In This Article

By the end of 2025, over 500,000 newly constructed rental apartments are expected to hit the U.S. market, significantly increasing inventory and helping to alleviate the housing shortage, according to a new report from RentCafé. This surge in supply could have significant implications for landlords nationwide.

The latest figures follow 2024’s nearly 600,000 new apartments, the largest number of newly constructed rental units since 1974, which temporarily lowered rents and increased vacancy rates before absorption took effect. However, the threat of tariffs and increased construction costs could impact future building projects.

Similar to 2024, the Sunbelt is leading the building boom, responsible for 52.5% of new inventory. Despite recent reports of overbuilding and vacant units, Texas (81,407 units) and Florida (62,184 units) will cumulatively contribute to approximately 30% of that amount.

Metro-Level Leaders

New York City remains the top U.S. metro for new apartment completions for the fourth consecutive year, with 30,023 units expected to be online by the end of 2025, despite an 8.4% drop compared to the previous year. The Big Apple building bonanza has been fueled partly by zoning changes and tax incentives designed to make housing more affordable and stop outward migration.

However, New York has been an outlier due to its economic importance and ability to sustain residents with jobs. Overall, Texas dominates cities with the largest number of new apartment buildings. A generally business-friendly environment, a booming population, plenty of available land, and a typically low cost of living are fueling new construction of both apartments and single-family homes.

Here’s a look at some hot areas:

Dallas-Fort Worth: 28,958 new units are coming to Dallas, ranking it second nationwide.

Austin metro: 26,715 new units in the Texas tech capital ranks it third in the country. Despite an upturn in vacant apartments last year, the city of Austin is on track to add 15,000 new apartments in 2025, outpacing New York City for city-specific completions.

San Antonio metro and surrounding hill country: When San Antonio’s 8,070 new units are added to the 5,921 in the city proper, as well as new development in New Braunfels (946 units) and Seguin (400 units), the overall metro jumps to third place.

Houston: Despite a statewide boom, Houston is heading in the opposite direction, delivering 14,439 apartments in 2025, a 37.6% decrease from the previous year. The reason is recent oversupply. The slowdown could be a boon to landlords, who have seen rents stagnate amid the construction frenzy of the last few years.

Tariffs, a Construction Slowdown, and Rent Increases

The subject of tariffs is uncertain following a recent federal court decision ruling them unlawful and President Donald Trump’s move to take the issue to the Supreme Court. The possible ramifications could have a profound impact on the construction industry and rental growth.

Should the tariffs prevail, construction costs will increase, and the deluge of new buildings will slow down, potentially leading to higher rents, especially in the Sun Belt and beyond.

Should the tariffs increase inflation and interest rate cuts be put on hold, with high mortgage rates keeping renters from buying, it will further increase rental demand and drive up prices.

Because of this, the Sunbelt’s bet on robust building this year appears to be prescient. Vacancy rates are down, absorption is at its strongest level since 1985, and rent growth is poised to turn positive by the end of the year.

“The relationship is going to very quickly flip from a renter-friendly environment to a landlord-friendly environment,” Lee Everett, head of research and strategy at multifamily giant Cortland, told the Wall Street Journal at the top of the year.

Policy and Zoning: New Rochelle—A Case Study

The housing crisis has led to an unprecedented building boom in New York’s tristate area. New Rochelle, a New York suburb, added 4,500 new housing units over the last decade, with a further 6,500 in the pipeline, an increase of 37% from 10 years ago. This caused median rents to slow in growth, increasing just 1.6% since 2020 and declining from 2020 to 2023 by 2%. Tax breaks and zoning changes have fostered the change.

“They set the playbook, then private developers could come and play,” Scott Rechler, chief executive of RXR, told the Journal. The property developer has played a pivotal role in New Rochelle’s turnaround. He invested $1 billion after the city greenlit his redevelopment plan.

New Rochelle’s success in halting rampant rent inflation through investment in development has created a path for other cities to follow, with approvals to build granted in record time. There are dissenters, however. Long-term residents worry about displacement and being priced out, turning the area into a bedroom community for wealthy Manhattanites who are drawn to luxury, amenity-filled buildings.

Florida

Despite the bad rap that Florida has received regarding overbuilding, rising insurance rates, and extreme weather, the allure of South Florida, particularly Miami, knows no bounds. Around 25% of all new rental apartments in the state are located in the Magic City. The Miami metro area is poised to deliver 15,666 new apartments this year, with Miami proper bringing 5,301 units to market and Fort Lauderdale, Hollywood, and Hialeah delivering the rest.

