A great credit score can mean the difference between qualifying for a dream home and getting rejected outright. But what if you don’t have months or years to build credit slowly? The good news is that there are clever, legal ways to raise your score quickly, sometimes in just 30 days. These aren’t magic tricks or shady hacks. They’re underused, effective strategies that take advantage of how credit scores are calculated.

Improving your credit isn’t about being perfect. It’s about being intentional. And the 30-day window gives you just enough time to demonstrate better habits, clean up errors, and use loopholes in your favor. Here’s how to start.

1. Request a Credit Limit Increase (But Don’t Spend It)

One of the fastest ways to improve your credit utilization ratio—a key factor in your score—is to increase your available credit. If you already have a good payment history, requesting a higher credit limit from your card issuer is often quick and painless. Most companies won’t even require a hard credit pull.

The trick is not to spend the extra credit. Simply having more available credit with the same or lower balance improves your utilization ratio, which can cause a noticeable bump in your score. A jump from 30% utilization down to 10% can make a big difference.

You can request increases online or over the phone. If you’re strategic about timing, this move alone might give you a boost within one billing cycle.

2. Pay Off (or Pay Down) Your Balances Before the Statement Date

Most people pay their credit card bills by the due date, but what really matters to credit bureaus is what shows up on your statement’s closing date. That’s the balance that gets reported to the credit agencies.

If you can pay off or at least pay down a large chunk of your balance before your statement closes, you’ll report a much lower utilization rate. This one habit can result in a score increase within days, especially if your utilization was previously high.

Even if you can’t pay the full balance, bringing it below 30% of your credit limit can make a huge difference. Under 10% is even better.

3. Dispute Errors on Your Credit Report

According to a 2021 study by Consumer Reports, more than one-third of Americans found at least one error on their credit report. That’s not a minor issue. Those errors can cost you serious points.

Get a free copy of your credit report at AnnualCreditReport.com and go over it with a fine-tooth comb. Look for accounts that aren’t yours, payments marked late when they weren’t, or balances that don’t match what you owe. If you find something inaccurate, dispute it immediately with the credit bureau.

By law, they must investigate and respond within 30 days. If the error gets removed or corrected, your score could jump quickly and significantly.

4. Become an Authorized User on Someone Else’s Card

If you have a trusted friend or family member with a long-standing, well-managed credit card account, ask if they’ll add you as an authorized user. This strategy works best if their account has a low balance, a high limit, and a long positive history.

When you’re added, their credit history gets added to your credit report, instantly improving your length of credit history and utilization ratio. You don’t even have to use the card for it to help your score.

Just be sure the primary user pays on time and maintains a low balance. Their bad habits can hurt you as much as their good ones can help.

5. Make Multiple Payments in a Month

Rather than waiting until your bill is due, consider making small payments throughout the month. This strategy, often called “credit card cycling,” keeps your utilization low at all times, even between billing cycles.

Credit bureaus love consistency. If your card never carries a high balance, even temporarily, your reported usage will reflect that responsible behavior. Multiple payments can also prevent interest from piling up, which helps you manage your debt more efficiently.

Plus, it’s a good way to keep spending in check. You’ll have a better real-time sense of where your money is going.

6. Ask for a Late Payment to Be Removed (If It Was a One-Time Mistake)

If you’ve generally been a responsible borrower but slipped once or twice, a goodwill letter can help. This is a polite request to your lender asking them to remove a late payment from your credit report.

Lenders aren’t required to comply, but if you’ve had a long-standing, positive history with them, many will make the adjustment. Late payments can drag your score down significantly, especially if they’re recent. Getting even one removed can give you a quick lift.

Be honest and polite, and emphasize how it was a one-time error due to circumstances like illness, job loss, or a missed notification.

7. Use a Secured Card to Add Positive History

If your credit history is limited or poor, a secured credit card can work fast to show responsible use. These cards require a cash deposit as collateral, but otherwise function like any other credit card. And yes, they report to credit bureaus.

Use the card for a small, regular expense like gas or groceries, and pay it off in full each month. Within 30 days, you’ll begin building new, positive credit activity, which is especially important if your file is thin.

Look for secured cards with low fees and make sure they report to all three major credit bureaus.

8. Don’t Close Old Accounts, Even If You’re Not Using Them

You might be tempted to tidy up your credit profile by closing old, unused accounts, but that’s often a mistake. Length of credit history makes up about 15% of your credit score. When you close old accounts, especially those in good standing, you shorten your average account age.

You also reduce your available credit, which can hurt your utilization ratio. Even if you don’t use a card often, keeping it open (and occasionally active) works in your favor.

Instead of closing old accounts, consider using them for small, recurring bills and paying them off monthly. That keeps the account alive and positively contributing to your score.

