If you’re looking for a great way to start saving money right now that will net you over $1,300 in 1 year, we’ve put together an easy system that offers a good amount of flexibility to give you the greatest chance of success. This is a hybrid of the original 52-week money challenge. But this one puts more control in your hands to deal with the inevitable financial challenges that come with daily life.

How the 52 Week Money Challenge Works

In a lot of ways, the 52 Week Money Challenge is similar to a game of Yahtzee. There are 52 weeks in the year, with a dollar amount corresponding to all 52 weeks. Each week, your goal is to try to save the highest amount that is still available from the bottom numbers. While the highest dollar amount is the goal, there will certainly be weeks when you aren’t able to save the full amount. Whatever amount you are able to save each week, that is the number that you write and then cross that number off the bottom. It’s fine if a particular month, you’re unable to save much due to special occasions. Focus on the bigger picture and don’t worry about individual days and weeks so much.

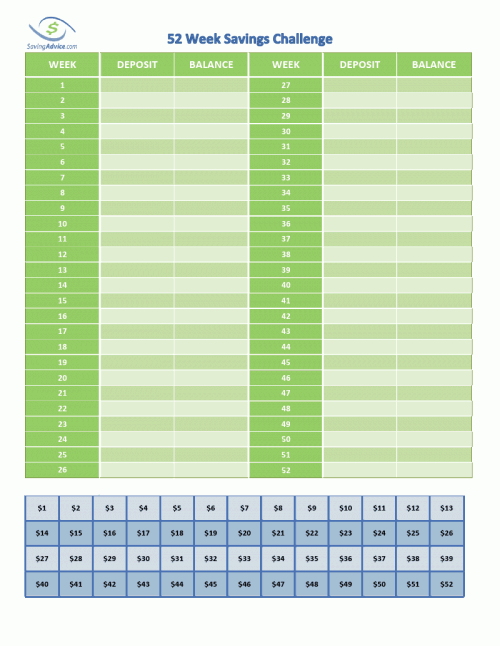

Here is a chart that lets you do the 52-week savings challenge. It’s downloadable and printable.

Click image to enlarge or print here (pdf)Your goal for the first week is to save $52, but even if you aren’t able to reach that amount, you haven’t failed. In this way, it is similar to Yahtzee. Whenever you roll the dice, your ultimate goal is to try to get a Yahtzee, but depending on how things are going with the rolls, you attempt to get the best number you can from the still open hands on your card. In this challenge, you’re doing the same thing, but just with the dollar amounts, you’re able to save each week.

Click image to enlarge or print here (pdf)Your goal for the first week is to save $52, but even if you aren’t able to reach that amount, you haven’t failed. In this way, it is similar to Yahtzee. Whenever you roll the dice, your ultimate goal is to try to get a Yahtzee, but depending on how things are going with the rolls, you attempt to get the best number you can from the still open hands on your card. In this challenge, you’re doing the same thing, but just with the dollar amounts, you’re able to save each week.

For example, say that you are able to save $42 the first week you begin the challenge. You would X out the $42 at the bottom of the chart and place it in the deposit line for week one, and that would also be your balance since it is the first week. In week two, you are able to save $18. You X out the $18 at the bottom of the chart and place $18 in the deposit line. You then would place $60 as the balance ($42 + $18) for week two. In week three, you’re able to save $52, which you cross off, add, and come away with a balance of $112. In week four, you have a tough week and are only able to save a single dollar. You cross it off, deposit the $1, and up your balance to $113.

This is a bit old-fashioned, but printing out the physical paper and writing down the amount you saved with a pen or pencil works to build good habits.

Save As Much As You Can, But Be Flexible

Because you choose the amount to save each week in relation to your finances (always with the goal to try to save the top dollar amount still available at the bottom of the chart), you don’t fail the challenge just because you have a few rough weeks where you aren’t able to save a lot of money. We all have good weeks, and we all have bad weeks, and they don’t come about uniformly. By trying to save the most you can each week, which takes into account the financial realities of that week, it gives you much-needed flexibility and a better chance of success compared to having a set dollar amount you must save each week that corresponds to that specific week.

Another advantage is that there is no need to begin this challenge at the beginning of the year; but you can start at any time. Week one is the first week you begin (as opposed to the first week of the calendar year). That means that if you come across this challenge in the summer, there is no need to wait half a year to begin. You can start today. Simply designate one day of the week when you will make the deposit, and you are ready to go for an entire year from that point.

Get Started, Get in the Habit of Saving

The most important aspect of this challenge is that you simply need to get started. Even if the first few weeks your savings amount is low, you are getting yourself into the habit of saving. There are some helpful tools that can assist you in kickstarting your savings journey. Here are five apps that will help you automate things and make saving easier.

Origin

Wallethub

You Need A Budget (YNAB)

Rocket Money

Quicken Simplifi

As you become comfortable with that habit, you should find more ways to save that will help you knock off those bigger numbers. The key is knowing that you have some small numbers there as well, if finances get tight some weeks. Once in the habit, you may find it easy to save even more. There are also now kids’ versions of this challenge, which replace the dollar amount with quarters, dimes, nickels, or pennies, depending on how old your child is and the amount that he wants to save.

Find a Community To Support You In the 52 Week Money Challenge

Print the 52 Week Money Challenge by clicking here. Before you get started, also check out the 52 Week Money Challenge forum group in the Saving Advice Forums, where you can share how your challenge is going with others and both receive and provide support for others participating in the challenge.

What to Read Next

10 Great 52 Week Money Challenge Alternatives

The Best New Year’s Deals and Freebies You Won’t Want to Miss

The 12-Week Savings Sprint That Will Help You Stack $1,000

10 Savings Goals People Are Setting After a Financial Wake‑Up Call

8 January Shopping Strategies Saving Seniors Hundreds

This post includes affiliate links. If you purchase anything through these affiliated links, the author/website may earn a commission.