If you keep losing in the market right now, there are two main reasons.

Here’s Jack Kellogg’s #1 piece of advice for new traders. Remember, I shared Jack’s story of humble beginnings as a valet to crossing the $20 million threshold.

There are two major factors that lead to extended losses for new traders.

1. Death by a thousand paper cuts.

2. Death from a few big losses.

Some traders are afraid of losing, so they cut the trade before they give it any time to gain momentum.

Other traders are afraid of losing, so they hold onto their bad positions with hopes that they’ll break even at some point.

Both of these mentalities are flawed.

But … it’s pretty easy to identify which kind of trader you are. And then, all we have to do is administer a correctional prescription for your trading process.

Chances are, you already have a good idea of the patterns that we’re supposed to trade.

If you’re trading without patterns, that’s another problem entirely. Educate yourself NOW!

We all use the same patterns to trade these volatile runners.

For example, the pattern that Jack used to trade Alibaba Group Holding Limited (BABA) this year:

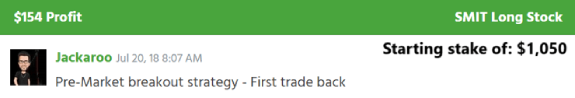

Is part of the exact same framework that he used in 2018, when he started with my process:

You’re on the right track when you trade with these patterns.

We just need to tweak your process a bit.

The Fix For Your Trading

Here’s Jack’s advice…

Problem 1: Traders who find themselves losing small amounts over and over again, only to watch the chart rally later.

Try to take a bigger loss.

It sounds counterintuitive. But you can always paper trade at first. Or just buy one share.

These are cheap stocks. There’s no need to risk a lot of money while you’re learning.

Here’s the main point: You need a stronger stomach for risk.

These patterns exist for a reason. Follow your process and trust the process!

Problem 2: Traders who find themselves losing large amounts in a few trades.

You need to take gains more quickly and you need to cut losses AT YOUR RISK LEVEL.

Don’t be greedy when these stocks spike higher. We’re not going to make $1 million on one trade. Follow the patterns that I teach, get in, and get out.

And if you’re trading without a risk level … I say again: Educate yourself!

We’re not here to gamble on these stocks. There’s a science behind my profits.

The sooner you learn the science, the sooner you’ll find success.

On Monday, I’ll share a risk management checklist with you so you can break some of the problems traders have today.

How was your holiday? What was your favorite part? Let me know at [email protected].

Cheers,

Tim SykesEditor, Tim Sykes Daily

Tim SykesEditor, Tim Sykes Daily