momentum and expansion of the opportunity ahead by introducing Clark AI to the platform.

What are the biggest challenges that you faced while raising capital?One challenge was clarity and cutting through the noise. There are so many AI tools launching every week, it’s a bit of a Wild West right now. So we had to be really clear: this isn’t a toy or a prototype generator. This is a serious platform for enterprises to scale internal app development, securely and sustainably. No one had delivered that to market in a manner that a CIO could roll out across the organization, and that’s where the lightbulb moment went off for investors.

What factors about your business led your investors to write the check?

A few things stood out. First, the size of the opportunity. Internal software is a massive, underserved market. Second, our differentiated approach with our open React framework under the hood – no vendor lock-in. And third, real traction and adoption. We’re already being used by companies like Instacart, Cvent, and Carrier, and they’re building real, production apps with Superblocks. Our massive momentum from our recent launch of Clark has already reinforced that we’re solving a real, urgent problem for the enterprise.

What are the milestones you plan to achieve in the next six months?

We’re focused on scaling adoption of Clark across the enterprise, deepening integrations with major systems like Databricks and AWS, and expanding our partner ecosystem. We’ll also continue to grow the team to meet rising customer demand.

What advice can you offer companies in New York that do not have a fresh injection of capital in the bank?

Nail your ideal customer profile and stay focused on solving a real, painful problem. The world is changing so fast with AI. The only thing that matters is shipping velocity, and staying on the bleeding edge of what the big AI labs are introducing.

Ship fast and iterate based on actual usage and feedback. Make sure you’re building something that delivers real, measurable ROI to your customers.

Where do you see the company going now over the near term?

From a people standpoint, we’re hiring across the board especially in Engineering, Sales, and Field Engineering. From a product standpoint, our goal is to scale Superblocks and our AI agent Clark from hundreds to thousands of customers.

What’s your favorite spring destination in and around the city?I’d say nothing beats a walk through Prospect Park on a warm day.