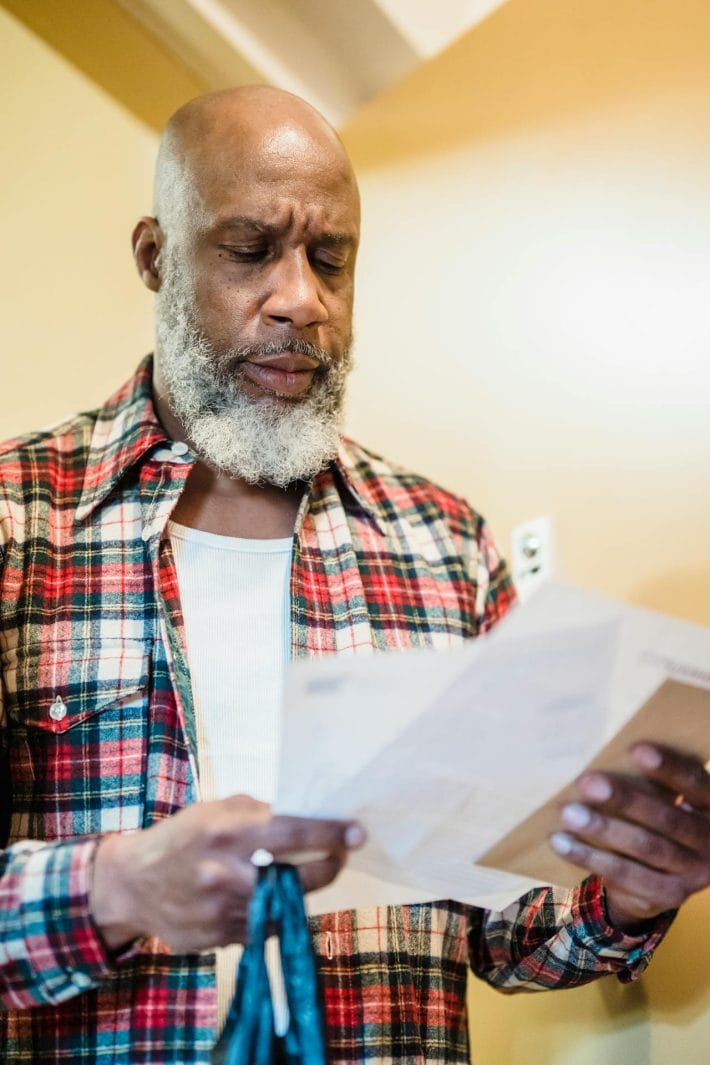

When most people think of homelessness, they picture tents, shelters, or people sleeping in cars. But what they rarely see are the months or even years of financial struggle that led them there.

Homelessness doesn’t usually come from one big catastrophe. It’s often the end result of a series of seemingly small money mistakes that spiral over time. Missed rent. Unpaid bills. Debt is stacking up silently in the background. Most families don’t wake up homeless one day—they get pushed toward it, inch by inch, decision by decision.

And the scariest part? It can happen to almost anyone. Here are the seven financial missteps that can quietly dismantle even the most stable families and how to avoid them.

7 Financial Mistakes That Leave Families Homeless

1. Living Without an Emergency Fund

In a perfect world, everyone would have at least 3–6 months of expenses saved for emergencies. But in reality, many families live paycheck to paycheck, leaving them with no buffer when things go wrong.

Car breaks down? Job loss? Medical crisis? Without an emergency fund, any one of these can derail your entire budget. And when you can’t pay rent or mortgage, even for one month, your housing is at risk. What begins as one missed payment quickly snowballs into eviction notices, late fees, and legal action. By the time families try to catch up, it’s already too late.

Solution: Even if it’s $10 a week, start saving something. Treat your emergency fund like a non-negotiable bill because one crisis shouldn’t mean losing your home.

2. Relying on One Income Stream

In many households, one person earns the bulk of the income. While this may work fine during stable times, it leaves the entire family vulnerable if that job disappears.

