August and September haven’t been great months for crypto investors, but that’s not necessarily a bad thing because markets need a healthy breather every now and then. Bitcoin (BTC), the largest cryptocurrency based on market capitalization, was down about 6.5% in August, and so far in September has regained only about 3.14% of that drop.

A quick look at the BTC price chart below shows that the price of BTC has hovered around the $110,000 mark (all figures in US dollars unless otherwise specified)—plus or minus 10% since May 2025. This is a consolidation, which indicates that for the time being, neither the bulls nor the bears are obvious winners.

Source: Google Finance as of Sept. 25, 2025

August and September are typically down months for BTC

Although months of flat trading can be frustrating for investors, it’s not unheard of and there’s historical precedent for August and September typically being bad for BTC.

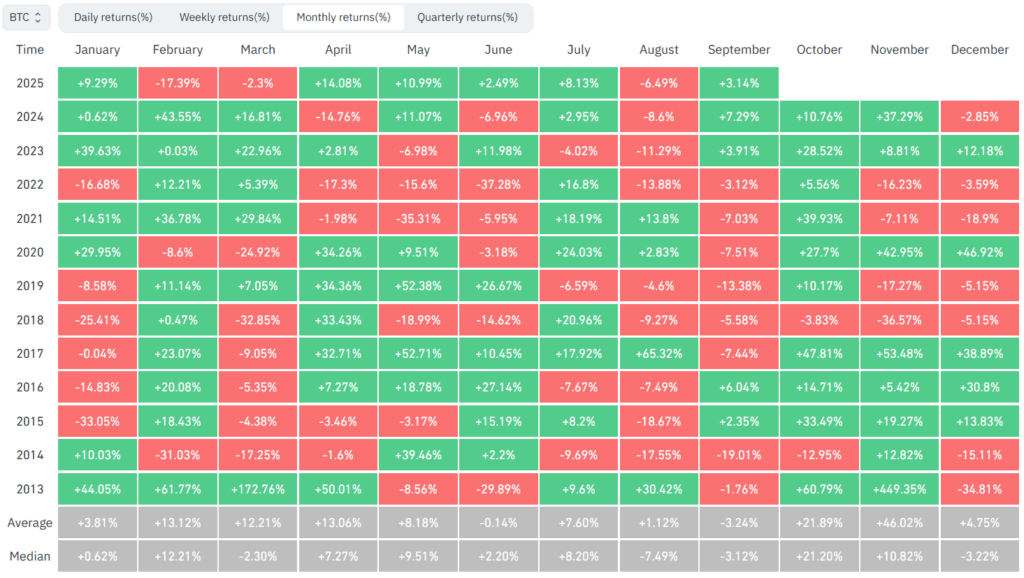

Of the thirteen instances since 2013—because that’s when we have reliable public data on BTC price movements from—August has been red nine times (including 2025) and September has been red eight times until 2024. On average, BTC’s August return over the years has been 1.12% and September’s has been -3.24%. On average, BTC’s best months have been October (up 21.89%) and November (up 46.02%).

The following table lays out BTC’s monthly return through the years. See the bottom two rows for average (and median) returns in each calendar month.

Source: Coinglass.com as of Sept. 25, 2025

Nobody can predict the market accurately based on such historical data, so what can crypto investors learn from this? If you’re bullish on BTC, ethereum (ETH), and other cryptocurrencies, it usually pays to remain invested—especially through October and November—despite the historical bearishness of August and September.

X

The best crypto platforms and apps

We’ve ranked the best crypto exchanges in Canada.

Is altcoin season over?

