Shares of Accenture (NYSE: ACN) dropped over 1% on Thursday, despite the company delivering better-than-expected earnings results for the fourth quarter of 2025. The top and bottom line numbers saw growth versus the year-ago period and came ahead of expectations. The company has forecast revenue and earnings growth for the upcoming year as well.

Results beat estimates

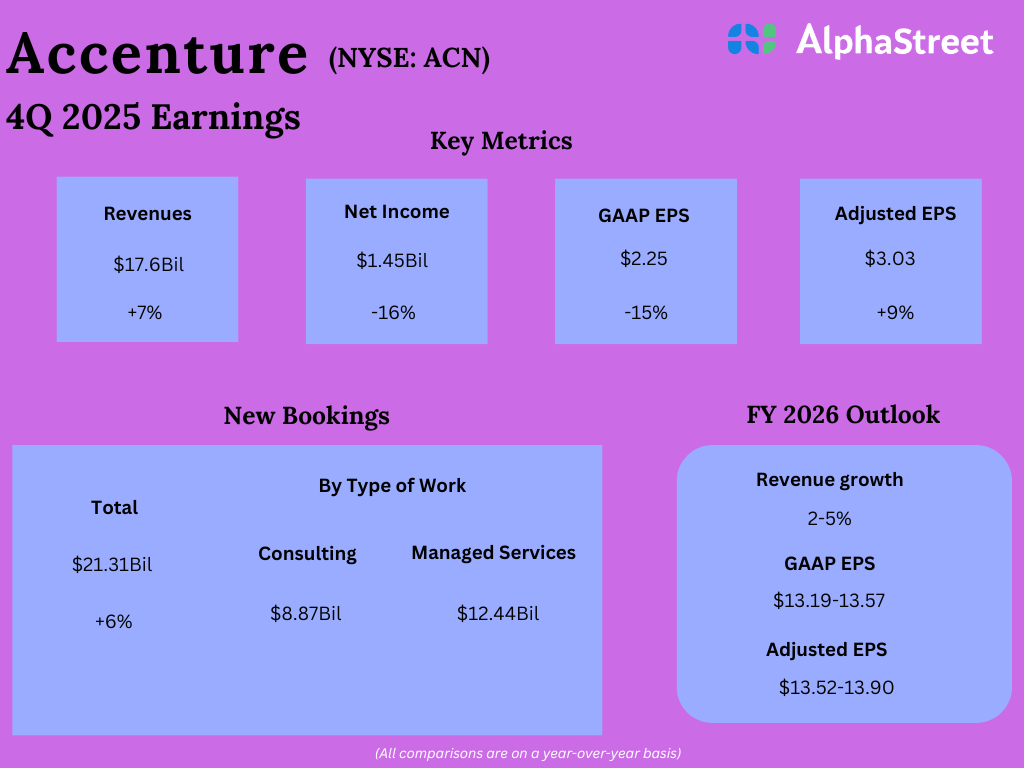

In Q4 2025, Accenture’s total revenues increased 7% year-over-year to $17.60 billion, beating estimates of $17.34 billion. Revenues grew 4.5% in local currency. On a GAAP basis, earnings per share decreased 15% to $2.25 versus the previous year. Adjusted EPS grew 9% YoY to $3.03, surpassing projections of $2.96.

Bookings and segment revenue growth

In the fourth quarter of 2025, Accenture’s new bookings increased 6% YoY to $21.31 billion. Of this, new bookings in Consulting totaled $8.87 billion while bookings in Managed Services amounted to $12.44 billion. Generative AI new bookings were $1.8 billion.

In Q4, revenues from Consulting grew 6% YoY to $8.77 billion while revenues from Managed Services rose 8% to $8.82 billion. The company saw revenue growth across all its geographies, with EMEA and Asia Pacific delivering double-digit growth while Americas recorded a 5% increase.

Accenture also saw revenues grow across all its industry groups, barring Health & Public Service which saw a 1% dip versus the previous year. Financial Services recorded the highest growth at 15%. Products and Resources posted revenue increases of 9% and 8%, respectively. Revenues from Communications, Media & Technology increased 7% in Q4.

Outlook

For the first quarter of 2026, Accenture expects revenues to range between $18.1-18.75 billion, representing growth of 1-5% year-over-year in local currency.

For fiscal year 2026, the company forecasts revenue growth of 2-5% in local currency. GAAP EPS is expected to be $13.19-13.57, representing a YoY growth of 9-12%. Adjusted EPS is projected to be $13.52-13.90, which represents a YoY increase of 5-8%.