Layoffs, illness, or disability can hit suddenly, and if there’s no second income, even temporarily, the rent doesn’t wait. Bills still arrive. Groceries still need to be bought. And unemployment benefits rarely cover the full cost of living. When there’s no backup plan, even a short-term income loss can drive a family straight into financial freefall.

Solution: Diversify income sources where possible. Whether it’s a part-time side hustle, freelance gig, or passive income stream, having a backup makes all the difference when the unexpected hits.

3. Ignoring Housing Cost Creep

One of the biggest mistakes families make is assuming they can “stretch” into a home they can’t quite afford. Rent that eats up more than 30% of your income becomes a ticking time bomb, especially if it’s tied to variable utilities or unstable income.

Worse, when families upgrade their homes but not their incomes, they leave no margin for error. All it takes is one bump in the road to miss a payment and trigger the eviction process. And landlords today are less flexible than ever. Many won’t hesitate to file a formal eviction the minute rent is late, regardless of your history.

Solution: Calculate your housing budget realistically. Don’t max out just because you’re approved for more. Leave room for other essentials, and stay below 30% of your take-home pay when possible.

4. Using Credit to Survive Instead of Budgeting to Thrive

Credit cards can be useful tools, but when they become lifelines, they slowly dig a financial grave. Many families fall into the trap of using credit to make ends meet, covering groceries, gas, and bills, thinking they’ll pay it off “later.”

But as interest piles up, so does the balance. And the minimum payment becomes just another expense to juggle. Before long, families are using new cards to pay off old ones, while falling behind on housing. Once the cards are maxed and the rent is late, there’s little left to shield them from homelessness.

Solution: Budget brutally. Track where every dollar goes. If you’re using credit to survive, it’s time to cut expenses or increase income before your roof depends on it.

5. Skipping Renters Insurance and Tenant Protections

Many renters assume their landlords will take care of everything. But when disaster strikes—fire, flood, or theft—it’s renters who are often left with nothing. Without renters’ insurance, families may lose everything they own and have no way to recover.

Worse, some tenants don’t understand their rights and unknowingly sign leases that give landlords far too much eviction power. In tight housing markets, this mistake can mean you’re replaced with a higher-paying tenant in a matter of weeks.

Solution: Always carry renters insurance—it’s usually less than $15 a month. And before signing anything, understand your state’s tenant laws and your lease’s fine print. Knowledge is your first line of defense.

6. Waiting Too Long to Ask for Help

Pride is powerful, but it can also be dangerous. Many families wait until they’re completely underwater before asking for help, whether from family, friends, nonprofits, or government programs.

But by the time eviction notices arrive, options are fewer and time is shorter. Charities are often overwhelmed. Rental assistance has long waitlists. And the legal process moves quickly. Delaying help can turn a solvable problem into a crisis.

Solution: Ask early. When you see the warning signs—job loss, debt piling up, missed rent—reach out. Local agencies, churches, and legal aid groups often have resources if you act fast enough.

7. Assuming It Can’t Happen to You

Perhaps the most dangerous mistake is thinking, “That could never be us.” Many families live on the edge and don’t realize how close they are to homelessness. Without savings, stable income, or support systems, they’re just one setback away from losing everything.

This mindset leads to risky choices, poor planning, and ignoring early warning signs. The fall from stability to struggle is faster and steeper than most people imagine.

Solution: Stay humble, stay prepared. Acknowledge how vulnerable all families are in today’s economy. Plan for the worst while working toward the best.

Homelessness Is a Process, Not a Personality Flaw

We often assume people become homeless because they were irresponsible. But more often, it’s the system that failed them, or a series of tiny financial missteps that snowballed out of control. A layoff. A medical bill. A rent hike. A car repair. Any one of these, without a safety net, can knock a family off its feet.

If you’re housed right now, you’re already ahead. Use that position to build a stronger financial foundation. If you’re struggling, remember: it’s not too late. Most crises are survivable with the right support, planning, and awareness. Because in this economy, the difference between housed and homeless is often just a few decisions away.

Have you or someone you know faced housing instability? What financial lessons did it teach you, and what would you do differently?

Read More:

Should We Stop Telling Poor People to “Act Rich”?

Debt Shame Is Keeping You Poor—Here’s How to Dismantle It