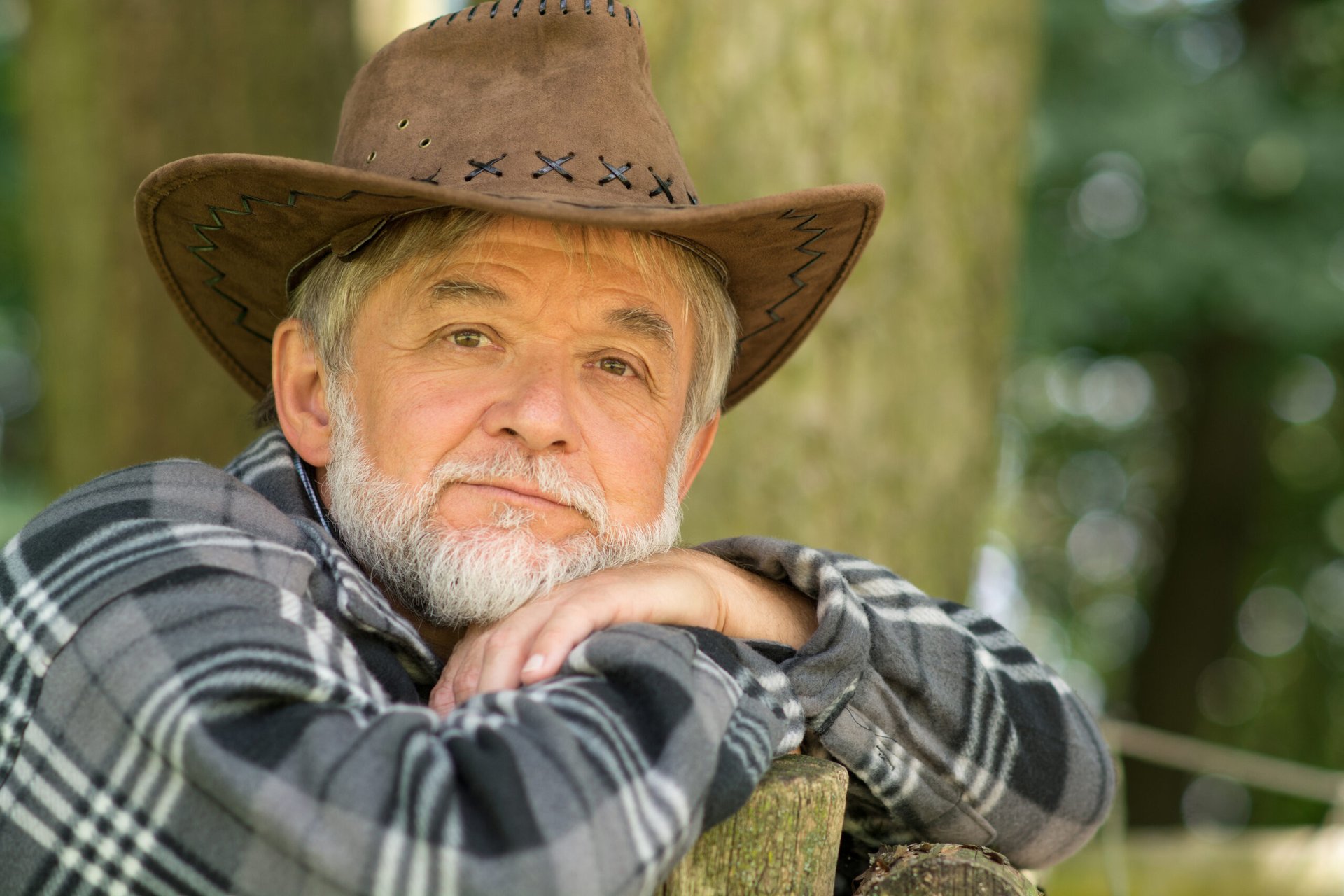

As we enter the second week of January 2026, a quiet but profound demographic shift has officially reached a tipping point. This year, the oldest members of the Baby Boomer generation turn 80, the age at which care needs transition from “optional” to “essential.” However, unlike previous generations, a record number of these seniors are navigating this milestone entirely on their own. Dubbed the “Solo Ager Crisis,” 2026 is revealing a massive gap between the needs of the aging population and the resources available to those without a traditional family safety net.

What is a Solo Ager?