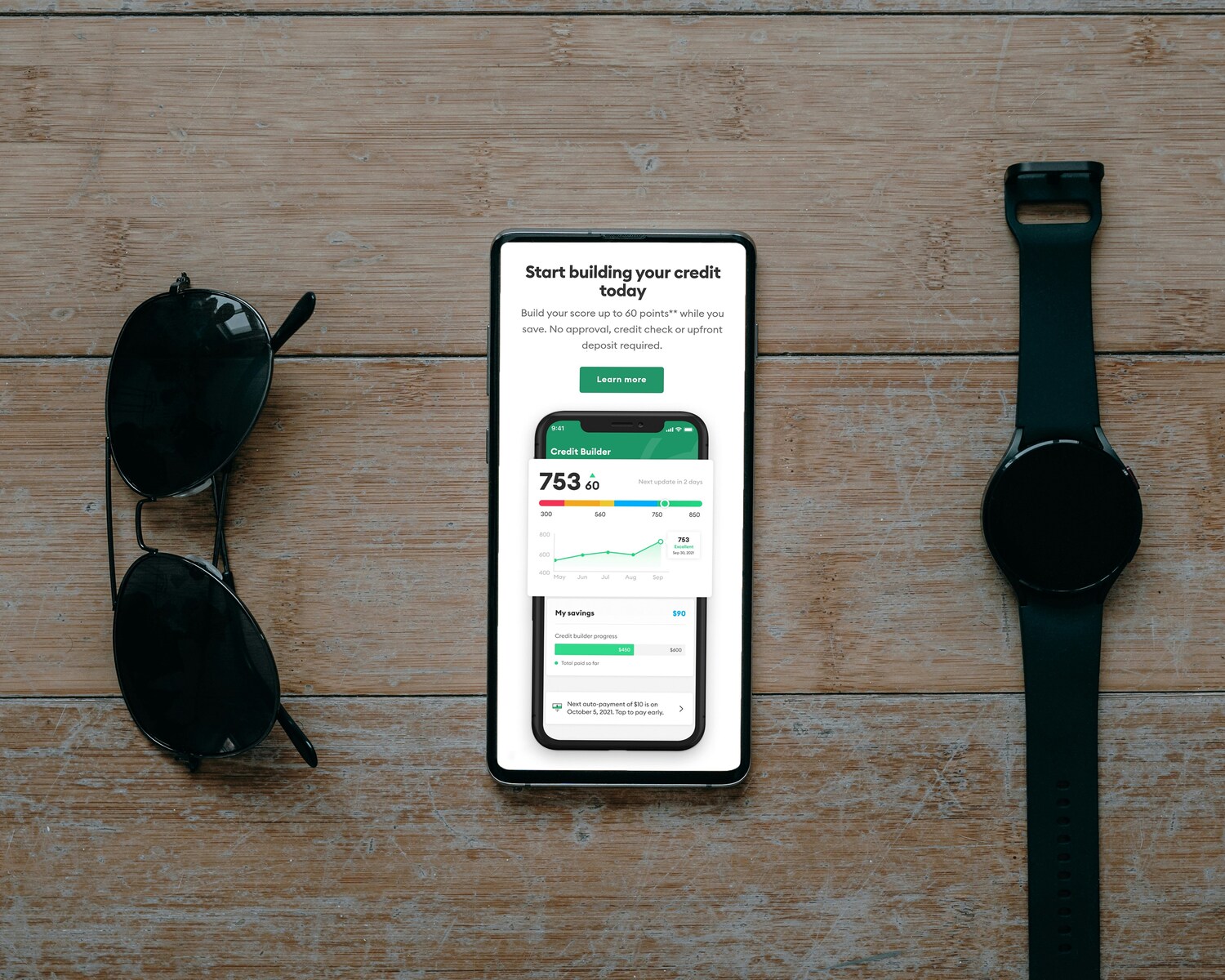

9. Use a Credit Builder Loan Strategically

Credit builder loans are small loans held in a locked savings account while you make payments. You don’t get the money up front. Instead, it acts as forced savings while also reporting your on-time payments to credit bureaus.

If you’re rebuilding your credit or have very little credit history, this can be a powerful way to demonstrate financial responsibility. And because the risk is low for lenders, approval is often easier. After 30 days of on-time payments, you’ll already start seeing the impact, especially if you’re adding positive activity to an otherwise sparse credit file.

10. Freeze Spending While You Boost

Credit repair isn’t just about paying off debt. It’s about behavior change. If you’re actively trying to boost your score in 30 days, now is not the time to splurge on big purchases or open new accounts.

New hard inquiries can temporarily drop your score, and high balances can tank your utilization. Freezing spending for a month while you apply all of the above tactics gives your credit time to stabilize and strengthen. Consider this a temporary financial boot camp—one that pays off with better loan terms, lower interest rates, and greater peace of mind.

Credit Growth Is Possible, Even Fast

Raising your credit score doesn’t have to take years. With strategic planning, focused effort, and a few well-timed moves, 30 days is enough to make a real difference. These tactics work because they leverage how credit scores are actually calculated, not because they bend the rules. Don’t fall for quick fixes or scams. Instead, apply these legitimate strategies to give your credit the boost it deserves, and then keep building from there.

What’s the smartest move you’ve ever made that helped your credit score fast?

Read More:

7 Credit Score Taboos You Can Break Without Tanking Your FICO

Do You Know Your Partner’s Credit Score? Why Experts Say You Should

Riley is an Arizona native with over nine years of writing experience. From personal finance to travel to digital marketing to pop culture, she’s written about everything under the sun. When she’s not writing, she’s spending her time outside, reading, or cuddling with her two corgis.