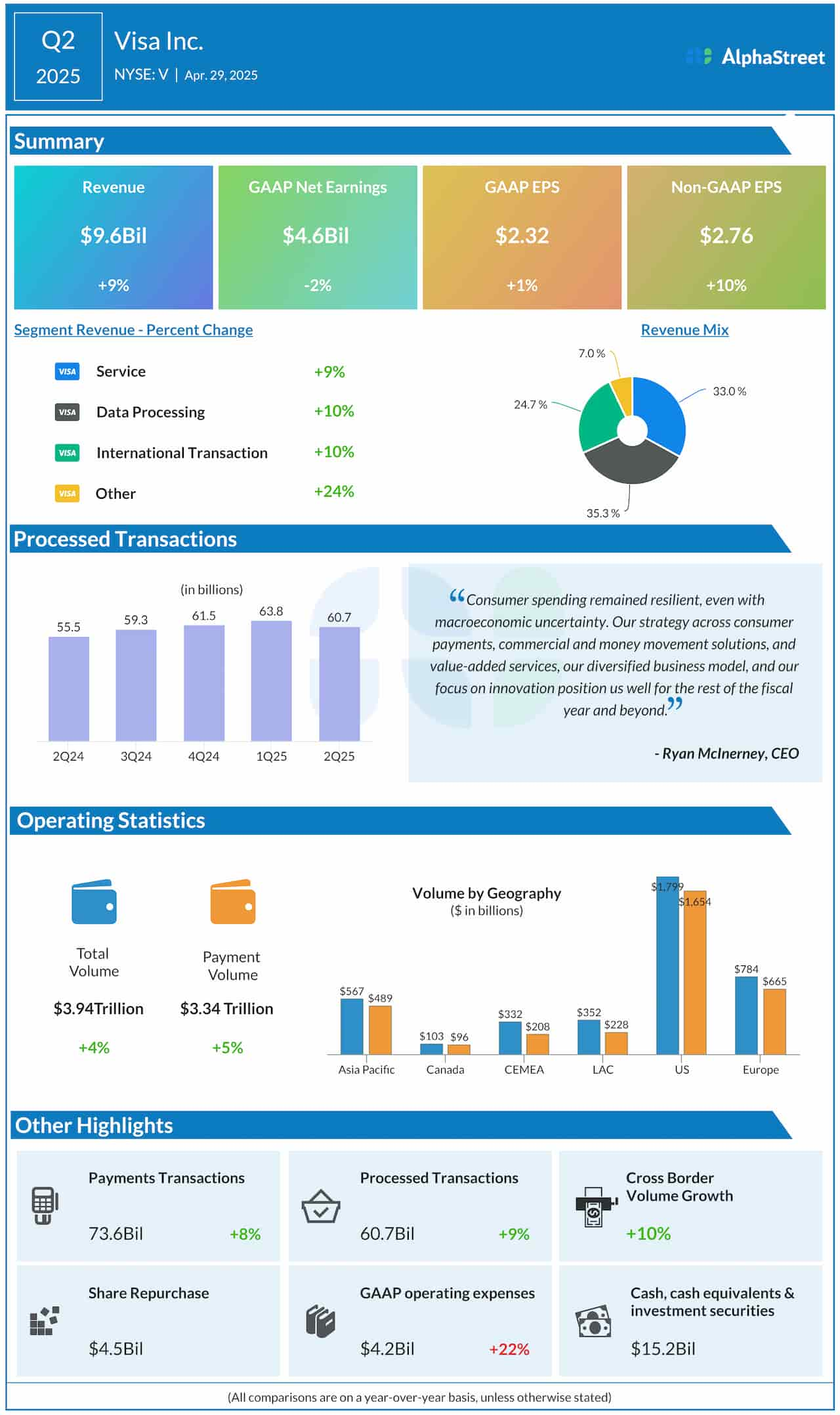

Visa, Inc. (NYSE: V) has largely remained unaffected by recent macro uncertainties as cardholders continue to spend despite inflationary pressures on household budgets. Maintaining its long-term growth trajectory, the San Francisco-headquartered credit card giant reported higher revenues across all operating segments in the most recent quarter amid strong volumes and processed transactions.

Investing

Visa is one of the top-performing Wall Street stocks, growing 32% in the past year and regularly outperforming the broader market. Two weeks ago, the shares reached an all-time high, after growing steadily for over a month. Market watchers are bullish on the stock’s prospects, with the majority expecting it to grow further and reach new highs this year. The company’s fundamentals are quite strong — the growing market share and extensive network make the business highly resistant to disruption. Since the company has already built most of the required infrastructure, it maintains healthy cash flows and regularly returns those funds to shareholders.

Visa’s CEO Ryan McInerney said in the latest earnings call, “Throughout our history, we have evolved our network and strategy to deliver the best innovation, serve our clients, and pioneer the future of payments. We saw the result of these efforts this quarter with our strong financial performance. Halfway through our fiscal year, consumer spending has been resilient and strong, but there is much uncertainty. Focusing on the US in Q2 and through April 21, we have not seen any signs of overall consumer spending weakening. While spending growth differs among consumer spend bands, with the most affluent growing the fastest, all spend bands remain resilient and consistent with past quarters.”

Expansion

Encouraged by resilient consumer spending, Visa continues to forge new partnerships and launch new products. They include the recent tie-up with cash-based payment network Efecty and the rollout of Tap to P2P service in partnership with Samsung. While the company has been using artificial intelligence to protect cardholders for a long time, currently it is expanding its AI capabilities to empower customers. The AI strategy has resulted in a significant improvement in productivity across the business including marketing, finance, and human resources.

Visa’s diversified business model and steadfast focus on innovation position it to effectively compete with arch-rival Mastercard while maintaining its dominance in global reach and transaction volume. In recent years, key financial metrics including revenue and profit mostly exceeded the market’s expectations. In the second quarter, total volumes rose to $3.94 trillion and payment volume reached $3.34 billion. Though the company has experienced weakness in areas like travel, the general consumer spending trend remains positive, with consistent year-over-year growth.

Strong Show

In the March quarter, adjusted earnings increased 10% annually to $2.76 per share. Net profit, including special items, was $4.6 billion or $2.32 per share in the second quarter, vs. $4.7 billion or $2.29 per share in Q2 2024. The positive bottom-line performance reflects a 9% increase in second-quarter revenues to $9.6 billion. Cross-border volume was up 10%.

On Monday, Visa’s shares opened lower, after experiencing volatility in recent sessions. The stock’s average price for the last 52 weeks is $307.34.