History of the Challenge

There was a woman who said she loved the concept of the 52-week money challenge, but she couldn’t do it. She explained that each week, when she needed to put aside the money for that week, she would panic.

The first couple of months were okay because the dollar amounts were low, but as they started to increase, the weekend became a time of terror because she knew she needed to put away money that she didn’t have. She ended up giving up because the challenge was causing more stress than it was worth. She asked me if there was a different challenge that might be able to help her.

It became clear what she needed. She liked the concept but dreaded when it was time to put money away because she didn’t have it when the week ended. What she needed was a challenge that forced her to save money before it was gone. She also needed to save smaller dollar amounts. Doing it this way would help so that she wouldn’t panic. The 365-day money challenge was born.

How the 365 Day Money Challenge Works

The concept of the challenge is simple. There are 365 days in the year. Every day before you go out, you need to pay yourself first. This step is vitally important. The woman panicked because she didn’t have the money at the end of each week. What she needed to do was pay herself first.

How to Incorporate the 365 Day Money Challenge Into Your Life

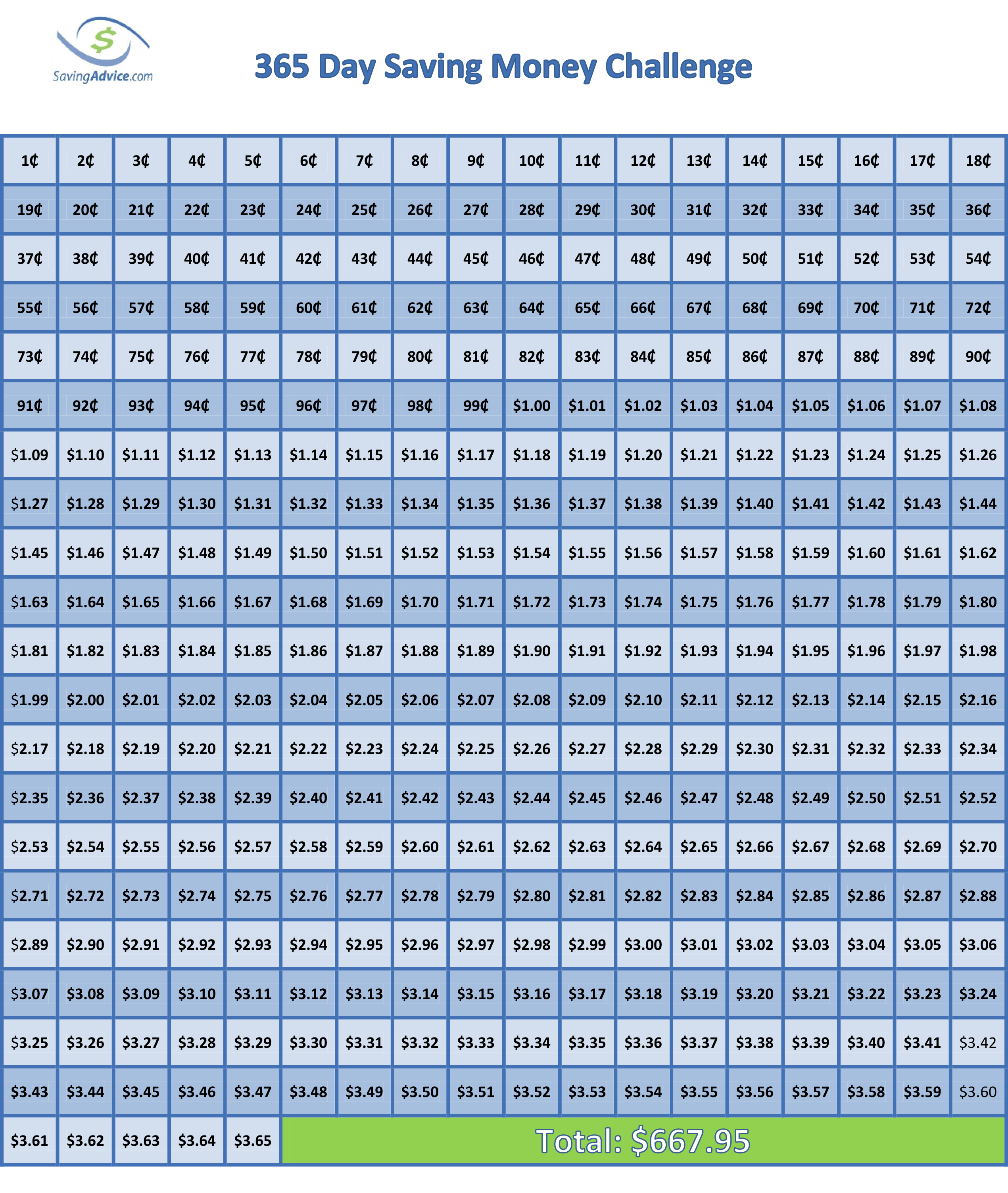

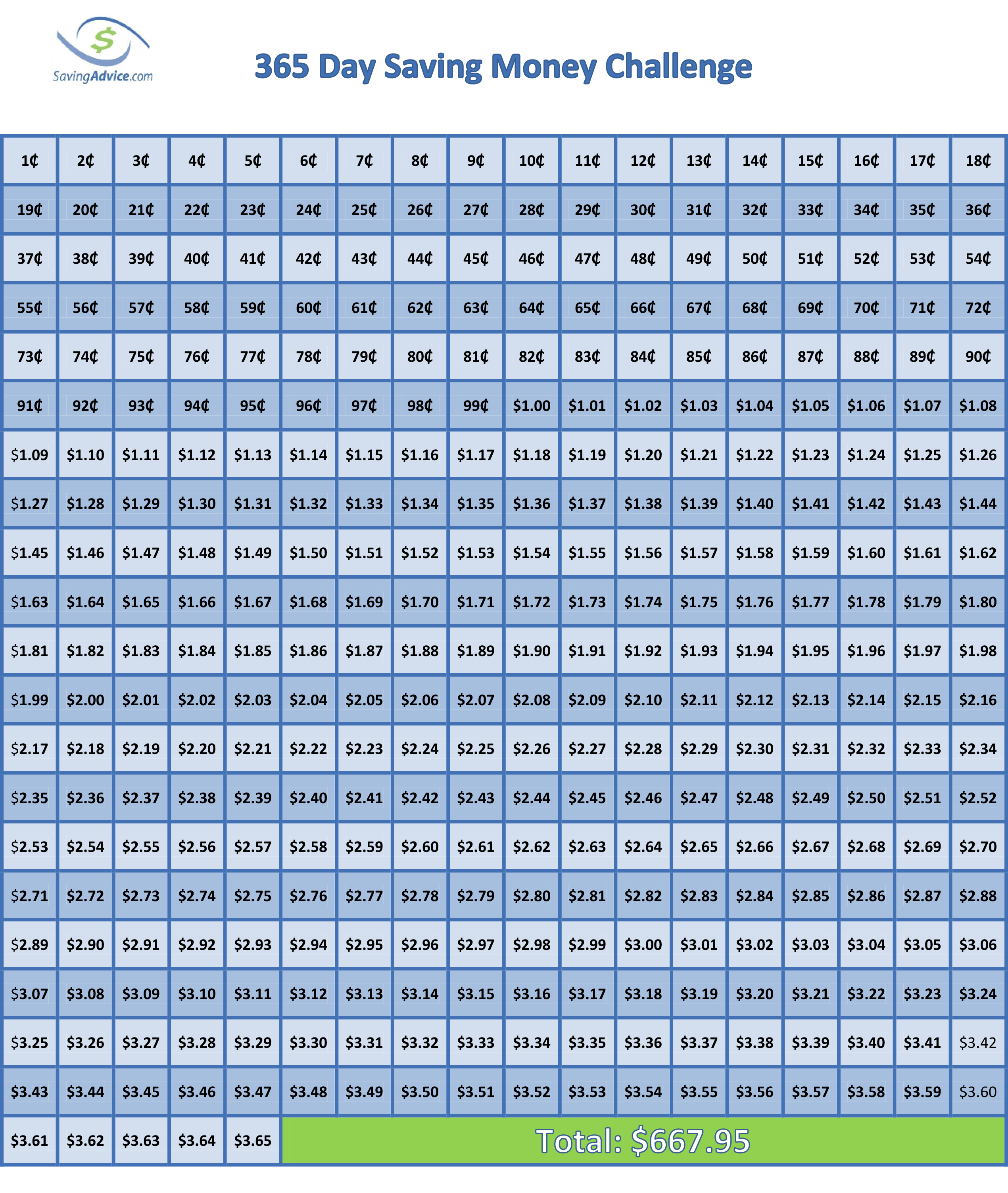

The best way to do this is to be old-fashioned – actually print out the challenge graph. After printing out the challenge sheet, you need to place it somewhere where you’ll see it each morning – someplace like on the mirror in your bathroom. It needs to be in a visible place where you will see it every day, so you’ll be less likely to forget about it.

