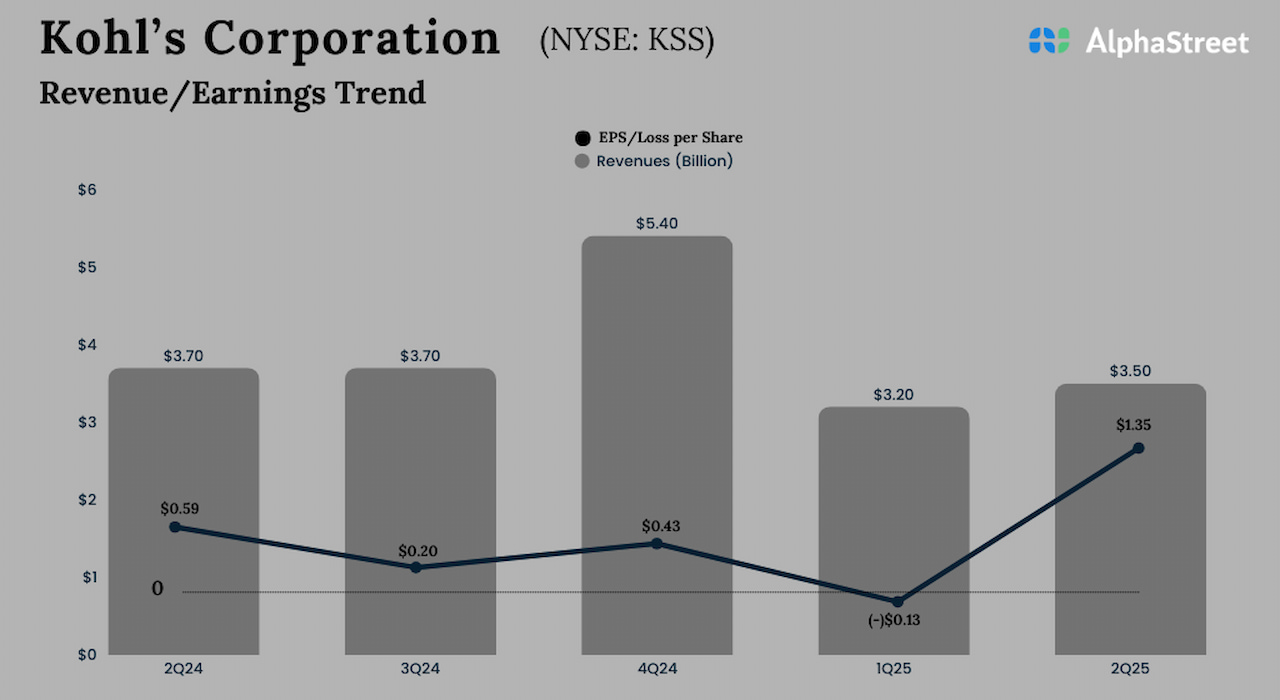

Kohl’s Corporation (NYSE: KSS) has reported mixed results for the second quarter and updated its full-year guidance. Earnings beat estimates by a wide margin, driving the stock higher soon after the announcement. The retailer’s sales have been under pressure for quite some time, due to a mix of headwinds, including reduced discretionary spending and increasing competition.

The Wisconsin-headquartered department store chain’s stock was trading up 20% on Wednesday morning as its upbeat earnings and positive guidance lifted investor sentiment. That came as a big boost to the stock, which is slowly recovering after slipping to a multi-year low a few months ago. The shares have gained about 35% in the past six months. The average price of Kohl’s stock for the last 52 weeks is $12.79.

Comps Drop

In Q2, Kohl’s total revenues declined 5% year-over-year to $3.5 billion, with comparable store sales dropping 4.2%. The top-line exceeded Wall Street’s expectations. The company reported net income of $153 million or $1.35 per share for the July quarter, compared to $66 million or $0.59 per share in the year-ago quarter. Adjusted net income was $0.56 per share in Q2, which is sharply above the $0.29/share profit analysts projected.

Commenting on the results, Kohl’s interim CEO Michael Bender said, “These results reflect the continued progress we’re making against our 2025 strategic initiatives now. While it’s clear that these efforts are beginning to resonate with our customers, we also recognize that this performance is not yet where we aim to be. Our entire team remains focused on enhancing the way we serve customers and over time, returning the company to growth. We saw our sales progressively improve throughout the quarter with May having the softest performance due in part to colder, wetter weather over the last couple of weeks of the month…”

Guidance

The management updated its full-year 2025 guidance and currently expects net sales to decrease by 5-6%. Full-year earnings per share are expected to be in the range of $0.50 to $0.80, on an adjusted basis. The company witnessed multiple leadership changes in recent years, triggering concerns about its operational and financial stability.

In the earnings call, the Kohl’s leadership said that its strategic initiatives are translating into an overall improvement in performance, while recognizing that the company is not yet where it aims to be. In Q2, there was an increase in digital business and proprietary brand sales. Gross margin improved as the company lowered its inventory and reduced expenses.

After slipping to the single-digit territory earlier this year, the stock has been regaining momentum. On Wednesday, the shares traded higher throughout the session, extending their post-earnings uptrend.