Money can be a touchy subject in any relationship. While we’ve made progress talking more openly about salaries and spending habits, there’s one financial number that still seems taboo: credit score. It might not come up in early conversations, but experts say it probably should.

Your partner’s credit score isn’t just a reflection of their financial past—it could affect your ability to buy a home, lease a car, or even qualify for a decent interest rate on a joint credit card. And if you’re considering building a life together, avoiding the conversation could mean walking straight into financial surprises.

So, do you know your partner’s credit score? And more importantly, do you know how it could impact your relationship?

Why Your Partner’s Credit Score Matters

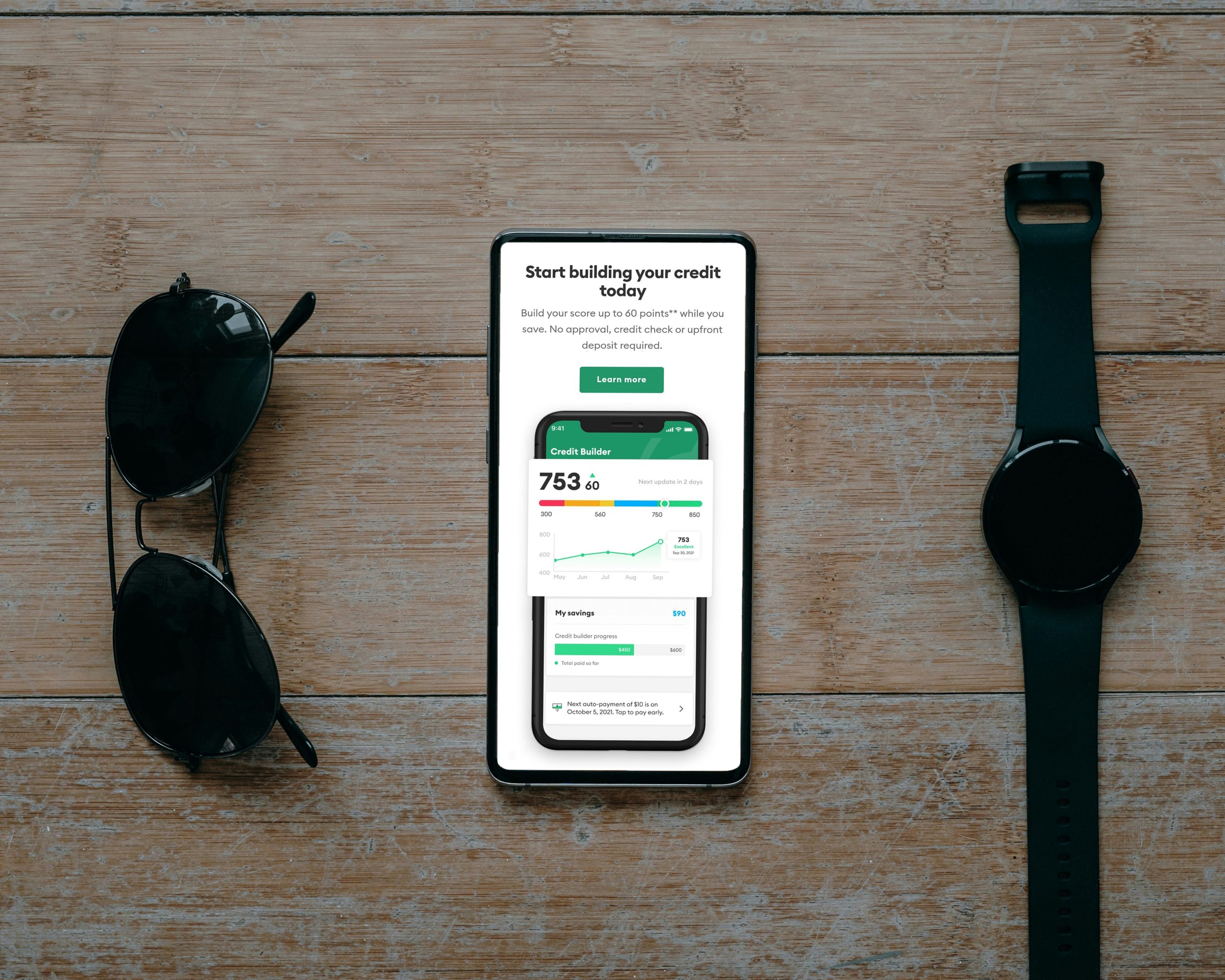

A credit score isn’t just a number. It’s a snapshot of someone’s financial behavior and responsibility. Ranging from 300 to 850, it’s based on factors like payment history, credit utilization, length of credit history, and more. A high score generally signals that someone pays bills on time, avoids taking on too much debt, and manages their credit responsibly. A low score, on the other hand, may indicate missed payments, overuse of credit, or a limited or troubled financial history.