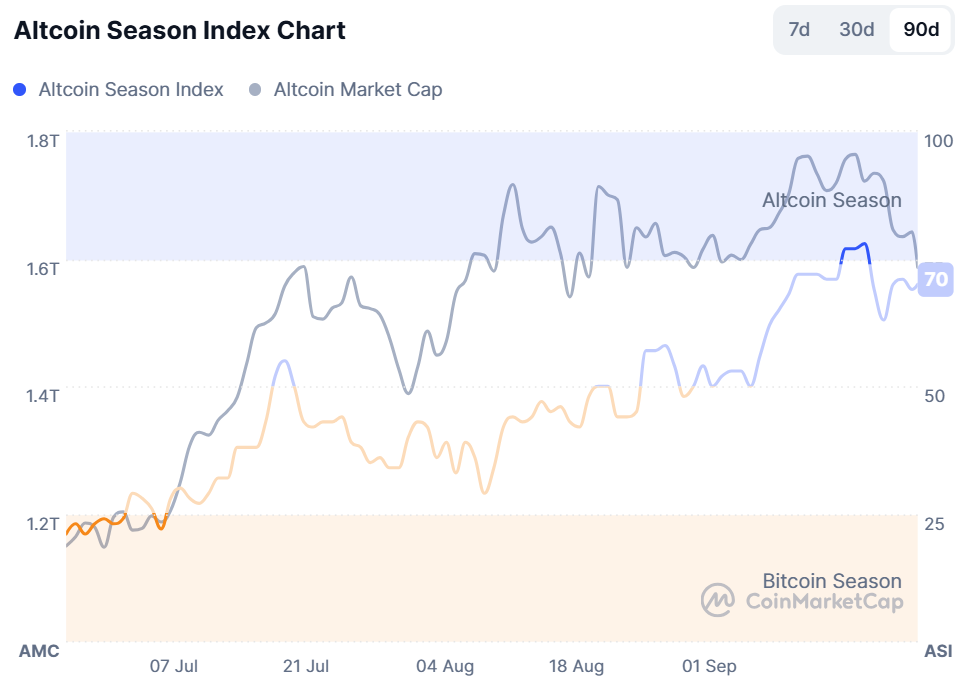

Altcoin season refers to the phase of the crypto market in which alternative coins (those other than BTC) outperform BTC itself in price appreciation. Typically, altcoin season appears at the end of a bull market cycle—the phase we’re probably in right now. I’ve written about altcoin season in an earlier edition of this column a few months ago, when I flagged the possibility of ETH and other cryptocurrencies outperforming BTC in the second half of 2025.

As the chart below shows, we’re in altcoin season based on the CMC Altcoin Season Index. This index tracks the performance of altcoins relative to BTC over 90 days and assigns a score of 0 to 100, with a score over 70 indicating the outperformance of altcoins relative to BTC.

Source: Coinmarketcap.com as of Sept. 25, 2025

The race for altcoin ETFs is on

The race for altcoin ETFs in the US is on. While altcoin ETFs are already available to Canadian investors, we’re about to see a rush of new altcoin ETFs being launched in the US in the coming months.

Recently, on Sept. 25, 2025, the Hashdex Nasdaq Crypto Index ETF announced that they’ll expand their crypto ETF holdings to include XRP, SOL, and Stellar (XLM). The inclusion of these altcoins will create the first truly multi-crypto ETF in the US. This is a sign of things to come.

While 2024 was the year for BTC ETFs, 2025 is the year for ETH and other altcoin ETFs. We could see a slew of altcoin ETFs being launched in the US as a result of the streamlining of listing rules by the US Securities and Exchange Commission (SEC). As reported by Reuters, these streamlined SEC listing rules (applicable to crypto ETFs), would reduce the approximate listing time from about 240 days to just 70 days.

Canadian investors searching for a multi-crypto ETF with exposure to BTC and altcoins can consider these two ETFs—both of which trade on the Toronto Stock Exchange (TSX).

Crypto price swings are common

Cryptocurrencies including BTC, ETH, XRP, SOL, XLM, and others are speculative and remain highly volatile assets subject to significant price swings. Even stablecoins, which are seemingly “safe,” may be risky if not adequately backed by real-world assets.