A “Solo Ager” (sometimes called an “Elder Orphan”) is an older adult who is aging without a spouse, children, or close family members to rely on for care or decision-making. Recent data highlights the scale of this shift:

Massive Growth: In 2021, there were roughly 22 million solo agers; by 2026, that number has surged as the “gray divorce” rate remains high and birth rates from previous decades continue to manifest in childless retirements.

The Advocacy Gap: Research shows that 55% of solo agers have no one with whom to discuss medical decisions, and nearly 39% have no one to call if they were sick and confined to bed.

The “Freedom” Paradox: While 1 in 3 solo agers celebrate their independence and “solitude as blissful,” the transition from healthy independence to needing assistance is where the 2026 crisis is most acute.

The 2026 “Supply-Demand” Imbalance

The crisis in 2026 isn’t just about loneliness—it’s about infrastructure. The senior housing market is currently facing a historic supply shortage. Occupancy rates are approaching 90% nationwide, the highest level in two decades. For a solo ager, this means:

Higher Bar to Entry: Facilities are using “precision pricing” and “SWAT teams” to maximize margins, often making units unaffordable for those on a single-income fixed budget. Same-store asking rents grew over 4.3% annually leading into this year.

Lack of Advocates: Traditional senior living models assume a resident has an adult child to help with move-in logistics. Solo agers often find themselves “screened out” by facilities that fear the liability of a resident with no emergency contact or power of attorney.

1. The “Acuity Trap” for Single Households

Many solo agers are finding themselves in the “Acuity Trap.” This happens when a minor health event—like a fall or a short-term illness—becomes a permanent crisis because there is no one at home to provide “light” recovery support. Approximately 27% of solo agers reported falling at home in the last six months. Without a family member to assist with medication or meals for a week, these individuals are often forced into expensive institutional care much sooner than their peers.

2. The Legal “Representation Gap”

The most dangerous aspect of the crisis is the lack of Healthcare Proxies. In 2026, hospitals and skilled nursing facilities are becoming stricter with discharge requirements. If you do not have a designated Durable Power of Attorney (DPOA) or Healthcare Agent to sign off on your care plan, the state may appoint a professional guardian. This often results in a total loss of autonomy over your finances and living situation.

Note: Many states are transitioning to POLST (Portable Medical Orders) in 2026, which are more robust than traditional DNRs. Solo agers must ensure these are filled out by a physician to ensure their wishes are followed in an emergency.

3. The Financial Burden of “Floating” Care

Aging solo is significantly more expensive. Without “informal” care from a spouse or child, solo agers must pay for every service. The cost of a private room in a nursing home is approaching $11,000 per month, while non-medical in-home care averages $33 per hour. For many, the cost of aging in place with 24/7 support can exceed $250,000 in total lifetime costs, a figure that 51% of retirees are currently underprepared to meet.

4. The Rise of “Village Models” and Co-Housing

To combat isolation and cost, there has been a rise in “Alternative Families.” Solo agers are increasingly turning to co-housing and “Village” models, where they live independently but share the cost of a “Village Coordinator” who acts as a collective advocate. These peer-led micro-communities allow seniors to “swap” services—such as one person driving to the grocery store while another handles light tech support—creating a DIY safety net that keeps them out of institutional care longer.

How to Future-Proof Your “Solo” 2026

If you are one of the millions of solo agers navigating this year, intentionality is your best defense. Do not wait for a health crisis to build your network. Start by:

Appointing a Professional Proxy: Look for a “Professional Daily Money Manager” or a private fiduciary who can be written into your legal documents.

Formalizing a “Care Circle”: Build a network of 3–5 friends or neighbors who agree to a daily check-in (text or call by a certain time).

Leveraging Technology with Empathy: In 2026, smartwatches with fall detection and AI-driven medication reminders are no longer luxuries; they are essential tools for maintaining your independence.

Auditing Your Housing: Consider moving to a Life Plan Community while you are still healthy to secure your spot before occupancy hits 100%.

The solo ager crisis is a wake-up call for the American retirement system. While the industry is still catching up, your personal plan must be proactive. Your “chosen family” is just as important as your 401(k).

Are you a solo ager who has successfully built a support network, or are you struggling to find a healthcare proxy? Leave a comment below.

You May Also Like…

10 Devices Making Independence Easier for Aging in Place

How Small Towns Are Rewarding Residents for Aging in Place

Is Aging in Place Really Cheaper Than Moving into a Retirement Community?

Why Affordable Assisted Living Is Becoming Nearly Impossible to Find

10 Warning Signs a Nursing Home Is Cutting Corners on Care