Understanding your partner’s score can offer deeper insight into their money habits. It might reflect their upbringing, how they approach risk or even past challenges like job loss or medical debt. It doesn’t mean you should judge or shame them, but it does mean you should know what you’re working with if you plan to merge lives.

While it’s technically a personal score, it becomes highly relevant in committed partnerships. Here’s why:

Joint financial decisions: From applying for a mortgage to co-signing a loan, your partner’s credit score can directly impact approval odds and interest rates.

Shared responsibilities: If you’re paying bills together or relying on one another financially, a poor credit history might reveal patterns of missed payments or overspending.

Long-term planning: Saving for a wedding, kids, or retirement often requires financial alignment, and knowing where you both stand is the first step.

Credit Scores and Commitment: The Financial Compatibility Test

Just like you might talk about values, family goals, or lifestyle expectations before getting serious, discussing finances should be a key part of defining compatibility. And credit scores offer a surprisingly objective look into someone’s habits and responsibilities.

A high credit score doesn’t mean someone is perfect, but it often reflects discipline, consistency, and a strong track record with money. A low score, on the other hand, might signal past struggles with debt, late payments, or financial instability.

That doesn’t mean a lower credit score is a dealbreaker, but it should be a conversation starter. Understanding why your partner’s score is what it is helps build empathy and transparency. Maybe they went through a medical crisis, or maybe they simply never learned how to manage credit. Either way, knowing the backstory matters.

When to Ask About Your Partner’s Credit Score

You don’t need to bring up credit scores on the second date. But if your relationship is heading toward cohabitation, joint financial decisions, or long-term commitments like marriage, the conversation becomes non-negotiable. Many couples wait until they’re house hunting or applying for a loan to discover there’s a financial imbalance, and by then, it might be too late to course-correct without added stress or compromise.

Ideally, the credit score conversation should happen when you’re talking about moving in together, opening a joint account, or making any large financial decision that ties your finances together. It’s also worth having before marriage. While marriage itself doesn’t merge your credit scores, it does bring your financial lives much closer together. Debt, shared bills, and credit-based decisions will all become part of your new normal.

How to Bring Up the Credit Score Conversation

If you’ve been avoiding this topic out of fear that it’ll be uncomfortable or feel too personal, you’re not alone. Money often carries emotional weight—shame, pride, anxiety, or even guilt. That’s why it’s important to approach the conversation with empathy and openness.

Start by sharing your own credit score and what you’ve learned from your financial journey. Maybe you had student loan debt that hurt your score early on, or you made mistakes in your 20s that you’ve since corrected. Framing the conversation around shared growth, not judgment, will set a collaborative tone.

From there, you can invite your partner to share their own experience. Ask how they feel about their score, whether they’ve checked it recently, and if they have any financial goals they’re working toward. This shifts the conversation from a pop quiz to a partnership check-in, and that’s where the real growth happens.

What If Your Partner Has a Low Credit Score?

Discovering that your partner has a low credit score doesn’t automatically spell doom for your relationship. But it does mean you’ll need to have some honest conversations and possibly make a few adjustments. Here’s what to consider:

Discuss habits: Are they taking steps to improve their score? Do they pay bills on time now?

Set shared goals: Whether it’s paying off debt or building an emergency fund, having a plan shows commitment to financial health.

Protect yourself: If you’re not married yet, avoid co-signing loans or opening joint credit lines unless you’re confident in their ability to manage it.

Financial Transparency Builds Trust

At the end of the day, financial compatibility isn’t just about matching credit scores. It’s also about openness, honesty, and shared values. If you’re willing to talk about the hard stuff now, you’re more likely to thrive when challenges arise later.

Financial secrets, whether it’s hidden debt, secret accounts, or just avoiding the credit score conversation, can destroy trust. And trust is the foundation of any healthy relationship. If you and your partner can talk about money without shame or defensiveness, you’re already ahead of the game.

Have you ever talked to your partner about their credit score or kept yours to yourself? Do you think it’s a vital relationship conversation, or is it something people overthink?

Read More:

The Debate Over Credit Score Algorithms: Fair or Flawed?

6 Tips for Improving Your Credit Score

Riley is an Arizona native with over nine years of writing experience. From personal finance to travel to digital marketing to pop culture, she’s written about everything under the sun. When she’s not writing, she’s spending her time outside, reading, or cuddling with her two corgis.