Each morning when you get up, you need to pay yourself some amount before you do anything else. The payment can be anywhere between a single penny $3.65. Once you have made that payment to yourself, you “x” out the box on your chart. Your next payment, the following morning, can be any of the remaining amounts on the table. You continue to do this every morning for the entire year. When finished, you will have saved $667.95. Even better, you will have formed the essential financial habit of paying yourself first, which will be an asset for the rest of your life.

365 Day Money Challenge

Flexibility Is Key

Some people have trouble with a money challenge because each week, the amount you have to save increases. By December, you’re paying more than any other month in the challenge. Unfortunately, that’s also when you likely have the most expenses due to the holidays. With the 365 Day Money Challenge, you choose how much to put aside each day. If February is a light month for bills, pick the higher daily totals to save. Then, in December, you can save the smaller amounts when you have less wiggle room in your budget.

Get In The Habit of Paying Yourself

Studies have shown that it can take as little as three weeks or as long as 254 days to form a habit. Therefore, it’s important to make saving as easy as possible for as long as possible. Making payments to yourself or transferring the funds for a year satisfies all the requirements to make a habit. As your income grows, continuing this habit will help you build wealth. By the end of the year, saving money will be a natural part of your day.

Advantages of the Challenge

There are a few advantages to this savings challenge. The first is that you’re starting with such small amounts that anyone, no matter what their current financial situation, can participate. If all you can do is pay the absolute minimum amount each day for the first month, you’re only out $4.65 for 30 days.

Additionally, $668 is an excellent start to an emergency fund. Even more important than that, you’ll put yourself in a position to save much more money in the following years. If you saved your money in a high-interest savings account, you would earn compound interest for an even higher balance.

Other Challenges You Might Want to Try

If you want more of a challenge, increase the daily values. If you want to try another substitute, here are some challenge articles that might be a better fit:

Changing Your Financial Future One Penny At A Time

You may have decided not to participate in money challenges before because the amounts were too high toward the end of the challenge. However, that’s not so with the 365 Day Money Challenge. No matter your budget, this challenge should be attainable. At the end of the year, you will have developed the savings habit, and you’ll have a good starter emergency fund to show for it.

You Might Also Enjoy

Amanda Blankenship is the Chief Editor for District Media. With a BA in journalism from Wingate University, she frequently writes for a handful of websites and loves to share her own personal finance story with others. When she isn’t typing away at her desk, she enjoys spending time with her daughter, son, husband, and dog. During her free time, you’re likely to find her with her nose in a book, hiking, or playing RPG video games.