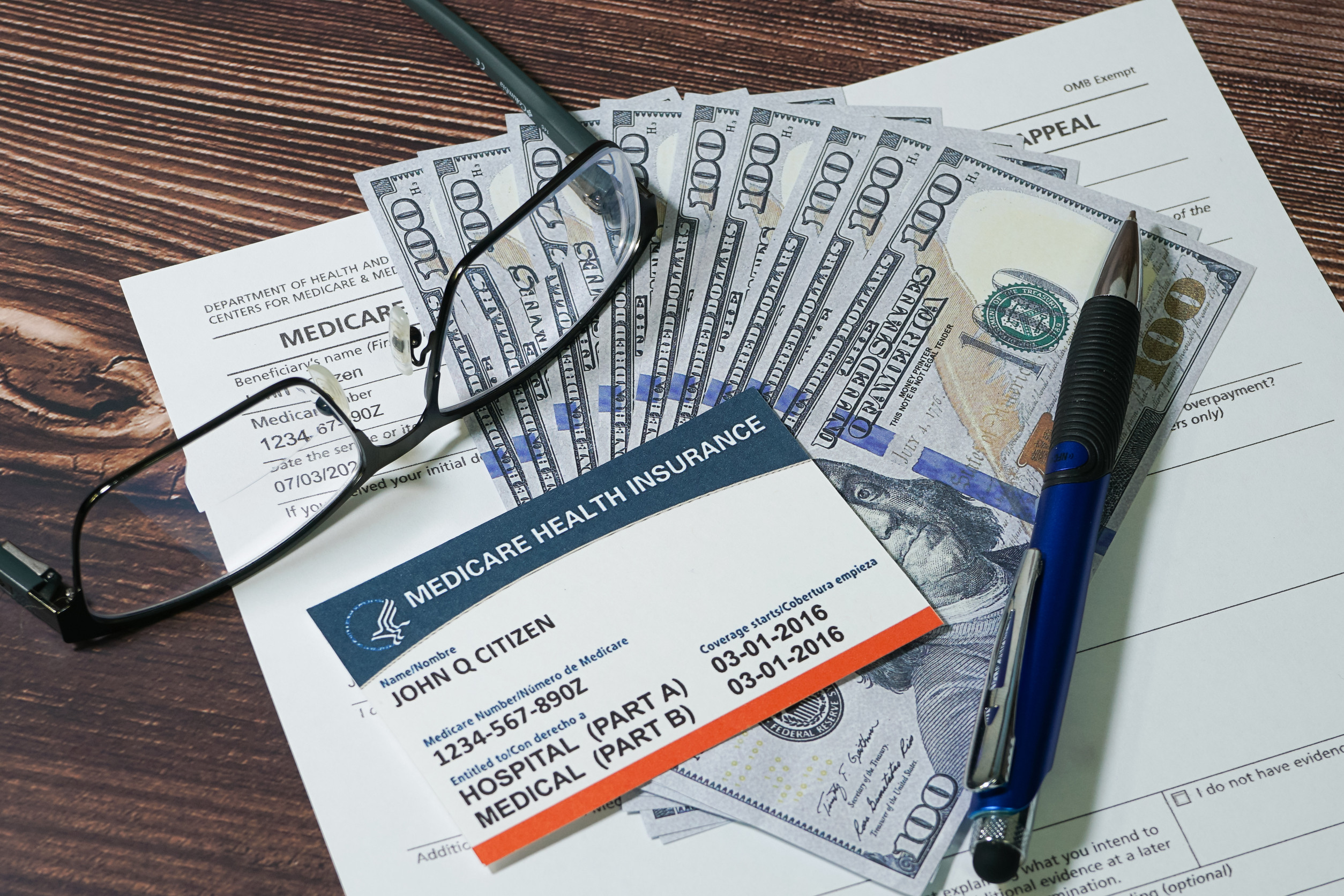

Artificial intelligence is no longer confined to Silicon Valley startups or tech giants—it’s quietly shaping healthcare decisions for millions of seniors. Medicare Advantage insurers increasingly use AI tools to approve or deny treatments, determine lengths of hospital stays, and decide when coverage ends. For patients, these algorithms can mean the difference between extended care or an unexpected bill. Lawmakers are now raising red flags, questioning whether automation is serving patients—or the bottom line. The future of care for retirees may depend on how these concerns are addressed.

