Shares of General Mills, Inc. (NYSE: GIS) stayed green on Monday. The stock has dropped 8% over the past three months. The branded foods company is scheduled to report its earnings results for the second quarter of 2026 on Wednesday, December 17, before the market opens. Here is a look at what to expect from the earnings report:

Revenue

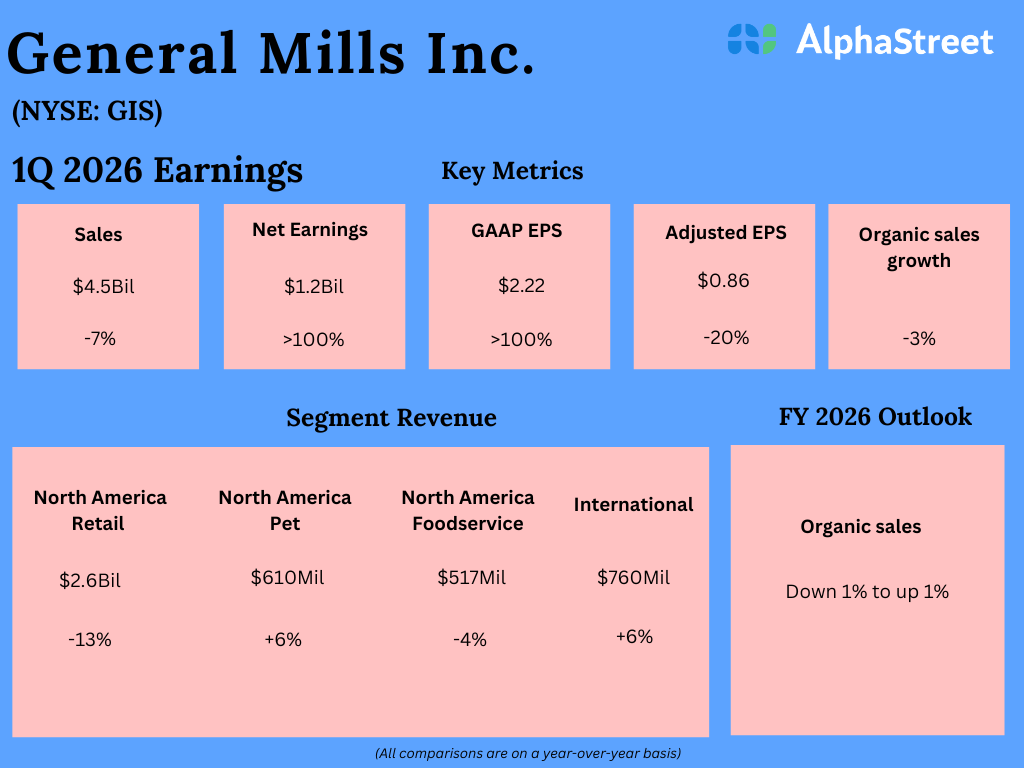

Analysts are projecting revenue of $4.78 billion for General Mills for the second quarter of 2026, which indicates a decrease of over 8% from the same period a year ago. In the first quarter of 2026, net sales decreased 7% year-over-year to $4.52 billion.

Earnings

The consensus target for earnings per share in Q2 2026 is $1.02, which implies a decline of 27% from the prior-year quarter. In Q1 2026, adjusted EPS fell 20% YoY to $0.86.

Points to note

General Mills continues to navigate a dynamic operating environment as budget-conscious consumers look for value and give priority to their favorite brands. The company’s organic sales were impacted by unfavorable price realization and mix while its margins were hit by higher input costs last quarter.

General Mills has been investing in its brands to drive organic sales growth and these investments are focused on five key areas – product, packaging, brand communication, omnichannel execution, and value. These initiatives involve product innovation, affordable pack sizes, brand marketing, building omnichannel capabilities, and offering value through price adjustments.

Within its segments, GIS continues to launch new products, expand distribution and offer healthy options. The pet segment is likely to continue benefiting from the pet humanization trend although value-conscious customers are being prudent in their spending.

The company also continues to reshape its portfolio through strategic acquisitions and divestitures. Its recent acquisition of the North America Whitebridge business is contributing to the growth in the pet business.

The post Earnings Preview: General Mills (GIS) projected to report lower sales and earnings for Q2 2026 first appeared on AlphaStreet.