Fiverr International Ltd. (NYSE: FVRR) reported revenue of $430.9 million for the full year 2025, a 10.1% increase compared to $391.4 million in 2024. The company reported its financial results for the fourth quarter and fiscal year ended December 31, 2025, before the market opened.

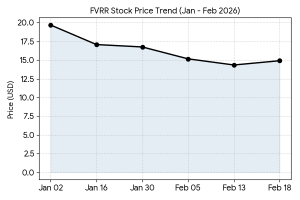

The company’s shares increased 3.97% to $14.91 at the close of trading on February 18, 2026. Fiverr’s market capitalization stood at $551.6 million as of today’s close.

Financial Results for Fourth Quarter and Full Year 2025

Fiverr reported revenue of $430.9 million for the full year 2025, a 10.1% increase compared to $391.4 million in 2024. For the fourth quarter of 2025, revenue reached $117.4 million, exceeding management’s previous guidance range of $104.3 million to $112.3 million. Net income attributable to ordinary shareholders was $23.4 million for the fiscal year, compared to a net loss in the prior year.

Operational Metrics and Business Segment Update

The company’s active buyer base totaled $3.1 million as of December 31, 2025, representing a 13.6% decrease from the previous year. However, spend per buyer increased 13.3% year-over-year to $330, driven by a shift toward high-value projects and the growth of Fiverr Pro. Gross Merchandise Value (GMV) from transactions exceeding $1,000 grew 22.8% during the period.

Financial Trends

Strategic Restructuring and AI Integration

In September 2025, Fiverr completed a strategic restructuring that reduced its workforce by 30%. The initiative aimed to integrate AI-native capabilities across the platform and streamline operations. The company launched Fiverr Neo and updated its dynamic matching infrastructure during the second half of 2025 to facilitate more complex service requests.

Institutional Analyst Commentary and 2026 Guidance

Institutional research from firms including Needham & Company and Citigroup maintained a consensus “Hold” rating following the release. Analysts noted the expansion of adjusted EBITDA margins, which reached 21.3% for the full year. For 2026, Fiverr management issued revenue guidance of $457 million and targets an adjusted EBITDA margin of 25%. The results reflect a transition toward high-value managed services despite a contraction in the total active buyer count.