How AI Is Being Used in Medicare

AI systems are marketed as efficiency tools that streamline claims processing and predict patient outcomes. Insurers argue that these models reduce costs and eliminate wasteful spending. In practice, they can cut off coverage for rehab, limit hospital stays, or deny treatments earlier than doctors recommend. These decisions often happen faster than appeals can be filed. For seniors, that means AI—not a human—may effectively decide the course of their care.

The Concerns From Patients and Families

Stories are emerging of seniors being discharged from facilities against their doctors’ advice. Families report being shocked when insurers cite algorithm-based assessments to justify ending payments. Even when appeals are successful, delays can cause stress and worsen health outcomes. Critics argue that AI is being used to ration care rather than improve it. The gap between what doctors recommend and what algorithms approve is where patient harm occurs.

What Lawmakers Are Saying

Congressional hearings have already highlighted the risks of outsourcing care decisions to machines. Lawmakers on both sides of the aisle warn that AI may prioritize cost-cutting over patient well-being. Some propose stricter oversight and transparency requirements for insurers using these systems. Others push for limits on how algorithms can override physician judgment. The concern is clear: healthcare decisions are becoming too automated, with too little accountability.

Why Oversight Is Complicated

Regulating AI in healthcare isn’t simple. Models are often proprietary, making it difficult for regulators to see how decisions are made. Insurers argue that revealing too much could compromise trade secrets. At the same time, patients deserve to know why their care is being denied. Striking a balance between innovation, efficiency, and patient rights remains a major challenge. Without transparency, trust in the Medicare system could erode further.

The Financial Incentive Behind AI Decisions

AI doesn’t operate in a vacuum—it reflects the goals of the companies deploying it. Medicare Advantage plans profit when costs are lower, creating an incentive to restrict care. Algorithms trained on financial outcomes may reinforce cost-cutting bias. Critics worry this could institutionalize denial patterns that hurt the most vulnerable. For retirees, it raises the unsettling question: is my care being guided by health needs or profit models?

The Push for Patient Protections

Advocacy groups are demanding safeguards to ensure AI doesn’t replace human judgment. Proposed solutions include mandatory human review of denials, stricter appeal timelines, and independent audits of algorithms. Some lawmakers also call for clear patient notifications whenever AI is used in decision-making. These protections would put more power back into the hands of patients and providers. The goal isn’t to stop AI, but to keep it from quietly overruling doctors.

Why This Matters for Every Retiree

Even retirees not currently in Medicare Advantage may feel ripple effects. Traditional Medicare programs and private insurers are watching closely and may adopt similar systems. If lawmakers don’t act, AI-driven care decisions could become the norm across healthcare. For seniors, understanding how these tools work—and their rights when denied care—will be crucial. The decisions being made today will shape the retirement healthcare landscape for decades.

A Healthcare Crossroads for Seniors

Artificial intelligence promises efficiency, but when it comes to Medicare, it’s raising urgent ethical questions. Lawmakers are right to worry whether algorithms are serving patients or shareholders. Without greater oversight, retirees risk losing control of their care to invisible systems. For a generation that earned its benefits through decades of work, that’s a dangerous trade-off. The debate unfolding now may define how fairly—and how humanely—Medicare functions in the AI age.

Do you think AI should ever be allowed to decide Medicare coverage? Share your thoughts in the comments.

You May Also Like…

7 Medicare Advantage Add-Ons Worth Keeping—and Which to Drop

2026 COLA Boost Could Be Erased by Medicare Hike—Here’s What Retirees Need to Know

8 Medicare Part D Decisions That Change Your Annual Drug Costs Drastically

10 Medical-Billing Moves That Slash a Hospital Invoice

Could a Patient Advocate Save More Than Your HSA Ever Could?