Broadcom, Inc. (NASDAQ: AVGO) has emerged as a key AI infrastructure supplier, leveraging its expertise in custom AI accelerators, to expand beyond its legacy smartphone and storage chip businesses. However, the semiconductor giant’s stock has retreated about 15% after reaching a record high earlier this month.

The pullback appears to reflect investor caution over a potential AI bubble, as huge amounts are being invested in AI infrastructure without a clearly defined roadmap for near-term returns. Another concern is that the company’s custom chips carry lower margins than its traditional standalone chips. Despite that, AVGO has been one of the best-performing Wall Street stocks this year, gaining around 38% in the past six months and outperforming the S&P 500. Analysts’ consensus estimates suggest the stock could rise by roughly one-third over the next twelve months.

Outlook

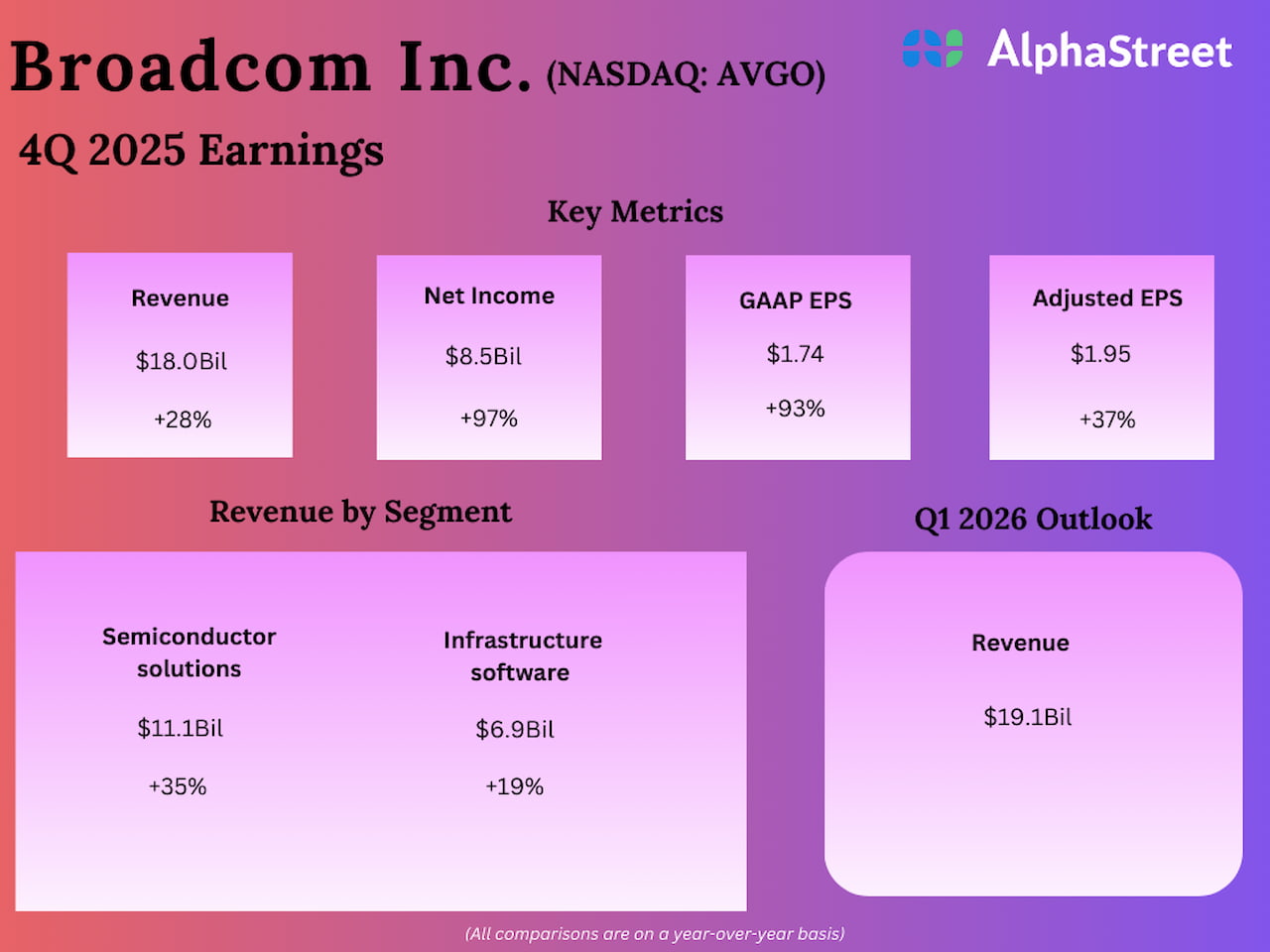

In a recent statement, the Broadcom leadership said it expects AI semiconductor revenue to double YoY to $8.2 billion in the first quarter, driven by the strong demand for custom AI accelerators and Ethernet AI switches. Total revenue is expected to grow by 28% from last year to about $19.1 billion in Q1, which is broadly in line with analysts’ estimates. The bullish outlook reflects strong orders from hyperscaler customers such as Google, Meta Platforms, and TikTok parent ByteDance. Meanwhile, it expects first-quarter consolidated gross margin to be down around 100 basis points sequentially, mainly reflecting a higher mix of AI revenue.

“We expect renewals to be seasonal in Q1 and forecast infrastructure software revenue to be approximately $6.8 billion. We still expect, however, that for fiscal 2026, Infrastructure Software revenue to grow low double-digit percentage. So, here’s what we see in 2026. Directionally, we expect AI revenue to continue to accelerate and drive most of our growth. Non-AI semiconductor revenue to be stable. Infrastructure software revenue will continue to be driven by VMware growth at low double digits,” Broadcom’s CEO Hock Tan said in the Q4 FY25 earnings call.

Record Revenue

In Q4 FY25, adjusted earnings rose sharply to $1.95 per share from $1.42 per share in the prior-year period, beating estimates. On an unadjusted basis, net income was $8.52 billion or $1.74 per share in Q4, vs. $4.32 billion or $0.90 per share in the fourth quarter of 2024. Revenues were a record $18.0 billion, compared to $14.1 billion last year. AI semiconductor revenue jumped 74% YoY. The top line beat analysts’ forecasts for the fourth consecutive quarter. Recently, Broadcom’s board approved a quarterly cash dividend of $0.65 per share, payable on December 31.

Despite Broadcom’s pivot into a leading supplier of custom AI accelerators and a massive backlog in AI orders, it is facing investor scrutiny as profit margins narrow amid a shift toward lower-margin AI-related sales. Broadcom’s revenue remains concentrated among a handful of hyperscale cloud customers, notably Google, which is also investing in its own in-house AI chips — underscoring the risks of customer dependence. At the same time, its legacy smartphone and storage chips business is experiencing a slowdown, with industry forecasts suggesting a recovery by mid-2026.

On Wednesday, shares of Broadcom opened at $350.68 and mostly traded higher during the session. They have grown more than 50% this year, staying sharply above the 12-month average of $272.65.