Many grandparents dream of helping their grandchildren pay for college. But before writing that tuition check, it’s worth asking a tough question: Can you really afford it? The truth is, funding education for the next generation while neglecting your own healthcare and long-term care planning can create financial strain for everyone. It’s not just about generosity—it’s about security. Here’s why your care should usually come first, and when supporting college might still make sense.

1. You Can’t Borrow for Your Future Care

Grandkids can apply for scholarships, grants, or student loans to cover college costs. But when it comes to your own long-term care—whether it’s assisted living, nursing care, or home health—you can’t borrow to cover those bills. The average cost of nursing home care already exceeds $100,000 per year. Without savings or coverage, those expenses could wipe out your assets. Prioritizing your future ensures you won’t depend on others later.

2. Health Costs Are Rising Faster Than Tuition

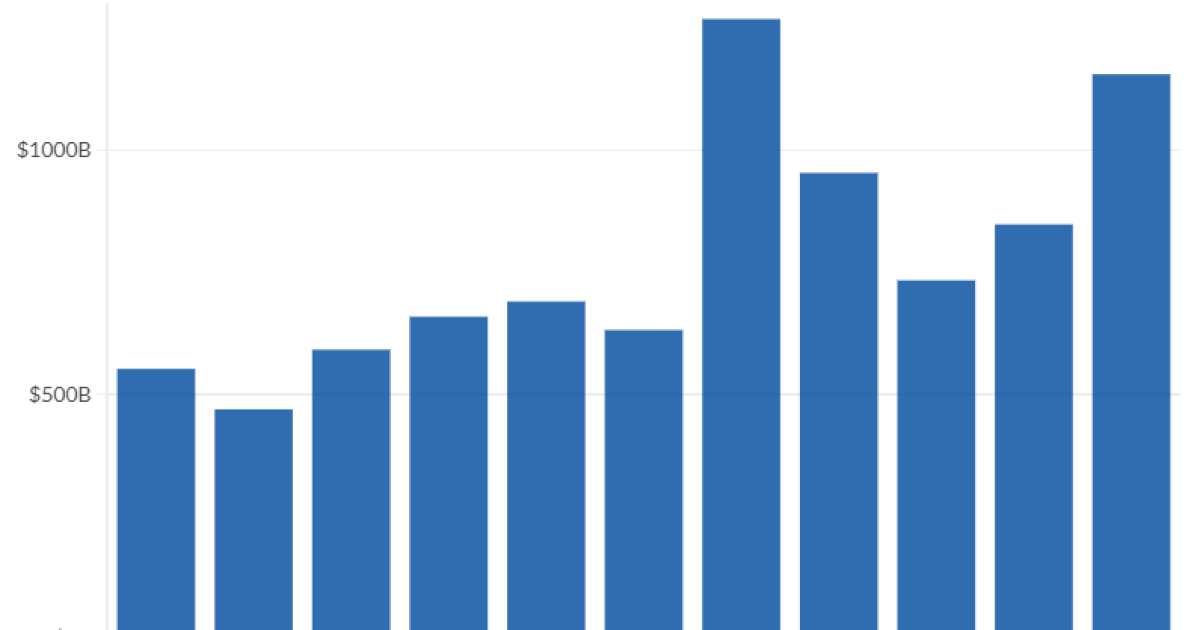

While college tuition has grown steeply over the decades, healthcare costs for seniors are rising even faster. Fidelity estimates a 65-year-old couple retiring today will need nearly $315,000 for health care alone. That doesn’t include long-term care, which Medicare rarely covers. Paying tuition first may feel rewarding, but it leaves you exposed to overwhelming costs that grow every year.

3. Protecting Independence Helps the Whole Family

Covering your care needs isn’t selfish—it actually protects your family. If you spend retirement savings on tuition, your children and grandchildren may end up responsible for your expenses later. The financial and emotional toll of caregiving is much higher than student debt. By securing your independence, you’re sparing your loved ones a future burden.

4. Tuition Gifts May Affect Your Financial Aid

Grandparent contributions can unintentionally hurt financial aid eligibility for college-bound grandchildren. Money drawn directly from 529 plans owned by grandparents may count as student income, reducing aid packages. Timing contributions carefully or shifting ownership can help—but only if your finances allow it. Without a plan, your generosity could backfire.

5. Your Retirement Savings Need Longevity

It’s easy to underestimate how long your retirement savings must last. With lifespans now stretching well into the 80s and 90s, you may need funds for 25–30 years of expenses. Using those savings for tuition may shorten your financial runway. Once depleted, rebuilding isn’t an option in retirement.

6. When Helping With College Does Make Sense

This doesn’t mean you should never help with college. If your retirement is secure, you’ve budgeted for long-term care, and you still have surplus funds, contributing can be a meaningful legacy. Even small, well-timed gifts—like helping with books, housing, or partial tuition—can ease the burden without endangering your security. The key is balance, not sacrifice.

Care First, College Second

Helping a grandchild with education is admirable, but your own well-being must come first. Without proper planning for health and long-term care, your generosity could turn into a financial crisis. Think of it this way: by securing your independence, you’re already giving your family one of the most valuable gifts. If you still have extra resources, then helping with tuition can be the icing on the cake—not the foundation.

Would you ever consider paying for your grandchild’s college before setting aside money for your own care? Share your thoughts in the comments—your perspective could help other families weigh this difficult choice.

Read More

8 Places That Quietly Exclude Seniors Without Breaking the Law

Is It Time to Sell the Family Home Before It Becomes a Burden?

Teri Monroe started her career in communications working for local government and nonprofits. Today, she is a freelance finance and lifestyle writer and small business owner. In her spare time, she loves golfing with her husband, taking her dog Milo on long walks, and playing pickleball with friends.