Shares of American Airlines Group Inc. (NASDAQ: AAL) fell 5% on Thursday. The stock has dropped 32% year-to-date. The airline is scheduled to report its earnings results for the third quarter of 2025 on Thursday, October 23, before market open. Here’s a look at what to expect from the earnings report:

Revenue

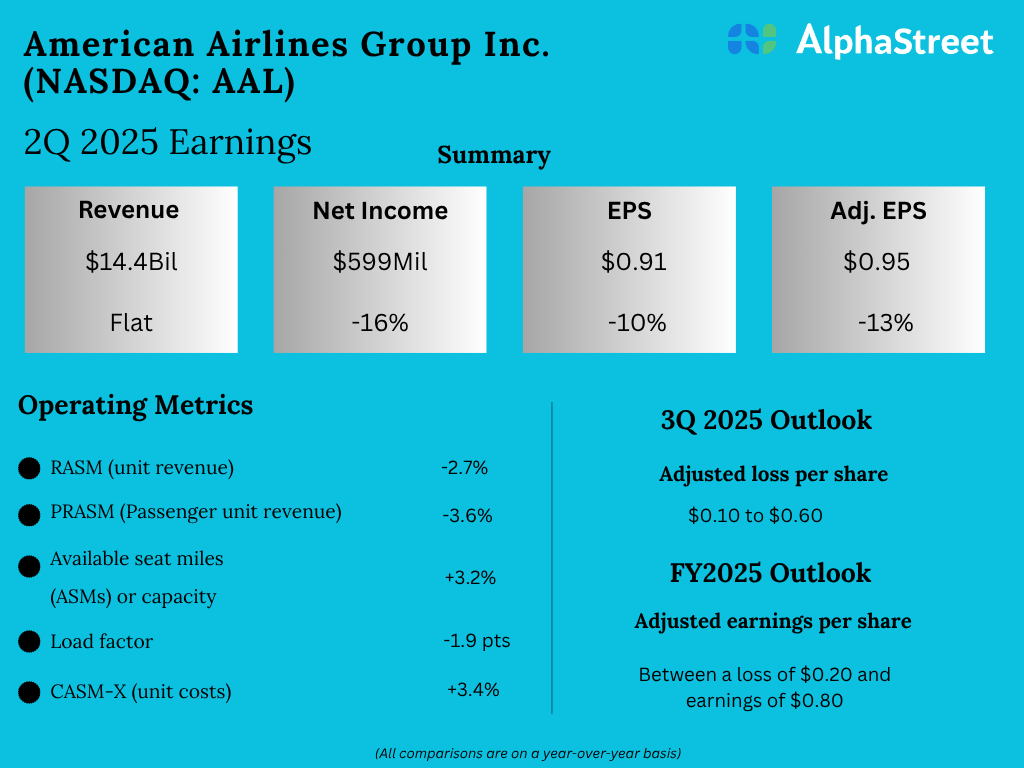

American Airlines has guided for revenue in the third quarter of 2025 to be down 2% to up 1% year-over-year. Analysts are projecting revenue of $13.63 billion for the quarter, which implies a slight dip from $13.65 billion reported in the same period a year ago. In the second quarter of 2025, total operating revenue remained relatively unchanged at $14.4 billion versus the prior year.

Earnings

AAL has guided for adjusted loss per share to be $0.10-0.60 in Q3 2025. Analysts are forecasting a loss of $0.28 per share for the period, which compares to adjusted earnings per share of $0.30 reported in Q3 2024. In Q2 2025, adjusted EPS declined 13% YoY to $0.95.

Points to note

American Airlines continues to operate in a dynamic environment. The company’s performance has been impacted by a drop in demand for travel within the domestic market, which makes up the majority of its revenue. In Q2, domestic unit revenue dropped around 6% YoY due to softness in the main cabin.

The airline expects domestic unit revenue to see a YoY decline in Q3 but it also expects July to be the weakest, and performance to improve sequentially each month in the quarter as industry capacity growth slows and demand strengthens.

Meanwhile, the company has been seeing strength in international travel and premium cabin. Spending from high-income customers remained resilient in Q2. This momentum can be expected to continue and further boosted by the initiatives the airline is taking to improve customers’ travel experience. AAL continues to see growth in its AAdvantage loyalty program members, who generate higher yield and account for around 77% of premium revenue.

American Airlines expects capacity to be up 2-3% YoY in Q3. Non-fuel unit costs are expected to be up 2.5-4.5% YoY, driven mainly by the collective bargaining agreements the company ratified over the past two years.