by Charles Hugh-Smith

Who believed that central banks’ monetary perpetual movement machine was something greater than trickery designed to generate phantom wealth?

Central banks appear to have perfected the best monetary perpetual movement machine: as credit score expands, cash pours into danger property, which shoot increased underneath the stress of increasing demand for property that yield both hefty returns (junk bonds) or hefty capital features because the hovering property suck in additional capital chasing returns.

As property soar in worth, they function collateral for extra credit score. Increased valuations = extra collateral to borrow towards. This open spigot of further credit score sluices capital proper again into the property which might be climbing in worth, pushing them increased–which then creates much more collateral to assist much more credit score.

This self-reinforcing suggestions of increasing credit score feeding increasing valuations feeding increasing collateral which then feeds increasing credit score has no obvious finish. Modest homes as soon as value $100,000 at the moment are value $1,000,000, and no person’s complaining besides these priced out of the infinite spiral of costs and credit score.

For these priced out of conventional property, there’s NFTs, meme shares and short-duration choices. The credit-asset bubble-economy on line casino has a gaming desk for everybody’s funds and need to “make it large” by way of hypothesis, because the conventional ladders to middle-class safety have all been splintered.

This monetary perpetual movement machine distorts conventional incentives. Why hassle renting a home purchased for speculative features? Renters are problematic, higher to only let it sit empty and rack up enormous capital features.

Rely the lighted home windows at night time in all these new apartment high-rises. Are even 20% occupied? Most likely not.

That is the way you get a “housing scarcity”: traders would fairly maintain models clear and off the market fairly than danger renting models. When credit score and asset valuations are each feeding an infinite enlargement, all that issues is leveraging capital to accumulate as many property as potential to maximise the features from this self-reinforcing wealth-creation machine.

This machine additionally incentivizes fraud. To actually maximize features, why not borrow purchasers’ capital? Certainly, why not?

However unbeknownst to the central financial institution sorcerers and the greed-crazed members, all programs have limits and all penalties have their very own penalties, i.e. second-order results. There are a lot of such dynamics that are eroding the apparently unbreakable monetary perpetual movement machine.

One is debt saturation. Even low charges of curiosity finally pile up consequential debt-service obligations, and any weakening in revenues, money movement or earnings exposes the borrower to a money crunch which may solely be resolved by promoting property.

One other is the widening disconnect between financially sound valuations and “market” valuations set by quickly increasing credit score and collateral. Primarily based on rental earnings or money movement, Asset B is value $200,000, but it surely’s at present valued at $1 million, and nonetheless rising. Clearly, conventional strategies of valuation not apply.

However weirdly sufficient, they do. Debt service doesn’t matter when your collateral is increasing so quick you’ll be able to borrow mountains of capital at “low, low costs” and never even take into account debt service. However as soon as collateral stops rising and rates of interest begin rising, instantly all these absurd obsessions with money movement begin making sense.

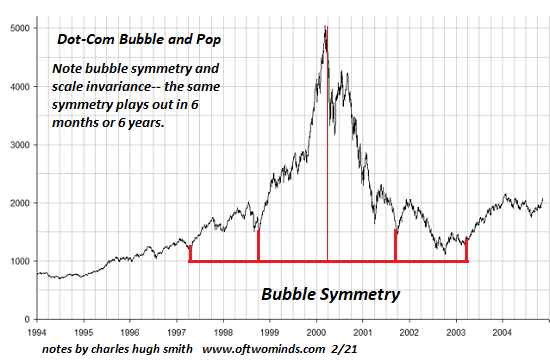

However too late, too late: bubbles, no matter how rock-solid the sorcery, are inclined to manifest symmetry: they fall at roughly the identical fee and magnitude as they rose. As collateral declines, loans slide underwater because the asset shouldn’t be longer value greater than the excellent mortgage. Credit score dries up and so does shopping for as greed-crazed consumers begin worrying that maybe the asset they’re about to purchase would possibly really be value much less subsequent month (gasp).

Liquidity and the credit score impulse aren’t sorcery, they’re herd behaviors. When the insanity of the herd switches from greed to panic, consumers disappear and thus so does liquidity–the flexibility of sellers to discover a Larger Idiot to purchase the depreciating asset.

Larger Fools are quickly worn out after which there’s no person left who’s dumb sufficient to purchase property which might be in freefall and nonetheless far above any financially prudent valuation. The magic circle reverses, and as valuations fall, collateral shrinks and credit score collapses. Lenders who greedily reckoned valuations and thus collateral would rise eternally are caught with life-changing losses–together with all of the punters who constructed shanties of credit score and leverage they mistakenly seen as everlasting palaces.

In making the economic system depending on the monetary sorcery of self-reinforcing credit-asset bubbles, central banks and all of the greed-crazed punters who participated have assured a self-reinforcing demise spiral because the “virtuous” self-reinforcing wealth-creation machine reverses right into a self-reinforcing wealth-destruction machine.

Who believed that central banks’ monetary perpetual movement machine was something greater than trickery designed to generate phantom wealth? As soon as the demise spiral reaches its devastating end-game, the true believers can have fallen silent.