You might also like

The city is also building many luxury residential condos, many of which are rented out by investor-owners, encouraged by Miami’s flexible rules regarding Airbnb ownership. Demand has been heightened in the wake of the Surfside Towers collapse in 2021, and the need to replace many aging buildings.

Final Thoughts: The Deluge of New Construction Rentals Could Help Smaller Landlords

Although it might seem counterintuitive, the surge of new construction could present an opportunity for mom-and-pop landlords. That’s because new buildings with a slew of amenities come with a price tag, even if some are deemed “affordable.” New developments receive tax breaks to offer a certain percentage of their units at below-market rents, but they don’t come close to catering to the vast number of renters struggling to make ends meet due to the high cost of housing.

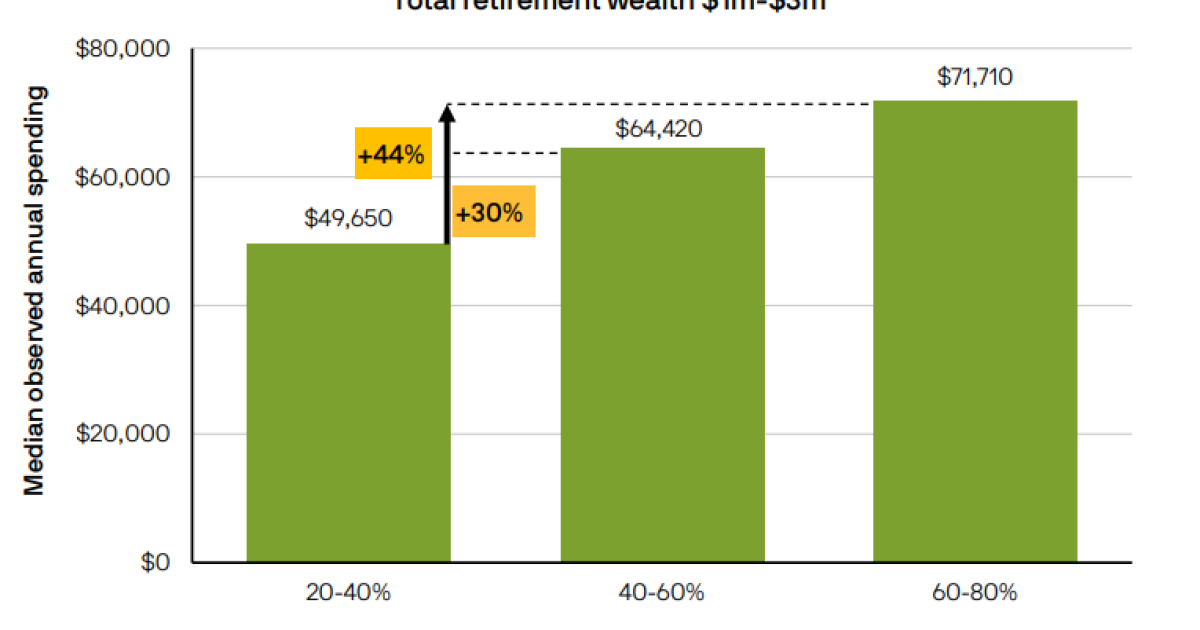

Almost half of renter households are cost-burdened, according to U.S. Census data, spending over 30% of their income on rent. The Harvard Joint Center for Housing Studies indicates that despite the amount of new housing coming to the market, the plight of unaffordable housing is worsening, particularly amongst older households. The National Low Income Housing Coalition (NLIHC) noted that the average hourly wage needed to afford a modest two-bedroom rental is $33.63, which is almost five times higher than the federal minimum wage of $7.25 per hour. The average U.S. wage is currently $28 an hour, according to ZipRecruiter.

For example, an apartment costing $1,500 per month in parts of the Midwest and Texas is not even a remote possibility in many coastal cities, such as New York, Boston, and multiple cities in California. This means that a large section of the population, who are working and earning an almost average U.S. income, is being left behind by the influx of new apartments.

For smaller investors purchasing single-family or two-to-four-unit buildings in and around large metropolitan areas with a high level of construction, there is likely to be a significant number of renters who can afford to pay rent for a modestly priced apartment without the bells and whistles of a new apartment building.